A startup is a new business entity formed by one or a group of enthusiasts’ entrepreneurs. Such businesses often set up a unique identity and motive for producing something that hasn’t been developed. Most startups advocate innovation and unique ideas, which set them apart from the rest and let them monopolize the market overtimes. To triggers the notion of innovation, entrepreneurship, and employment in the country, the Indian government has initiated a program called Startup India a few years back that advocates such ideas. Having said that, let’s move ahead and look into the Documents required for Startup India Registration.

Overview of Startup India Registration

The Indian Economy created vast opportunities regarding new businesses for upcoming entrepreneurs. Most of the startups, preferably with intellectual goals, seek these opportunities. Keeping that potential in view, the Government of India has launched a platform, namely Startup India for startups. The main objective of such an initiative is to lay off the foundation where new business ideas can thrive without legal and financial obstacles. It would benefit the businesses in many ways and allow them to reap solid recognition in their specific market.

Key features of Startup India Campaign

- Introduction of a mobile application for Single Window Clearance.

- Corpus fund of Rs 10,000 crore advocates startup’s growth.

- The patent registration fee is lower as much as 80%.

- Refined and less-stringent Bankruptcy Code for the hassle-free exit.

- Three years of relief from tax on profit and mystifying inspections

- No Capital Gain Tax for three years.

- Self-certification compliance

- Innovation hub for startups under Atal Innovation Mission

- New schemes advocating IPR protection to new firms and start-ups.

- Encourage innovation, employment and entrepreneurship.

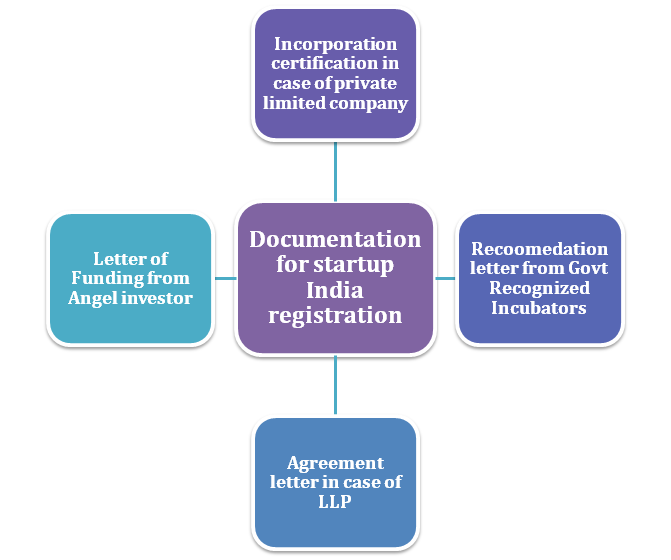

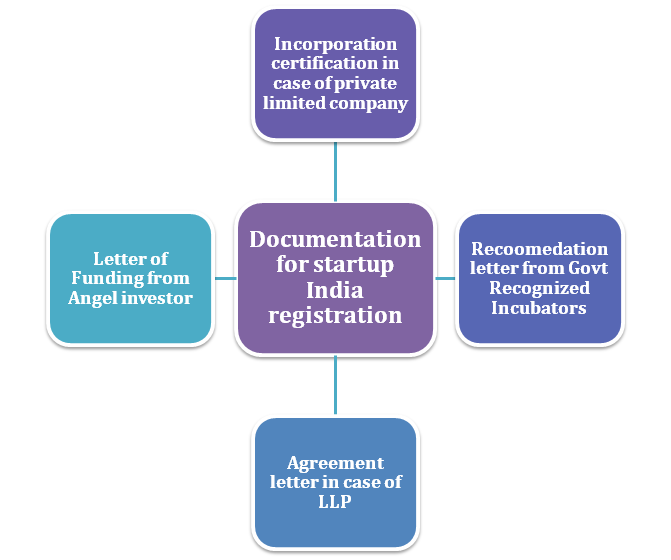

Documents required for Startup India registration

- Email ID and the contact number

- Company Details such as category, industry, sector, office address etc.

- Details of Directors/Partners ( Name, contact details, photos, gender)

- Authorised Representative detail such Name, contact details, and designation)

- A Brief info regarding business operations and product.

- Note on innovation.

- Description stating product uniqueness

- Revenue model.

- Overview of a business plan

- Website info

Read our article:Benefits of Startup India Registration in India

Details of the product or the services projected to be offered by the applicant

The applicant shall submit a brief description of a business idea in a written form to the authority. The description should convey the innovative aspect of the product and services. It is done to convince the authority about the feasibility of an idea.

Incorporation certification

Incorporation Certificate is a Legal document that renders a legal status to the business entity. In other words, it is a proof of the existence of the company. To avail COI, the applicant needs to file an online application on the Ministry of the Corporates Affairs’ online portal.

Letter of Funding from Angel investor

A recommendation letter from a renowned and SEBI-driven angel investor can help startups start their dream business. An Angel investor is a private investor who often makes investments in startups in the initial stage. Such entities usually invest in new businesses after interpreting data-driven projection on profit.

Letter of recommendation

Any entities who wish to setup up a new startup in India were required to avail the recommendation letter from the government recognized incubators. To serve this purpose, you might need to approach some apex institutions in India. Following is the list of the renowned institution in India which can offer recommendation letter to the startups against the prescribed fees.

- Confederation of the Indian Industry.

- Indian Drug manufacturers association.

- National research Development Corporation.

- Maharashtra center for entrepreneurship development.

- Indian angle network.

- Indian paper manufacturer association

- Center of excellence, ISB

- Society of Indian Automobile manufactures.

- Kerala institute for entrepreneurship development

- The All India Plastic Manufacturers Association

- Cement’s manufacturers Association.

- Indian Electrical and electronic manufacturer association.

- All India Biotech association

- Biotechnology Industry research assistance council

- Indian software product industry round table.

- National Association of software and service companies.

- PHD Chamber of chamber and commerce.

- Federation of Indian chamber of commerce and industry.

We hope everything has been cleared regarding the Documents required for Startup India registration to you to this point. Let’s move on to the next sections.

Steps to Approach to Govt Recognized Incubators

The following are the steps for approaching the govt recognized incubators to avail the recommendation letter.

- The first and foremost step to avail recommendation letter is to register the entity as LLP/Partnership firm/Private limited company.

- After being transformed into a legal entity, the next step is to approach the bank and open the current account for seamless business transactions.

- Next, apply for tax registration such as Service tax or VAT[1].

- After catering to the above requirement, approach to incubators either via the official website or meet their officials in person.

- Next, submit a fee to the incubators based on the government norms.

- Finally, avail the recommendation letter.

Fees charged by the incubators for furnishing letter of recommendation

The majority of renowned incubators charge a max fee of 5000/ for furnishing the letter of recommendation for the startup India scheme.

Points to Remember

- To avail tax benefits under section 56 of the Income-tax Act, the startup should be registered under a private limited company.

- Also, the startup should possess DPIIT registration to avail of such tax benefits. The applicant needs to visit the startup India portal to serve such a purpose.

- Startups that made investments in transport vehicles and immovable properties above INR 10 Lakh won’t be able to reap tax benefits.

- To avail tax benefits under section 80 IAC, the applicant needs to fill to an application on the Startup India portal. The application goes along with the documents like MOA, board resolution, copy of the annual account, and ITR.

Conclusion

Startup India scheme has certainly opened up a door of development for upcoming entrepreneurs and startup seeking funds to excel. With a corpus of 10000 Cr in place, the government is eyeing on strengthening the root of the Indian economy by promoting innovation and research through this initiative. Furthermore, the scheme is also quite useful in shedding off unnecessary compliances and requirements for the new business.

Read our article:An Outlook on Registration Mistakes made by Startups