Employees’ State Insurance Corporation (“ESIC”) is a governmental apex body established under the ESI Act 1948. ESIC is the one that regulates the ESI schemes in India. The ESI Scheme is a social security scheme meant to safeguard the employees against financial issues arising from disablement, sickness, and death due to employment injuries.

The headquarters of ESIC is situated in New Delhi, besides 23 regional offices, 26 sub-regional offices, & over 800 local offices nationwide to support the implementation of this scheme. The Medical Benefit Council operationalizes the medical benefits under the ESIC schemes.

ESIC scheme aims to provide adequate financial assistance to the affected employees dealing with severe health issues. The compromised health often leads to loss of wages, which can create critical financial problems for the employees in the longer term. The ESIC scheme mitigates such challenges by providing complete financial assistance to the affected employees.

Rate of Contribution under ESIC Scheme

ESIC scheme is funded by the contribution from the employers & employees payable monthly at the standard percentage of wages paid. At present, the employee contribution rate stands at 0.75% of the wages & that of employers is 3.25% of the wage payable.

The employer contributes from his/her share, favoring those employees whose daily average salary stands at Rs 137. These employees are not liable to contribute from wage and pay the same with ESIC within the due date. The payment regarding ESIC contribution can either be done online or via designated banks.

The ESI Scheme aims to render conducive services to both employers & employees via its online portal. As part of this effort, all payments & compliance are covered via the internet. Employers of the company can send a monthly contribution via an online portal. Currently, web-based payment is enabled for the account holders of State Bank of India, having a net banking facility.

Read our article:Brief Analysis on Top Benefits of ESI Registration in India!

Critical Aspects for Making Web-Based Payment

- SBI internet banking login credentials, i.e., user id and Password

- ESIC login credential, i.e., user id and password (users can avail it through the ESIC service portal).

Type www.esic.in in the URL section, and you will be redirected to https://www.esic.in/ESICInsurance1/ESICInsurancePortal/PortalLogin.aspx automatically

- Now login to the portal with ESIC login credentials which are provided during registration.

- After a successful login, a page with hyperlinks will be prompted on your screen.

Procedural Steps for online Monthly Contribution Filing

- The applicant can make the contribution via the “Online Monthly contribution Screen.”

- After submitting, a preview webpage will be prompted.

- Click Submit tab to submit the details regarding the monthly contribution to ESIC.

- The portal allows the users to make a contribution for each employer on an individual basis or can submit an excel file as an attachment to upload in bulk. This offers the convenience of uploading the bulk data.

- After submitting the data, the user can pay the required amount via SBI net banking by exploring the Pay online option.

- Tap on the OK button to move further in the process.

- Make sure to take a screenshot of the Challan number, click on continue to proceed. This will land you on the SBI[1] online payment page.

Further, it will redirect the users to the banking portal, where web-based payment can be made via net banking. The user needs to furnish credential regarding net banking and then will be able to make the required payment.Wait until the confirmation page arrives on your screen as soon as you hit confirm button.

Steps to get Challan Online on ESIC portal

Users can follow the given instructions to generate the Challan online

- Tap on the link highlighting generate Challan; the screen will be redirected, click view.

- The record against which the employer wants to make the payment should be selected, enter the payable amount

- Select online>submit. A message will be prompted, and the user should tap on the OK button.

- Reprinting or cross-checking of the successful transaction

- Head over to the link highlighting “Online Challan Double verification” and select the same.

- Double verification relating to the Challan page will be prompted. Now fill the Challan number’s text box with the legit challan number and tap on the Submit button.

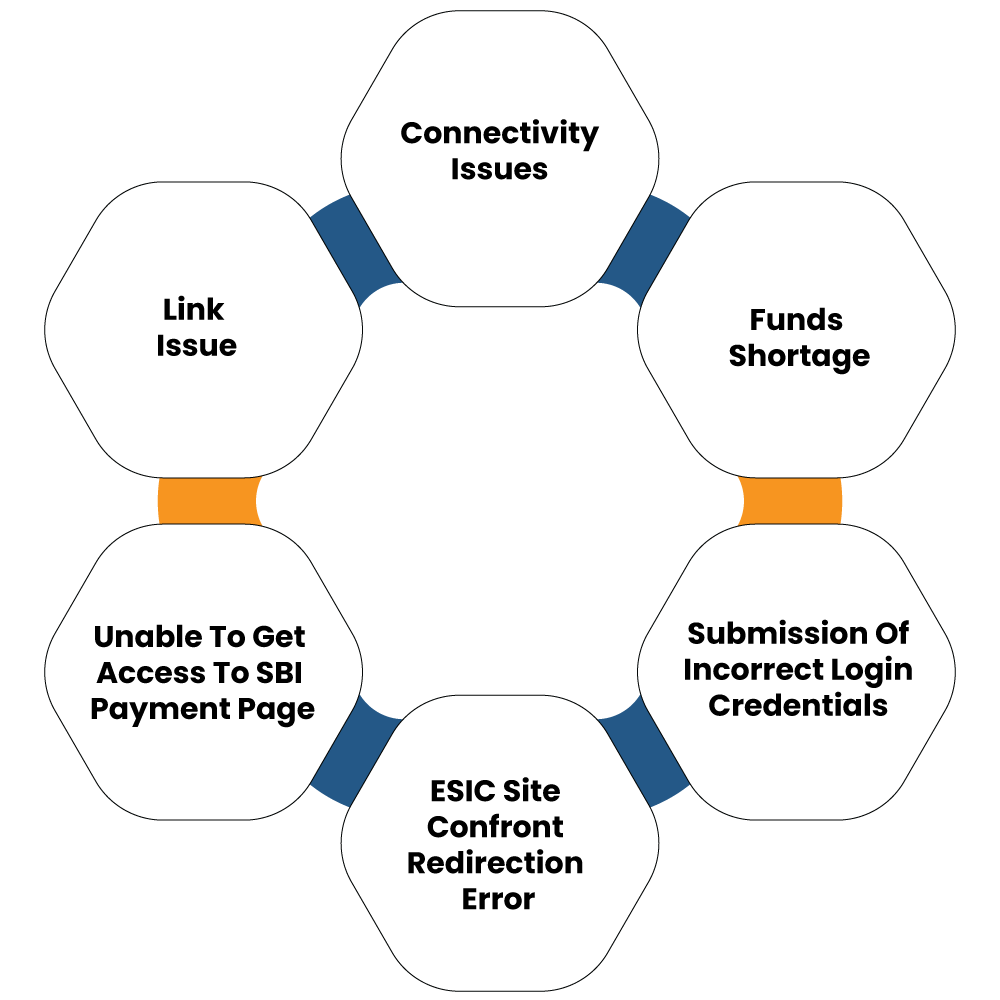

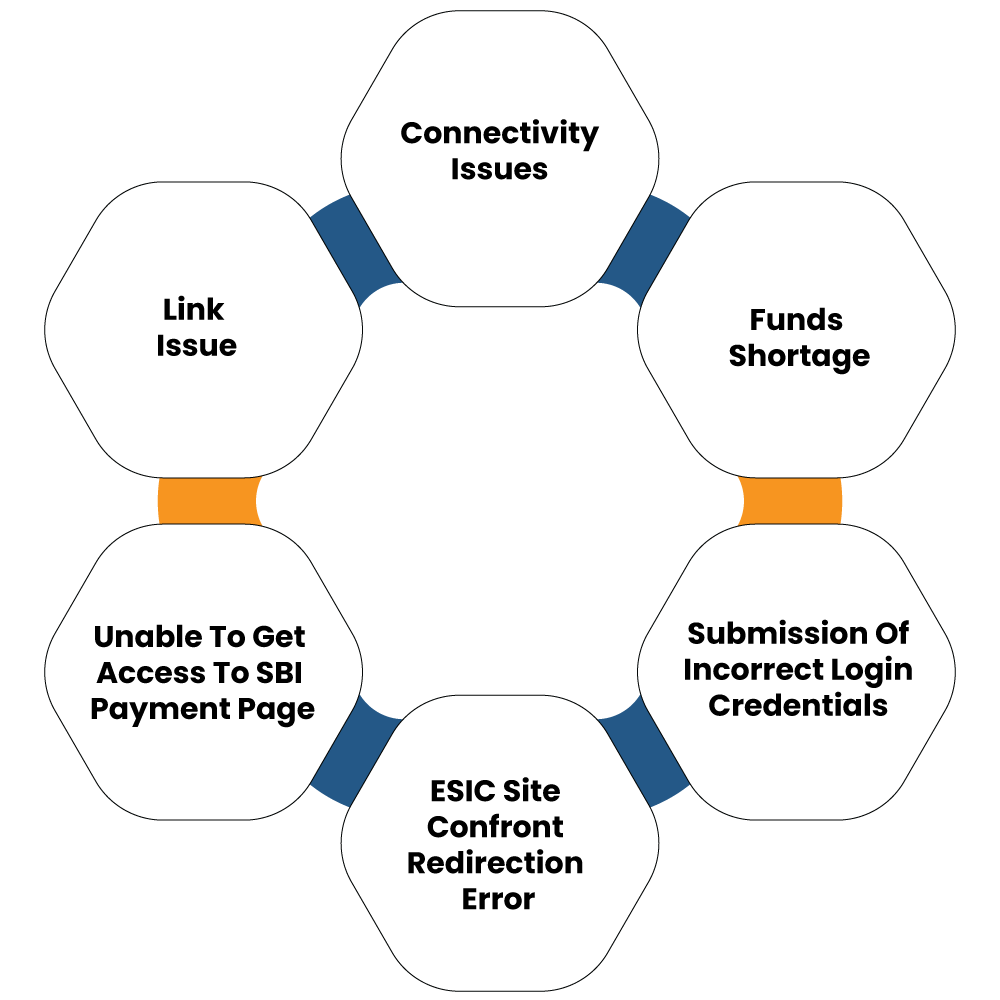

How to Resolve Failed Transaction Issues?

The failed transaction can occur in the following scenarios:

- To get rid of the failed transaction, the user can click on the link “Online Challan Double”.

- Users are required to enter the challan number in the appropriate field and click submit tap to proceed further.

- Now the amount, as well as the Challan number, will be prompted on the screen. The screen encloses the option of making an online payment.

- As soon as the user opts for the “make payment” option, the portal will redirect him/her to the SBI’s net banking page.

Every employer is required to make an ESI Contribution by the 15th of every month. A company owner who fails to make the ESIC contribution on time as mention under Regulation 31 shall be accountable to pay simple interest @ 12%/annum in respect of each day of delay (Regulation 31-A)

Conclusion

ESIC is a multi-dimensional scheme that provides socio-economic protection to the employees against sickness, disablement, & death owing to employment injury. Employees and employers under this scheme require contributing the aforementioned amount on the prescribed due date.

The late submission of the contribution would attract a penalty in the form of interest. The employers can leverage the ESIC portal to make a payment regarding their contribution in a timely and hassle-free manner.

Read our article:Everything You Need To Know About ESI for Employees