A Temple registration as a society or trust or a company registered under Section 8 of the Companies Act, 2013. Generally, Temples are formed as a trust when it is instituted by one or more person. For temples to be formed as a society, seven persons are required to register. Institutions engaged in the promotion of art, commerce and culture in the formation of temples are often registered as Section 8 Company.

Temple Registration as a Trust

Temple registration as a trust is created with a document known as trust deed. The trust is formed by the founder in relation with the trustees. The deed includes objective of the trust, operation, information related to the trustee and powers, duties, rights and liabilities of the trustee. After the formation of the deed, the trust registration will be done in the office of the registrar or sub-registrar’s according to the laws applicable in your state.

After the trust registration, copy of the registration certificate from the registrar will be provided and you will have to apply for PAN card. Then, the trust will have to apply for tax registration.

Application for Income tax Certificate and tax exemptions certificate from the income tax department can only be done after one year of operation of the trust. A trust should be registered with movable or immovable property.

Read our article:NGO Organizational Structure & Section 8 Company Registration Process

Application for 80G Certificate

To acquire the 80G certificate, the association has to fill up the Form 10G and affix its activity report for the past 3 years. The activity report should consist of the audited report from the date of institution of the trust or the report from the past 3 years. Download the form 10G to get registered in 80G from the department of Income Tax website. Moreover individuals, a body of individuals or any artificial person like an association of persons, a company, institution; a Hindu Undivided Family can also form a trust.

Process for Temple Registration

Temple registration can be done by filing for application for registration of charitable or religious trusts under Rule 17A.

The procedure is as follows-

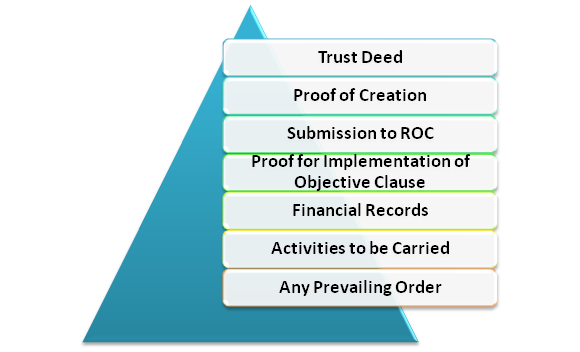

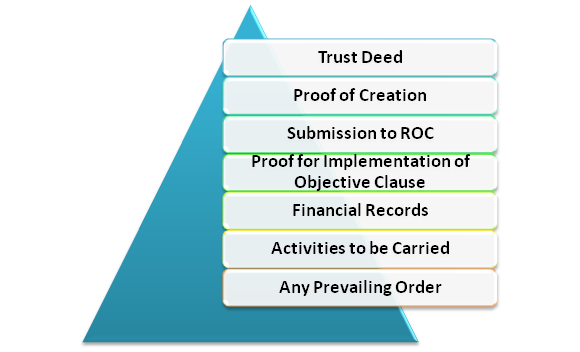

- An application for temple registration will be made in Form 10A and is required to be supported by following documents-

- Self-attested copy of Trust Deed where the trust is created under any instrument;

- Self- attested copy of the document as a proof of creation of the trust;

- Self-attested copy of registration certificate submitted with the Registrar of Companies or Registrar of Public Trusts or Registrar of Societies;

- Self-attested copy of the documents as a proof for implementation or alteration of the objective clause;

- Self-attested copies of the yearly financial records of the trust related to prior years;

- Note on the activities to be carried out by the trust;

- Self-attested copy of any prevailing order granting Temple registration under section 12A or 12AA;

- Self-attested copy of the rejection order of any application for grant of Temple registration under section 12A or 12AA.

2. Form 10A can be furnished electronically-

- Under digital signature, the income return is mandatory to be furnished along with the digital signature;

- In the process for E-Verification code in a case that is not covered in the above mentioned point (clause i).

3. Form 10A will be verified by the person who is authorized to verify the return of income under section 140, as applicable to the assessee.

Temple Registration under Section 80G

In situation of section 80G registration for Trust, a benefit is given to the donors to gain exemption under section 80G concerning the amount of contribution so made subject to some limits from the income. The ‘Finance Act 2020[1]’ has come up with some variation for the donee trust accessible of which some are of consideration for the donors, they are-

- The existing established donee trust or fund are already permitted under section 80G of the Act;

- Any new applicant will be arranged interim registration mainly;

- The time limitation and registration process is more or less similar in the section 12AB with an important exemption for non-applicability of any confusion as to the agreement of any other laws in force;

- Indisputably the statement will appear to be in the form of e-filing of the explanation, and the same should be working to reflect in the ‘annual statement’ regarding the donor;

- An outcome of INR 200 per day under section 234G in case of dissatisfaction to provide statement and a registration certificate as mentioned above.

- The border of cash donations under section 80GGA has been restricted to INR 2000.

Conclusion

Temple Registration is a concept that generally features all over the place. There are many benefits of registration of temple such as well-being of public and deity members, safety of wealth, protection of liquidation, & taxation. If the temple is formed with all the required legal measures, then it will help every structure of a temple. If you want to get your Religious Trust Registration, contact our experts at Corpbiz.

Read our article:What are the Differences in Between Section 8 Company from Trust and Society under NGO?