Individuals who reap income by any means ought to pay income tax without any exception. Since it is a mandatory requirement, skipping it could lure significant penalties. The government has revamped the process of making tax returns. Now it is a lot simpler and less tiresome as compared to the preceding version. There are ample advantages of filing an income tax return without fail. In this article, we will unfold some facts regarding the filing income tax return and explain the reasons why it is of utmost importance.

Why ITR is important?

- There is a general misconception among the taxpayers that a person without taxable income needs not to document their tax forms. The IT department recommends the filing of income tax return if the income of the individual exceeds Rs 2.5 before any deductions, exceeds three lakh rupees for those over sixty years of age, or Rs 5 lakhs for those over eighty years of age.

- If you are residing in the Indian Territory and have some investments in overseas locations, it is compulsory to file ITR irrespective of whether your income doesn’t attract any taxation. In the event, if you don’t come under any of the said categories, then you can bypass the filing requirement.

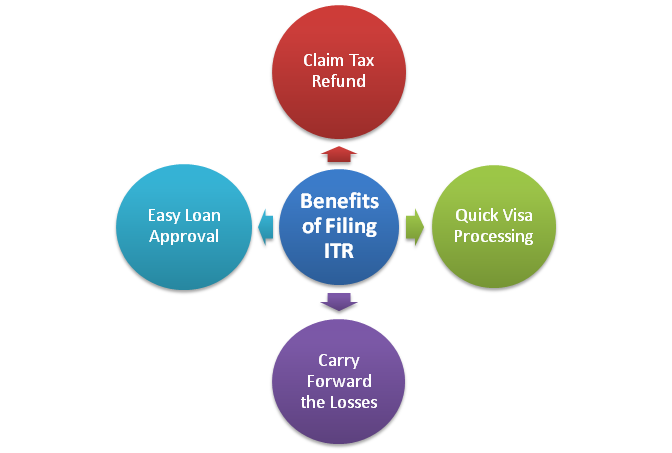

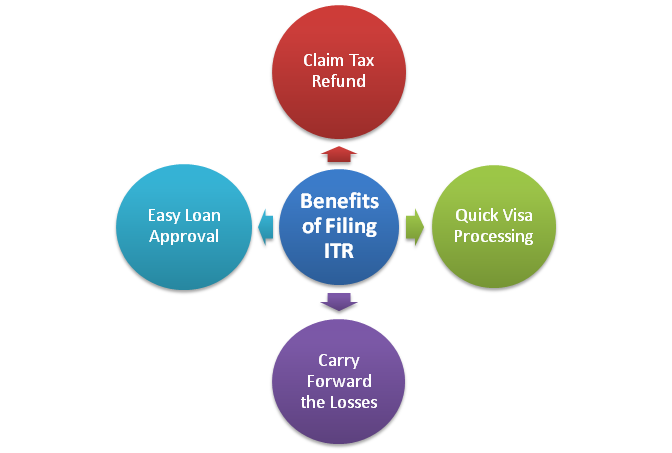

- Even if your income comes under the taxable limit, you may have to address the tax liabilities as per the government obligations on it. A person can file ITR to get this additional charge paid via TDS (Tax deducted at source), in the given financial year. Saving money from the taxable income is just like availing a check credited. Failure to file a return can prevent you from availing conceivable reimbursement.

- If you are about to move to an overseas location, you must prepare the professional tax in advance for the ongoing years. The majority of the government departments, especially the UK and the US seeks ITR related documents to process via submission.

- If you intend to apply for credit, for instance, a home or car loan, you are required to provide the income tax return to the latest years along with necessary documents to the bank. The income tax return act as a key performance indicator for your income. It allows the lender to get accustomed to your reimbursement limit.

- If you have encountered relentless capital loss, the IT act allows you to carry forward losses for 8 years in order to counterbalance it against future income and profit. Apart from that, you need to file your income tax return on time without fail to profit from this benefit. Therefore, it is essential for you to plead for a return regarding the losses occurs in the financial years in order to convey them forward.

- Even if your income doesn’t attract any taxes, you may have other sources of income, for instance, earning via bonds or by other means, accounted over Rs 2.5 lakhs, you must file an income tax return manifesting the non-assessable profit which could act as an evidence for income.

- Under section 234F of the IT Act, if a person fails to file the ITR by July 31then the defaulters have to pay the penalty of Rs 5000. Furthermore, if the taxpayers continue to stay in default and file the return after 31st December, the fine of Rs 10000 shall be levied. For the taxpayer whose earning is less than five lakh rupees, the amount of the penalty is reduced to Rs 1000.

- An individual is needed to file ITR mandatorily when one earns via property held under a trust for NGO or political group or a merchant union, news channel, religious reason, or educational institution.

- Filing an IT form not only makes you a law-abiding citizen but also renders long-term benefits. Similarly, it deters the individual from the critical issues if he/she is ever obligated to furnish the return under a show-cause notice U/S 148 from the Information technology department.

Read our article:Submitting of Audit Report with Income Tax Return is not Compulsory – ITAT

What happens when you don’t pay taxes?

- A notification regarding the non-filing from the IT department[1].

- A fine interest of one percent/ month will be charged until the date taxes are paid out. A tax paid after the due date falls into the category of two penalty provisions. A fine of Rs 5000 shall be levied on the defaulter if the return files on or before December 31. Furthermore, a penalty of Rs 10000 will be imposed on a person of the return file after the said date.

- For small taxpayers whose total income does not exceed Rs 5 lakh, the penalty amount is reduced to Rs 1,000. Apart from this, under Section 234A, interest would be levied @1% per month, calculated from the due date.

- Not allowed to avail of the discount of overabundance TDS Deducted.

- Not having the capacity to compensate for capital misfortunes. Losses caused (other than the property loss) are not allowed to be carried forward to compensate against the future earnings.

Conclusion

It’s not wise to deem a tax filing a burdensome errand or a mode for entertaining the government. The tax filing allows you to reap countless benefits, particularly in the long term. Consistent and default-free filing will improve the taxpayer’s credibility overtimes which in turn helps them to avail of the loan without an issue. Connect with CorpBiz’s professional to get tips for the seamless filing of ITR.

Read our article:An overview on Tax Residency Certificate & Double Taxation Avoidance Agreement: How To Get It?