With regard to the apportionment of ITC in cases of business reorganization, CBIC has provided circulation by issuing a Circular No. 133/2020– GST dated March 23, 2020, in the eventuality of amalgamation or change in the business ownership/constitution, merger or demerger. Through this circular, CBIC has provided a clear picture to numerous taxpayers.

Representations were received from the several taxpayers asking for clarification with reference to the apportionment of ITC in cases of business reorganization (during the hours of amalgamation or change in ownership/constitution of business, merger as well as demerger) The provisions concerning the apportionment of ITC in cases of business reorganization(post-merger or demerger) are carrying lack of clarity of provisions of the law since it is a subject of complexities that demands in-depth introspection.

The merger is the unification of two or more than two corporations that encompass the transfer of all assets, liabilities, as well as the stock of Transferor Company to Transferee Company and Transferee Company, issues shares in the form of consideration. A business strategy in which transfer of business undertakings takes place from one company to another company is known as Demerger.

Demerged company is the company that is responsible for transferring such business undertakings while the resulting company is the company to whom the business gets transferred. An acquiring company issues shares to the shareholders related to the selling company in the form of consideration.

Apportionment of ITC in Cases of Business Reorganization – Issues and Clarifications Related to M&A Transactions

Concerning the interpretation of section 18-subsection 3 of the CGST Act, 2017, and Rule 41(1) of the CGST Rules, 2017, in the connection of business reorganization, doubts have arisen.

Whether the value of assets of new units would get the consideration at All-India level or State-level for apportionment of input tax credit?

- Proviso to Rule 41(1) directs that the apportionment of ITC in cases of business reorganization should be in the ratio of assets value of the new units as prescribed in the scheme of demerger.

- Furthermore, Rule 41(1) of the CGST Rules[1] clarifies that the “value of assets” refers to the entire asset value of the business.

- Whether ITC has been availed or not.

- As per the CGST Act provisions, a company or an individual holding the same PAN must acquire separate registration in different states.

- Such registration would get identified as a distinct person for the Act purpose.

- The value would get consideration at the state level. On the other hand, it won’t get considered at the All-India level.

Is there any requirement for the transferor to file Form GST ITC-02 in all the registered states?

Form GST ITC-02 should get filed in those states where the transferor, as well as transferee, got registered.

Whether there will be the applicability of clause to Rule 41(1) of CGST Rules, 2017 for calculation of the transferable ITC amount?

As prescribed in the proviso to Rule 41(1) mentioned in the CGST Rules, yes, the formula will be applicable in connection with the apportionment of ITC in cases of business reorganization that would lead to the partial transfer of assets of the business as well as the liabilities.

Read our article:Elucidation on GST Refund Issues – Recent Updates

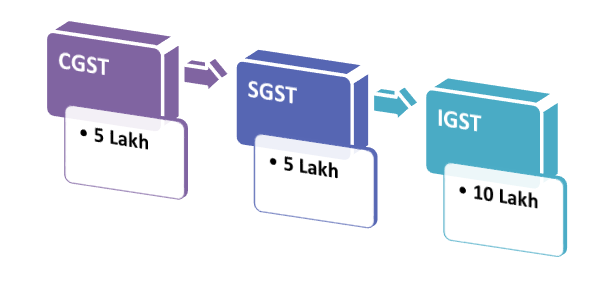

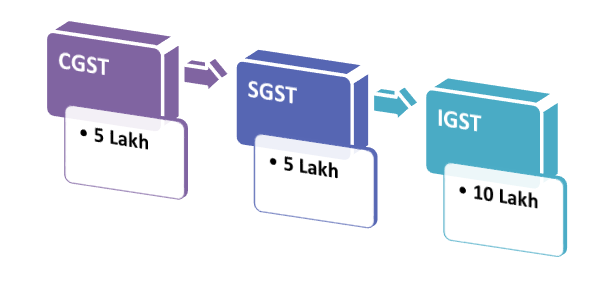

Is the Ratio of the Value of Assets shall be Applied Separately in each of the Input Tax Credit Heads- CGST, IGST, SGST Cess, as Prescribed in Rule 41(1) of CGST Rules?

- No, the ratio of the value of assets, as given in the proviso to Rule 41(1) of CGST Rules, would get applied to the entire unutilized ITC amount of the transferor.

- There is an inclusion of the sum of CGST, UTGST/SGST/ as well as IGST credit.

- Furthermore, there is no applicability of said formula with regard to ITC heads (IGST/CGST/SGST).

- Most importantly, there will be the applicability of the stated formula for cess apportionment b/w the transferee and transferor.

Illustration

The ITC balances of X (Transferor) in Maharashtra state are-

In accordance with the demerger scheme, X will be transferring 60% of its assets to Y (Transferee). As a result, the ITC amount that would get transferred to Y from X will be 60% of 20 lakh. The resultant figure will be 12 lakh.

In what ratio the amount of Input Tax Credit would get transferred while filing of FORM GST ITC-02 by the transferor?

- The transferor would determine the amount that is to get transferred under various tax heads (CGST, IGST, UTGST/ SGST) within this total amount subject to the availability of ITC balance under the concerned tax head in the hands of the transferor.

- As defined in Rule 41(1) of CGST Rules, the total amount of ITC that would get transferred to the transferee must not be more than the amount of ITC ready for the transfer in the future course of time.

Which shall be the Relevant Date for Calculating the Amount of Unutilized Transferable ITC of the Transferor?

A joint reading of section 18(3) of CGST Act as well as Rule 41(1) of the CGST Rules will infer that the applicability of apportionment formula would be on the input tax credit balance of the transferor as existing in the electronic credit ledger on the filing date of FORM GST ITC- 02 by the transfer.

What shall be the relevant date for calculating the ratio of value of asset?

As prescribed in Companies Act, 2013- (section 232(6)); the ratio of the value of assets needs to be taken as on the appointed date of the demerger for ITC apportionment. The said ratio will be applicable to the input tax credit balance of the transferor on the FORM GST ITC- 02 filing date for calculation of transferable ITC amount.

Conclusion

Society has embraced the GST and made it the biggest multi-stage, destination-based tax in India. Transferors, as well as the transferee, must ascertain the apportionment of ITC in cases of business reorganization at the time of Merger and Acquisitions. The CBIC has provided clarifications to the questions raised by the representatives. Our team of experts at Corpbiz would assist you with the advice concerning the apportionment of ITC in cases of business reorganization.

Read our article:Input Tax Credit for Restaurants