The Auditor in a Privately-held organization plays a vital role in maintaining the integrity of the financial statement through periodic inspection. Every registered organization is liable to disclose its audit reports at the end of the financial year.

The financial statements of the company must be thoroughly scrutinized and assessed prior to submission. If any error were found in the reports, then the company’s auditor will be held accountable.

Who is an Auditor in a Privately-held Organization?

All the government & non-government entities have to continually monitor their accounts & audit reports as the financial year arrives. The financial statements require to be analyzed inside out and assessed prior to furnishing them to concerned departments. This assessment is done under the supervision of the company’s auditor. In case of any error identified in the reports, the auditor is held answerable. Thus, the auditor plays a crucial role in ensuring the legitimacy of the financial report at the utmost level.

Legal Aspects Connected with the Appointment of Auditor in a Privately-held Organization

There are few important aspects which are connected with the appointment of Auditor in a Privately Held Organization, which are as follows:-

Time Period- 30 days

Every entity must appoint its first auditor within 30 days of the registration during the AGM or within 90 days in an Emergency General Body Meeting carried by the board of directors. The first auditing firm or an auditor appointed will hold office when the 6th AGM is held. Therein, the appointments of the auditor are reviewed every sixth year.

Written Permission

Written permission from the auditor, along with sufficient proof under Section 141 of the Act, requires to be furnished prior to appointment.

Appointment Notice

The company must issue a notice regarding the appointment of the auditor along with a Form- ADT-1 is needed to be furnished with the registrar within 15 days of the general meeting in which the appointment of the auditor is being made by the members.

Section 139

The companies enlisted in Sec 193 (related to the class of entities as cited in the section) and Rule 5 (audit & auditor) of the companies, 2014 has to do the following obligation, which are as follows:-

- Appoint a person as an auditor for only one consecutive five-year tenure.

- Appoint an auditing firm for only two terms of five consecutive years

Apart from that, the auditor who completes his/her tenure will not be liable to be reappointed in the same organization. The same concept applies to auditing firms as well, which means that they will not be reappointed in the same company after completing their prescribed tenure.

3 years is the transition period which is given to ensure conformity with this requisite. Even though, as per the rule, the 5 years is calculated in view of retrospective effect. Sections 139 to 148 of the Companies Act, 2013 provides comprehensive & thorough detail on the auditor’s role along with other requirements, such as their removal or appointment.

New Appointment of an Auditor in a Privately-held Organization

An auditing company or an Auditor in a Privately-held organization will stand eligible for re-appointment at the AGM, provided:-

- The auditor has shown no interest in continuing his/her role with the company.

- A resolution regarding the appointment of a new auditor or firm has been passed in the meeting.

- If at the Annual General Meeting, no decision is taken for the appointment or re-appointment of the auditor, the exiting auditor will serve his/her tenure as per the rules.

- In case of the auditor’s demise, the new candidate will be appointed within 30 days by the board. He/she would continue to serve the tenure to the point where next AGM arrives.

- If the auditor resigned from his position, the new candidate will be appointed within 30 days by the board. The board members would approve the same matter within 3 months of the appointment at the meeting.

- The auditor who has resigned from the organization requires filing a Form-ADT 3 enclosing the matters and the reasons for the same.

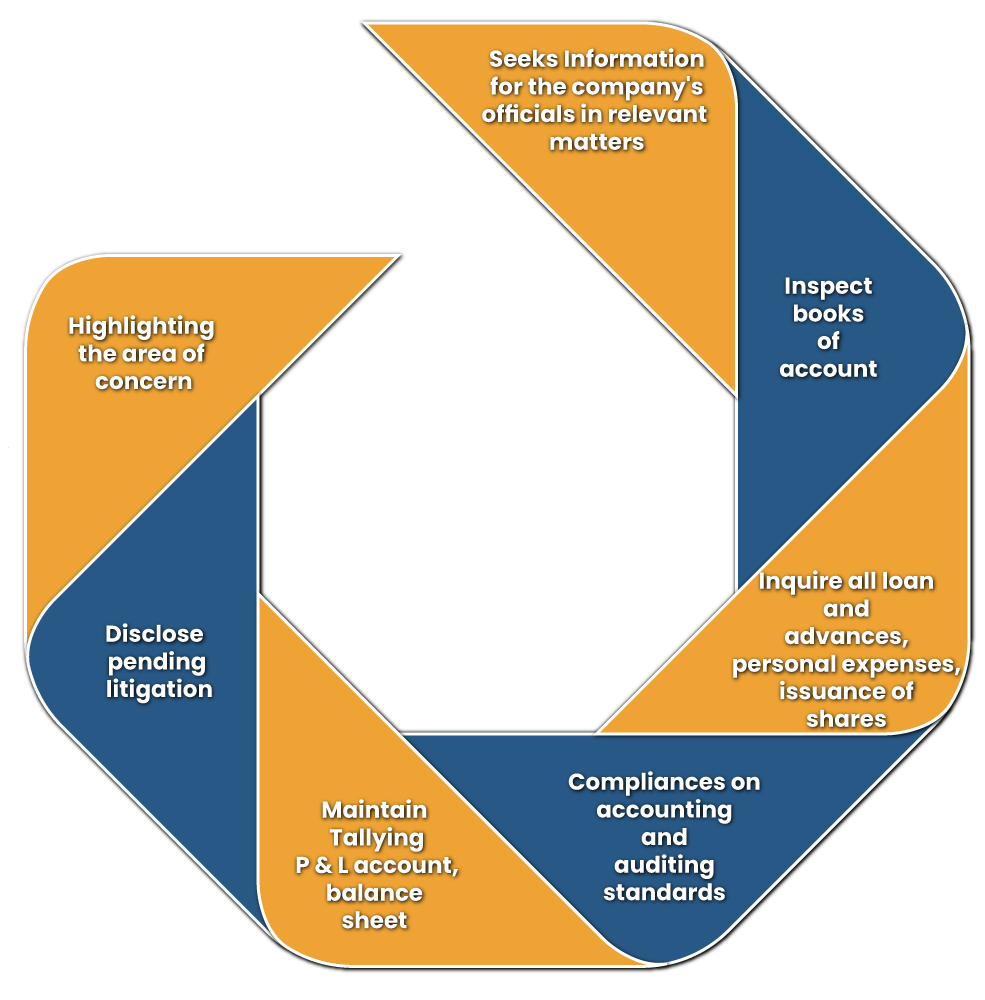

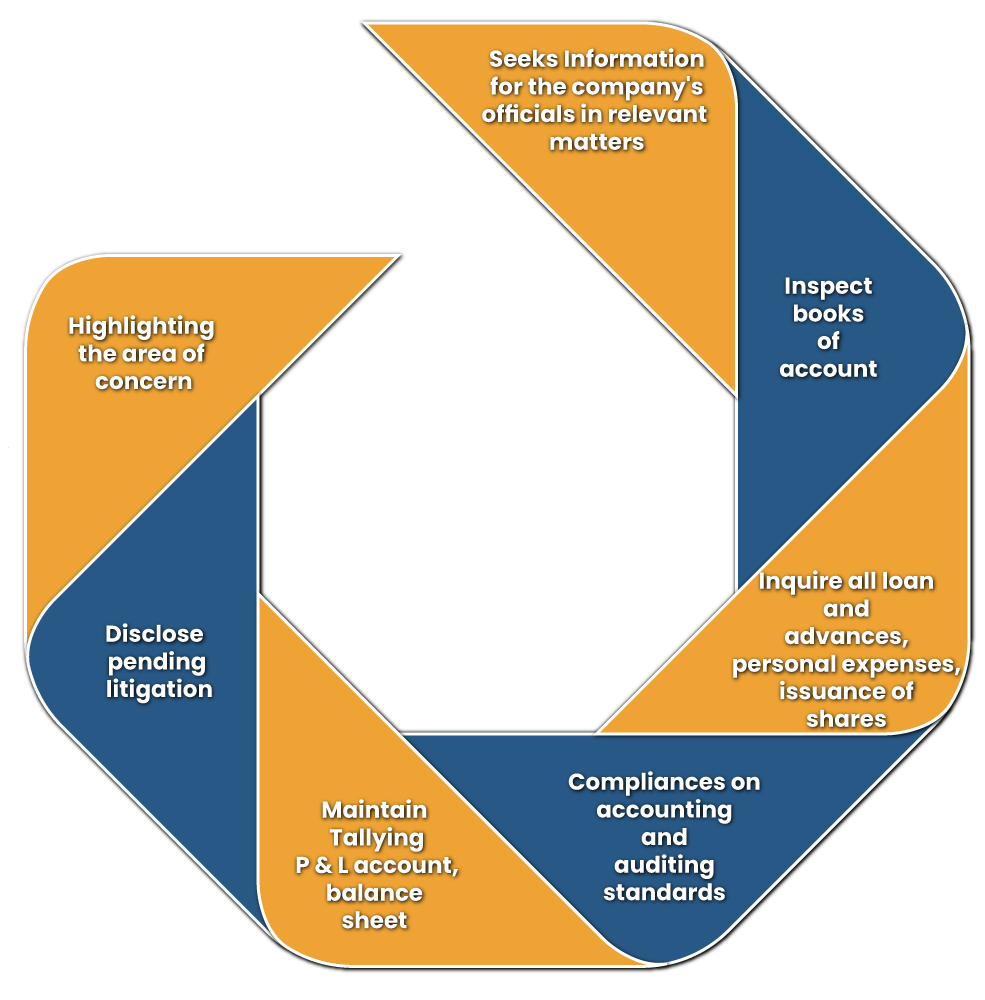

Duties Performed by Auditor in a Privately-held Organization

The Companies Act, 2013[1] has revised & added additional norms under Auditor’s role against the provisions mentioned in the Companies Act, 1956. Accordingly, there is some strict compliance made to the director to make corporate governance concise & clear. The new provisions also render an auditor extra responsibilities that also make him/her answerable to the financial reports’ faults.

Read our article:Powers of Registrar for Removal of Name of Company from Register of Companies

Auditors’ Roles & responsibilities as prescribed by the Act

- The Companies Act, 2013 has made some measurable changes in the power and duties exercised by the Auditor in a Privately-held organization. Every auditor has the legal right to get access to account statements & vouchers irrespective of the timeframe. He can demand officials to disclose the documents as and when asked for.

- Auditors has to ensure that the existing loans and advances are free from any disparities and are in the company’s interest,

- Auditor in a Privately-held organization must ensure that all the financial transactions & statements are in line with the company’s rule and true to its core.

- After identifying the frauds in the company records, the auditor must communicate the matter to the concerned authority with legit evidence. A fine amounting to Rs 25 lakh will be imposed on the auditor in case of the violation of the said condition.

- The Auditor in a Privately-held organization is not legally permitted to provide services regarding internal audits, investment advisory, bookkeeping, or banking services to the company.

- The company’s auditor must ensure conformity with auditing standards.

- If the auditor fails to meet the prescribed conditions/standards, the penalty ranging from 1 lakh to Rs 25 lakhs would be imposed in view of existing standards.

- The auditor should examine all the records and financial statements in all subsidiaries in view of legal rights conferred by the existing bylaws.

- Auditors should maintain a backup of useful information in certified copies for future usages.

Legal Aspect Associated with the Removal of Auditor in a Privately-held Organization

- The companies Act, 2013 enclose the norms related to the removal of auditor prior to the completion of the tenure. This matter comes into existence where the company seeks prompt replacement of auditor due to performance issues. The process regarding the auditor’s removal is included in the sub-section (1) of Section 140 of the Company Act, 2013.

- Prior to removal, the auditor is given an equal chance of being heard off before the concerned members.

- If the company removed the auditor during the active tenure, the central government mandatory undertaking before passing any resolution. The company is required to file an application in the form ADT-2 to serve such a purpose. The application fees as mentioned under Section 12 of the Companies (Registration Offices and Fee) Rules, 2014 required to be furnished along with this form.

- The company is bound to file the aforesaid application within 30 days of the resolution passed.

- The company can conduct a general meeting within 60 days after availing Central Government’s permission.

Conclusion

Appointment, removal, or re-appointment of the auditor in a Privately-held Organization is subjected to a long list of provisions cited under the concerned Act. So make sure to avail a better understanding of these norms before indulging in such activities. Share your concern with our associates at the CorpBiz’s helpdesk and avail best of the guidance on any legal affairs.

Read our article:Annual Compliance for Section 8 Company: A Complete Checklist