As per the section 138 of N.I ACT, 1881 shows criminal effect in the event of dishonour of cheque. Police have the right to arrest the defaulter in the dishonoured cheque case if the payee made complaint u/s 417 and 420 of IPC. This provision ensures that unscrupulous people do not fool innocent people in terms of payment and do not flee from the country. The arrest may be to confirm the presence of the accused in a court of law.

There is a sigh of relief for you because if you assure your presence in court then you can be out on bail. The offense committed under section 138 of N.I Act is a non-cognizable offense (dishonoured cheque is an issue in which police officer cannot arrest an accused without an arrest warrant).

The dishonoured cheque cases are common these days. Sometimes large amounts of carrying cheques remain unpaid and are returned by the bank to which they are attracted.

When a Cheque is Dishonoured or Bounced?

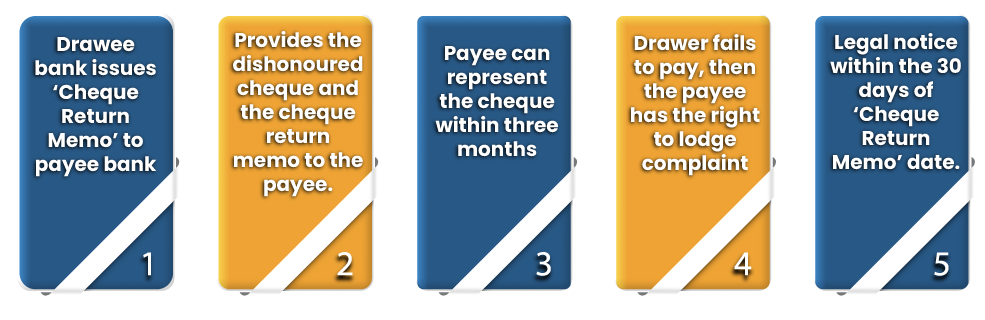

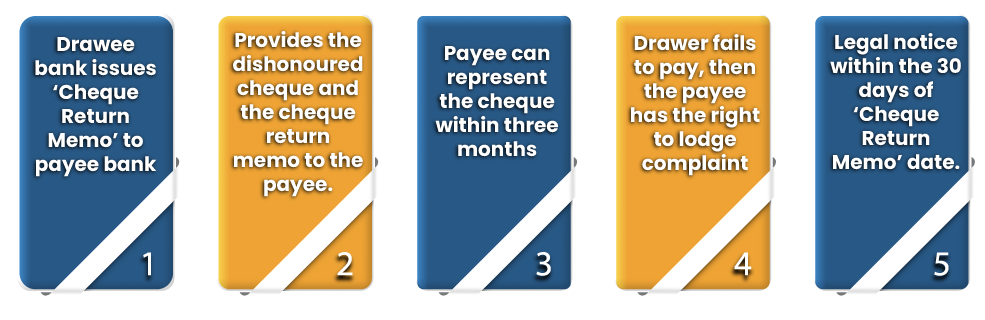

- When the cheque bounced then the drawee bank issues ‘Cheque Return Memo’ to the banker of the payee mentioning the reason for non-payment.

- The payee’s banker then provides the dishonoured cheque and the cheque return memo to the payee.

- The payee can represent the cheque within three months of the date on it, if he believes it will be cleared in the second time.

- In case the drawer fails to pay, then the payee has the right to initiate legal proceedings against the drawer.

- The payee has to send legal notice within the 30 days of ‘Cheque Return Memo’ date.

Dishonoured Cheque is a Criminal offence

- Although it is one of the most common financial offenses in India, under Section 138 of the Negotiable Instruments Act, 1881[1], it is a non-cognizable offense.

- Dishonoured cheque cases are punishable with imprisonment for a period of time that may be extended to two years, or a fine which may be double the amount of the cheque, or both.

- The payee can file a civil or criminal complaint against defaulter to recover his amount.

- A cheque is consider to be dishonoured or bounced when it is submitted to a bank but the cheque returned unpaid because of either insufficient funds in the drawer account or mismatched signature or any other reason.

- It is a non-cognizable offence u/s 138 of N.I Act and a non bailable warrant can be issued on immediate basis against defaulter u/s 417 & 420 of the IPC, 1860.

- If there is more than one cheque that has dishonoured or bounced, the aggrieved can file separate suits against each dishonoured cheque.

Read our article:How to Send a Legal Notice for Cheque Bounce?

Can a Police Complaint be Investigated in Dishonoured Cheque Case?

Yes, payee can register a police complaint against the drawer in dishonoured cheque case. Following are the condition requires making a police complaint in dishonoured cheque cases, which are given below:-

- The complainant has to prove that there was a criminal intention of drawer at the time of issuance of cheque.

- The complainant has to prove the Mens rea.

- If the drawer knows that he has insufficient funds in his account but to escape from his liability at that time he issues the cheque.

- If the drawer is frequent defaulter of cheque bounce

Filing Complaint Procedure under a Dishonoured Cheque Case in India

- If the drawer pays payment of the cheque amount within fifteen days from the date of receiving of the notice, in that condition cheque bounce will not be considered as an offence.

- If the drawer fails to aforesaid condition then payee may proceed to lodge a complaint in the court of the first class magistrate within one month from the date of expiry of 30 days prescribed in the legal notice.

- Once the complaint has been registered against the drawer, the court proceedings can be start by the court.

- The procedure of filing complaint and prosecuting the drawer in a court of magistrate involves certain finer points like cause of action, preparation of legal notice and complaint in accordance with legal requirements, modes of sending the written legal notice, service of summons and non-bailable warrants, conducting the criminal case etc.

Rights of Drawer under the Case of Dishonoured Cheque

- The defaulter can take anticipatory bail from the District Court or High Court if the payee file a complaint against the drawer and the same was lodged as a crime in the concerned police station.

- The drawer can go to the police station when the police authorities call him and answer their queries and after enquiry.

- If any crime is lodged and take defaulter into custody, he can get bail from the concerned first-class magistrate before whom he was presented.

- Police Authorities will not entertain any case that fall u/s 138 of N.I Act unless & until payee does not prove the Mens rea before the police.

Concluding Remarks

Considering the number of cases pending in our legal system, if you attend each hearing and provide sufficient evidence that indicates that you did not intend to defraud the person who filed the case against you , It can be disposed of in about a 1.5 years.

But if you are inconsistent and if the magistrate has issued a summons, it may take 3-5 years to settle the case. If you decide not to abscond from the city or leave the city without a hearing, the case against you will be placed in a pending position. Kindly associate with the Corpbiz expert to know more about dishonoured cheque qualifies to be a criminal offence or not.

Read our article:What is the Legal Rights Available for Payee in Cheque Bounce Cases?