Implemented in the mid of 2017, the Goods and Services Tax has overcome several indirect taxes which were levied earlier. Registering to GST is the first and foremost requirement of this tax reform. GST Registration number (GST Identification No.- GSTIN), is a uniquely encoded 15 digit number which is allocated GST registration holders engaged in the supply of taxable goods and services.

Importance and Eligibility Criteria for GST Registration

It’s important to keep in mind that GST registration is done basis of PAN. A supplier has to opt for the registration in each state from which he/she is making supplies. Hence, if suppliers have an extended business footprint with multiple branches across different states- he/she would be entitled to avail separate registration for each of these states. But within a state, a business owner has the authority to declare one place as the principal place of business and the rest of the branches as a supplementary place of business. Section 22 to Section 30 of the CGST Act, 2017[1], facilitates registration provision for business pan India encompassing every supplier of goods and services.

GST registration is mandatory for the following persons:-

Read our article:Revocation of Cancellation of GST Registration

Government notification about the GST registration with effect from 1st April 2019

- Every taxpayer involved in the supply of services & reaping more than Rs 20 lacs of yearly turnover in special states* and Rs. 40 lacs for the rest of the state should comply with GST provisions. It’s mandatory for both the category of the taxpayers to get registered for GST in the state, from where he/she handles their trading activities.

- Every supplier of goods and services whose yearly turnover exceeds the threshold limit i:e Rs. 20 lakh, in case of special states* and Rs 40 lakhs for rest of the states, should address GST-based liabilities in the state where he/she handles their trading activities.

- Taxpayers are eligible for selecting multiple registrations within a State for their various businesses located within the same state. This provision is also applicable to the taxpayers from Union territory.

- However, there are some criteria in which the GST provision is not applicable. The following pointer illustrates the same.

- GST registration is not mandatory for the class of suppliers dealing with the following products:-

- Ice cream

- Edible ice

- Pan Masala

- Tobacco

- The person registered under the terms of Section 25 (3) of the CGST Act, 2017;

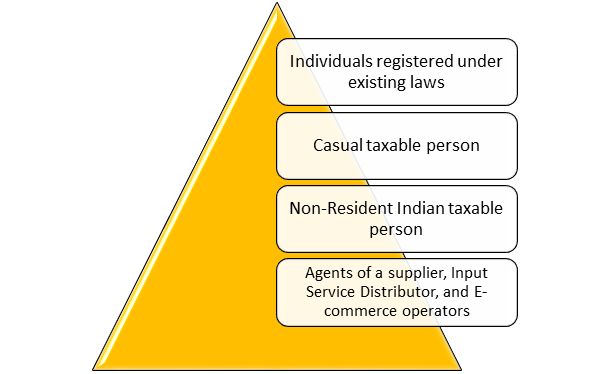

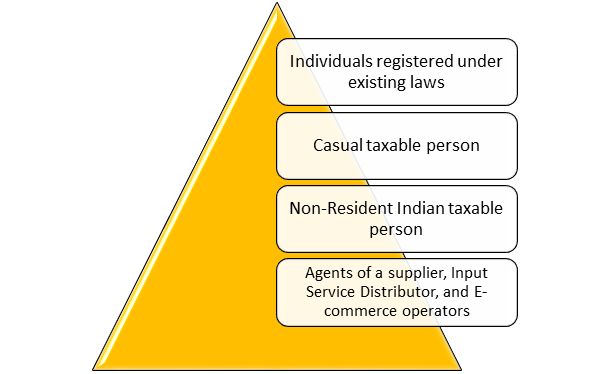

- It’s compulsory for the person to get registered under section 24 which includes

- A person supplies taxable goods on an Inter-State basis.

- Taxpayer operating its business under the canopy of the reverse charge mechanism;

- A person liable to bear tax liabilities under sub-section (5) of section 9;

- A taxable person from overseas making taxable supply;

- Persons who are accountable for deducting tax under section 51 regardless of the status of their registration.

- Persons involved in the supply of taxable goods or services on behalf of other entities.

- Input Service Distributor, whether or not registered under this Act.

- Persons engaged in the supply of taxable goods or services or both via electronic commerce operator who is liable for tax collection at source under section 52;

- Every e-commerce operator who is under the obligation of collecting tax at source under section 52;

- Every person providing information or database access through an online portal from a remote location outside the country

Class of entities that don’t come under GST

Here is the list of the following persons on which GST is not applicable. Those are as follows:-

- Persons associated with the trading of goods and services or both, which are not taxable under this Act or under IGST.

- Persons involved with business activities on the reverse charge basis.

- The person catering to the type of business deals with the taxable services and generates turnover below the threshold limit and is exempted under GST provision. Also, the class of entities that are reaping yearly turnover of fewer than Rs 10 lacs is also subject to this condition.

- The class of entities dealing with handicraft goods and generating up to INR 40 Lakhs or INR 20 Lakhs of annual turnover is also exempted under GST.

- A business owner is catering to supplies of notified goods on the inter-state basis and generating an annual turnover exceeding INR 40 Lakhs or INR 20 Lakhs.

- A business owner is rendering inter-state taxable services to a registered person generating a yearly turnover of INR 40 Lakhs or INR 20 lacs concerning jewelry.

- Persons engaged in the supply of services (not under u/s 9(5)) via e-commerce operators and able to generate the turnover within the threshold limit.

Eligibility Criteria for GST Registration (Composition dealer)

Any person who is unwilling to comply with Section 9 (1) of the CGST Act and generating an annual turnover of Rs 1.50 crore can opt for such registration. In the following states, this threshold limit concerning the aggregate turnover has been slashed down to Rs. 75 Lacs.

- Arunachal Pradesh,

- Manipur,

- Meghalaya,

- Mizoram,

- Nagaland,

- Sikkim,

- Tripura,

- Uttarakhand

Who is not eligible for Composition Levy?

- The person involved in the inter-state supply of goods;

- A person using an e-commerce operator platform for the supply of goods.

- The person catering to supply of exempt from levy of GST;

- Manufactures dealing with the supplies Ice cream and other edible ice cream, Pan Masala, Tobacco, etc.

The composition scheme has already been extended for Service providers or Mixed Suppliers. With effect from 1st April 2019, even service providers (other than the hotel sector) or mixed suppliers of taxable goods or services having yearly turnover of Rs 50 Lacs are eligible for such scheme.

Conclusion

GST has proved effective on every ground where previous tax reform lacked. The implementation of GST discourages the tax leakage and ensures the transparency within the taxation system. The digitization has made the GST implementation more formidable than ever. With the online portal in place, any taxpayer can drop an application for GST registration in minutes. If you are not familiar with the online GST registration process or Eligibility Criteria for GST Registration, then let our experts help you out.

Read our article: How to Download GST Registration Certificate?