There are various forms of business present in the market to start with. However, the latest and beneficial among them are LLP (Limited Liability Partnership). LLPs are a flexible legal entity which allows partners to benefit from economies of scale by way of working together, reducing their liability for the actions of other partners. Being an entrepreneur you likely want to choose an LLP once you will know about the key factors of LLP registration.

Understand the Basic Concept why to choose an LLP

Professionals that use LLPs tend to rely heavily upon reputation. Most of the LLPs are created and managed by the group of professionals who have experience with them. By pooling resources, the partners lower the cost of doing business while increasing the LLP’s capacity for growth. Most importantly, reducing costs allow partners to gain more profits from their activities than they could get individually.

The partners in an LLP also have a number of junior partners in the firm who work for them. These junior partners are paid salary and they have no stake or liability in the partnership. The important thing is that they are designated professionals qualified to do the work that partners bring in. This is the way that LLPs help the partners scale their operations. Junior partners and employees do the work and free up the partners to focus on bringing in new business.

Advantage to Choose an LLP

The advantage of LLP has an ability to bring partners in and let partners out. Because of the partnership agreement exists for an LLP, partners can be added or retired as outlined by an agreement. It becomes handy as an LLP can always add partners who bring existing business with them. Usually, a decision to add the existing partners requires approval from all.

It has the flexibility of an LLP for certain type of professional that makes it superior option to any LLC or other corporate entity. Like LLC, the LLP itself is a flow-through entity for the tax purposes. It means the partners receive untaxed profits and must pay the taxes themselves. Both LLC and LLP are preferable to the corporation, which is taxed as an entity and then its shareholders are taxed again on its distributions.

Read our article:What are the Required Documents for LLP Registration in India?

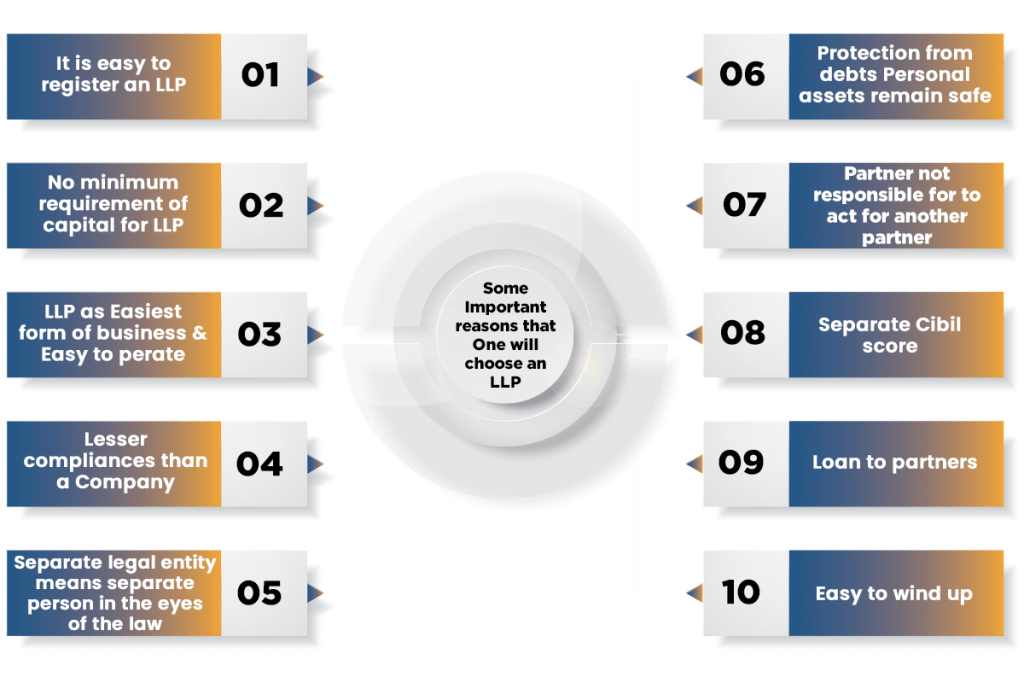

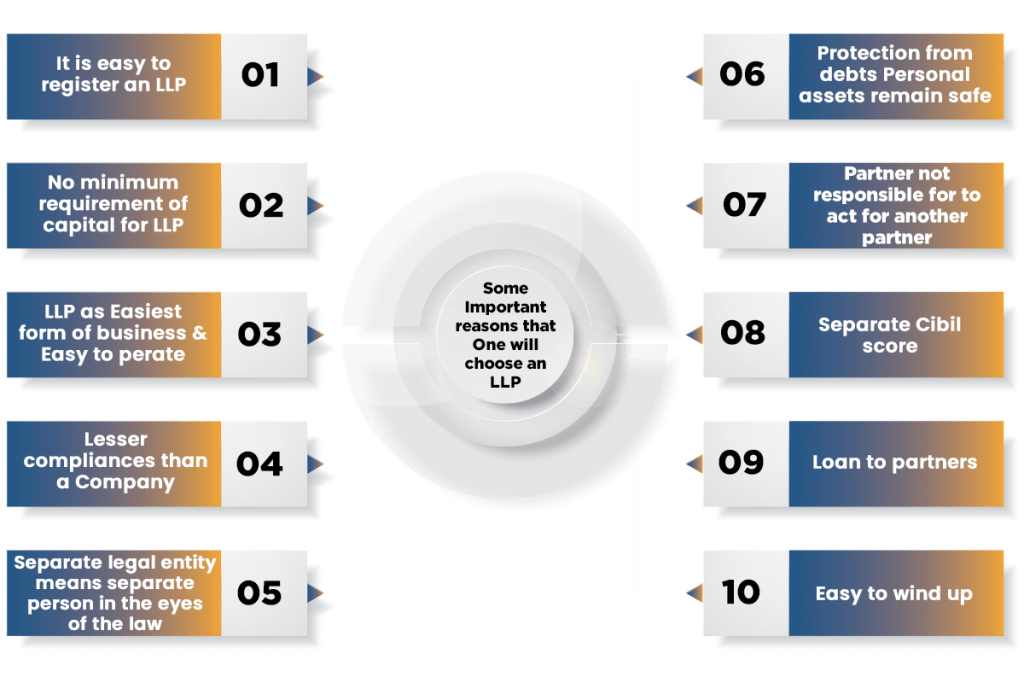

Some Important reasons that One will choose an LLP

The some basic reasons that we must keep in mind while we choose an LLP are as follows:

It is easy to register an LLP

The basic requirement is of two partners out of which one hast to be a resident of India. A registered office must be within the territory of India.

No minimum requirement of capital for LLP

People usually face a capital crunch while setting up a new business hence it is beneficial that cost of registering the LLP is less as there is no minimum capital requirement for setting up an LLP, even a person can start business with the capital amount of Rs 5000.

LLP as Easiest form of business & Easy to operate

LLP is the easiest form of business as there are not as many obligations on the partners. All duties and responsibilities of partners are mentioned in a partnership deed. It is easy to operate and conduct. In a company, one is required board resolutions to be passed for taking any decision. However, no such requirement as such in LLP, though a decision is still taken by a majority or in consonance with an LLP agreement.

Lesser compliances than a Company

Once you register an LLP, there are not many compliances one need to follow. For new businesses, LLP is perfect start with. No need to worry about a general meeting, annual general meeting, board meetings etc. One can conduct your business peacefully without many formalities. Similarly, partners can decide and organize any internal management mutually, which will require an LLP agreement. Only two forms are required to be filed annually, i.e. Form 8 and Form 11.

Separate legal entity means separate person in the eyes of the law

As the separate legal entity, you have the power to sue under the LLP and not partners. LLP can sue & be sued by others. The Partners will not be liable in a case of LLP in any legal case.

Protection from debts Personal assets remain safe

The partners are protected from debts of the LLP. In other words, partners will not be responsible personally for debts of the business. It is another example of limited liability. If business is under debt that has to be returned then you being a partner will not be held responsible for it personally.

Partner is Liable only for his Own Action and not for others

It is the most sensible and reasonable advantage of an LLP. The law says that if in LLP any partner commits the fraud then the other partner cannot be held responsible for his act of doing. Similarly, if any of partners was negligent or careless and some loss was incurred then that particular partner has to bear those losses.

Separate Cibil score

In LLP partner is an agent of business hence the cibil score of business and partners are different. The partners individually will have the different cibil score and the LLP will have different. Hence, even if partners have a bad cibil score, the same will not have an impact on the cibil score of an LLP.

Loan to partners

In company law, the company cannot provide a loan to its directors as it is restricted by law. However, in LLP, this is not the case. Under LLP, business can provide a loan to its partners if the same is allowed by an LLP agreement.

Easy to wind up

If anything goes wrong in LLP then one can plan to end the business/partnership without as many formalities. the winding up of an LLP can be either can be done voluntarily or by tribunal[1].

Conclusion

Since there are a lot of startups are emerging in India day by day it is important to know that what is best for us. Starting any new business is a very huge step and it should not weigh you down in any way. So, let us make this step a happy and easy journey for you at Corpbiz.

Read our article:How to Apply for LLP Registration in India