A Private limited company is one of the popular and widely adopted business forms in India. The Company Act 2013 is a sole regulator of privately held entities in India.

Process for company formation in India has been simplified by the Ministry of Corporate Affairs under the ongoing initiative such as “Ease of doing business”. MCA has inculcated a new web-based form viz SPICe+ for the applicants seeking company formation under Company Act, 2013.

Minimum Eligibility Criteria for Registering an Entity as a Private Limited Firm

At least two shareholders are required to establish a private limited company in India. However, the maximum limit in this regard can go up to 200, as per the guidelines of the Company Act, 2013[1].

In a state of financial crisis, the shareholders of the private limited company are not liable to compensate for such a loss. That means their assets remain safe regardless of the financial standing of the company.

As per Company Act, 2013, the private limited company is liable to appoint a minimum of 2 directors to oversee its operations. The upper limit in this regard, as the said act, is capped at 15- meaning a maximum of 15 directors can exist in a privately-held entity. An eligible candidate from abroad can also be appointed as a director in a private limited company.

Read our article:Private Limited Company Registration Procedure in India

Procedural Instructions for Company formation under Company Act 2013

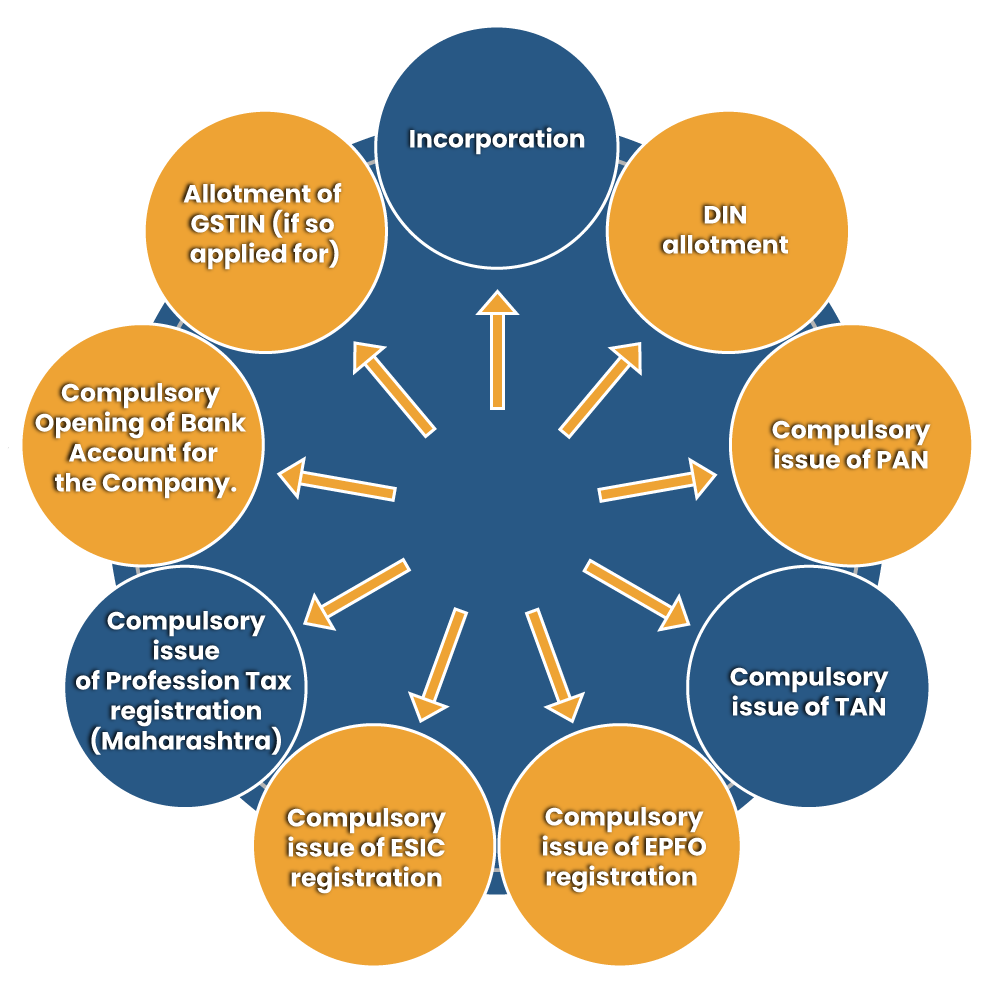

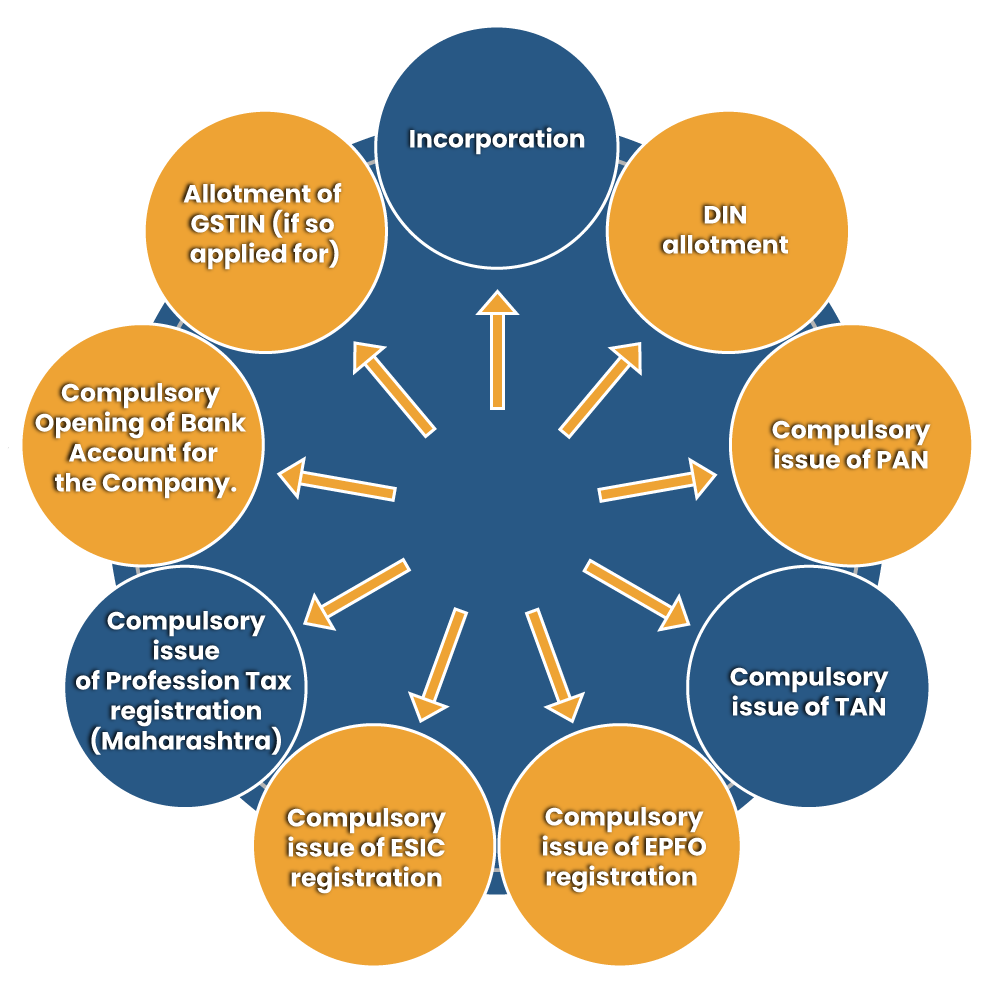

On 15th Feb 2020, the Ministry of Corporate Affairs (aka MCA) introduced the new web-based form known as SPICe+ for company formation under the Company Act 2013. The SPICe+ form consolidates two sections, which are as follows:

- PART A: Name Reservation for new companies.

- PART B: Encloses the string of the following services:

The process of company formation starts with the name reservation on MCA’s website. To fulfill such a requirement, you need to make sure to follow the underneath instructions carefully.

Part A of SPICE+ Form

- First, open the official website of the Ministry of Corporate affairs and then log in to the same website:-

- On the home page, select “MCA services” > SPICe+ option.

- As soon as the new windows appear on your screen, tap on the “New Application” and fill up the underneath options

- Type of the company

- Class of company

- Category of company

- Sub-Category of company

- Main division of industrial activity of the company

- Description of the main division.

- Enter the two proposed names for your company.

- After selecting the option “Auto Check”, the portal will start examining the input data.

- After opting for the Auto Check option, the portal shall initiate the verification process by leveraging its database for the name availability.

- Result regarding the verification process will prompt on your screen as soon as the portal completes the verification process.

- Click on the “Save” button at the bottom of the page as soon as you get the approval.

- Wait until the confirmation messages prompt on the screen, and then hit the Submit button.

- Select the “submit for name reservation” option on the newly open dialog box that will appear at the top of the screen.

- On the subsequent window, a message/notification will be prompted on your screen regarding the fee submission. Kindly note down the SRN as it could prove to be useful for tracking the application’s status.

- Tap on the “Pay now” for the submission of the fees for name reservation.

Once you met the prerequisite of PART A, make sure to proceed further towards the incorporation process i.e. Part B of the SPICe+ form.

Part B Consolidates Various Sections regarding the check form.

The detail regarding the incorporation is as follows:

- Location of the registered company

- Proposed directors as well as subscribers.

- Resources presented at the company’s disposal.

- Apply for tax registrations i.e. PAN & TAN.

- Leverage pre-scrutiny check. A confirmation notification regarding the form submission shall prompt on the screen.

PDF version of Part B SPICE+ Form

Download the PDF version of Part B for attaching the Digital Signature Certificate and for filing up other linked forms in addition to Form B. The forms linked with SPICe+ consolidates SPICe + MoA & SPICe + AoA, AGILE-PRO, URC-1 & INC-9.

Applicants can easily submit the Part B of SPICe+ and linked form on the online portal of the Ministry of Corporate Affairs. A Service Request Number is generated by the portal against the fees submitted by the applicant. Upon receiving the requested fee, the application undergoes the evaluation for further assessment.

In an event where the authority flagged the application for viable flaws, consider resubmitting the application by following the entire process again.

Check List Required for Documents Applicable for Company Formation in India

- The Articles of Association (AOA) & Memorandum of Association (MOA).

- Declaration by the directors & subscribers.

- A confirmation regarding the office’s address.

- Copy of utility bills (for the last two months)

- Nominee’s assent

- Residential address & Identity proof of the nominees & subscribers.

- residential address and the Identity proof of Applicants

- The Declaration/Resolution of the unregistered companies

For AGILE-PRO:

- Proof regarding the principal place of business

- Authorized Signatory’s appointment proof.

- Letter of Authorization or Copy of Resolution approved by the Board of Directors.

- Appointment proof for the proposed director for GSTN.

- Proposed Director’s identification proof for a new bank account.

- Proposed Director’s address for opening the bank account.

- Proposed Director’s signature for EPFO.

Conclusion

As per the existing trends, registering an entity is certainly beneficial both in terms of tax obligations and long-term growth. The entity under the Company Act, 2013 is entitled to leverage several exclusive benefits that ensure its consistent growth. Hopefully, you would find the above-mentioned process simple and straightforward. However, if you need some expert-level advice on the company formation, kindly make your way to CorpBiz ‘s professional.

Read our article:Steps for Private Limited Company Incorporation In India