Starting a new business can be a rewarding experience for anyone. But setting up a business can incur countless challenges. Selecting the right business structure is one of the biggest roadblocks in a business journey. At present, new businesses have access to a slew of business structures that are legally stable and adhere to plenty of benefits. That is where is confusion can occur especially for startups that lack clarity on the same. In the recent past, the structure like LLP has gained a lot of popularity in the business landscape owing to its increased adoption. New businesses, in particular, are more inclined toward this business structure considering the host of benefits it offers to the business owner. In this article, we will unveil the potential benefits of LLP for startups in brief.

Why LLP for startups adheres to immense potential?

New businesses do not usually have ample capital to initiate their business journey. Under tight budgets, they probe every possibility to keep the irrelevant expenses out of the equation, be it a matter of registering a company or partnering with vendors for raw materials.

LLP is a business structure that renders the pros of Limited Liability Company and flexibility of a partnership firm. The existence of this business structure remains unaffected by changes in partners. It allows the partners to draw a contrast with third-party firms and hold property under its name. LLP for Startups seems more profitable, unlike other business structures, as far as the magnitude of compliances is concerned.

Read our article:Difference Between LLP and Partnership Firm: Choose the Correct Form of Entity For Your Startup?

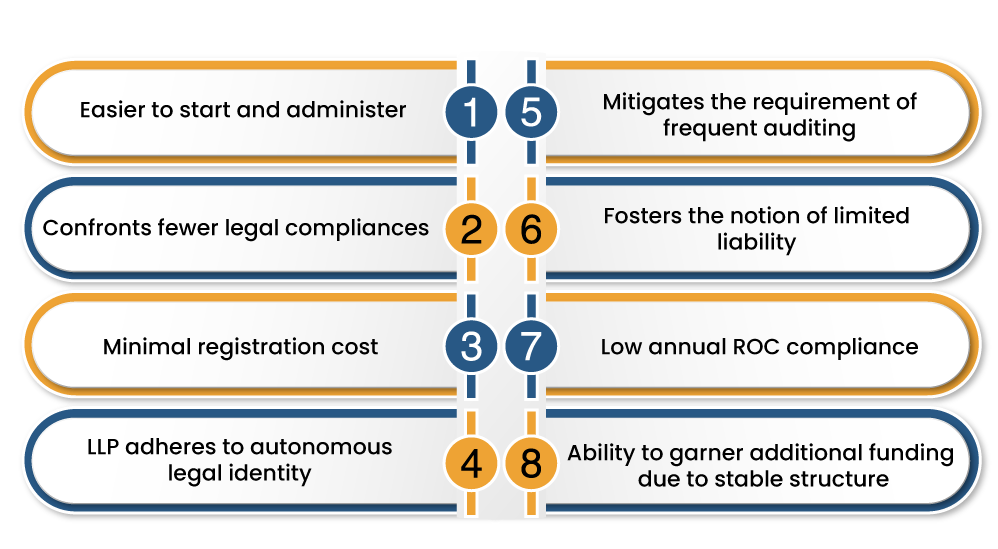

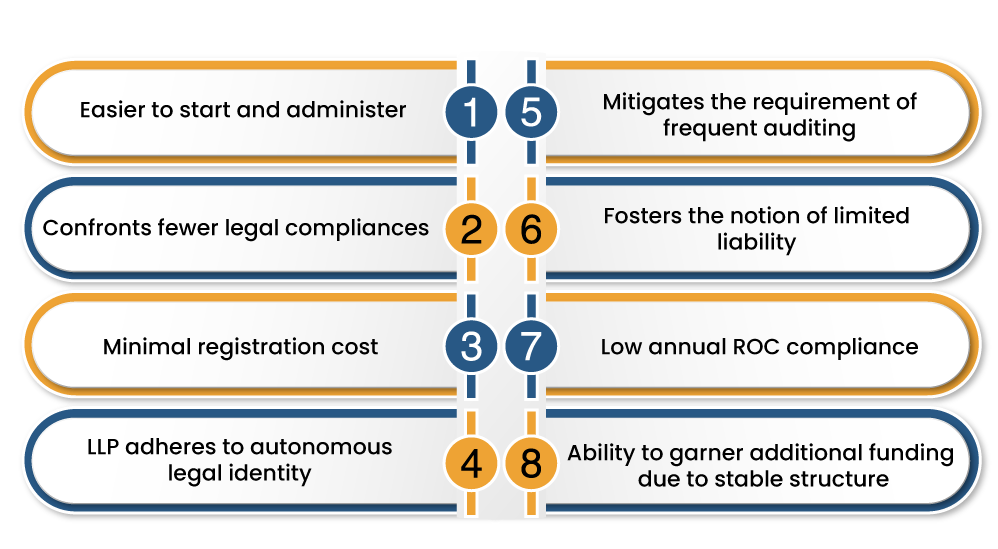

Upfront benefits of Registering under LLP Business Structure

LLP is a popular business structure in India. It offers a slew of benefits such as limited liability, tax exemption, and fewer compliances to the business owner. But, less compliance doesn’t make it less credible in any regard as it comes under the ambit of the Ministry of Corporate Affairs[1]. When contrasted with other business structures like private limited company and public limited company, it faces lesser legal implications. This makes LLP the most suitable business structure for start-ups.

What makes LLP so special from a start-ups standpoint?

LLP makes its way into the business landscape in 2008 and since then it has been adopted by thousands of start-ups. It is one of that business structures that enable the business owner to keep stringent norms at the bay. The cost of maintaining this business model is incredibly lower than the counterparts like private and public limited companies. Where private limited companies have to put in more effort and resources to maintain their compliances, LLP negates this severe downside. LLP for startups is as good as other business structures when it comes to legal stability.

Private Limited Companies have extended applicability. A private limited company draws a line of distinction between shareholders and directors, enabling it to procure additional funding and offer ESOPs. If you wish to serve such purposes then you can opt for this business structure without thinking twice. On the contrary, if your priority is to run your business seamlessly and your biggest constraints are time and money, it’s better to stay away from this business model.

Incur fewer expenses in terms of registration

LLP has an upper hand when it comes to the registration cost. One can get the private limited company registered at Rs 15000. But once you addressed such an expense, you need to pay an additional 15000 bucks per year to ensure conformity with MCA’s norms, some of which initiate as soon as you registered. Furthermore, you also need to confront audit expenses that will cost you around Rs 15000. This implies that this business structure seeks Rs 45000 per year.

An LLP, on the other hand, is way more affordable. It costs around Rs 11,000 to incorporate and Rs 4000 to comply with MCA norms. Furthermore, you only need to cater to audit requisites once your firm surpasses the minimum threshold of annual turnover and paid-up capital, which is presently being capped at Rs. 40 lakh and Rs. 25 lakh respectively.

It is evident from the above that for the cost of starting a privately held entity you can start & maintain an LLP in its first year.

Lures Fewer Penalties

Many privately-held entities fail to comply with MCA norms. This can lead to a stringent penalty of up to Rs 100000 a year. With an LLP, considering its low costs, the likelihood of non-compliance is pretty low. This would ensure that you stay out of the penalty zone.

So if you are commencing a business that is not likely to procure funds or render ESPOs to employees, an LLP could be your best bet. It will keep the initial expenses as low as possible and ensure you focus on core competencies rather than addressing the ever-changing compliances, unlike the private limited companies.

Conclusion

LLP is a perfect business structure for starts up as far as the level of compliances and risks are concerned. It puts start-ups in a commendable position by averting tedious legal requirements and let them stay isolated from ever-changing compliances. Furthermore, it saves the partners from the risk of losing personal assets under fiscal crisis. All in all, LLP seems to be a suitable business structure for start-ups that are low in capital and are incapable to address compliances. Choosing a business structure like LLP for startups is certainly a wise decision since it lures low set-up costs and fosters improved transparency.

Read our article:How to Register Your Limited Liability Partnership Firm in India?