A business is an entity that indulges in selling goods or in offering services for the purpose of gaining profit. The three major legal forms a business can be divided into are: – sole proprietorship business, partnership business and a company. The term profession is referred to anyone who follows some ethical standards and they earn their living by performing activities that mandates a definite level of education requirement, certain skill level, education or training. There is usually a requisite standard of proficiency, knowledge, or credential that the person is ready to apply. Therefore, there is a huge difference between business and profession which have been dealt in detail in this article.

What are Business and its Main Characteristics?

Business can be defined as an economic activity that indulges in the purchase, exchange, sale or manufacture of goods and providing various services with an intention to earn profit and assure the customer’s needs in return.

Businesses can both be a profit derived or a non-profit organization that serves the purpose to gain profit or accomplish a social cause respectively. The characteristics of the business are given below:-

- Economic activity

- Buying and selling

- Continuous process

- Profit oriented

- Customer satisfaction

- Optimum utilisation of source

- Risk & Uncertainties

Read our article:Here’s how Sole Proprietorship Company can apply For an MSME Registration?

What are Profession and its Main Characteristics?

A “professional” is someone who makes their income from their expertise in a particular subject or talent in a specific thing. A profession is a group of disciplined individuals who are mandated to follow certain principled standard.

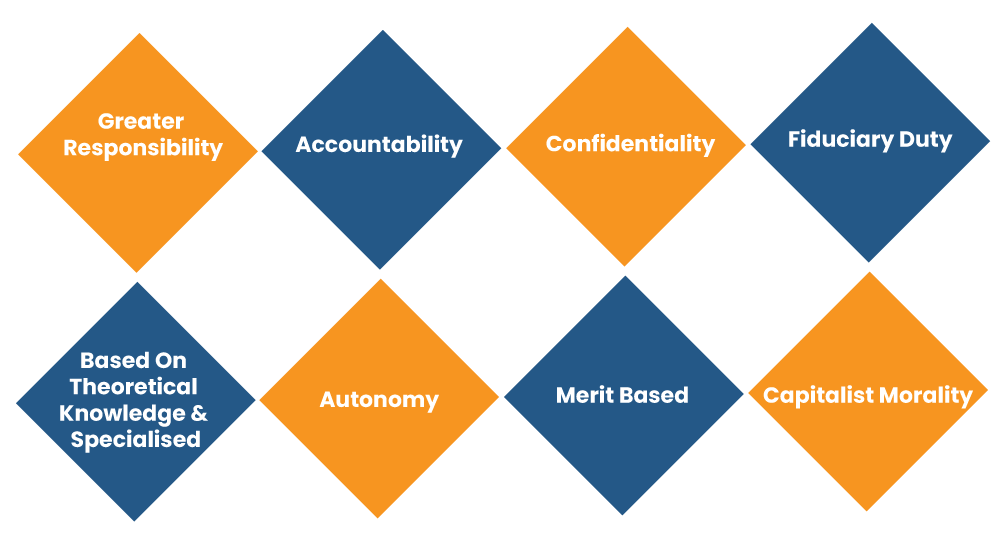

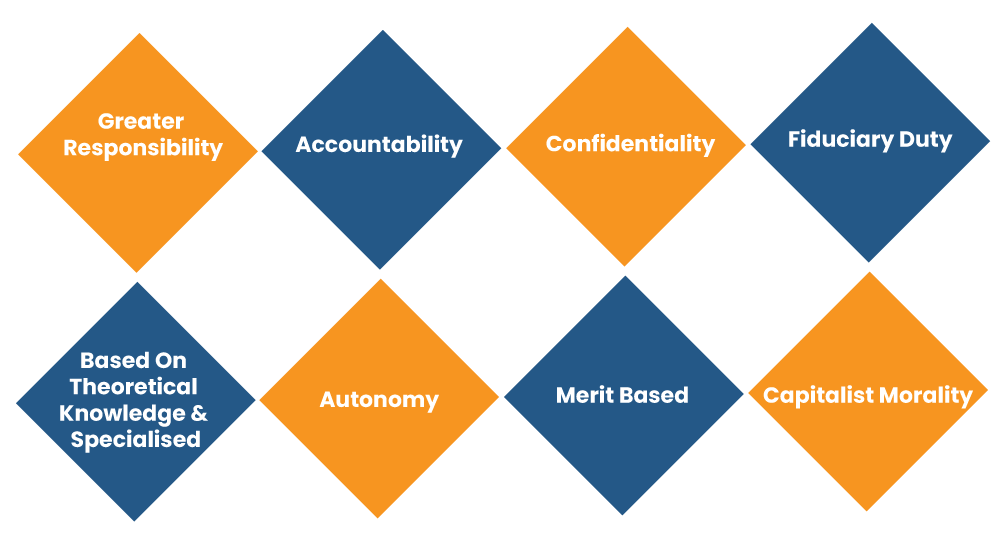

These group of individuals position themselves as possessing special knowledge, academic qualification, skill and learning which is derived from education, research and training at a higher level and is acknowledged by the public as such. The characteristics feature of profession is given below:-

What is the Difference between Business and Profession?

Human activities are chiefly divided into two major categories of work i.e.

- Economic activities and

- Non-economic activities.

The economic activities are those activities performed with an objective of earning money and develop in terms of economy. Moreover, the economic activity is further sub-divided into:-

- Business,

- Profession and

- Employment.

There is a huge difference between Business and profession as there is no minimum qualification requisite for starting a business but before entering into any profession like Lawyer, Accountant, Teacher, Doctor, etc. there is a mandatory requirement of the minimum qualification.

Under Section 2(13) of the Income Tax Act, 1961[1], it provides an inclusive meaning of the term “business”. According to Income Tax Act sec. 2(36) – “profession” includes vocation. Various English dictionaries have differentiated the meaning between “business” & “profession”.

Supreme Court has observed in CIT vs. Manmohan Das (1966) 59 ITR 699 (SC) that a profession means and involves any occupation with purely manual or intellectual skill.

The Major Differences Between Business and Profession

Basic Objective

The difference in business and profession lies in their basic objective and purpose. The basic objective of business is to earn profit while that of a profession is to render services of skill and qualification.

Establishment

The difference in the establishment of business and profession is that business is established on the decision of entrepreneur and by fulfilling certain legal obligations but profession is established by being a membership to the relevant professional body and having the exact skill, education and certificate of practice as mandated in the particular profession.

Qualification

The difference between business and profession lies in the basic qualification as in starting a business there is no requirement of any particular minimum qualification but before entering into a profession expert knowledge on the study is a minimum necessary requirement.

Code of Conduct

The code of conduct in business and profession clearly differentiates in them as because in business there is no prescribed code of conduct for the entrepreneurs to follow. But while in profession, it is mandatory to follow the Code of conduct as has been prescribed by the professional bodies.

Capital

The capital requirement in both the business and profession determines the difference in them because in starting a businessthere is capital required which completely depends on the size and nature of business. But in profession the capital required in limited which is dependent on the kind of profession a person desires to achieve.

Accounting Type

Business deals with manufacturing, trading and managing profit and loss account. But in profession usually Income & Expenditure account is maintained.

Reward

The reward obtained in both the business and profession is different as in business the much awaited reward is the profit of the business and in profession the reward is the professional fee.

Advertisement

The advertisement is the internal structure of the business and profession and both have their own advertisement techniques. In business, the advertisement plays a major role in increasing their profit and hence the products, good and services are advertised with proper techniques to increase sales. Whereas, in profession they are advised not to advertise anything shared to them to anyone out of their work and advertisement is strictly prohibited.

Transfer of Interest

There is difference in transfer of interest both in business and profession. As in business there transfer of interest is possible but in profession one cannot transfer his interest to anyone.

Risk Factor

Business always involves risk factor i.e. the outcome of the business can either result in profit or in loss. But the risk factor is not always present in profession.

Tax Audit

Under Section 44 AB of the Income Tax Act, tax audit is required if the annual turnover or the gross receipt is exceeding beyond Rs. 1 Crore (2 crore for presumptive income scheme under section 44AD in case of business.

In case of profession, under section 44AB tax audit is required if the gross receipt is exceeding Rs. 50 lakhs.

Conclusion

Thus, after reading all the differences it can be said that there is huge difference between business and profession but sometimes a profession like a teaching service shall not be considered as a profession if it is given by a corporate company or a partnership. Therefore, it is really important to know and acknowledge the difference while implementing the same in both the categories of business and profession.

Read our article:What are the Different Kinds of Sole Proprietorship Business can be formed?