At the outset, Society is an association of more than a few individuals combined using a common consensus to deliberate, govern and act supportively for some public purpose. Usually, Societies get registered for the development of charitable events such as sports, music, culture, religion, art, education, etc. under The Society Registration Act in India. It has specific processes for the requirements of society registration and its internal as well as external operations. By seeing the needs of Society, this act has executed to expand the legal stipulations of society registration for the improvement of literature, fine arts, science, or circulation of awareness for various purposes.

What is the Overall Purpose of the Society Registration Act?

The overall purpose of Society Registration rendered under section 20 of Society Registration Act, 1860. Therefore the society registration can be done for the objects which are as follows:-

- To Promote fine arts

- To Diffuse political education

- To Grant charitable support

- To Promote science and literature

- To Create military orphan funds

- To Maintain galleries or communal museum

- To Maintain reading rooms or libraries

- To Promote instructions of beneficial knowledge

What are the primary points to keep in mind while forming an Educational Society?

- According to the Emblems Act, 1950. It prohibits the use of any name, emblems, official seal, etc. as stated in the act without prior permission of the competent authority. Moreover, it also prohibits the use of the name of ‘national heroes’ and other names cited in the act. It is advisable to all the Societies intending to seek registration to consult with advisors also before proposing the name for your registration.

- On the other hand, if the suggested name gets duplicated by any other registered society or likely to deceive the public, should be avoided.

- You should be cautious about the Memorandum of Association which should contain the following particulars:-

- Name of the Educational Society

- Objects of the Educational Society;

- Details regarding the names, addresses, and professions of the governors, council, directors, committee, or other governing body to whom by the rules and management affairs of the Society.

- A Certified copy of the rules and regulations of the Educational Society by not less than three of the members of the governing body.

What should be the Aims and Objectives of School Registered under the Society Registration Act of 1860?

- The aims and objectives should be to open and run educational and vocational schools to take along education within reach of poor & backward and reluctant children.

- The goals and objectives should be to arrange for libraries, publish books on educational, cultural, and social topics.

- The aims and objectives should be to organize deliberations & seminars to impart knowledge & understandings surrounded by the people.

- The goals and objectives should be to provide hostels & residential accommodation that may be reflected necessary for the students & for each member of the staff that may appropriate for it.

- The aims and objectives should be to establish & maintain institutions for the Physically Disabled or handicapped & for adult education. It may include vocational training of household industry, semi-skilled jobs for self-employment, shorthand & type-writing, social science, dialects, music, painting, physical working out etc.

- The aims and objectives should be to give the best education available in some of the best schools in a particular area. A greater emphasis would be on shaping up of character, self-discipline & the progression of the creative & social faculties. The Society aims at creating well informed & well assured young children just the kind of children that our country needs.

- The aims and objectives should be to strive to meet the changing need of providing comprehensive education. It is to develop various sides of personality and to impart knowledge to children on the most contemporary lines & give an environment suitable to growth as well as development of the children.

- The aims and objectives should be to arrange & organize the social, cultural & educational platforms from time to time basis.

- The goals and objectives should be utilizing all the income, earning, movable-immovable properties of the Society exclusively towards the promotion of its aim & objects, as cited in the memorandum of association. Moreover, it is essential to determine that no member of the Society shall have any personal entitlement on any moveable property of the Society or make any profit

- The aims and objectives should be to offer free meals, clothes, medicines, and things to the needy ones as well as children of widows.

What is the Legal Preceding Section 6 of the Act?

After getting registered, the proposed educational Society may sue or be sued in the name of the chairman as per legal section 6 lay down under Society Registration Act, 1860. It applies to the National Capital Territory of Delhi (NCR Region).

What should be the Source of Income of Educational Societies?

According to the Society Registration Act, 1860[1], the source of income of the educational Society shall consist of:-

- Fees acquired through Admissions,

- Capital fund of the Educational Society,

- Funds acquired via Donations and Favours,

- Funds obtained by all Subscription and donation from members of the Educational Society,

- Funds received as aid from governments, semi-government, charitable trusts, influential institutions, and associations.

- Funds acquired in the name of charity or donation or gifts from foreign charitable interventions via any other sanctioned and authorized establishments.

What about Audit of Educational Societies? Is it necessary?

Yes! It is essential to go for Auditing for every Educational Societies. Accounts of educational Society shall get audited once in a year by a qualified auditor, appointed by the Governing Body of the same.

What is the Financial Year for Educational Society?

The financial year of the educational Society shall be from 1st April to 31st March of Every year.

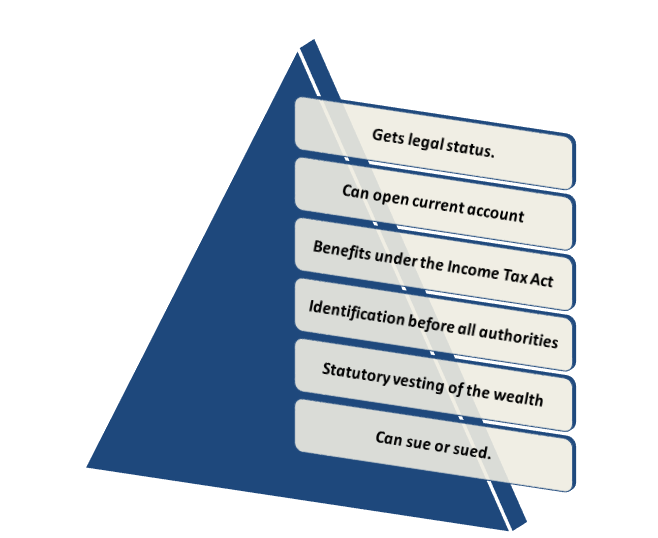

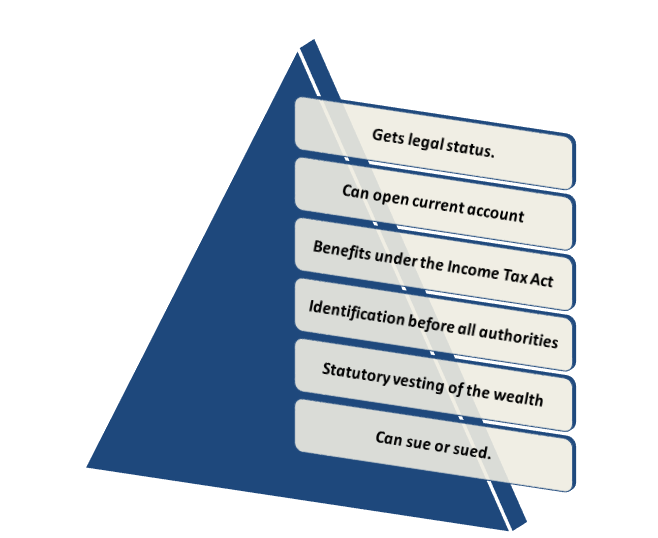

What are the Benefits of Enrolling the educational Society?

What is the General Body of the Educational Society that should be Consist?

- According to the given act, there should be a General Body of the educational Society involving all the members. Moreover, the meeting of the General Body should be held once in every year with 2/3rd of its quorum.

- In consonance of the emergent meeting of the General Body, it may also be summoned on the written request of 3/4th members with specific days prior notice to the meetings. The business programs that should get transacted in such meetings are as follows:-

- The meetings should arrange annual programs and their policies.

- The meetings should discuss all such problems and issues which are related to the affairs of the public.

- The meetings should pass the annual budget of the educational Society.

- The meetings should appoint a qualified auditor for piloting an annual audit of the educational Society.

- The meetings should consider any supplementary business conveyed by the Governing Body.

Who are the Governing Bodies of the School under Society Act?

According to the Society Registration Act, the management of the affairs of the Educational Society should get conferred in the governing body which should consist of the following particulars:-

What are the Powers and Duties of Office Bearers of the School under Societies Act?

- Powers of the Chairman

The Chairman of the Educational Society will be the head of the educational Society. He shall supervise over the meeting of the General Body as well as the Governing Body. He will also get the right to cast a vote during elections in the situation of a tie.

- Powers of the Vice-Chairman

The Vice-Chairman of the Educational Society should act in the absence of the chairman. He also shall enjoy all powers which has delegated to the chairman.

- Powers of the Secretary

The Secretary of the Educational Society gets the power:-

- To sign on behalf of the educational Society,

- To bear all its correspondence,

- To record all the proceedings of meeting at his best,

- To summon &appear in the meeting of General Body of the educational Society,

- To request and call any ordinary general meeting if preferred, on written request.

- Powers of the Treasurer

The Treasurer of the Educational Society shall keep accounts of all receipts & expenses of the educational Society. He needs to furnish necessary information of the Governing Body regularly, and the balance account will be placed in the bank/post office or whatsoever as decided by the Governing Body.

Read our article:Guide: Registration Aspect of Educational Trust

What are the Documents required to register an Educational Society in India?

- An affidavit has to get furnished regarding the ownership and NOC for the registered office of the proposed educational Society.

- An affidavit has to get furnished regarding persons not related to each other stating the name of the Society

- All ID Proofs have to get submitted, such as Adhar card, Driving license, or Pan Card of all the members of the proposed Educational Society.

- All the members of the proposed Educational Society should furnish their Address proof, which may include Lease or Rent agreement, Electricity bill, Water bill, etc.

- A Covering Letter, declaring the objective or the purpose of the proposed Educational Society signed by all the founding members.

- Copies of Property papers associated with the proposed Educational Society

- Furnish the Minutes of the preceding meeting of the proposed educational Society

- Furnish the Certified Bank Statements of the proposed Educational Society.

- A declaration has to be given by the chairman of the proposed Society stating that he is ‘willing’ and ‘competent’ to hold the position.

- Memorandum of Association has to be equipped and should contain the following clauses and facts:

- The work and the objectives of the proposed Educational Society for which it has recognized.

- The particulars of the members forming the proposed Educational Society.

- It will enclose the address of the registered office of the proposed Educational Society.

- Articles of Association also have to be equipped and should contain the following facts:

- The Rules and regulations by which the operational aspect of the educational Society will get governed and the upkeep of daily activities,

- It will enclose the rules for taking up the membership of the proposed educational Society

- It will insert the particulars about the meetings of the proposed educational Society and the regularity with which they are going to get held,

- It will enclose the information about the Auditors of the proposed educational Society,

- It will insert the forms of Arbitration in case of any dispute between the supporters of the proposed educational Society

- It will add the ways for the closure of the proposed educational Society.

- The MOA and AOA documents should then be signed by every member of the proposed educational Society, witnessed by a notary public or accountant with their address and official stamp.

- It is advisable hiring a professional to figure the clauses on each Memorandum of Association and Rules and regulations under Articles of Association of the proposed educational Society. It could make sure you have what the registrar is searching for approval of those societies.

- After the formation of Rules and Regulations, they can get changed, but the new set of rules will have to sign by the Chairman, Vice President, and the Secretary of the Society.

- Along with the requisite fees, two copies of the above-stated documents have to get submitted to the Registrar of Societies. In receipt of the application, the registrar will sign the first copy as acknowledgment and return it, whereas keeping the second copy for authorization.

- After getting the approval on the proper vetting of the documents, the registrar will issue an Incorporation Certificate by assigning a registration number to the proposed education Society.

What all about Benefits under the Income Tax Act for Educational Societies registered under Societies Act?

The exemption for Educational Societies registered under Societies Act subjected to the aggregate annual receipts of the school.

- School registered under Societies Act, having yearly revenues up to Rs. 1 crore-

According to Section 10(23C)(iiiad) of Income Tax Act, the income received by the school, existing solely for educational purposes, shall be exempted from tax only if the aggregate annual receipts do not go beyond Rs. 1 crore.

- School registered under Societies Act, having yearly revenues beyond Rs. 1 crore:

Section 10(23C)(iiiad) of the Income Tax Act states that income earned by school existing solely for educational purposes, except those mentioned in sub-clause (iiiab) or sub-clause (iiiad), shall be exempt if the prescribed competent authority permits them. (Form No. 56D)

There are some additional conditions set upon for an educational institution/School having income receipts over Rs. 1 crore. The 3rd provision to Under Section 10(23C) of the Income Tax Act provides for the following two situations:

- Use a minimum 85%: The educational institution shall spend at least 85% of total income receipts to claim the full exemption. Remember that the educational institution is allowed to retain up to 15% of total income deprived of any conditions.

- Investments: The 2nd condition is that the educational institution shall invest its money only in the methods specified under section 11(5).

- Other Conditions:

- Audit and Income Tax Return: Taking the Leverage of 139(4C) every educational institution referred to as above whose total income, without getting influenced by the provisions of section 10, exceeds the extreme amount which is not taxable, shall furnish a return of income.

- Corpus Donations to other Societies: Being a corpus donation Under Proviso no. 12 to the Section 10(23C), any sum of amount credited or paid out of income of any school or educational institution to any institution registered under section 12AA, shall not be treated as application of the revenue to the objects educational institution has established.

- Other Provisions: An educational institution is obligated to deduct tax from payments to entitle the total sum as application of income.

Conclusion

It is quite visible that all operations under educational Society depend on the measure of managerial control that the founders want to hold over it. It is because the educational institution can be created as a Non-Profit Organization; it can avail all the advantages delivered to it by the Centre or the State Government. Approximating the success, the founder of the educational institution needs to focus more on the execution of top-quality educational services rather than focusing on achieving profit ends. Herewith, we at Corpbiz have skilled professionals to help you with the process of Registering Educational institutions, ensuring the successful and timely completion of your work.

Read our article: Society Registration in India: Know the Entire Procedure and List of Documents Required