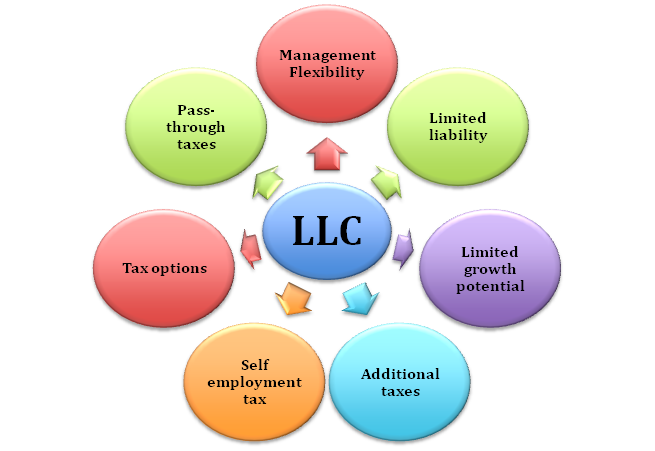

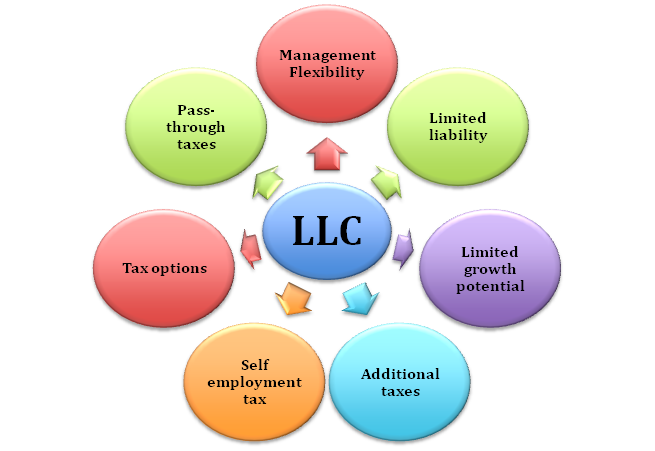

The corporate fraternity in India is yet to get accustomed to LLC’s working protocol and its taxation traits. There is a common misconception that LLC taxation traits are similar to private limited companies or a partnership firm. After the amendment of the Finance Act 2009, it has been clarified that LLC would be taxed like a partnership firm. In this article, you will come across several aspects of Taxation for Limited Liability Company.

Understanding of Taxation Norms: Comparision

To get a better understanding of the LLC’s taxation norms, let us go through the private limited companies’ taxation policy. The income generated in a private limited company is taxed at a rate of 30%. The law has assigned the Private Limited Company as a separate legal entity. Apart from filing income tax, the private limited company is also accountable to pay the surcharge of 5% whenever their taxable income surpasses the minimum threshold limit i.e., Rs. 1 crore. Such companies need to address the secondary and higher education cess of 1% as well. Private limited company lures the following taxation charges.

- Education and Higher Education Cess: Private limited company attracts secondary education cess at the rate of 2% and higher education cess @ 1%.

- Turnover exceeds one crore: Surcharge of 5% will be applicable when the company generates more than Rs. 1 cr of taxable income.

- In case of dividends declaration: A dividend tax @ 15% is applicable whenever the Private ltd company declares the dividend. A surcharge of 10% is also relevant in this case.

Taxation for Limited Liability Company

The LLP taxation norms are more or less identical to that of a partnership firm. Since partnership firms deem as a separate taxable entity, they need to bear the income tax @ 30% + education cess @ 2% + secondary and higher education cess @ 1%. A private limited company also follows these norms.

A partner can claim interest on capital and a deduction for remuneration rendered by them to the LLP. If LLP has no provision mentioned in the agreement in this context, then the partner cannot avail of these components. The LLP Agreement should clearly illustrate the clause that supports these claims. The payment regarding remuneration cannot be granted to the LLP Partner, who is not actively involved with the company’s affairs.

Read our article:Detailed Process of LLP Name Change in India

What are the criteria for deducting the remuneration of an LLP partner?

LLC can make remuneration payments to its partner on the basis of the LLP agreement. Moreover, the Remuneration to Partners cannot exceed the prescribed limit mentioned under the income tax act, 1962[1]. The following table would help you understand the provision for remuneration in LLC.

|

S.no |

Conditions |

Remuneration |

|

1. |

On the first three lacs of book profit or loss |

Rs 1.5 lacs or 90%, whichever is higher |

|

2. |

On balance |

@60% |

Example: The book profit of an LLC comes out to be Rs, 12,00,000. Here’s how you can calculate the amount of remuneration of the partner in this case.

As per the first condition- on the first three lacs, the remuneration will be 90% of the same i.e., Rs 2,70,000. Now the balance amount i.e. Rs, 9,00,000, will be deducted @ 60% which will eventually come out to be – Rs 5,40,000. Thus, the net remuneration that an LLP should pay to its partners is Rs. 8,10,000.

Provision of Taxation for Limited Liability Company

The interest and remuneration obtained by the partner from an LLP deem as a taxable income of the LLP partner. Therefore, if the LLP partner allocates some expenditure concerning the company’s affairs, it can be set off against the receipt of remuneration and interest. The LLP doesn’t have to address TDS provision on account of interest and remuneration necessarily.

Surcharges on the LLP income

In general, LLP lures surcharges, but only if the generated income exceeds the threshold limit i.e., Rs. 1 crore.

Income tax on LLPs

Typically, every LLPs operating in the country needs to file income tax return every year. The income tax return, in the case of LLC, seeks the signature of the active partners.

What is a surcharge?

As the name suggests, the surcharge refers to as an additional charge or tax. A surcharge of 10% is levied on an individual earning more than Rs 1 crore as a net taxable salary. However, some relaxation is also provided as oftentimes the increase in tax liability becomes more than the increase in income above Rs 1 crore after factoring surcharge.

The domestic corporations earning in the range of Rs 1 cr to Rs 10 cr is liable to a surcharge of 5%. The moment this income surpasses the threshold of 10 cr, the surcharge rate goes higher up to 10%. A surcharge of 2% is levied on a foreign corporation whose net income falls in the range of Rs 1 cr to Rs 10 cr. as soon as the entity exceeds this income bandwagon, the surcharge changes to 5%. An incremental relaxation is furnished to both foreign and domestic corporations if the income surpasses Rs 1 cr and Rs 10 cr.

Conclusion

LLC in India operates as a separate legal entity that lures substantial tax on the income generated. LLC caters to a wide variety of taxes, starting from the surcharge to education cess. Unlike other business models, LLC discourages any provision for TDS on account of interest and remuneration. If you still need some assistance regarding Taxation for Limited Liability Company, then feel free to contact the CorpBiz’s expert.

Read our article:Modified LLP Settlement Scheme, 2020