Recently, MCA has deployed an e-form on its website, which has to be filled voluntarily by the company’s signatory for ensuring their commitment towards Compliance with the recent guidelines implemented in the context of COVID-19. The filling up this form is not mandatory but crucial for those who want to work in tandem with COVID-19 measures rendered by the Central/ State Government to combat this pandemic.

Relaxation offered by MCA w.r.t COVID 19 crisis

Form CAR (Companies Affirmation of Readiness towards COVID-19)

The filing of this e-form does not require any charges or Digital signature. This is just to ensure that organizations are taking measures needed in their combat against COVID-19. Again, no fees will impose on the filling of this form. Companies who are willing to take part in this Government-initiated program can fill this e-form voluntarily. The government took this initiative to create awareness among the corporates in the context of COVID-19 measures. The structure of this form is not complicated at all, as it’s relatively simple and demands some necessary details which have to be filled by the company’s authorized signatory. The Ministry of Corporate Affairs released this form on 23rd March 2020.

Companies Amendment Rules, 2020

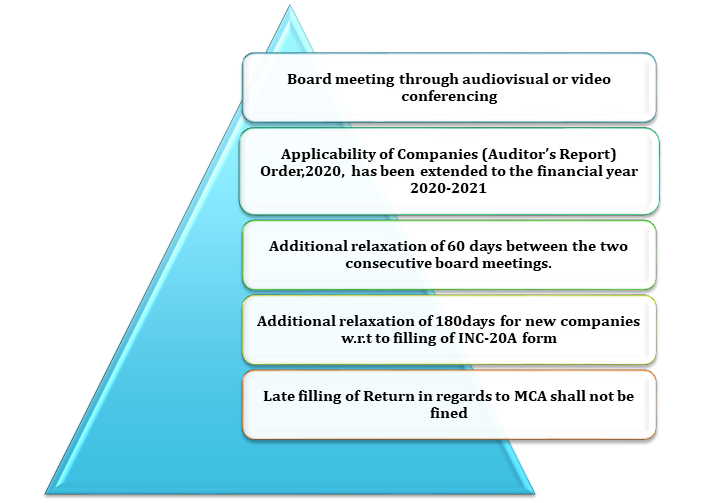

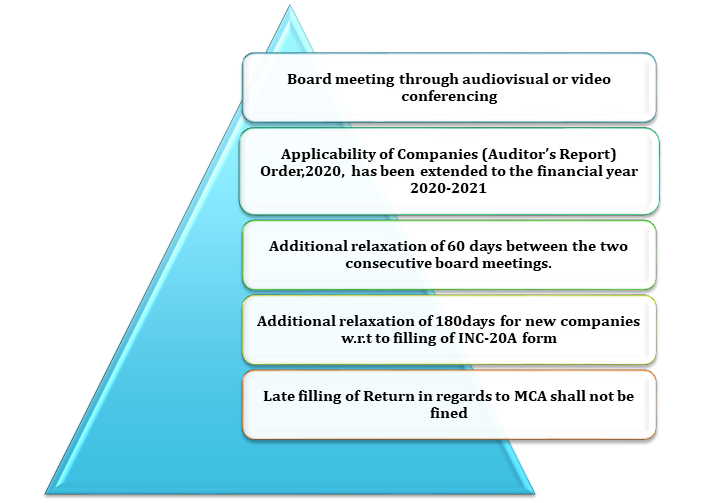

From the time being since this establishment of these rules, i.e., 19th march 2020 till 30th June 2020, the board meeting that requires the presence of the concerned directors may be held via audiovisual or video conferencing means as per rule 3. It is one of the most important COVID-19 measures taken by MCA to stabilize the normal working activities of the corporate.

The following list of matters that demands the physical presence of members was mandatory under CA, 2013:-

As the new financial year is around the corner, companies can conduct their important Board Meetings via Video Conferencing. The physical presence of the Director’s panel is not mandatory until 30th June 2020.

Interim period

The Ministry has already rendered a Moratorium period to the LLPs from 01st April to 30th September 2020. The late filing of any return or document is not subjected to any additional charge or fine that is required to be filled at MCA 21.

This initiative is an important part of COVID-19 measures that ensure the seamless functioning of the corporates. Also, it creates an opportunity for the LLPS/corporates to deal with long-pending Compliance and wants to complete them by avoiding additional charges.

Board Meetings

The MCA also set up a provision for the board meeting’s schedule. According to the latest amendment, a period of 60 days has been added up between the two consecutive Board Meetings, amending the figure to 180 days instead of 120 days. This relaxation of additional timespan is applicable till 30th September 2020, and it will prove extremely helpful for the companies looking to put the better fight against the crisis.

CARO 2020

The applicability of Companies (Auditor’s Report) Order, 2020, has been extended to the financial year 2020-2021. This amendment is against the previous notification, which was released earlier, indicating the financial year 2019-2020. This will help the companies and their auditors to unload the burden for the financial year 2019-20. It is arguably one of the most crucial COVID-19 Measures taken by MCA.

Read our article:MCA issues clarification on the spending of CSR funds for COVID-19

Independent Director’s Meeting

As per the provision of Company Act 2013[1] , the containment of at least one meeting should be done by the company’s independent directors without including Non-Independent Directors. The Ministry has dispensed this regulation for the year 2019-2020. However, if the IDs fail to comply with this provision, it shall not be deemed as a violation.

Extension for Declaration of Commencement of Business

This amendment cum relief has offered by the government to the companies who are facing adversity regarding the filling of INC-20A form. The recent change will allow newly established companies to avail of the additional relaxation of 180days.

All the companies established after 02nd November 2018 were supposed to complete the filling of the INC-20A form within 180 days of receipt of Certificate of Incorporation. Those companies which have possession of current account and shareholder money in that very account are the only eligible candidates in this regard.

The requirement of Section 149 (3)

Section 149 (3) requires every company to secure one Director who will ensure its presence for 182 days in India during the financial year. Any violation by the company in this regard shall not be deemed as a non-compliance. The current pandemic has left an adverse impact on the transportation system of the country. This initiative is a welcome change for those companies whose operations are under the management of foreign directors.

CSR funds

Ministry has clarified that the expenditure made by companies’ w.r.t CSR funds for COVID-19 shall be deemed as CSR activity. The spending of this fund can be allocated to serve different purposes under item no. (i) And (xii) of Schedule VII that promotes spending on health care, including disaster management and sanitation.

This way, companies can provide a better platform to help seekers dealing with this pandemic. Corporate giants like Reliance, TATA, and Mahindra are already working in this direction quite proactively.

Requirement under section 73(2)(c) of CA-13

- To ensure the deposit repayment reserve of 20%, growing in the financial year 2020-2021 prior 30th April 2020 will be authorized to have complied till 30/6/2020

- As per Companies Act 2014, rule 18, to invest 15% of debentures growing in the financial years 2020-21 or deposit prior 30/4/2020, may be complied till 30/6/2020.

Both these amendments are the imperative part of the COVID-19 Measures taken by MCA in recent times.

Conclusion

COVID 19 pandemic has put everything on hold, including corporate activities. LPPs across the nation can expect more changes in the upcoming months from the government if the situation gets worse. These reforms can act as a savior for a lot of companies who are looking to render better performance in this crisis and stay safe at the same time. If you have some second thoughts or queries regarding this topic, please share your views with us.

Read our article:CARO 2020: New Norms Issued for Auditors