A private limited company remains the top choice for most of the NRIs and non-resident Indians who intend to make an investment in India. Private limited companies encourage 100% Foreign Direct Investment (FDI) via automatic route for different sectors. Even though the incorporation cost of a private limited company is significantly lower than LLPs, dealing with its compliance is a different proposition. This blog will provide a briefing regarding LLP Registration with Foreign Directors and some additional details related to registration.

The Government has opened the door of opportunity for overseas investors by allowing 100% FDI in LLP via an automatic route. It would enable foreign nationals to make a secure investment without interfering with stringent compliances.

LLP Registration – An Overview

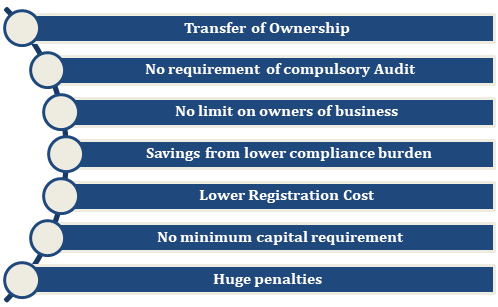

LLP business model was introduced in the country in 2008 under the Limited Liability Partnership Act, 2008. Since then, it has been witnessing staggering growth owing to the reason for lesser compliances and nominal registration costs. Owing to the amendment in FDI regulations on 10th November 2015, the overseas investors have been permitted to make FDI in LLP under the automatic route that discourages FDI-linked performance conditions.

Moreover, LLPs will also have permission to engage in downstream investment in LLP or another company supporting 100% FDI under the automatic route. Therefore, foreign direct investment in LLP is entirely feasible, and Foreign Nationals or overseas investors have permission to invest in LLP.

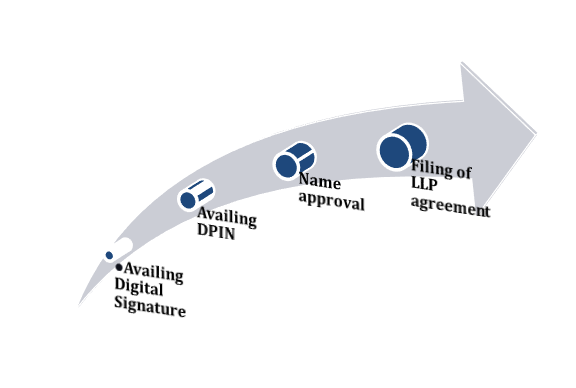

Procedure for LLP Registration with Foreign Directors

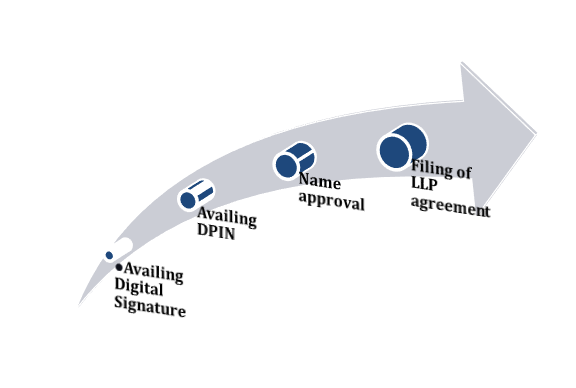

As per the law, the two designated partners are required for the LLP registration in India. The nationality of the partners plays a vital role in such registration. Individuals seeking LLP registration should make sure that at least one of the forming partners should be an Indian national, as it is mandatory. The LLP registration can be completed in five significant steps, namely:

- Availing Digital Signature

- Identification number of the founding partner, aka DPIN.

- Approval of the name.

- Filing of LLP agreement and Incorporation.

Digital signature certificate

Digital signature certificate (DSC[1]) shall be availed by the partners responsible for handling the company affairs. DSC will be needed to obtain the Designated Partner Identification Number (DPIN). For the DSC’s availment, the concerned NRIs need to furnish the signed DSC application attached with a copy of the passport validated by the notary. The applicant also needs to provide address proof such as residence card or driver’s license along with the application.

Designated Partner Identification Number

Designated Partner Identification Number (DPIN) is mandatory for the proposed partners in LLP. DPIN cannot be obtained without a Digital signature certificate. The partners are allowed to use Designated Partner Identification Number along with Director Identification Number that plays a vital role in the incorporation of a company.

Name Approval for LLP

Once the partners avail the respective DPINs from the authority, an application regarding LLP name reservation is required to be furnished to the Ministry of Corporate Affairs (MCA). The application allows the inclusion of six names as per the LLP Act, 2008. The name proposed by the partners ought to be unique and must not be resemblance with existing LLP. If the concerned authority approves one of the proposed names, the partners has to file the incorporation application within sixty days to complete the incorporation.

Incorporation of LLP

Based on name authenticated by the authority, the partner shall submit the incorporation application to the respective authority annexed with the mandatory documentation, including a sheet of the subscribers. If the authority approves the application, the Ministry of Corporate Affairs will furnish a certificate of incorporation to the LLP. The certificate of incorporation provides legal status to the LLP.

LLP Agreement Filing

The partners must sign and file an LLP agreement within thirty days of incorporation. It is a mandatory requirement, and any failure in this context lures hefty fines. Therefore the partner needs to draw an LLP agreement immediately after the date of incorporation.

Read our article:Appointment procedure of Designated Partner in LLP

Conclusion

There is no denying that LLP is the most productive business model both in terms of legal and operating affairs. Similar to the Private Limited Company, LLPs encourage 100% FDI and attract lesser compliances. The newer government compliances are proliferating the reach LLP to the by providing them investment options in other firms. Contact CorpBiz’s experts if you seek technical advice on LLP Registration With Foreign Directors or some other details.

Read our article:A Complete Guide on Annual Filings for Limited Liability Partnership