The share purchase agreement (SPA) refers to a legal document that outlines the buyer and seller’s role for a given share transaction. The share purchase agreement is typically used when the individuals are transacting a large number of items. In this write-up we will talk about the inclusion of the important clause for Drafting of Share Purchase Agreement in detail.

Drafting of Share Purchase Agreement: An Overview

A share reflects a degree of ownership in an organization, and the no. of shares available at the individual shareholder manifests their stake in the company. This agreement encloses a buyer & a seller. The buyer intends to sell its company’s share to the buyer.

The no. of shares & price of the same would be mentioned in the share purchase agreement. A letter of intent is drafted before the said agreement, and the buyer must examine it carefully to ensure that it matches the SPA to the fullest. If there is any incorrect manifestation of the warranties and responsibilities, then the defaulter will be penalized accordingly.

How Drafting of Share Purchase Agreement is Beneficial?

- It helps in legalizing the deal between the partners.

- It Clarify the roles and obligations of parties to the transaction.

- It gets rid of disputable matters to have the potential to hinder to buyer-seller relationship.

- Tax benefit.

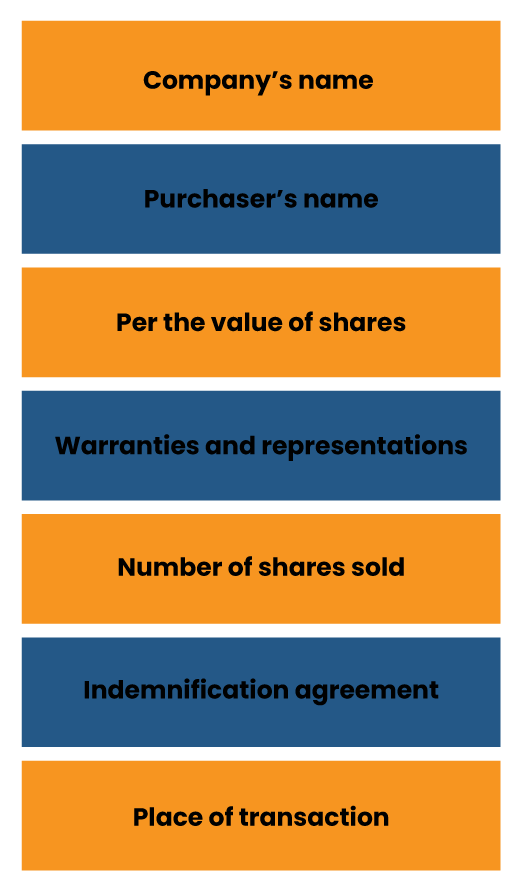

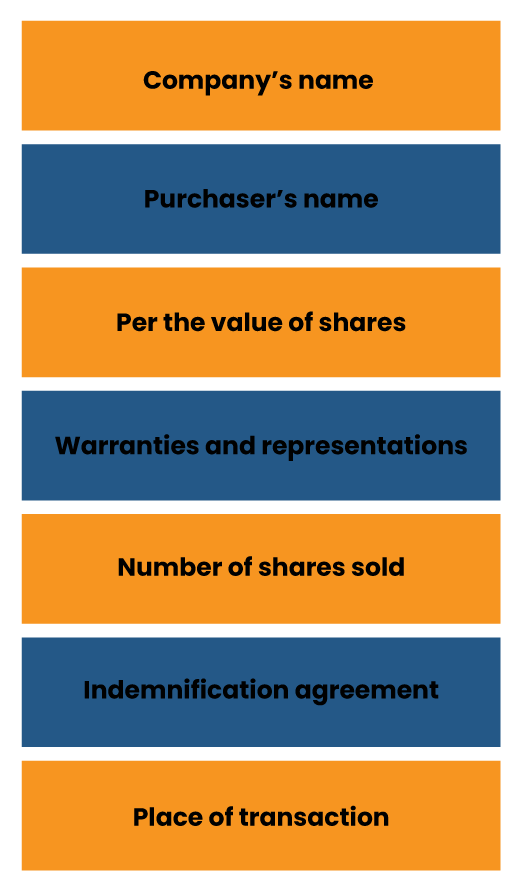

Few attributes of the share purchase agreement are:-

Common Loopholes in the Share Purchase Agreement

- The incorrect manifestation of warranties

- The price & number of shares being sold.

- Purchase price adjustments.

What Detail to Consider While Drafting of Share Purchase Agreement?

The following information should be included while the drafting of Share purchases agreement:-

- Firm detail

- Seller and purchaser of shares

- Kind of shares being sold i.e. (voting shares and non-voting shares*)

- Termination

- Dispute resolution clause

- Price of the shares being sold

- Payment details

- Number of shares being sold

The member having voting shares* has an authority to question against the BOD’s decision or policy formulation. Whereas non-voting shares* do not give such privilege to the members.

Read our article:Know the Difference between Shareholder Agreement & Share Purchase Agreement

Standard clauses to Consider While Drafting of Share Purchase Agreement

Following are the standard clauses that often find their way in the share purchase agreement.

Parties

Parties to the agreement are a significant factor for any deal. In SPA, the buyer and the seller are the parties to the contract. Sometimes the firm is incorporated for a SPA or any company with no fiscal record. In these scenarios, a guarantor is appointed for the claims promise made in the contract.

Recitals

Recitals generally include the valid information and objectives of the transaction and each party’s role.

Considerations and sale of shares

Payment structure ought to be mentioned descriptively. About the amount that is payable on closing, deposit to be submitted at the time of execution, the sum to be set off at the time of the violation of the warranties or indemnity amount. The payment will be done partially or wholly or when it will be triggered. All these delicate details should be clearly mentioned in consideration terms.

Definitions and Interpretations

The definition of the terms mentioned in the contract ought to be defined as what it implies. The clause should be clarified in the same way as the definition of the terms and phrases are stated. The drafting of share purchase is not possible without proper definition and interpretations.

Closing

This clause must entail all the information (including the smaller ones), including the time, destination, and method in which closing shall be executed.

Condition precedent

This clause should represent the individuals who are liable for authorization, permissions & permits. This clause must encompass the warranties, representations, obligations & execution of the agreement.

Condition subsequent

In the rarest case, there would be a requirement of this clause because, in SPA, it becomes needless. In case of a condition’s violation, a subsequent buyer should be protected.

Seller’s Representations & Warranties

Vendor’s representation as to the no. of shares held by them & the list of the director’s. Other affirmative detail furnished by the seller such as loan information, pending dispute, accounts transparency. Thus, the clause must render proper clarification on the vendor’s right to sell their share to the buyer.

Covenant by the Parties

It is included to render some degree of relaxation to the concerned parties. It is needed from the seller regarding the company’s management.

Buyer’s warranties & representations

It is typically a repeating clause to protect the party’s interest.

Confidentiality

It is perhaps one of the most significant clauses in SPA. At this stage, parties shared the company’s classified detail, so the clause aids in isolating the information, and it cannot be accessed without the parties’ permission. Confidential clauses are typically kept time-barred from a time period ranging from 18 months to two years. Drafting of share purchase agreement is incomplete and invalid with this clause.

Force Majeure

Such clauses are mainly incorporated to tackle unexpected scenarios and impart transparency in the share purchase agreement. It is regarding the fiscal crisis and dynamic market conditions.

Indemnification

This clause talks about the claim amount, time limit, procedure, and the subject matter.

Resolution of dispute& arbitration

Arbitration refers to a dispute settlement mechanism that can be modified as per the party’s need and nature of the dispute. The parties have the authority to choose the seat of the arbitral tribunal, the language of the arbitration, the number of arbitrators; the need for specific qualification of the arbitrators; the applicable cost division & counsel fees & the possibility for legal proceedings against the arbitral award. Given the procedural versatility, it is viable to save cost and time via arbitration.

Termination

The clause should explicitly define conditions regarding the termination of the Share purchase agreement.

Jurisdiction & general clause

Indian laws will be pertinent. The place of the buyer’s court[1] will have jurisdiction.

Five Easy Steps to File a Share Purchase Agreement

- Review of the share purchase agreement by both the parties.

- Signature by both the parties. A witness can be signatory as well in case of any doubt on the purchaser.

- Copies should be made for a purchaser, seller and the company.

- Giving the certificate after the payment.

- It can register if you meet certain criteria.

Conclusion

One has to consider the clause above during the Drafting of Share Purchase Agreement. Since such documents are highly prone to error, hiring a professional for Drafting of Share Purchase Agreement is advisable. Kindly share your concern regarding this topic by dropping the message in the comment box, we will be glad to hear from you.

Read our article:What is Share Purchase Agreement in NBFC?