Union Budget 2021-22 was introduced in the higher house of parliament in the month of Feb. It was the first time when the budget was unveiled on the digital platform. While promulgating the new budget, the honorable Finance Minister Nirmala Sitharaman promised to take plenty of measures to propel the growth of startup and MSME. The budget also aimed to boost the digitization that has witnessed tremendous growth in the Covid era. Let us go through the announcements that were intended to benefits the MSMEs and Start-ups

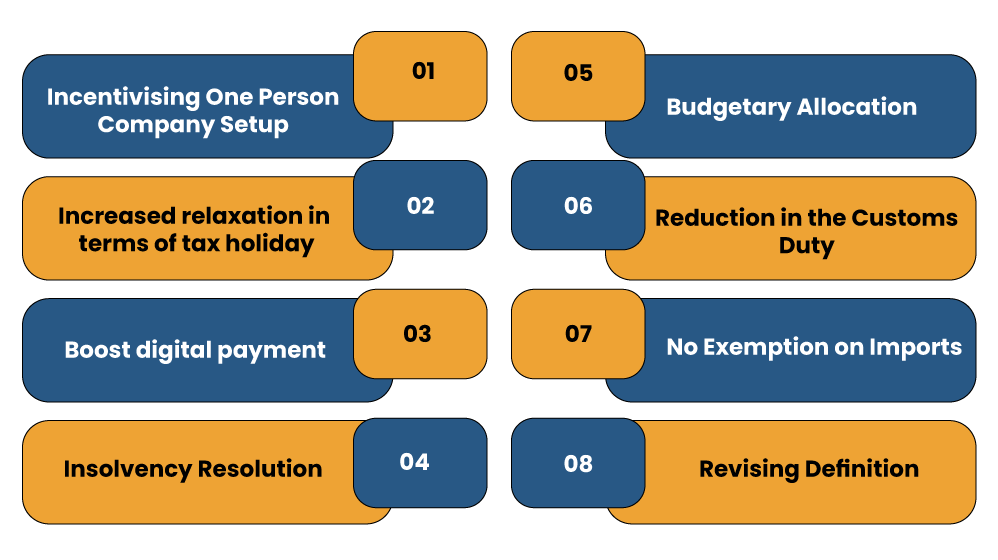

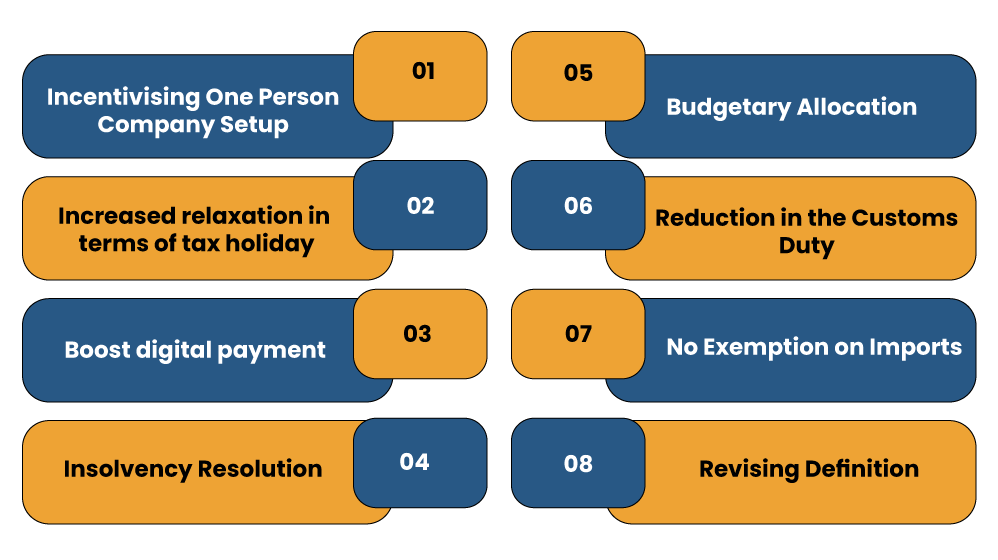

Key Announcements Unveiled By Finance Minister under Union Budget 2021-22

Here are the key announcements made under the Union Budget 2021-22 by the honorable Finance minister:

Incentivising One Person Company Setup

To benefit start-ups in establishing One Person Companies, Finance Minister stated the OPCs to propel without any limitation on annual turnover and paid-up capital. The Minister also permitted their conversion into any other company structure at any time and minimizes the residency limit for an Indian national to establish an OPC from 182 days to 120 days and also enables NRIs to register OPCs in India. The decision is likely to benefits a massive number of small businesses by allowing them to adopt a business structure that is more stable and resilient.

Increased relaxation in terms of tax holiday

To stimulate the growth of start-ups investment in the nation, the budget proposed eligibility’s extension for claiming tax holidays new businesses along with capital gains exemption for investment in start-ups till 31st March 2021, to encourage funding. Since the majority of small businesses are still in the post-COVID recovery phase, this decision has come as a relief as it allows catering upfront liabilities other than taxes for an extended time frame.

Read our article:What is MSME Registration and how to get it?

Boost digital payment

Finance Minister unveiled the corpus of Rs 1500 crores for the projected scheme that aims to render financial support to ensure widespread utilization of digital payment modes. This decision envisages the incentivization of digital payment modes so that financial transactions would become more swift and secure.

Insolvency Resolution

To ensure prompt settlement of cases, the Finance Minister made the following decisions

- Strengthening of National Company Law Tribunal (NCLT) framework

- Implementation of e-courts system

- Inculcation of alternate methods of debt framework

- Implementation of a new framework for MSMEs

Budgetary Allocation

An assured sum of Rs 15,700 was announced for the development of the MSME sector. The declared amount was almost double of sum released in the preceding year. The decision has come as a massive relief for small businesses and MSMEs whose existence was at the stake in the Covid era. The said amount will ensure their prompt revival and let them make the stronger move to come back on track.

Reduction in the Customs Duty

The government of India[1] said that it is minimizing custom duty to 7.5% on semis, flat, & long products of alloy, non-alloy & stainless steel to support MSMEs and other industries that have been badly hit by the sharp spike in iron and steel prices. The Finance minister also promised to exempt duty on steel scrap for the period up to March 31st, 2022 to facilitate relaxation to metal recyclers.

The minister also proposed a spike in duty from 10 to 15% on the plastic builder and steel screws to benefit MSMEs. By increasing the import duty, the government intends to help the local manufacturers as it would allow them to boost the production volume.

No Exemption on Imports

The Union Budget 2021-22 has got rid of prevailing exemption on import of certain class of leather. This decision would allow the local manufacturers (which are mostly MSMEs) to scale up the operation and avail the much-needed production order.

Revising Definition

FM Sitharaman proposed the revision in the small companies’ definition in the budget by escalating limits for paid-up capital from Rs 50 lakhs to Rs 2 crores and revenue from Rs 2 crore to Rs 20 crore. The announcement aims to benefits more than two lakhs entities in simplifying their legal obligation

Key highlights of Union Budget 2021-22

Expenditure: The government projects to spend Rs 34,83,236 crore in FY 2021-22. In light of the revised estimates, the GOI spent Rs 34,50,305 crore in FY 2021-22, which is 13% higher than the budget estimate.

Receipts: The receipts (excluding borrowing) are anticipated to be Rs 19,76,424 crore in 2021-22, which is 23% higher as compared to the revised estimates of 2020-21. In 2020-21, revised estimates for the same were 29% lower compared to the budget estimates.

GDP growth: Nominal GDP is anticipated to experience a growth rate of 14.4% in 2021-22.

Deficits: Revenue deficit is expected to stay at 5.1% of GDP in 2021-22, which is lower than the previous year’s rate. The fiscal deficit, on the other hand, is likely to stay at 6.8% of GDP in 2021-22, which is lower than the revised estimate of 9.5% in 2020-21. The government is assured that the fiscal deficit rate will encounter a gradual drop in the coming years.

Conclusion

When announced, the Union Budget 2021-22 seems to be on par from the growth standpoint of MSMEs and start-ups. A lot of attention has been given to the small businesses under this budget with the introduction of growth-based measures such as Rs 1500 Crore corpus, encouraging OPC setup, reduction in the customs duty, so on and so forth. The decision for leveraging the MSME sector via a corpus size of Rs 1500 crores seems to be influenced by the loopholes created by the Covid-19 pandemic. Furthermore, the decision for withdrawing exemption on leather import was certainly remarkable as it gives an edge to the local manufacturer to escalate the production volume. Also, the revelation regarding the incorporation of e-courts and Strengthening of the National Company Law Tribunal has ensured the prompt resolution of cases.

Read our article:How to Register under Micro Small and Medium Enterprises in India?