Registering your business is the primary step in helping it become a legally binding entity in India. Doing so not only imparts plenty of benefits but also ensures that you remain safeguarded against legal troubles later on. Furthermore, the most crucial step in registering a business understands which business structure to incorporate as.

Partnership firm registration has garnered tremendous popularity in the past few years owing to the benefits it provides. Entrepreneurs looking to register a partnership firm in Delhi can use this blog as an instructional manual to complete the registration formalities.

Understanding a Partnership firm

A Partnership firm refers to a business form wherein the partners held equal rights on the share of profits & losses in a predetermined manner. Moreover, partnership company registration serves as a suitable alternative for small & medium business enterprises.

The partnership firm registration in Delhi is well-known owing to its ease of formation & less compliance. Such entities fall under the regime of the Partnership Act, 1932[1] & its amendments. According to the Act, there are two forms of partnership firms that exist in India;

- Registered Partnerships

- Unregistered Partnerships

Since the only criterion to operate as a Partnership firm is the execution of the partnership deed, partners have the option to stay away from it.

However, this could have a drastic impact on the business as they do not possess certain rights, as mentioned in Section 69 of the Act. Staying unregistered often leads to a poor growth rate and inconsistent revenue. Therefore, opting for registration is more of a necessity than an option.

What is the Government Fee for Registering a Partnership Firm in Delhi?

While there is no legal charge to incorporate a partnership firm in Delhi, you will still require paying the professional fee as well as the stamp duty for the following:

- Affidavit on an Rs10 stamp paper declaring consent of the partner to enter into the deed.

- Similarly, the court fee stamp worth Rs 3 on the application form.

- Stamp duty on the partnership deed, which may vary 1% of the capital & INR 5000.

- Registration & document fee for deed registration depends on prevailing state laws, but in most scenarios, it cost around Rs 1000.

- Professional fees are levied by the legal consultant for the drafting of your legal documents.

What are the Documents Required for Registering Partnership Firm in Delhi?

- Duly filled form 1 enclosing INR 3 stamp

- Attested Identity as well as the Address proof of Partners such as PAN /Driving License/ Passport /Aadhaar/Voter’s ID

- Original copy of the Partnership deed.

- Attested evidence of registered office address such as Lease Agreement/ Sale Deed/ / tax receipt/ telephone bill/ Latest electricity bill.

- No Objection Certificate from the owner on a non-judicial stamp paper worth Rs 10.

Any of the given persons must attest the entire documents:-

- Magistrate 1st class

- Gazetted Officer

- Notary Public

- Advocate

- Chartered Accountant

What is the Procedure for Registering Partnership Firm in Delhi?

- Deciding the Name of the firm is the first step of the registration process. The members are required to decide on a name that stays within the boundary of the law.

- Next, the members ought to work cohesively to get all the required documents attested & notarized.

- Moreover, an important part of incorporating a partnership firm in Delhi is drafting & notarizing the Partnership deed.

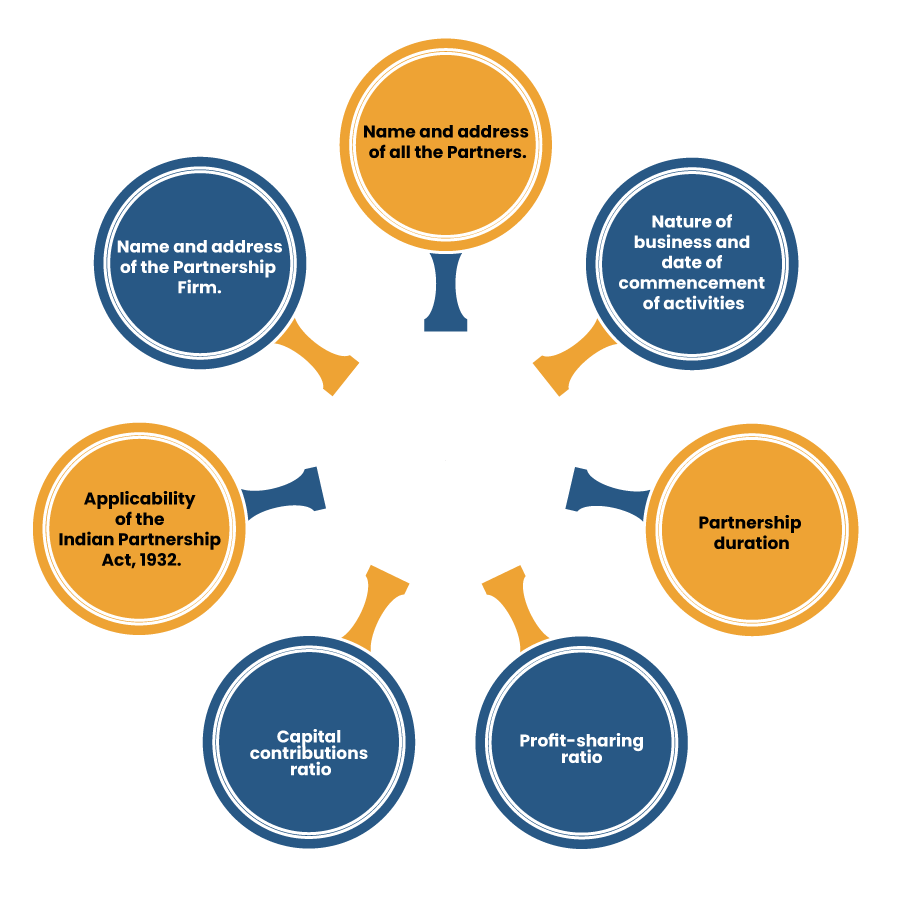

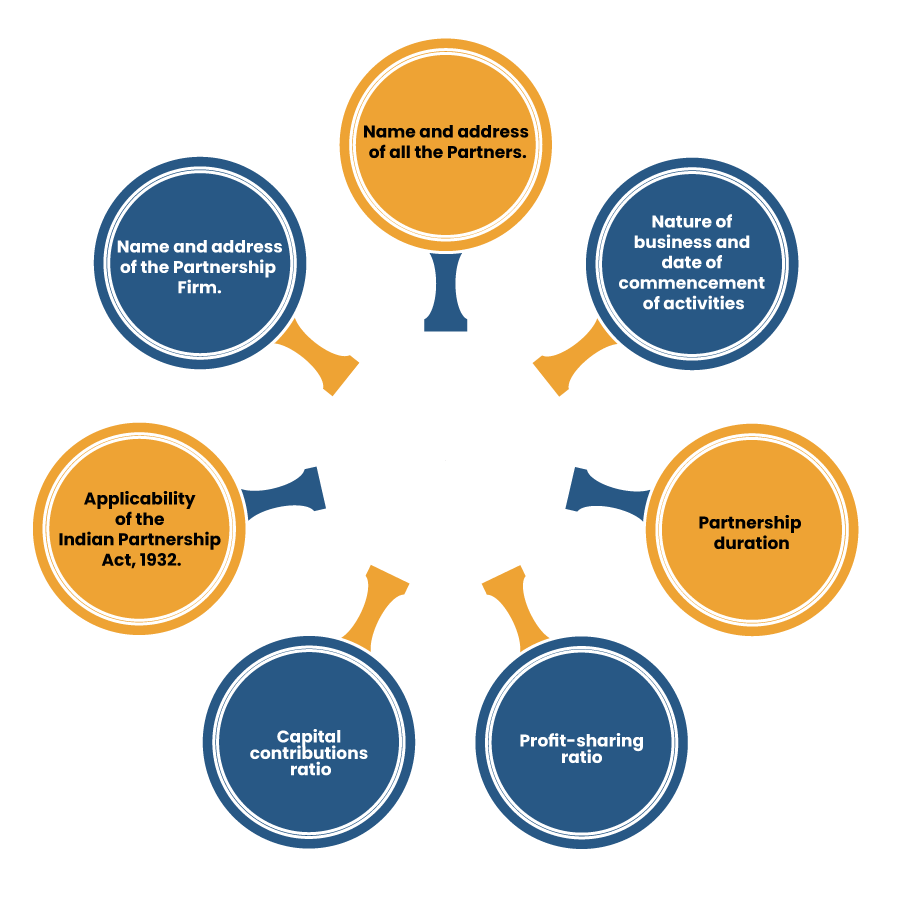

- A well-versed advocate will aid you in drafting a partnership deed that should enclose the given information:-

- The attested copy of the registered partnership deed should be printed on a non-judicial stamp paper. Moreover, the worth of this document should be equivalent to either 1% of the capital introduced or INR 5000, whichever is lower.

- Next, the partner should reach out to the concerned registrar with the documents mentioned above.

- Apply for registration.

- On submission of the requested documents and form, you will get an application ID for future reference.

- Lastly, after successful verification, you will get a Registration Certificate.

Here is the address of the Magistrate serving in the jurisdiction of Delhi to register the partnership deed;-

1. M. Band Gali, Shastri Nagar,

New Delhi, Delhi 110031

What if a Partnership Firm Opts to Stay Unregistered?

- A firm without a registration loses its right to sue defaulters or another company in case of a dispute. Such companies do not have the authorization to follow a legal procedure in the quest for justice against unlawful activity.

- A firm that opts to stay unregistered does not have the right to sue any defaulter in any court.

- In the absence of a registration, the claim exceeding INR 100 cannot be set off by another party henceforth; there is no relaxation in this regard to the party. Such rights are only available to the registered firms only.

Conclusion

It is evident from the section above; the staying unregistered is not beneficial for your company. If you intend to garner seamless growth for your business in years to come, then staying within the legal regime is the only option that can drove you to success.

A registered Partnership Firm encounters less compliance as compared to unregistered businesses. Besides, it helps business owners to minimize the frequency of the financial scrutiny of the company. Don’t hesitate to connect with one of our associates at CorpBiz’s helpdesk if you need some professional guidance on the registration process for a Partnership Firm in Delhi.

Read our article:Procedure & Reasons for Change in Partnership Deed