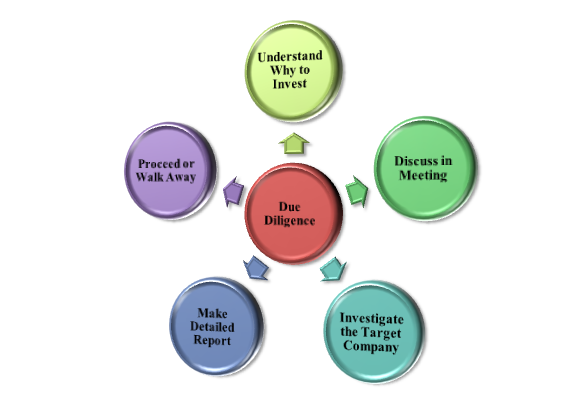

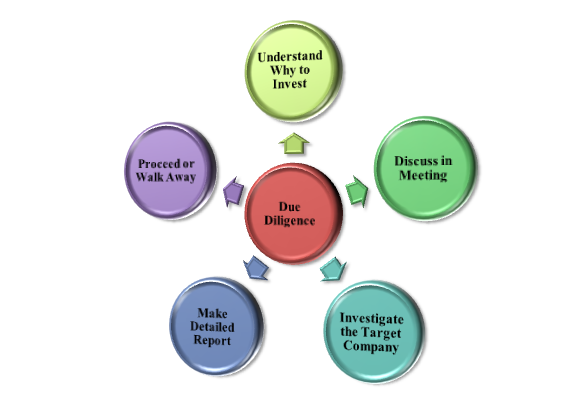

The term Due Diligence describes a general responsibility to exercise care in any operation. All the remunerations, efforts and analysis to be made by an individual or body corporate, to systematically evaluate or perform any essential deals or contracts, come under this. To perform different types of businesses and transactions in the financial world, it is a vital aspect to be present. In this article, the complete overview of the process of Due Diligence will be discussed.

What is Due Diligence?

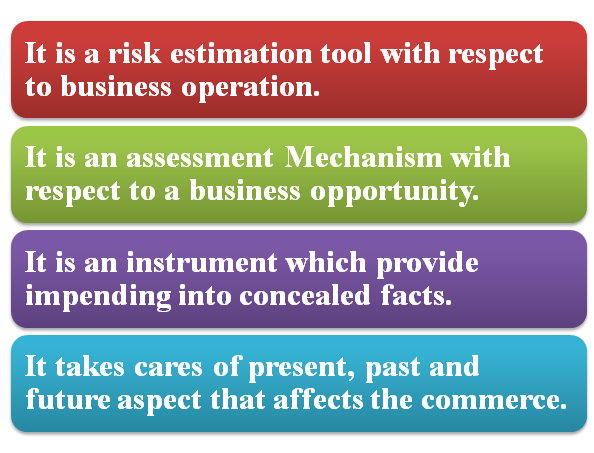

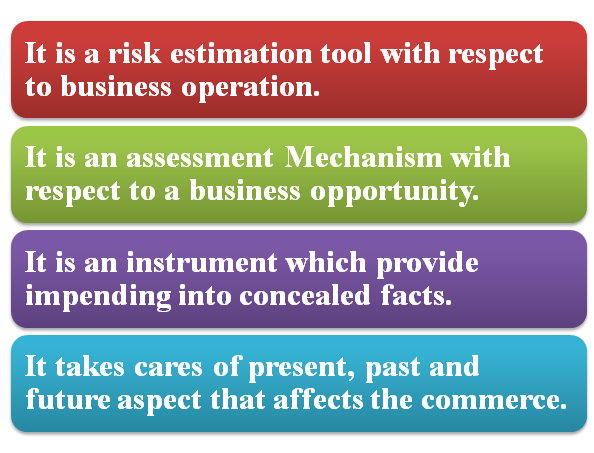

The different meanings of Due Diligence are as follows:

What are the Objectives and Scope of Due Diligence?

The Objectives of Due Diligence is as follows:

- To identify the strong point and to discover threats and weaknesses

- To take a good quality decision about an investment

- To make a smooth decision

- To develop confidence in shareholders

- To provide a secure level in a transaction

- Collect material information

The Scope of Due Diligence is as follows:

- Depends on the needs of the people who are involved in investments, addressing issues which are not covered, areas of threat and identifying any new opportunities.

- In general, it covers Compliance, litigations, uncovered risks and future investments.

Read our article:Due Diligence: A Complete Run-Through

What are Different Types of Due Diligence?

Due differs for different types of entities. There can be as many as 25 or more angles for observing and analyzing day to day affairs of Company[1]. The main types are as follows:

Business Due Diligence

This typically involves looking at the quality of parties, business scenario, and value of the investment. This type includes:

Operational

This type looks into the operational weaknesses, functioning of the Target Company, degradation or up-gradation related to operational process of Company, economical impact on the operational efficiency of the Company.

Strategic

In this analysis of business or transaction is checked whether business or transaction is commercially feasible or not. The position of Company in a competitive environment is also looked into to gain better results later on in industry.

Technology

This includes the check on the current level of the technology and the current existing level of the technology. If there is any further investment is required in the Company or not.

Environmental

This type involves environmental risk associated with a Company. This type includes risk identification regarding:

- Site assessment

- Managing operation at sites

- Reviewing the history of sites and the environmental condition of a site

- Regulatory pollution check of the site

Human Resource

This type aims at the issues related to the workforce in the Company. Sometimes, there are cultural differences in the Company, which lead to problems in the Company. It is essential to understand the crucial cultural differences in the Company for a pleasant environment in the Company.

Ethical

This type calculates the ethical risks involved with the Company. The ethical character of the Company, the reputation of Company, the partner is ethical or not; all these risks are managed under this type.

Legal Due Diligence

This type mainly focuses on the legal aspects of the transactions, legal pitfalls and other law-related issues. Under this type, the examination of the following elements are done:

- Memorandum of Articles (MoA)

- Minutes of Board Meetings

- Copy of all the share certificates issued to employees

- Guarantees to which Company is party

- Licensing Agreements

- Loan Agreements

Financial Due Diligence

This type involves an analytical study of business, assessing the key issues facing the Company and drivers behind maintainable profits and cash flows, identifying the vital monetary risks and potential deal breakers of the transaction. The validation of Financial, operational and commercial assumptions are done here. The review of the accounting policies, internal audit, earning sustainability, the value of assets, and structure of deals and examination of the financial system is done in this type.

Conclusion

Diligence would include a thorough understanding of all the obligations of the Company. The rights and responsibilities, pending lawsuits, leases, guarantees, warranties, debts all are analyzed for better working of Company in the market. Undergoing, Due Diligence means doing homework on a potential deal and calculate the risks involved with the agreement. We at Corpbiz assist you with steps followed while applying Due Diligence in a Company. Our professionals will ensure the successful completion of your work.

Read our article: Financial Due Diligence: A Complete Checklist