Several companies don’t realize that their balance sheet is not perfectly synchronized with their cash flow. By optimizing the account receivable strategies, the companies can improve their liquidity and minimize debt to stay healthier in the competition. This article will discuss the 7 most productive techniques that let you improve Account receivable collections to a significant extent.

What is the significance of the accounts receivable in the company?

Ideally, all invoices should be paid in a timely manner to be no requirement of chasing customers through a tedious follow-up process. Unfortunately, most companies fail in this regard. The culture of delayed payment is affecting businesses all across the globe.

This has a drastic impact on the company’s cash flow management. If the working capital dominates the balance sheet, the companies have to take some relevant measures before running out of cash.

Read our article:Accounts Receivable: Definition and Tips to Manage

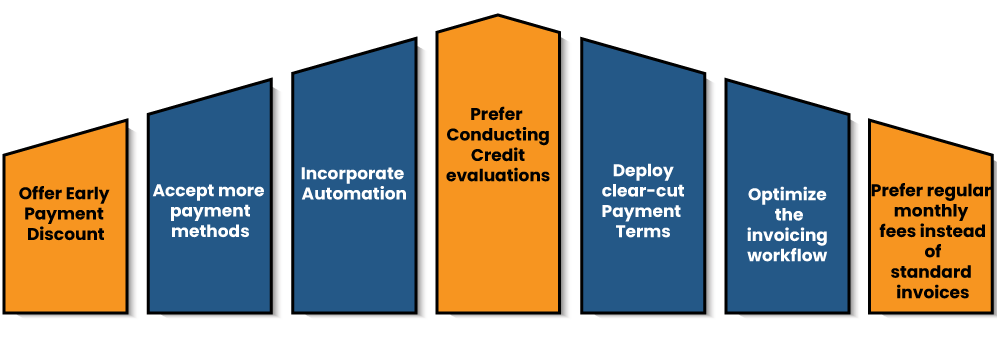

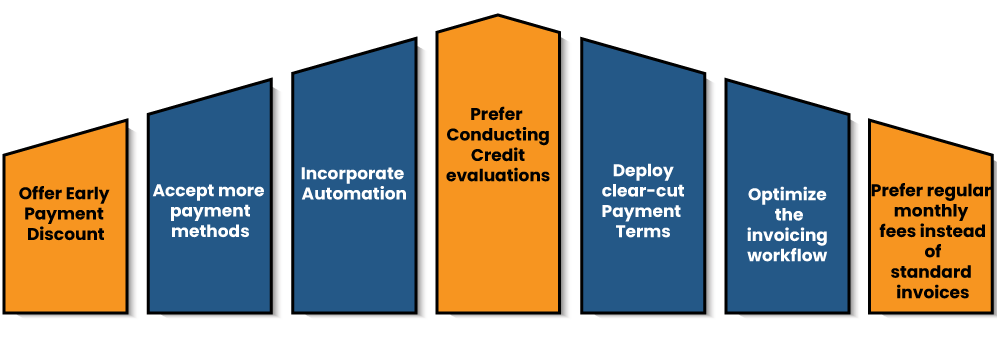

Tips to Improve Account Receivable Collections

Outstanding invoices owed to your firm by clients can enable your company to maintain an optimal cash flow. That is imperative for businesses of all sizes, not just SMEs and Startups. Therefore, here are some top-of-the-line strategies to minimize the load of capital stuck in the accounts receivable.

Offer Early Payment Discount

Offering payment incentives on invoices is probably the smartest way to secure prompt payment from the customers and improve accounts receivable collections. Early payment discounts motivate clients to pay an invoice before the due date.

These terms typically come in the format 5% 10 Net 30- which implies the customer receives a 5% discount if they make the payment within ten days from the invoicing date, or else payment in full is due thirty days after the invoice date.

Accept More Payment Methods

Another way to improve Account receivable collections is making payment as simple as possible for your clients. This implies rendering a wide array of payment options, including cheque and cash, Debit and credit cards, Direct Debit, and bank transfers. Direct Debit is rather useful as it is a pull payment, instead of a push payment. Fundamentally, this implies that the payment is pre-approved, and the client does not need to respond to authorize payment.

Incorporate Automation into the Invoicing Process

Electronic invoicing overcomes the apparent delays and cost linked with postal mail, but the advantages of leveraging electronic invoicing are much more than that. These Automation features significantly minimize the time spend contacting suspicious accounts. If you can incorporate Automation in your invoicing via a digital solution, you can reduce human error, bill your client promptly, & monitor the incoming payments to impart transparency into your cash flow.

Automating the invoicing process also facilitates scheduled payment reminders for intimating clients about their balance payment via email, phone calls, text, and other communication modes. These solutions can be synchronized to create efficacy in the AR process. For instance, you can opt to automatically get in touch with overdue accounts, making these interactions even more impactful. Hence, Automation is worthwhile to consider if you wish to improve Account receivable collections.

Prefer Conducting Credit evaluations

Before authorizing credit to the new client, it is best to examine the credit history to ensure that they have a good track record of paying bills on time. In addition to that, underpin clear-cut policy and inform your client about the same before it came into effect.

If your Days Sales Outstanding (aka DSO) is worsening & you wish to improve efficacy, consider deploying stricter credit evaluations. These techniques will enhance the effectiveness of the Account receivable and strengthen the company’s cash flow.

The more promptly an Account receivable department can distribute invoices along with effective payment incentives, various payment methods, friendly reminders, and clear terms, the more efficient your AR efforts can be.

Deploy clear-cut Payment Terms

As accounts receivable is fundamentally a form of lending to clients, it’s imperative to have transparent guidelines around issuing credit and recovering the debt.

Ensure that sales & finance staff work cohesively to establish practical policies for your customer base, pinpoint the exact scenarios when credit limits should be extended and ensure that the credit approval process is regularly examined to sync with changing economic conditions.

Optimize the Invoicing Workflow

To avert hindrances related to AR process, it’s imperative to mitigate any errors within the AR business[1] process flow for invoices. From invalid client detail to failure to issue an invoice, there are a lot of areas where a mistake can be made. Make sure to leverage the invoice template to ensure that you are consolidating all the legit information when you request a payment. To improve the process agility, issue invoices through a billing tool as soon as the work is completed instead of invoicing in batches weekly or monthly.

Prefer regular monthly fees Instead Of Standard Invoices

When it comes to AR processes & procedures, billing your clients on a monthly basis can be beneficial. It will help improve the budget and encourage clients to make timely payments. Besides, switching to regular monthly fees make sure your client can pay with Direct Debit, making it convenient to recover payment when it’s due.

Conclusion

AR process is equally important as other areas of the business. After all, it’s about the cash in hand, which lets your company move forward. Don’t be hesitant to employ the clear-cut payment terms for your client base. Sometimes deploying stringent policies become a necessity rather than an option.

We hope after deploying the strategies described above, you will be able to improve Account receivable collections and ensure transparency within the company’s cash flow management. Drop us a message if you have a second thought on this topic.

Read our article:Account Receivable & Payable Process in Cash Flow Management