Under Buyback, there is the repurchase of its existing shares by the Company. To increase the overall value of shareholders, returning cash to shareholders, and restructure its capital structure Company generally Buyback its existing Shares. Under Companies Act, 2013, Section 68, 69, and 70 governs the Buyback of Shares and other Securities. In the article, we will go through the broad process of Buyback of Shares and other Securities as per Companies Act, 2013[1].

What is Buyback of Shares?

The process by which the Company repurchase its own shares and other securities from the existing shareholders of the Company at a higher price than market price is referred to as Buyback of Shares. The number of outstanding shares in the market fall, when a Company Buyback the Shares and other Securities.

Moreover, it can be said that Buyback is the method of cancellation of Share Capital of Company. Whenever the Company’s management thinks that the shares of Company are undervalued or if the outstanding shares are falling in the market, the Company goes for Buyback.

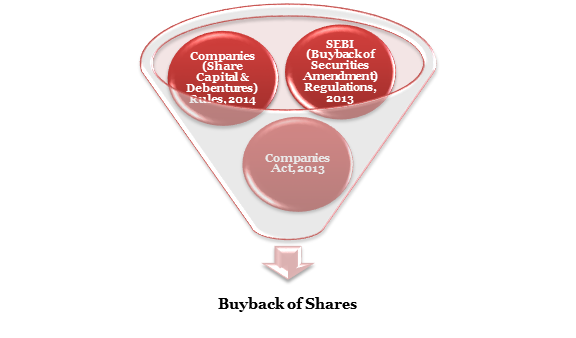

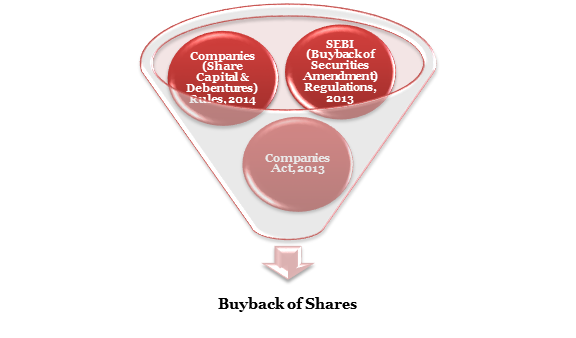

What are the legal provisions governing Buyback of Shares and other Securities?

The legal provisions governing the Buyback of Shares and other Securities are as follows:

- Section 68, 69, and 70 of the Companies Act, 2013

- Rule 17 of the Companies (Share Capital & Debentures) Rules, 2014

- SEBI (Buyback of Securities Amendment) Regulations, 2013 along with the subsequent amendments after that.

What are the different modes for Buyback of Shares and other Securities?

The different modes for Buyback of Shares and Securities are mentioned under Section 68(5) of the Companies Act, 2013. The Buyback of Shares and other Securities can be done:

- On the proportionate basis from the existing shareholders or security shareholders,

- From the open market,

- By Purchase of Securities issued to employees of Company under stock option scheme or sweat equity.

What are the conditions which should be fulfilled for Buyback of Shares and other Securities?

The conditions to be fulfilled for Buyback of Shares and other Securities are as follows:

- The AoA of the Company should authorise for the Buyback of Shares and Securities.

- The Buyback of Shares can be done only up to 25% or less than the paid-up Share capital of the Company & Free Reserves.

- The Buyback of Shares and other Securities can be done through:

- Free Reserves of the Company.

- Securities Premium Account of the Company

- The proceeds of Issue of any Shares or other Specified Securities

- The debt-equity ratio of the Company should not exceed 2:1.

- The Shares and other Securities for Buyback should be fully Paid-Up.

- In the case of Buyback of only 10% shares, exclusively an Ordinary Resolution is necessary.

- In the case of Buyback is up to 25% of the total paid-up capital and free reserves, the Company needs a Special Resolution.

- There should be a minimum gap of 1 year between two Buyback.

- No Buyback can be done from proceeds of an earlier Issue of Shares and other Securities.

What are the prohibitions for Buyback of Shares and other Securities?

Under Section 70 of the Companies Act, 2013, the prohibitions mentioned are as follows:

- Company cannot directly or indirectly go to purchase its own shares and other securities through any Subsidiary Company which includes Company’s own Subsidiary Companies;

- Company cannot directly or indirectly go to purchase its own shares and other securities through any Investment Company or group of Investment Companies;

- Company cannot directly or indirectly purchase its own shares and other securities in case the Company has made a default in the following:

- Repayment of Deposits is accepted either before or after the commencement of the Companies Act, 2013,

- Payment of Interest thereon,

- The payment of Dividend to any Shareholder,

- Redemption of Debentures or Preference Shares of Company,

- Repayment of any interest payable or any term loan thereon to any Banking Company or Financial Institution.

- After availing Company Registration, if the Company has not complied with the provisions of Sections 92, 123, 127 and Section 129 of the Companies Act, 2013, the Company cannot directly or indirectly purchase its own Shares and other Securities.

What is the procedure for Buyback of Shares and other Securities?

The procedure for Buyback of Shares and other Securities is as follows:

Buyback through Ordinary Resolution

In case of Buyback is for 10% or less of the total paid-up capital and free reserves of the Company:

- A notice at least 7 days before the Board Meeting to the Directors should be sent.

- The Directors will authorise the Buyback of Shares and other Securities by an Ordinary resolution in the Board Meeting.

- The Directors should pass an Ordinary Resolution for the Buyback in the Board Meeting.

Read our article:Issue of Shares through Private Placement

Buyback through Special Resolution

In case of Buyback is for more than 10% and up to 25 % of the paid-up capital and free reserves of the Company:

- Notice for Board Meeting

Notice of Board Meeting should be sent 7 days prior to the date of Board Meeting. The agenda of the Board Meeting should be attached in the notice.

- Hold Board Meeting

In the Board Meeting, the approval of the following things should be given:

- Approval for the Buyback of Shares and other Securities

- Fix time, date, day and place of the EGM

- Approval of notice for calling EGM along with the Explanatory Statements.

- Send Notice for EGM

The notice of EGM should be sent at least 21 days before the date of the EGM.

- Hold EGM

A Special Resolution for the Buyback of Shares and Securities should be passed in the EGM.

- File Form MGT-14 and Form SH-8

After passing of the Special resolution file form MGT-14 with the Registrar of Companies (RoC). The Form MGT-14 should be filed within 30 days of the date of the EGM. The attachments with Form MGT-14 are:

- A copy of the Special Resolution and Explanatory Statement.

- The copy must be certified by CA, CS or any Cost Accountant of the Company.

A Letter of Offer is filed in Form SH-8 by the Company which should be signed by not less than 2 Directors of Company, one of whom can be Managing Director (MD) of the Company. The Form SH-8 should be attached with the following attachments:

- Details of Promoters of the Company

- Declaration made by the Auditors

- A copy of the Board Resolution

- A copy of the notice issued with the explanatory statement

- Financial Statements of the Company for last 3 years

- List of all Subsidiary and holding Companies

- Buyback list of past 3 years of the Company

The Form SH-9 should also be filed with Form SH-8. The Form SH-9 is a Declaration of Insolvency Form submitted by the Company. The Form SH-9 should be signed by at least 2 Directors of the Company, one of whom can be the MD of the Company.

- Letter of Offer

Letter of Offer should be dispatched to Shareholders of the Company within 21 days of the filing of the Form SH-8. The offer should be open for not less than 15 days and should not exceed 30 days from the day of dispatch of the offer letter.

- Acceptance of Offer by Shareholders

If no communication of the Rejection is made within 21 days of offer closure, the offer will be considered to be accepted by the Shareholders.

- Open Bank Account

Immediately after the closure, deposit the money in a separate bank account for Buyback of Shares and other Securities.

- Verification and Acceptance and Rejection

Within 15 days from the closure of the offer, the verification and acceptance of the Buyback should be done. The shares will be deemed to be accepted if no communication of Rejection is made within 21 days from the date of closure of the offer.

The payment of consideration amount should be made to the shareholder who’s Shares and Securities are accepted. Payment should be made within 7 days of the Verification and Acceptance.

In case the Shares and Securities of Shareholders are not accepted, the Share Certificate of such shareholders should be returned within 7 days of the Rejection.

The Share and Securities brought back should be destroyed within 7 days of the completion of the Buyback process.

- Maintain Register of Shares and Securities

The Register of Shares and Securities brought back should be maintained as per Form SH-10. The Register should be kept at the registered office of the Company.

- File Return of Buyback

The return of Buyback should be filed with the Registrar within 30 days of completion of the Buyback process in the Company. The return should be filed as per Form SH-11 with the following attachments:

- A copy of Special Resolution passed at the EGM.

- A copy of the Board Resolution passed at the Board meeting.

- A copy of balance sheet of the Company.

- The description of Shares and Securities, which are bought back.

- Details of holders of securities, before Buyback.

What are the consequences of contravention with the provisions of Section 68 of Companies Act, 2013?

If the Company is in default in complying with the provisions of Section 68 of Companies Act, 2013, and of any regulation made by Securities and Exchange Board of India (SEBI), the following consequences will be faced:

By Company

The consequences faced by the Company are as follows:

- A fine of not less than 1 lakh rupees which can be extended to 3 lakh rupees on the Company.

By Officer of Company

The consequences faced by every officer of the Company are as follows:

- An imprisonment which can be extended to 3 years to every officer of the Company who is in default, or

- With fine which should not be less than 1 lakh rupees and can be extended to 3 lakh rupees, or

- With both.

Conclusion

Section 68 of the Companies Act, signifies that any Company limited by Shares can opt for Buyback of Shares and other Securities. The Company for its improvement in the market goes for Buyback. The process of Buyback of Shares and Securities is a time-consuming task. We at Corpbiz have experts who can assist you with the process of Buyback in the Company. Our experts will aid and help you with the process and assure you the successful completion of your work.

Read our article:Issue of Preference Shares without Public Offer: A Complete Procedure