A Corporate Tax rate is the direct tax which is levied on the net income earned and the profit that corporate enterprises make from doing businesses. The tax is imposed at a specific rate in accordance with the provisions of Income Tax Act, 1961[1].

Recently, the Finance Minister has made significant cuts to India’s corporate tax rates to boast the economy during the pandemic. Such as for new manufacturing companies set up from 1st October 2019 and operational before the time periods of 31st March 2023, the existing tax rate is 25% which has been brought down to 15% (plus surcharge & cess).

Highlights of Amendment

What are the Two Sections inserted in the Income Tax Act?

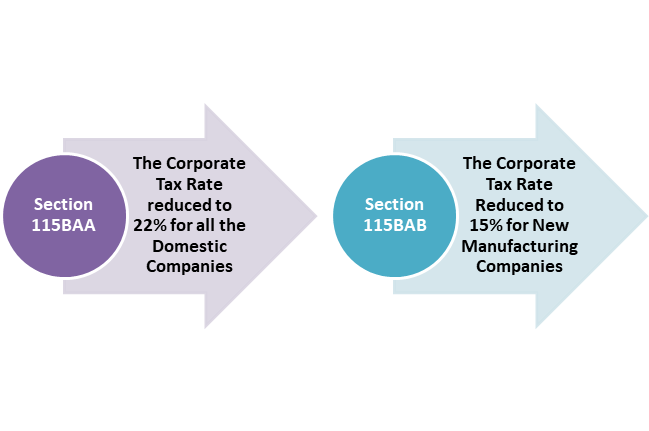

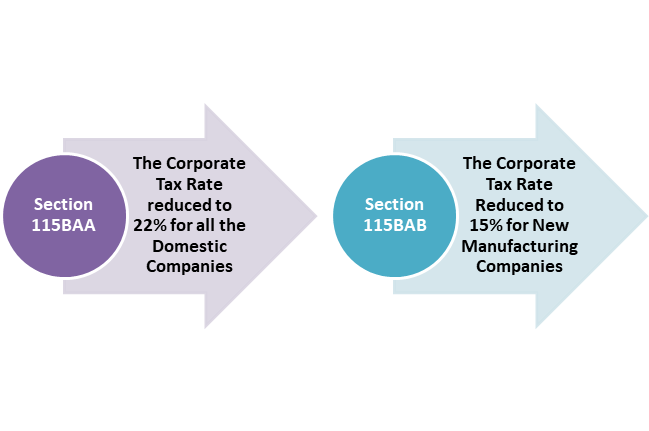

According to the Taxation Laws (Amendment) Act, there are two inserted sections to the Income Tax Act which are Section 115BAA and Section 115BAB. Those are as follows:-

Section 115BAA

The corporate tax rate reduced to 22% for all the domestic companies. As of fiscal year 2019-20, all the domestic companies can choose to be taxed at a rate of 22% (including surcharge and cess), provided that they will not avail of specified exemptions or incentives. Additionally 10% surcharge tax will be levied. Accordingly, an effective tax rate for companies opting to pay tax under Section 115BAA of the Income Tax Act will be 25.168%.

All Domestic companies who avail for this reduced corporate tax rate must not have to pay minimum alternate tax (MAT) under Section 115JB, currently charged at 18.5% of a book profits. An amendment Act clarifies that companies that do not wish to avail of this concessional rate immediately can choose to do so once applicable exemptions or incentives have expired. However, once the company opts to be governed by Section 115BAA, it cannot subsequently opt out.

Section 115BAB

The Corporate tax rate reduced to 15% for new manufacturing companies, under which a reduced tax rate of 15% plus applicable surcharge and cess will apply to manufacturing companies. Those are as follows:-

- The companies which were set up and registered on or after 1st Oct 2019 and commence manufacturing on or before 31 March 2023;

- The companies which were not formed by splitting up or reconstructing an existing business (a certain level of relaxation applies in this regard);

- The companies which where use no machinery or plant previously used for any purpose (a certain level of flexibility applies in this regard);

- The companies which are not engaged in any business other than the manufacture or production of goods or research in relation to, or the distribution of, such goods; and

- The companies which do not avail of specified exemptions or incentives. The taxpayers have the option of availing of the reduced tax rate.

However, once a taxpayer opts to be governed by Section 115BAB of the IT Act, they cannot waive the liability. Additionally, 10% surcharge tax will be levied. Hence, an effective tax rate for companies which opt to pay tax under Section 115BAB of Income Tax Act will be 17.16%. Companies which opt for the reduced rate under Section 115BAB of the IT Act must be exempted from MAT.

Conclusion

The rate underlining corporate tax in India differs from one type of company to other i.e. foreign corporations and domestic corporations to pay tax at different rates. Also, it depends on the type of corporate entity & the different revenues earned by each of them; the corporation tax rate varies on the basis of each and every slab rate system.

2115194290_GST-Council-Corporate-Tax-Press-Release-Spetember-2019Read our article:Let’s Understand the Concept of Professional Tax in Tamil Nadu