Limited Liability Partnership in India is a form of business entity in which partners are not liable for each other’s ill actions. Also, the firm does not have to suffer due to such actions. LLP is a form of business entity in India which is very easy to incorporate and maintain. LLP is an ideal business model for professionals, Small and Medium-scale Enterprises, and family-owned businesses.

An overview of Limited Liability Partnership

The concept of Limited Liability Partnership in India was introduced through the Limited Liability Partnership Act, 2008. The main motive behind the introduction of this form of an entity was to provide an entity model that is easy to maintain and has limited liability. Also, the compliance formalities of an LLP are pretty less.

Features of Limited Liability Partnership

The key features of a Limited Liability Partnership firm are as follows;

- The LLP is an independent legal entity separate from its members;

- An LLP has perpetual succession;

- Furthermore, any change in the partners of the LLP must not hinder the existence, rights and liabilities of the firm;

- Moreover, the provisions of the Indian Partnership Act, 1932 does not apply to an LLP;

- Every LLP must consist of at least two partners, and one of them must be a resident of India. However, if the number of partners gets reduced and the LLP is run by only one partner for a period more than six months, such partner will be liable personally for any obligations of the LLP incurred during that period;

- An individual cannot be appointed a partner in an LLP unless he/ she has given a prior notice to act as one.

Benefits of LLP Registration

The benefits of LLP registration is:

- Seperate Legal Entity

- Flexible Agreement

- Suitable For Small Business

- No Owner /manager Distinction

Requirements for starting an LLP in India

You must fulfill the following requirements to incorporate an LLP in India;

- Minimum 2 partners

- Director Identification Number[1] (DIN) for all the designated partners

- The nominee should be a natural person if the body corporate is a partner

- Digital Signature Certificate (DSC) for all the designated partners

- Each partner should contribute some capital of LLP, although there is no concept of share capital in an LLP

- At least one partner should be the resident of India

- Address proof of LLP

Read our article:How to validate the Company Registration Number?

Forms used by Limited Liability Partnership firms

The following forms are used to incorporate an LLP firm and after;

| Sr. no. | Form | Purpose of form |

| 1. | RUN – Reserve Unique Name | The form used to reserve a name for your LLP |

| 2. | FiLLiP | A form used for the incorporation of LLP |

| 3. | Form 5 | Used to send a notice for change of name |

| 4. | Form 17 | Application form for converting any firm into an LLP |

| 5. | Form 18 | Application form and statement for the conversion of a private company or unlisted company into an LLP |

| 6. | Form 3 | Information related to LLP Agreement |

| 7. | Form 4 | Notice for appointment, cessation, change in name, address, or designation of a partner or designated partner |

| 8. | Form 4A | Addendum of Form 4 |

| 9. | Form 8 | Statement of account and solvency |

| 10. | Form 11 | The annual return of Limited Liability Partnership firm |

| 11. | Form 12 | A form used to intimate any other address for service of documents |

| 12. | Form 15 | Notice for change of registered address |

| 13. | Form 22 | Notice for intimation of the order of court, tribunal, central, government to the registrar |

| 14. | Form 25 | Application for reserving or renewal of name by a Foreign Limited Liability Partnership (FLLP) or Foreign Company |

| 15. | Form 27 | A form used for registration of particulars by Foreign Limited Liability Partnership (FLLP) |

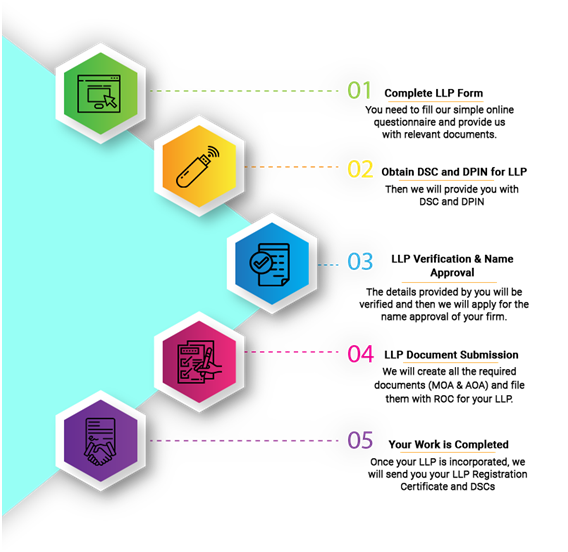

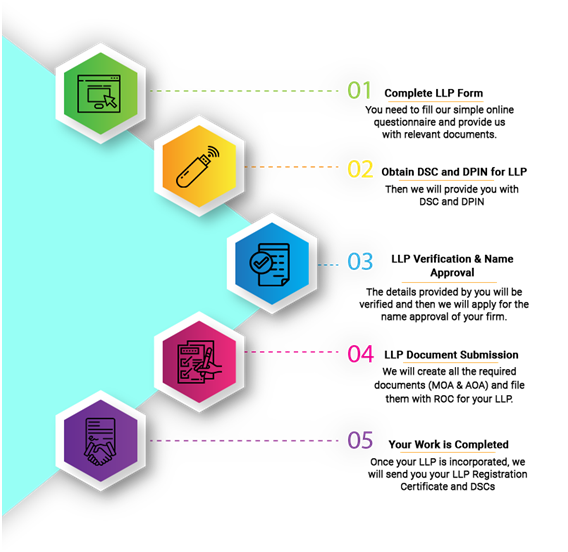

LLP Registration Procedure

Step 1: Obtaining a (DSC) Digital Signature Certificate

The first step before initiating the process of registration is to apply for the digital signature for the designated partners of the proposed LLP. This is because all the documents for registering an LLP are filed online, and they are required to be digitally signed.

Therefore, the designated partner must obtain their digital signature certificates from a government recognized certifying agencies. Moreover, the cost of obtaining DSC varies, based upon the certifying agency. Also, you need to obtain either class 2 or class 3 category of DSC.

Step 2: (DIN) Director Identification Number

Then, you have to apply for obtaining the DIN of all the designated partners or those intending to be the designated partner of the proposed LLP.

Furthermore, the application for the allotment of DIN has to be made in Form DIR-3. Then, you have to attach the scanned copy of the required documents (usually Aadhaar and PAN) to the form. The form needs to be signed by a Company Secretary in full- time employment of the company or by the Managing Director/ CFO/ CEO of the existing company in which the applicant is going to be appointed as a director.

Step 3: Reservation of Name

Limited Liability Partnership-Reserve Unique Name (LLP-RUN) is filed for the reservation of name of proposed LLP which is then processed by the Central Registration Centre under Non-STP. However, before quoting the name in the form, it is recommended that you use the free name search facility on the MCA portal. The system will provide the list of resembling names of existing companies/LLPs based on the search criteria filled.

It will help you in choosing names which are not related to already existing names. Furthermore, the registrar will approve the name only if the name is not undesirable in the opinion of the Central Government and does not resemble any existing partnership firm, an LLP, a trademark or any other body corporate. Moreover, the form RUN-LLP has to be accompanied with the fees as per Annexure ‘A’ which may be either approved or rejected by the registrar. A re-submission of the form is allowed to be made within 15 days for rectifying the defects in case of rejection. Also, there is a provision to provide two proposed names of the LLP.

Step 4: Incorporation of LLP

- The form used for incorporation of an LLP is FiLLiP or Form for the incorporation of Limited Liability Partnership) which shall be filed with the Registrar who has the jurisdiction over the state in which the registered office of the LLP is situated. The form is an integrated form.

- Pay the fees as prescribed under Annexure ‘A.’

- The form also provides for applying for the allotment of DPIN in case an individual who is to be appointed the designated partner does not have a DPIN or DIN.

- The application for the allotment is allowed to be made by only two individuals.

- Also, the application for the reservation can be made through FiLLiP.

- In case the name is approved, then the approved and reserved name can be filled as the proposed name of the LLP

Step 5: File Limited Liability Partnership Agreement

The LLP agreement governs the mutual rights and duties of the partners and also between the LLP and its partners. Also, these actions must be taken regarding the LLP Agreement;

- The LLP agreement must be filed in form 3 online on the MCA Portal.

- LLP agreement in Form 3m has to be filed within 30 days of the date of incorporation.

- The LLP Agreement needs to be printed on a Stamp Paper. The value of the Stamp Paper is different for every state.

What are the documents required for LLP Registration?

The following documents are required to register an LLP firm;

Documents of Partners:

- PAN Card/ ID Proof of the Partners

- Address Proof of the partners

- Residence Proof of Partners

- Photograph

- Passport (in case of Foreign Nationals/ NRIs)

Documents of LLP firm:

- Proof of Registered Office Address

- Digital Signature Certificate

Government fees of LLP Registration

The government fees for LLP Registration in India are given in the table below;

| Sr. no. | Certification/ Authorization | Fee |

| 1. | DSC | Approximate Rs. 1500-2000 for two partners (varies based on the agency) |

| 2. | DIN | Rs.1000 for two partners |

| 3. | Name Reservation | Rs. 200 |

| 4. | Incorporation | Depends on capital contribution. The contribution up to Rs. 1 lakhs – Rs. 500, The contribution between Rs. 1 and 5 lakhs – Rs. 2000 |

| 5. | LLP Agreement | Depends on the capital contribution A contribution up to Rs 1 lakhs – Rs 50 for filing Form 3 and the stamp duty is based on the state where LLP is formed |

Time is taken to register an LLP

Generally, it takes about fifteen days to register a Limited Liability Partnership Firm. However, it may vary from one state to another.

Conclusion

Limited Liability Partnership is a type of firm which includes at least two partners or individual people who come together to run a business. The major advantage of LLP over a traditional Partnership Firm is that in an LLP, one partner is not responsible for the misconduct or negligence of another partner.

Read our article:Difference Between LLP and Partnership Firm: Choose the Correct Form of Entity For Your Startup?