A Digital Signature certificate (DSC) is the equivalent of a physical signature in an electronic format, as it establishes an identity of the sender of an electronic document on the Internet. After incorporation, the person authorized is to apply for DSC else he/she would not be able to file returns or verify the documents. The DSC is also mandatory for filing of important government forms such as GST, Income tax, etc.

It comes in the form of a USB E-Token, wherein the Digital Signature Certificate is stored and can be accessed computer/laptop to sign documents electronically. There are 3 types of Digital Signatures which are Class I, Class II and Class III Digital Signature.

What is a Digital Signature Certificate (DSC)?

DSC is a secured digital key which contains details of a person holding the Digital Signature Certificate like name, country, pin code, email address, and the name of the Authority that has issued the DSC. DSC reduces cost, time and reduces the scope of fraud during the e-filing or other statutory filing.

DSC validates an identity of a person signing the document and maintains the integrity of the Data. However, the physical presence of Authorized Signatory is not required, but the customers are assured of the documents received as it is authorized, and the scope of the forged document is reduced.

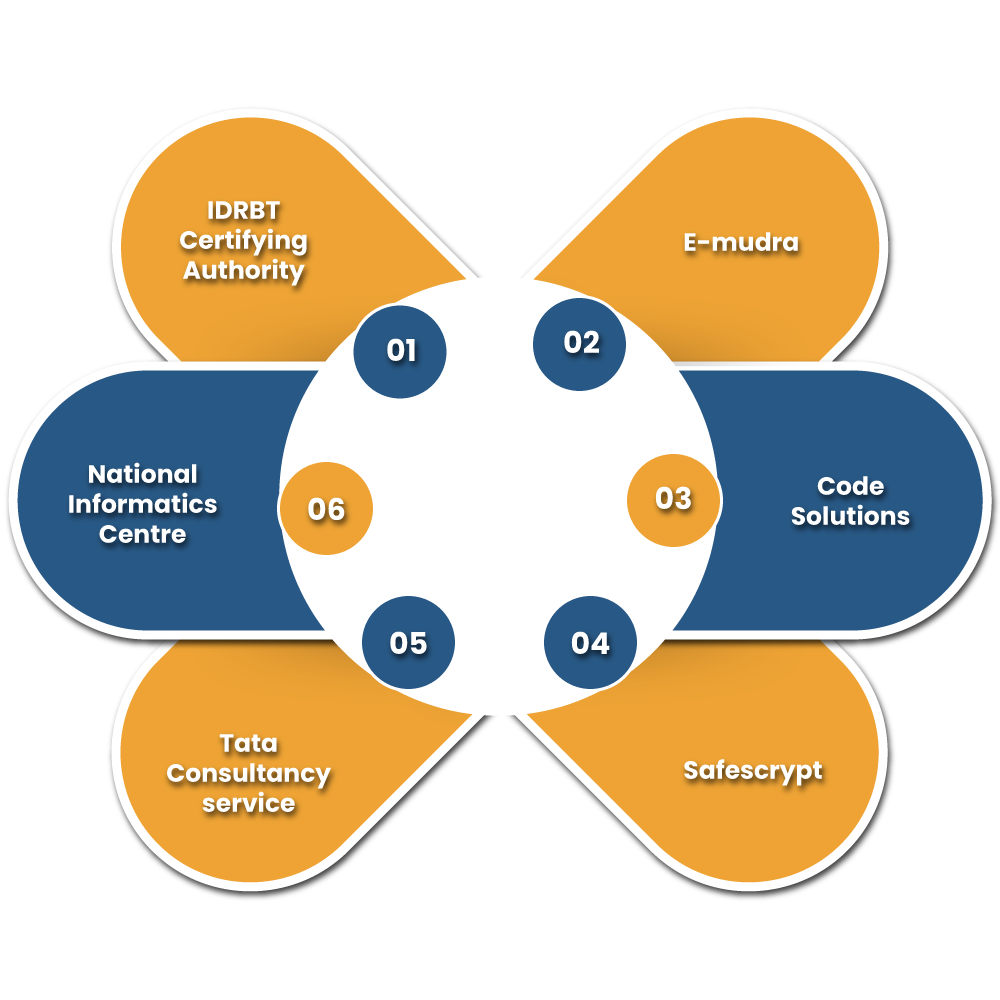

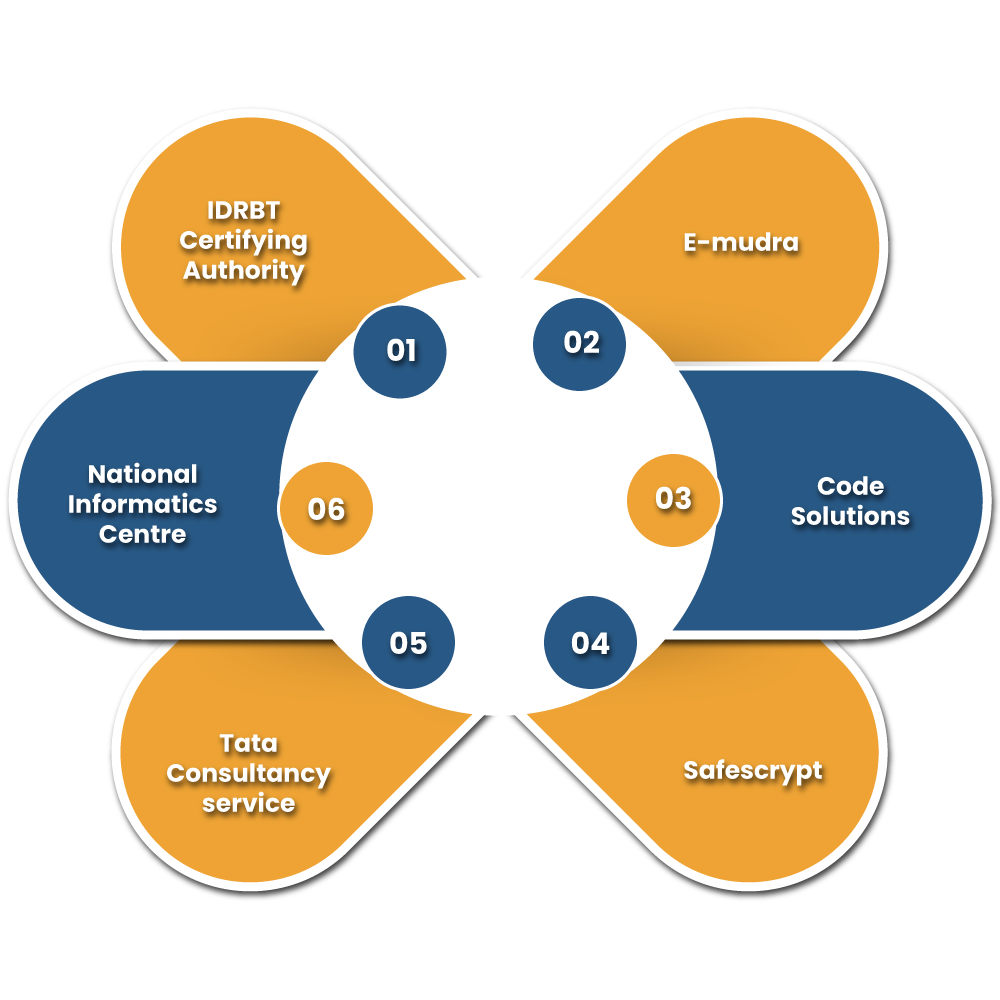

Who are the DSC Certifying Authorities?

The Certifying Authorities are individuals or agencies who have been granted the license & rights to issue/apply for DSCs. According to Section 24 of Information Technology Act, 2000, the IT Ministry[1] has recognized the following entities as licensed DSC Certifying Authorities:

How to Obtain DSC?

DSC can be availed either by approaching to Certifying Authority directly or through online by third-party service providers. All the original documents and the self-attested copies are required. The DSC applicant has to undergo the eKYC authentication process as well. The authorities also accept a certified document of an applicant which has been issued by the bank Authorities containing the applicants’ database in a bank. Usually, DSC gets issued within 3 to 7 working days.

What all Documents needed to Apply for DSC?

DSC is divided into three classes that are Class 1, Class 2 and Class 3. Class 2 & Class 3 are valid for the MCA21 program. Class 1 DSC is for an individual. In case of Class 2, an identity of a person is e-verified, and in case of Class 3, the person is required to be physically present in order to prove his identity with the authorities. The person is required to have the duly filed DSC application form along with the photo identity and an address proof before applying for the DSC certificate from the Certifying Authority.

Process to Apply for DSC (Digital Signature Certificate)?

The process to Digital Signature Certificate has to be done with adequate care and diligence, in which the following steps are needed to be accomplished. Those are as follows:-

STEP 1: Login and select the Type of Entity

Log in to website of the Certifying Authority licensed to issue Digital Certificates in India. Then you will be guided to the Digital Certification Services’ section. Under ‘Digital Certification Services’ section click on type of entity for which one wants to apply for DSC such as for individual or for organization.

In case if you applied for an individual DSC, click on the ‘individual’. A new tab containing a DSC Registration Form will appear. Download the DSC Registration Form.

STEP 2: Fill up all the Necessary Details

Once you download the form, fill in all the necessary details as required in the form:

- Class of the DSC

- Validity

- Type: Only Sign or Sign & Encrypt

- Applicant Name & Contact Details

- Residential Address

- GST Number & Identity Details of Proof Documents

- Declaration

- Document as proof of identity

- Document as proof of address

- Attestation Officer

- Payment Details

On filling up all necessary details you must affix the recent photograph and your signature under a declaration. Check the completion of the form thoroughly. Take a print of completed form.

STEP 3: Proof of Identity and Address

The supporting documentation must be provided as the proof of identity and address that has to be attested by an attesting officer. It must be ensured that the sign and seal of the attesting officer are properly clear and visible on supporting proof documents.

STEP 4: Payment for the DSC

A demand draft or cheque is ways to make payment for application of DSC in the name of Local Registration Authority where you are submitting your application for the verification. You will find the details of the Local Registration Authority according to your city of residence by searching for the Certifying Authority licensed to issue Digital Certificates online.

STEP 5: Post the Documents Required

Enclose all the following in an envelope:-

DSC Registration Form duly completed

All supporting document for Proof of Identity and proof of address must be attested by an attesting officer.

Demand Draft/Cheque for payment

Address the enclosed envelope to Local Registration Authority (LRA) and post it to the designated address for further processing.

On completion of the above-mentioned steps by filling DSC Form and providing necessary documents and payment, you have successfully completed an application process for Digital Signature Certificate.

What is a Validity of DSC?

The validity of DSCs ranges from 1 to 2 years. Once the DSC is expired, it can be renewed. The process of renewal of DSC is also same as that of the DSC registration on the MCA portal. An applicant can either go to Certifying authority with the original documents or through online he can get DSC.

Conclusion

Digital Signature Certificate has been made mandatory by the (MCA) Ministry of Corporate Affairs while having company registration, hence apply for DSC soon. It is required by the company directors, designated partners in case of an LLP or by professionals such as Chartered Accountants or Company Secretaries.

Read our article:A Complete Overview on Compensation to Director for Loss of Office