With government initiative to build up Startup India, several leverages are given to startups such as tax exemption, etc. Due to this reason, there is a surge in the development of many startups. Many investors across the world have made significant investments in the country due to the large market size. Angel tax is one of the initiatives taken by the government that was however introduced in 2012, but final execution was made in February 2019 only when certain tax exemptions were given to startup industries.

Definition of Angel Investment

Such investment, which is made by angel investors, is called Angel Investment. Angel investors generally make an investment in startup companies or new companies establish by entrepreneurs. The main intension behind the investment is not to make a profit but to boost startup growth and new ideas by youngsters. To boost the confidence of startups, angel investors provide lucrative terms as compared to other investors. Recently many startup companies in India have received abundant investment across the globe, which has secured not only startups growth but also economic growth in India.

What is definition of angel tax?

Angel tax was introduced in the year 2012, which can be defined as income tax that is to be paid by angel investors on the amount of capital raised in companies by issuing shares. These investors basically make an investment in unlisted companies by issuing shares in the company. The main motive of introducing angel tax was to restrain money laundering by inhibiting buying of shares at a higher price.

Angel investors get benefits in the form of taxation as the entire investment made by investors in not taxed. The amount which is regarded as the above fair value during the valuation of a company is taxable. This tax is chargeable at the maximum rate of 30% that affects both investors as well receivers.

What benefits does angel investor gets in India?

In many countries, in order to promote angel investments, many exemptions, such as tax breaks are given to investors. For instance, in the United States, reinvestment profit is being generated from one to another startup. However, in India, this is not the scenario as any such special tax break is given to angel investors. Further, 30% of the funding needs to be paid in the form of tax as ‘other source of income’ that imposes a much higher rate of taxation. Many startups and investors are against this and fighting for this, as this creates unnecessary pressure on them.

The legal stance of angel taxation is defined under Section 56(2)(viib) of the Income Tax act of 1961, which is applicable for startup companies. As per the said section, when equity shares are held by the closely held company, and further such shares are taken by investors, such investors shall pay such value of shares, which is higher than fair share value to be considered as income from other sources. Such companies need to pay the taxation amount at the rate of 30%, and cess levied.

Purpose behind Angel taxation:

The main intention behind angel taxation was to curb money laundering. Only a minor percentage of the population does comply with taxation requirements, which comprise only 2% of the total population. Due to the reason if India supports angel investment, then it may lead to the creation of black money in India, which may further lead to money laundering. Most of the startups don’t maintain proper books of account and show or their assets legibly. Due to this flaw, the income tax department of India is of view that the valuation of companies needs to be done by special officers based on prescribed guidelines and formulas. This will help the department to do the proper valuation of assets of the company, which shall further lead to higher tax payment.

What is the reason behind that startups are against concept of angel taxation?

There are many reasons due to which startups are opposing this concept of angel taxation along with investors. As investors are reluctant to invest in Indian startups due to this concept, which impose higher tax amount on them. Certain reasons are as mentioned below:

- There is a difference in the method of calculation of market value shares as used by companies from the concept as used by government authorities. Government authorities don’t use many factors while calculating the market value as include by many startups, which results in a much lower value. This calculation result done by startups results in higher price value, which leads them to make a huge investment in the companies. But this difference in calculation later leads to payment of a large amount of tax amount.

- Due to large amount of taxation to be paid, many investors are avoiding making an investment in the market. Which has a huge impact on Indian industries as many large investors are avoiding funding due to the reason?

- Angel taxation has halted the development and growth of startups, leaving them disheartened.

After huge opposition by startups and many investors, finally Indian government has come up with certain changes that have further a positive hope in this direction.

What are initiatives taken by the government in this regard?

In order to promote the startup industry, the government has taken certain steps in regards to angel taxation as mentioned:

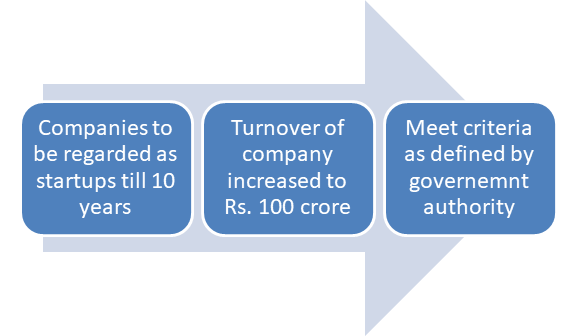

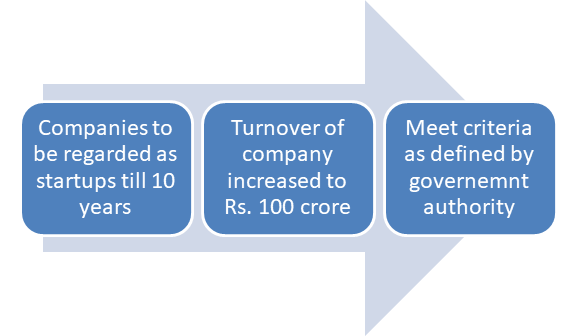

- Earlier, a company was regarded as a startup for a period of 7 years from the date of its incorporation. But now it has been increased to 10 years in order to provide benefits in terms of income tax for a further three years.

- Further, a company shall be regarded as a startup if it has not attained a turnover of more than Rs. 100 crores for the said financial year. This limit was Rs. 25 crores before, which has now been increased.

- In the case said entities meet the criteria as defined by the government, then exemption from angel taxation shall be given.

What are various circumstances under which exemption from angel tax can be taken?

There are certain conditions that need to fulfill in order to get an exemption from angel taxation. Certain norms were given by the government through the Department of Promotion of Industry and Internal Trade (DPI) via its notification dated April 2018, which was further amended dated 4th February 2019. As per the said notification:

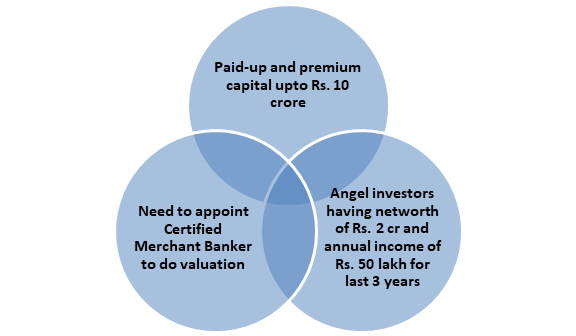

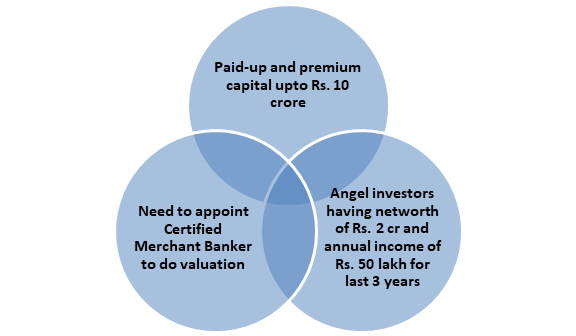

- after issuance of shares, the paid-up capital of the company, along with premium share, should not exceed Rs. 10 crore;

- Before companies could use their own methodology in order to calculate market value but now the government has made it compulsory to get the assistance of a certified merchant banker in order to get the valuation.

- The person who is making an investment should have a net worth value of not less than Rs. 2 crores, and his annual income for the last 3 years should not be less than Rs. 50 lakh. Only on fulfillment of these conditions, the startup shall qualify as an angel investor

Conclusion:

Although the said amendment of 2018 and 2019 has given certain relief to the investors as well as startups, there are still many challenges that startups and investors face in this regard. A major challenge in as per Article 68, according to which a company shall be imposed too heavy tax liability in case it fails to disclose the source of this income. These impositions have hindered the growth of many startups, so the government needs to take more steps in order to improve startups’ conditions.

Read our article:Income Tax Slab and Rate for financial year 2020-21