Here’s the synopsis of the notifications issued by CBIC on several GST during the month of June 2020.

Overview of the Notifications by ‘40th GST Council meeting’ on GSTR

In our previous blogs, you can see that GST amnesty for taxpayers between July 2017 and January 2020 who haven’t filed GSTR-3B for the said tax periods is notified, as per the announcement made previous at the ‘40th GST Council meeting’.

In the CGST notification no. 52/2020 dated 24th June 2020, the CBIC notified that Nil GSTR-3B for the above period could be filed with no late fee in between ‘1st July 2020 and 30th September 2020’. Additionally, it shall be restricted to a maximum of Rs, 250 per return per month, per act for the rest of the taxpayers.

Brief Explanation on 40th GST Council meeting’ on GSTR

Moreover, a late fee waiver has added and pushed the last dates for GSTR-1 to June 2020 from March. The fresh deadlines for monthly filing with no late fee charge from March to June 2020 will be 10th, 24th, 28th July 2020, and 5th August 2020. For quarters January-March 2020 and April-June 2020, the last date for quarterly GSTR-1 shall be 17th July and 3rd August 2020 correspondingly.

With an annual turnover is beyond Rs 5 crore in the previous financial year, the large taxpayers have not been informed any further extension for filing GSTR 3B “from February to May 2020”. Henceforth, for the first fifteen days from the respective due dates of February to April 2020, no interest would have been charged, i.e., the 20th of the next month correspondingly. After that, if there is any further delay in GST payments until 24th June 2020, interest at a reduced ‘rate of 9% ‘p.a. would be charged.

Until 24th June 2020, for furnishing their pending GSTR-3B from February 2020 to April 2020, the late fee would not have been charged. The next deadline for them to watch out for is 27th June 2020 to file GSTR-3B of May 2020, without late fee or interest. No relief or extension has been entitled out for any additional months.

GSTR-3B Return: Central Board of Indirect Taxes and Customs alerts Late fee of Rs. 500/-

The government has notified to cap the maximum late fee for Form GSTR-3B at Rs. 500/- (five hundred only) per return as a significant relief to the GST taxpayers[1]. It has been pronounced for the tax period “July 2017 to July 2020”. Moreover, it is subjected to the condition that such GSTR -3B returns have to get filled before 30th September 2020.

Brief Explanation of Late fee alerts

A notification has been allotted to be responsible for nil late fees if there is any tax liability, a maximum of late fee of Rs, and no tax liability. Therefore, up to 30th September 2020, 500 per return would apply to such filed GSTR-3B returns.

In addition to the relief provided for cleaning up past pendency of returns from July 2017 to January 2020 and earlier provided relief for February 2020 to April 2020, various representations were received to give further relief in a late fee charged for the tax periods of “May 2020 to July 2020”.

If it has no tax liabilities; then no Return fee is needed: Excess Amount shall be re-credited

In accordance to the change in the late fee ‘for the delay in GSTR-3B’, the CBIC (Central Board of Indirect Taxes and Customs), has notified in the Goods and Services Tax portal that late fees on GSTR-3B would be waived off to whosoever has Nil Tax Liabilities. A lot of Return Filing was on hold before the COVID period for the period from July 2017 to Jan 2020, according to the Notification issued by CBIC.

The portal has tweeted responding to the new changes, that “the change in late fee amount completed by the vide circular/notification no. 57/2020, dated 30-06-2020, has been integrated on the GST portal. Moreover, al the late fee paid shall be re-credited in due course, which was in excess than prescribed in the Notification.”

Read our article: A Study on Apportionment of ITC in Cases of Business Reorganization

Brief Explanation of the Notification (Nil Liability)

The Notification talks about the taxpayers who fail to furnish the return in FORM GSTR-3B for May 2020 to July 2020. They have an aggregate turnover of more than rupees 5 Cr. in the preceding financial year by the due date but present the said return till the 30th day of September 2020.

In this case, the total amount of late fee under section 47 of the said Act shall stand entirely waived for those taxpayers wherever the total amount of central tax payable. In the said return is NIL and shall stand waived, which is more than two hundred and fifty rupees”.

Small taxpayers will be provided a waiver of interest whose aggregate turnover is up to ₹ 5Cr and late fees if they file the form GSTR-3B for the supplies exaggerated in months of “May, June, and July” of 2020, by the end of September 2020. It will assist them to have no late fee or interest assigned to them.

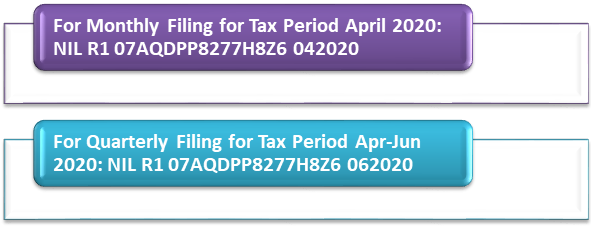

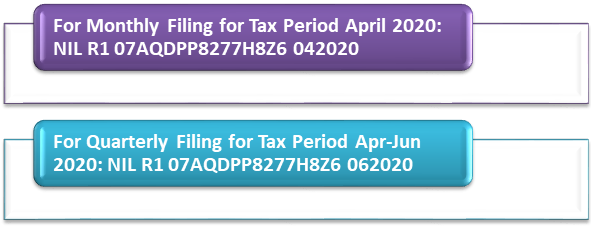

Filing of NIL Form GSTR-1 on GST Portal over SMS

An advisory has been issued by the Goods and Services Tax Network (GSTN) on filing NIL Form GSTR-1 through SMS on GST Portal. The announcement is primarily concentrated on a few subjects.

Those are as follows:-

- Apart from filing it through online mode, a taxpayer may now file NIL Form GSTR-1 on GST Portal through an SMS service.

- The taxpayer must complete the following conditions to file NIL Form GSTR-1 through SMS:-

- They must be registered as an SEZ Developer/ Casual taxpayer/ Normal taxpayer/ SEZ Unit

- They must have valid GST Number

- The phone number shall be registered on the GST Portal of Authorized signatory.

- No data must be in saved or submitted stage related to that respective month for Form ‘GSTR-1’ on the GST Portal.

- NIL GSTR-1 Form can be filed in which return is to be filed on or after the 1st of the following month.

- The taxpayer must have opted for the filing frequency as either quarterly or monthly.

- NIL GSTR-1 Form for a tax period should be filed by the taxpayer only if the following situation is satisfying.

Those are as follows:-

- There are no ‘Outward Supplies’ (Which includes supplies on which tax is to be charged on zero-rated supplies, reverse charge basis, and considered exports) during the quarter or month for which the return is being filed.

- No Amendments/changes should get evolved to any of the supplies declared in a previous return.

- No Debit or Credit Notes to be amended.

- No particulars of advances established for services to be adjusted or declared.

- There are few steps to File Nil Form GSTR 1 over SMS.

Those are as follows:-

- To file Nil Form GSTR-1 – NIL space Return, send SMS to 14409 number – “Type space(_____) GSTIN (_____)space Return Period “

- To ascertain the filing of Nil Form GSTR-1, send SMS again on the same number ‘14409’ along with Verification Code – CNF space(___) Return Type (___) space Code – CNF R1 324961 (For Example Verification Code got here is 324961)

- GST Portal will send back ARN on registered e-mail ID and to the same mobile number of the taxpayer after successful validation of the “Verification Code” to intimate successful NIL filing of GSTR-1Form.

- All the authorized representatives can file NIL Form GSTR-1 through SMS for a particular GSTIN.

Conclusion

A uniform late fee is stress-free to implement on a common computerized portal and modest in strategy. Our CorpBiz group shall be at your disposal if you seek expert advice on any aspect GSTN Advisory issues on GSTR (1&3B) Forms & GST Registration along with complete compliance. We will help you ensure full compliance concerning all the requirements based on your anticipated activities, ensuring the productive and well-timed completion of your expectation.

Read our article:How Offences & Penalties Under GST Can Put In Trouble?