As the company thrives, the downsides of the Sole proprietorship could force the business owner to opt for a more flexible business model such as a private limited company. The private company renders a string of advantages over the proprietorship firm including that of ease of investment, constant presence, and so on. In this write-up, we would look into the method for changing the Sole proprietorship into private limited company.

Private Limited Company: Vital Traits

A private limited company is a privately held business entity whose ownership is not limited to a single member which is regulated by the Company Act 2013. A maximum of 200 shareholders can exist in a private limited company. Limited liability is one of the vital traits of this business model that allow the member to repay the debt only up to the extent of their shares. The private ltd company renders numerous benefits which are as follow:-

- The liability of the shareholders in a privately held entity is restricted only up to the extent of their shareholding. The personal assets of the shareholders are not at the stake in case if the company fails to repays the debt to the creditors.

- The hostile takeover of the private limited company is not possible due to the restriction on the transferability of the shares.

- Due to perpetual succession, the private limited company continues to survive much longer than other business models. The absence of the core member doesn’t affect its existence and continue to operate in a normal fashion.

- Private limited companies don’t encounter heavy tax burden under the income act 1961.

Sole Proprietorship

A sole proprietorship business is controlled, owned, and managed by the single individual and there is no legal distinction between the owner and the business. Unlike a private limited company, the liability factor in the sole proprietorship business model is practically unlimited.

- It is arguably the most popular form of business in India.

- Shareholders and the board of directors don’t exist in this business model.

- Self-governance

- Less statutory compliances in comparison to other business models.

Documents required for Converting Sole Proprietorship into Private Limited Company

The following documents will be needed to convert sole proprietorship into private limited company:-

- Identification proof of the owner of the company.

- Power of attorney/ letter of authority.

- Address proof of the registered office such as utility bill, sale deed, and rent agreement.

The concerned person ought to visit the website of Ministry of Corporate Affairs (MCA[1]) and need to furnish Form 1, Form 18, and Form 32. Apart from that, the applicant must upload the aforesaid documents and forms on the same portal.

Declaration of Incorporation

After completing the aforesaid prerequisite, the MCA conducts a thorough verification of submitted documents. Upon successful verification, the authority will grant the Certificate of Incorporation to the concerned applicant. Upon receiving the COI, the conversion of sole proprietorship into private limited company will be completed.

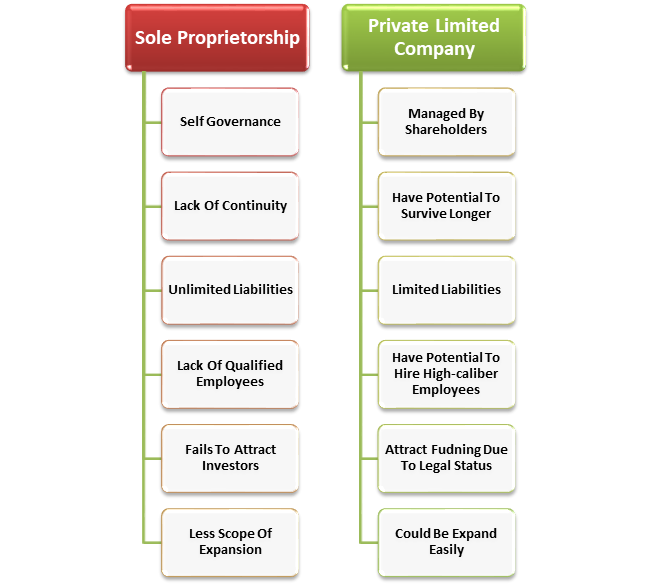

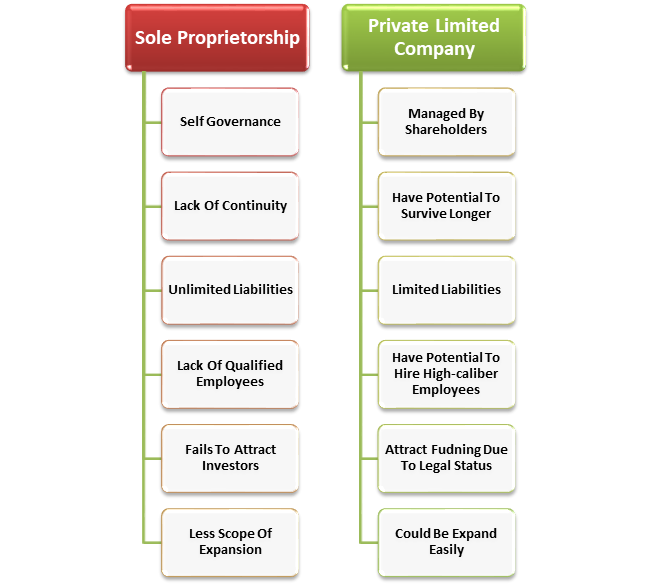

Pros and Cons of both business models

The following are the factors that act as a prominent ground for differentiating these two entities.

Separate Legal Entity

It’s a well-known fact that sole proprietorship business and its owner are treated as a single legal entity under the law. Although such a business model offers unparalleled benefits like self-governance and tax relaxation, the owner is always at the risk of losing the business under relentless financial obligations.

Liability

Unlike a private limited company, the sole proprietorship is more likely to get crushed under an economic crisis. Since the owner of such a business is liable to address all the financial obligations, the loan providers may take stringent action against the owner to recover the loan amount.

Private limited company, on the contrary, is more reliable in this regard as the liability of organization members is limited to the extent of the capital invested by them. Self-governance may sound like an obvious advantage but it is wrapped around by unlimited liability. Sole proprietorship business often falls apart when it comes to addressing the stringent financial debt.

Tax Liability

Private limited companies are entitled to pay tax on the profits and dividends but the dividend received by the shareholder is non-taxable. Meanwhile, in the case of a sole proprietorship, income tax is imposed on the personal income of the owner.

Limited Capital

A sole proprietorship has limited fundraising alternatives, whether in terms of equity fundraising from investors or raising loans from banks. It means that the allocation of the working capital is confined around the personal fund of the owners. Indeed Sole proprietorship is a profitable business model but it doesn’t attract investors due to lack of visibility and legal status. Whereas private limited companies have a huge potential in this regard.

Perpetual Progression

Simply put, the absence of the owner endangers the existence of the sole proprietorship firm. Meaning it will only continue to exist as long as the owner lives. Thus; a sole proprietorship business model is more vulnerable to dissolution when contrasted with a private limited company. The ownership of a private limited company is not confined to a single member.

Public perception

Sole proprietorships often encounter issues in executing an extensive business plan because the perception is less than favorable. Moreover, these firms also struggle to procure high-caliber employees who have the potential to ensure growth through strategic decision making. Sole proprietorships firm fails to offer reliability on various grounds which are ultimately responsible for the growth of the business.

Conclusion

Sole proprietorship business is inconsistent on a lot of ground, be it a matter of long-term reliability or attracting funds from the investors. The absence of the legal identity could be another reason why sole proprietors often switch over other business models.

And the scope of expansion is also not that great in this business model. The private limited company, on the other hand, offer more flexibility in term of expansion and tax rates as compared to sole ownerships. It has a huge potential of growth and its risk is not confined to a single member which makes this business structure easier to handle.

Read our article: An Ultimate Guide to Registration of a Sole Proprietorship Firm in India