The import of batteries in India has certain regulations and guidelines. These regulations may have changed since September 2021, so it’s necessary to consult the latest information from the authorities which are relevant, such as the Directorate General of Foreign Trade (DGFT) and the Central Board of Indirect Taxes and Customs (CBIC), to make sure that the compliance is done with current import necessities for batteries import in India. Customs duties, import documentation, quality standards, and environmental regulations are certain important points to be kept in mind while importing batteries in India.

It’s advisable to work with a customs broker or seek guidance from Indian customs authorities to navigate the import process effectively. There are specific rules and regulations which is applied depending on the type of batteries you wish to import (e.g., lead-acid batteries, lithium-ion batteries), so it’s important to research to adhere to compliance with the rules for your specific product category.

When there is import of batteries in India, it requires complying with customs regulations, quality standards, and environmental laws. The Customs Act of 1962 governs the process, defining customs duties and procedures. CBIC issues relevant guidelines.

Import of batteries in India may require Bureau of Indian Standards (BIS) certification to meet quality and safety standards. Any hazardous material to comply with environmental rules and regulations. Proper labelling, packaging, and documentation are some of the important key points when customs clearance is done.

General Rules to Import of Batteries in India

Here are some general rules related to the import of batteries in India:

- Customs Duties: Batteries may be subject to customs duties and tariffs upon import. The applicable rates can vary depending on the type and category of batteries. It’s essential to check the current customs duty rates through the Indian Customs Department.

- Import Documentation: You will need to provide proper import documentation, including a bill of entry, commercial invoice, packing list, and any other documents required by Indian customs authorities.

- BIS Certification: Some batteries may require Bureau of Indian Standards (BIS) certification to ensure they meet quality and safety standards. Check if the specific type of battery you are importing falls under mandatory BIS certification requirements.

- Environmental Regulations: Batteries, especially those containing hazardous materials like lead-acid or lithium-ion batteries, may be subject to environmental regulations. Make sure the compliance is done with environmental law, waste disposal, and recycling necessities.Ensure compliance with environmental laws and regulations, which also include waste disposal and recycling requirements.

- Labelling and Marking: Batteries may need specific labelling and marking requirements, including safety information, voltage, capacity, and recycling symbols.

- Import Restrictions: There may be restrictions or prohibitions on importing certain types of batteries due to safety concerns or environmental impact.

- Customs Clearance: Work with a licensed customs broker or clearing agent to facilitate the customs clearance process and ensure compliance with all customs regulations.

- Transportation and Storage: Follow guidelines for the safe transportation and storage of batteries, especially if they are classified as hazardous materials.

Important Terms Related To the Import of Batteries in India

- Importer Exporter Code (IEC): It is a business identification number that is necessary for export from India or Import to India. Until and unless specifically exempted, no one can export or import without an IEC

- Bureau of Indian Standards (BIS): It is the national standard related agency of India, which aims at promoting and developing standardization and quality control in India.

Legal Provision Vis-À-Vis Import of Batteries in India

The legal provisions for the import of batteries in India are primarily governed by customs laws and regulations, quality standards, and environmental regulations. Here are some of the key legal provisions and authorities involved:

- Customs Act, 1962: The Customs Act is the primary legislation governing the import of goods into India. Customs duties, tariffs, and the procedure for importing items, including batteries, are covered.

- Central Board of Indirect Taxes and Customs: CBIC is the apex authority for customs and indirect taxes in India. This authority issues notification, circulars, and guidelines for custom procedure and duties, which also involves information specific to battery imports.

- Bureau of Indian Standards (BIS): BIS sets quality standards for various products, including batteries. BIS certification is required for some types of batteries to make sure they meet specified quality and safety standards.

- Environmental Regulations: Environmental laws and regulations in India, such as those related to hazardous waste management, may apply to certain types of batteries, especially those containing hazardous materials. Compliance with the regulation is necessary.

- Central Pollution Control Board (CPCB): The CPCB is responsible for enforcing environmental regulations and standards, and it may have guidelines related to the import, storage, and disposal of batteries.

- Labelling and Packaging Regulations: Certain compliance like labelling and packaging regulations, including safety information, voltage markings, capacity, and recycling symbols, are to be done. These requirements are often specified by the relevant authorities.

- Import Licensing: In some cases, specific types of batteries or battery-related products may require import licenses or permits from relevant government departments or agencies.

- Customs Documentation: Proper import documentation, such as a bill of entry, commercial invoice, packing list, and certificates of origin, may be required as per customs regulations.

Variety of Batteries

To meet the diverse needs across different industries and consumer sectors, many batteries are imported from India. Here are some types of batteries that are commonly imported into India:

- Automotive Batteries: Vehicles, including cars, trucks, motorcycles, and electric vehicles, use such batteries. For starting power engines and powering electrical systems in vehicles, it is necessary.

- Industrial Batteries: For use in machinery, backup power systems, uninterruptible power supplies (UPS), and telecommunications equipment, industrial batteries are included with lead-acid batteries, nickel-cadmium batteries, and lithium-ion batteries are designed

- Consumer Batteries: These consist of remotes, toys, flashlights, and portable devices that are small and disposable. Some of the examples include alkaline, nickel-metal hydride (NiMH), and lithium-ion batteries.

- Renewable Energy Batteries: There is a growing demand for energy storage solutions as it can be seen that India is continuously investing in renewable energy sources like solar and wind power. For energy storage in renewable energy systems, Lithium-ion and lead-acid batteries are commonly used.

- Mobile Phone Batteries: India has a significant mobile phone market, and importing batteries for mobile devices is a substantial part of the battery import sector.

- E-bike and E-scooter Batteries: the demand for lithium-ion has increased with the rise in electric bicycles and scooters, which are used in E-bike and E-scooters.

- Solar Batteries: Batteries are some necessities that are required in off-grid and grid-tied solar power systems for storing excess energy for later use. For this purpose, Lithium-ion and lead-acid batteries are mostly used.

- Marine Batteries: For application, vessels, boats, and marine equipment India Maritime needs batteries

- Aviation Batteries: Batteries for aircraft and aviation equipment are essential for safety and backup power.

- Medical Device Batteries: Medical equipment and devices often rely on specialized batteries to ensure consistent and reliable performance.

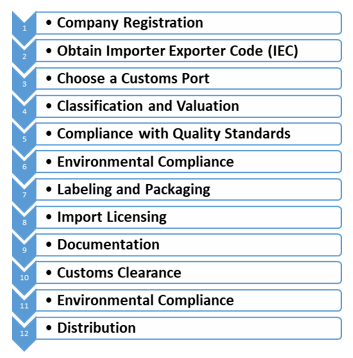

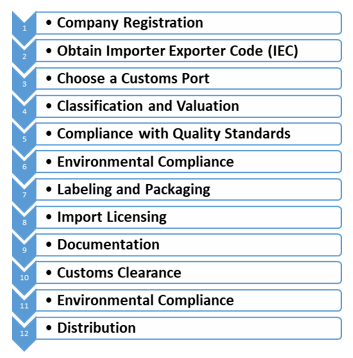

General Process for Importing Batteries in India

Importing batteries into India involves several steps and compliance with various regulations. Here’s a general process to import batteries:

- Company Registration: Ensure your business is registered in India and has the necessary permits and licenses for importing goods.

- Obtain Importer Exporter Code (IEC): You need an IEC issued by the Directorate General of Foreign Trade (DGFT). Apply for it online through the DGFT’s website.

- Choose a Customs Port: Decide which customs port you’ll use for the import. This determines where your goods will enter India.

- Classification and Valuation: Determine the correct customs classification (HS code) for your batteries. The customs value of goods is required to be accessed.

- Compliance with Quality Standards: Check if your batteries require Bureau of Indian Standards (BIS) certification. If so, obtain the necessary certification.

- Environmental Compliance: Ensure compliance with environmental regulations, especially if your batteries contain hazardous materials.

- Labelling and Packaging: Batteries must meet labelling and packaging requirements, including safety information, voltage markings, capacity, and recycling symbols.

- Import Licensing: Check if your batteries require any specific import licenses or permits from relevant authorities.

- Documentation: Prepare all required import documents, including a bill of entry, commercial invoice, packing list, and certificates of origin.

- Customs Clearance: Work with a customs broker or clearing agent to facilitate customs clearance at the chosen port. Pay applicable customs duties and taxes.

- Environmental Compliance: Ensure proper storage and disposal of batteries in accordance with environmental laws.

- Distribution: Once cleared by customs, you can distribute or sell your batteries in the Indian market.

Environmental Compliance for Import of Batteries in India

Importing batteries typically falls under general import regulations, and you would need to provide specific documents for customs clearance and compliance with relevant quality and environmental standards. Here are some common documents that may be required when importing batteries into India:

- Importer Exporter Code (IEC): An IEC is mandatory for individuals or businesses engaged in importing or exporting goods from India. You’ll need this code to facilitate the import process.

- Commercial Invoice: This document provides details of the transaction, including the value of the batteries, quantity, description, and terms of sale.

- Bill of Entry: A customs declaration form containing information about the imported goods, including value, quantity, and description. For customs clearance, it is submitted.

- Packing List: A list detailing the contents of each package or container, including weight and dimensions.

- Certificate of Origin: Depending on the type of batteries and their country of origin, you might need a certificate of origin to establish where the goods were manufactured.

- Bureau of Indian Standards (BIS) Certification: If the batteries are subject to mandatory BIS certification, provide the BIS certification documents to demonstrate compliance with Indian quality and safety standards.

- Environmental Compliance Documents: For batteries containing hazardous materials, provide documents demonstrating compliance with environmental regulations, including waste disposal and recycling plans.

- Test Reports and Quality Certificates: These documents may be necessary to demonstrate that the batteries meet quality and safety standards.

- Digital Signature Certificate: A digital signature might be required for submitting online documents to government authorities.

- Import License or Permit (if applicable): Some battery types or categories may require specific import licenses or permits from relevant government departments.

- Customs Duty and Tax Documents: Documents related to the payment of customs duties, taxes, and any applicable exemptions or concessions.

General Procedure for Renewing Your IEC

The import of batteries in India typically falls under general import regulations, and the renewal process may involve renewing your Importer Exporter Code (IEC) and ensuring ongoing compliance with relevant quality and environmental standards.

Here’s a general procedure for renewing your IEC, which is a common requirement for importers:

- Prepare Required Documents:

- A copy of the IEC issued previously.

- A valid PAN (Permanent Account Number) card.

- Bank certificate or cancelled check showing your business’s bank account details.

- Digital signature certificate.

- Visit the DGFT Website:

- For accessing the website of the Directorate General of Foreign Trade (DGFT)

- Login to DGFT Portal:

- Log in using your existing credentials if you have an account. If not, you will need to register on the DGFT website.

- Go to IEC Section:

- Navigate to the IEC section, which should have options for IEC modification and renewal.

- Select the Renewal Option:

- Choose the “Renewal” option for your IEC.

- Filling of Renewal Application:

- Complete the renewal application form with correct information that is up-to-date

- Attach Required Documents:

- Upload the necessary documents mentioned earlier, including a copy of your previous IEC.

- Pay the Renewal Fee:

- Pay the applicable fee for IEC renewal online through the DGFT portal[1].

- Submission of Application:

- Reviewing of the application is done and make sure all details are correct, and after that, submit it.

- Acknowledgment and Processing:

- After submitting, you will receive an acknowledgement with a reference number. Your renewal application will be processed by the DGFT.

- Verification and Approval:

- DGFT officials may verify the provided information. Once everything is in order, they will approve your IEC renewal.

- Download Renewed IEC Certificate:

- Once approved, you can download your renewed IEC certificate from the DGFT portal.

Conclusion

Importers need to be aware of the specific customs duties, regulations, and certification requirements related to their particular type of battery. India’s customs duties and import regulations can change over time, so it is important to keep a check on the latest information from government authorities. Pursuing renewable energy and electric mobility initiatives results in demand for batteries, especially lithium-ion batteries. The market trends and advancements, which are technological in nature, are considered an essential element for importers in the battery industry.

Comprehensively, successful battery imports into India mandate careful consideration of market dynamics, compliance with regulations, and adaptation to evolving consumer and industry demands.

FAQs

Importing batteries into India involves adhering to customs regulations, quality standards, and environmental laws. The Customs Act of 1962 governs the process, defining customs duties and procedures. The Central Board of Indirect Taxes and Customs (CBIC) issues relevant guidelines.

Yes, batteries can be imported into India

The following batteries and devices cannot be shipped • Lithium-ion cells and batteries • Lithium metal cells and batteries • Batteries that have not passed safety testing • Low-production and prototype batteries

Lithium cells and batteries can become dangerous and cause fires and electrical shocks if not safely packaged and handled when transported.

Types of batteries used in aircraft include • Lead Acid • Nickel Cadmium (NiCd) • Nickel-Metal Hydride (Ni-MH) • Lithium-ion/Lithium-polymer • Lithium Metal

Read Our Article: BIS ISI Certification For Multipurpose Dry Batteries