Input tax credit (ITC) is a vital term of understanding that has various ramifications under the regime of GST. One of the main objectives for establishing GST is to bypass the overflow effect of the various taxes and assure seamless progress of credits.

The GST law includes the various provisions which diminish the consistency of input tax credit of goods/or service. In a changing scenario, the government keeps on formulating several amendments under the regime of GST. There are various sections defined under GST law related to ITC for all leagues of taxpayers.

Introduction to ITC

Input tax credit (ITC) is the tax that entrepreneurs pay at the time of purchase and that it can be used to curtail its tax liability when it makes a sale. In other words, the enterprises can curtail their tax liability by alleging credit to the extent of GST paid on the purchase.

GST is a unified tax system where every enterprises purchase shall be matched with a sale or another by another business. This makes the flow of credit across an entire supply chain a seamless process.

How Does ITC Works Under the Regime of GST?

When trader sales goods to the customer, he collects GST based on the HSN of the goods sold and places the destination. At the time of making payment for the above taxes, an input tax credit will be allowed in a below-listed manner-

| Credit | 1st to be utilized for payment of | Balance if any |

| CGST | CGST | IGST |

| IGST | IGST | CGST and then SGST/UTGST |

| SGST/UTGST | SGST/UTGST | IGST |

For Example

The price of the product in the hands of the dealer is the amount of Rs. 825. This involves the amount of Rs. 125 as GST. The trader can claim amount of Rs. 125 as an input tax credit and diminish his original tax liability amount of Rs. 180 by this amount. In simple words, the trader will need to pay only amount of Rs. 55 (Rs. 180- Rs.125) to the government.

Taxes under the Regime of GST to Claim ITC

There are four types of taxes discussed under the regime of GST on which the ITC to be claimed. Those are as follows:-

- Integrated GST (IGST) is for interstate movement of goods

- Central GST (CGST) & State GST (SGST) / Union territory GST (UTGST) is for intrastate movement of goods.

- GST Compensation cess is for notified goods

Conditions to Claim ITC under the Regime of GST

Every registered individual can be authorized to claim ITC charged on any supply of goods or services to him who is used or intended to be used in the course of his business.

Eligibility for Claiming ITC (Under Section 16 CGST ACT, 2017)

The registered person can claim ITC charged u/s 16 of CGST ACT, 2017, if he falls under the below-mentioned eligibility criteria.

- An individual should have a GST registration.

- An individual can claim Input Tax Credit only if the goods and services received is used for the course of business.

Conditions for Taking ITC (Under Section 16 CGST ACT, 2017)

The below-mentioned conditions to be met in order to claim the ITC u/s 16 of CGST ACT, 2017

- Possesion of Invoice

- Tax Levied on Supply actually paid to Govt

- Claim ITC by filing GSTR- 3B

- Receipt of the Goods/Services

Individual must have a debit note, tax invoice, supplementary invoice, in order to entitle the Input Tax Credit. Moreover, the individual shall make payment in cash or using ITC on the goods and/or services for which the ITC is taken. Also, all GST returns such as GST-1, 2,3, 6, and 7 must be filed as per requirement.

- Payment for the invoice to be cleared within 180 days from the date of the invoice

- The registered person must have cleared the payment to the supplier within the 180 days from the date of invoice has been generated.

- If the registered individual fails, such credits availed by the recipient should be reversed in GSTR -3B. Interest will be charged @ 18% from the date of utilizing credit until the refund of credit.

- When the payment is made to the supplier after that, the registered individual shall be authorized to utilize the credit again without any stipulated time period.

- Exception

The aforesaid condition of payment of the value of supply plus tax within 180 days will not be applicable in the following situations:

- Goods on which tax is chargeable under refund charge

- Deemed supplies without consideration.

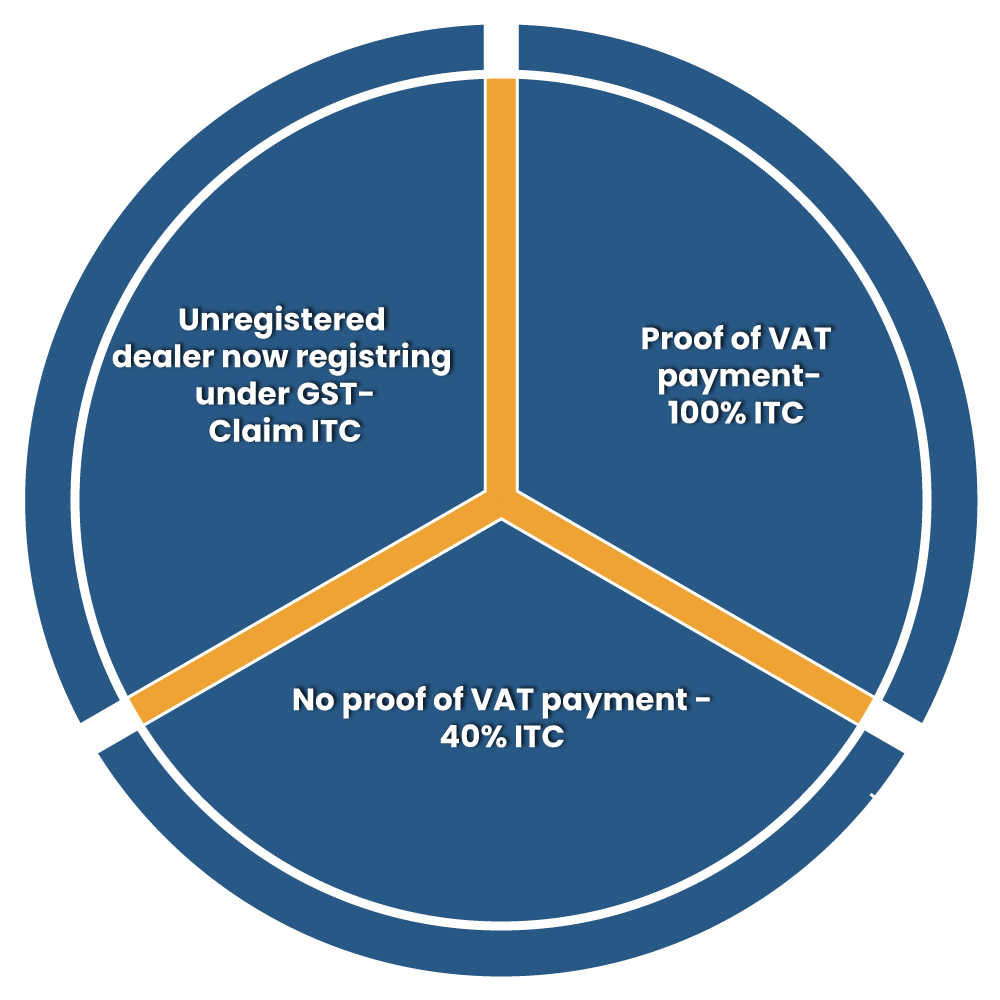

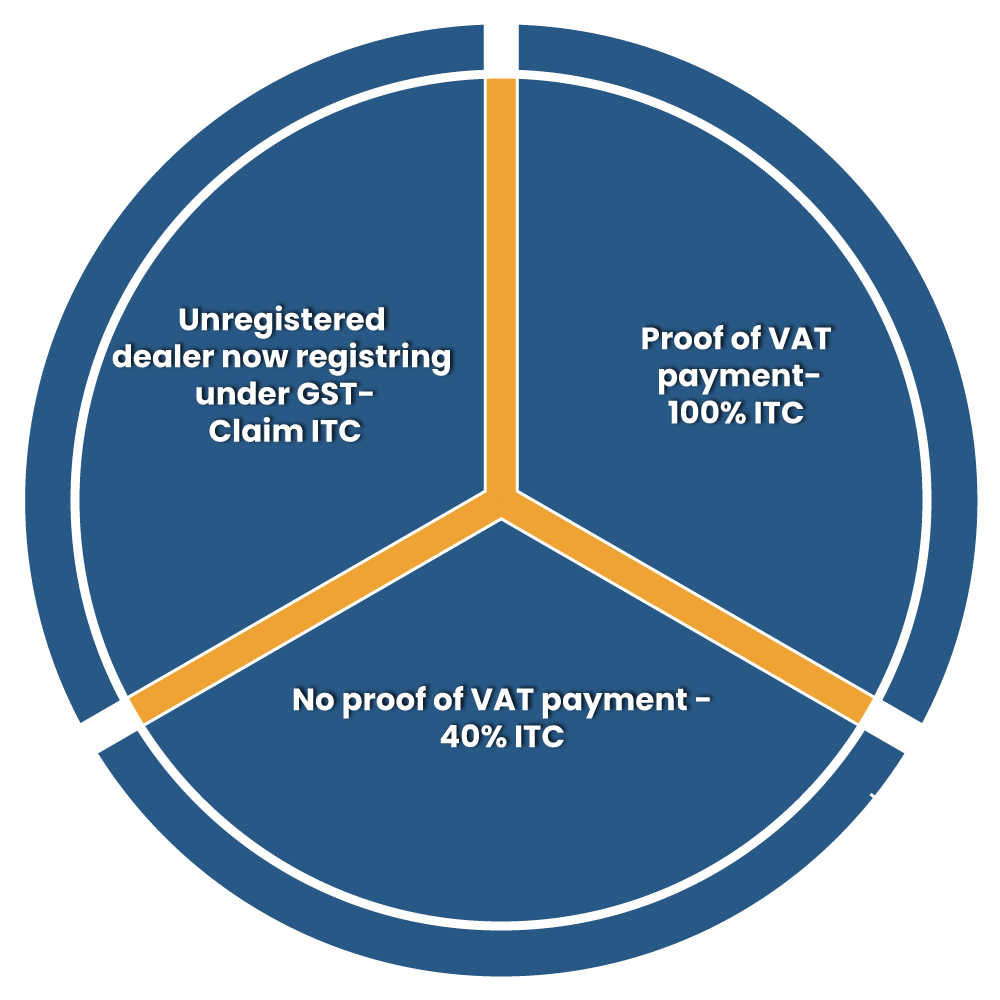

Norms to Claim ITC of VAT Registering Under the Regime of GST

- This case will be considered the case of excise duty; unregistered people can available VAT credit by registering under the regime of GST.

- The credit of both and entry tax will be available.

Condition When Evidences of Payment of VAT Is Not Available

A certified individual (prior not certified under VAT), posses goods which were tax paid only at the first point in the state and subsequent sales of which were not tax paid, shall be granted to avail input tax credit on stock-in-hand on the enacted day of GST ACT,2017 i.e., (1st July 2017).

The credit shall be granted at the rate of 40% of the SGST applicable after the GST ACT[1] enacted date 1st July 2017. ITC of 60% shall be applicable if the total GST Rate is 18% more than it.

This credit shall be credited to the taxpayer’s electronic ledgeronly after payment of output SGST on those goods of sale. It will be applicable from the appointed date (i.e., till 31st December 2017). The below-mentioned conditions will have to be fulfilled for this:-

- Those goods shall not be excluded from the current VAT.

- The registered person shall have documents (shreds of evidence) of these goods like challan’s, receipt of invoice, etc.

- A registered person using this scheme shall separately submit the details of stock in hand on 1st July.

- The registered person shall provide particulars of sales of such products mentioned in the FORM GST TRAN-1 on the last date of every month during which the scheme is active.

- The credited granted cost will be transferred to the electronic credit ledger provided in the FORM GST PMT-2.

- The stock of products on which the credit is utilized must be easily recognized by the certified individual maintained accordingly.

Conclusion

The GST journey started in 2000 when a committee was formed to draft comprehensive law to deal with all indirect taxes. When GST comes into enforcement in the year 2017 at that time, there were many laws present in the society like excise duty, sales tax, service tax, vat.

To rectify the previous law related to taxes, the Government had announced the GST Act,2017, but the implementation of new law over the previous laws is a difficult task so the government has implemented the GST with some exceptions and these certain exceptions allows an unregistered person to claim the ITC of VAT by registering under the regime of GST. This case will be considered as the case of excise duty under the regime of GST.

Read our article: GSTN Rolled out Solutions to Prominent GST Errors