The biggest reasons for the failure of a start-ups are lack of funds and lack of management. But here it is advisable that if you are not taking care of the legal formalities and legal requirements of the country, it can be the result of the failure of the start-up company.

Therefore, in this article, we have discussed mistakes or legal mistakes made by Indian start-up companies, which need to be taken care of to ensure that your start-up business does not shut down.

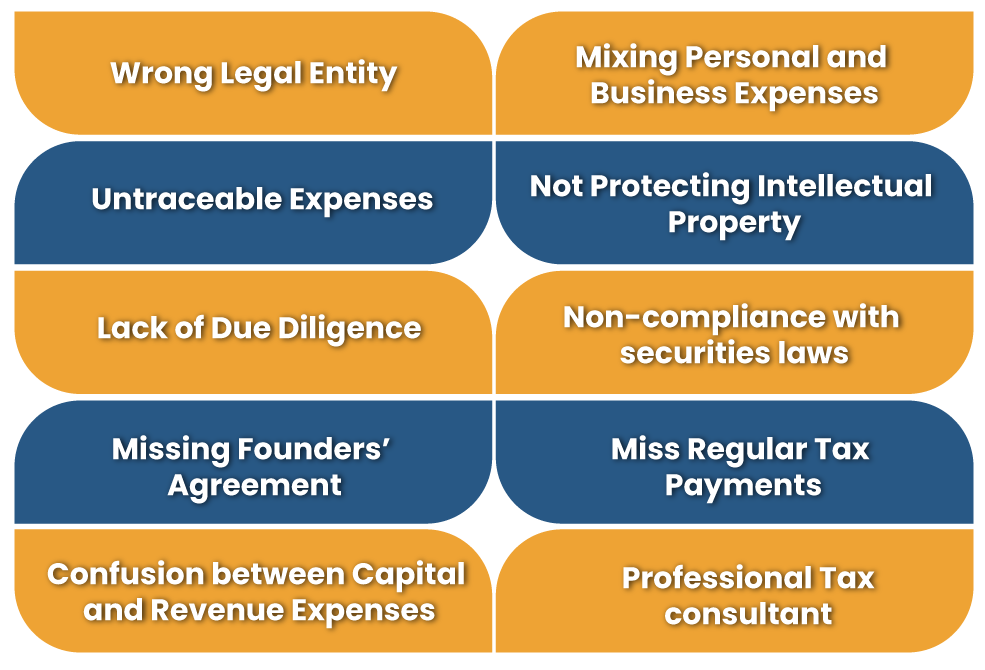

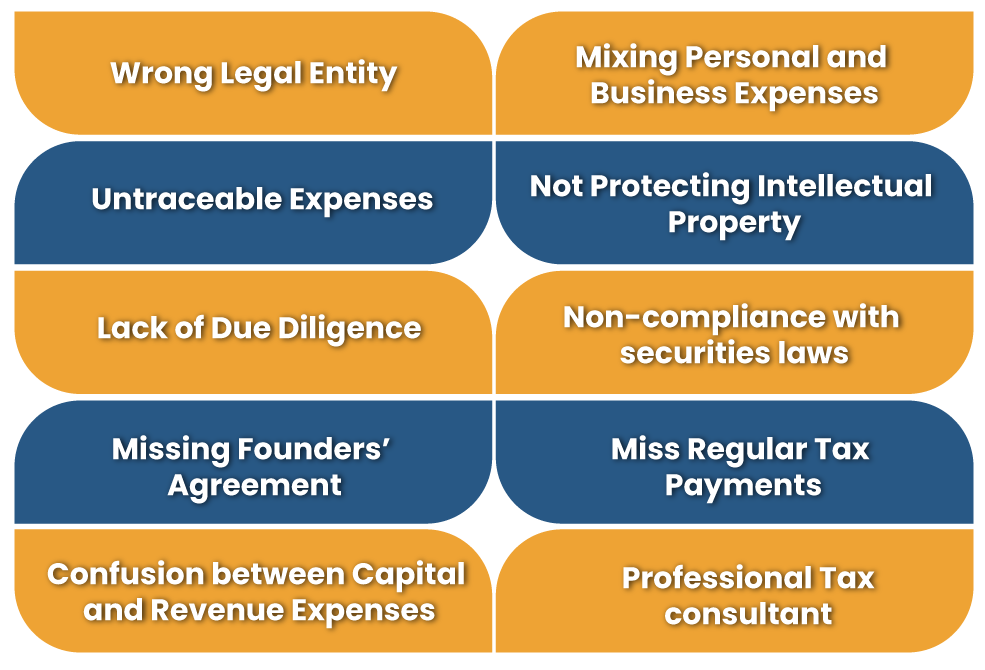

Mistakes or Legal Mistakes Made By Start-Ups in India

Following are the mistakes or legal mistakes made by start-ups in India, which are as follows:-

Wrong Legal Entity

Discussing the main factors in which the person must determine the type of entity to form. This is important because compliance with various registration requirements and legal laws depends on the type of legal entity being formed. For this, various appropriate arrangements should be made properly in each sector by our young entrepreneurs.

Untraceable Expenses

The usual and very common mistakes done by start-ups in India that they are not maintaining their records of expenses either huge or petty expenses throughout the year.

Therefore while filing ITR (Income Tax Return), including expenses or much misleading information and several important documents related to make the business unprofitable in the profit and loss of an account would worsen the entire financial position of a start-up in India.

Lack of Due Diligence

Legal due diligence can make as well as break an investment deal also. This means that documents are the greatest asset to the nature of any entity. Therefore it should be completed in all aspects. It can be in any form of a unit either big or small.

Missing Founders’ Agreement

The Founder ownership agreement which means that document on the nature of the Memorandum of Association (MOA) or the Association of Associations (AOA) or any other document on the nature of the start-ups business.

Confusion between Capital and Revenue Expenses

The major existing confusion for first-time businessmen is about expenses. A dilemma arises between taxpayers or start-ups in which the expenses are treated as asset /capital expenditure; hence these revenue expenses are reduced to P&L A/c, accordingly.

Mixing with Personal and Business Expenses

Often personal and professional expenses become indistinguishable. Doubt or confusion can get arise on personal or business expense. If not properly assessed, it can be a distorted financial situation.

Read our article:Know the Complete Rundown of Documents Required For Startup India Registration

Not Protecting Intellectual Property

Intellectual property rights are the most valuable asset of start-ups in India. Trademark, patent, and copyright are the three essential components of IP. In other words, business is largely at risk from all sorts of IP breach.

The solution to this problem is not to disclose agreements i.e. non-disclosure to ensure this. Typically, this is the main problem arising in start-ups as they often neglect the security of their business IP and do not have pre-determined steps for it.

Non-compliance with Securities Laws

Start-ups mostly lack professional knowledge in cases that may be under securities law or other income tax provisions and this is normal so it can give rise to serious legal issues at a later stage. The entrepreneur is expected to be equipped with a TAX or Legal specialist.

Miss Regular Tax Payments

The businessman is needed to pay taxes in advance except for certain exceptions prescribed under the Income Tax Act, 1961[1]. Therefore accordingly taxpayers are required to determine their liability before the start of the financial year of the respective financial year.

If the tax-related provision is not complied with, it can lead to severe penalties. Therefore, be knowledgeable in paying taxes of any nature or be regular in hiring a specialist in the relevant field.

Professional Tax consultant

Due to various compliances, start-ups players must be a professional expert in every business as a tax consultant or law experts to fulfil their goals.

Concluding Remarks

It is imperative that you go through small things first, and then take big steps with the right foot. To have a new start-up onboard, everything must be timely and well planned. It is advised that if you want to start your start-up business from the beginning, go for the right advice. The beginning step for any entrepreneur is to shape his idea into a legal entity and bring it into existence.

Many registrations are obtained by a business to work in the Indian legal framework. For various registrations, entrepreneurs require some basic compliance and knowledge of ethical issues before jumping into entrepreneurship. Kindly associate with the Corpbiz expert to know more about the mistakes made by start-ups in India

Read our article:Benefits of Startup India Registration in India