The footwear industry is one of those prominent sectors that hardly goes out of trend or encounters negative growth dip. The ever-evolving taste of customers and rising demand for trendy footwear create massive domestic demand, thereby compelling producers to raise their production volume. Presently, India is one of the prominent footwear producers in the world. If you plan to initiate the business journey but are sceptical about choosing the right domain, then the footwear industry could be your best bet. In this article, we have penned down some essential legalities for commencing a Footwear Business in India.

Why footwear Business is a profitable venture for start-ups?

- Liberal investment Policies in the footwear & leather sector

- Availability of 100% FDI in the footwear sector via the automatic route

- Easy availability of workforce, advanced technology and equipment

- Ever-increasing inclination of customers towards trendy footwear

An Overview on the Indian Footwear industry

- The Indian footwear industry is categorized into two important segments: Leather and Non-leather. The non-leather footwear industry, in particular, has witnessed surging demand in the domestic as well as a foreign market, helping India to secured second position globally. In global consumption terms, almost 86% of worldwide footwear consumption has become non-leather in terms of volume.

- Nearly 75% of the production in the non-leather footwear sector belongs to the unorganized sector in India. This includes entities working under the MSME sector. The production of non-leather footwear is primarily done in Kanpur, Chennai, Sonepat, Kolkata, Ernakulam, Ludhiana and Calicut.

- India has secured the second position globally in terms of production, which further could be extended eight folds by 2030. India footwear sector is projected to attain a valuation of $15.5 billion by 2022.

- It is projected to grow by 11% in the next five years. The Indian non-leather footwear sector is expected to achieve a valuation of 6 billion dollars by 2024.

- The Indian leather and footwear sector contributes nearly 2 per cent of the nation’s overall GDP & is a prominent job creator.

Read our article:Benefits of Startup India Registration in India

Basic legalities for setting up Footwear business (production unit)

Following are the legalities to be catered by the start-ups to set up a shoemaking production unit in India.

Avail Company Registration

Any entities seeking to operate as a legal establishment in India can register under the following business forms

- Private Limited Company

- One Person Company (OPC)

- LLP

- Partnership firm

Points to be noted

- The top four business structures in the list above come under the ambit of the Company Act, 2013. Company Act, 2013 entails the incorporation and post registration compliances.

- Entities intending to operate as LLP, OPC, Private or Public Limited need to draft charter documents such as MOA and AOA. This is a mandatory pre-incorporation requisite.

- Ministry of Corporate Affairs facilitates an online incorporation form, known as SPICE+ form. The introduction of Spice+ has mitigated the requirement of filing separate forms to complete the incorporation process.

Obtain Factory License

Factory License is a must-have requirement for production-based entities running a footwear business. The Factory Act, 1948[1] mandates the production-based entities to avail registration of their facility from the local governing authority before commencing the operation. Presently, the labour department of the respective states grants this license to the factory owners.

Secure BIS Registration

In the purview of the order released by the DPIIT, 27 footwear items have been brought under the ambit of BIS registration w.e.f 1 July 2021. To facilitate shoemakers in availing BIS certification, a set of norms has been outlined by BIS.

Key points to be noted

- Application fee ranges from Rs 500 to Rs 1000 based on the scope of production and organization size.

- The BIS certification also attracts an audit fee ranging from Rs 9000-12000-per manday. Again, the fee for auditing varies in accordance with the size of the entity.

- The application for BIS Certification also seeks technical documents apart from the basic ones. These documents include detailed plant schematics, product quality report (not older than three months), detail of machinery.

- Footwear business production units will undergo conformity assessment conducted by the BIS’s officials for the grant of the license.

Avail GST registration

Businesses engaged with the inter-state supply or generating a yearly turnover more than the prescribed limit is mandated to obtain the GST registration. GST number is a 15 digit alpha-numeric which is based on the PAN of the business entity, and it is assigned to every eligible taxpayer under GST.

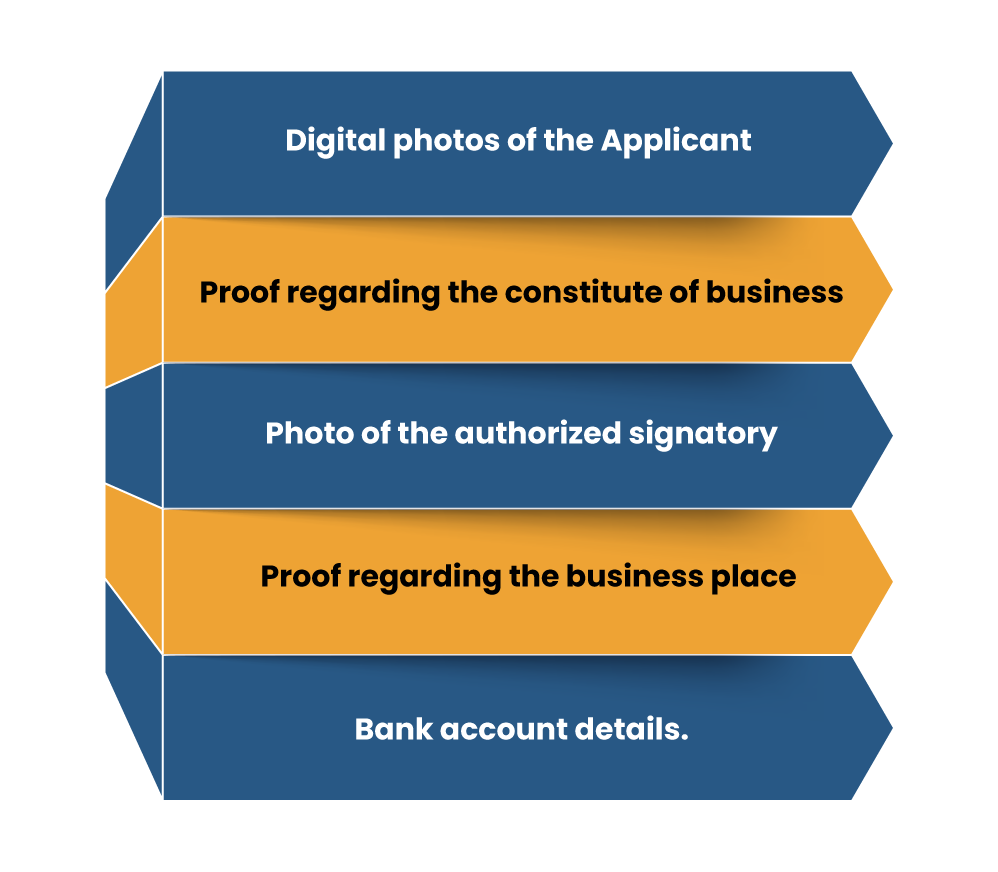

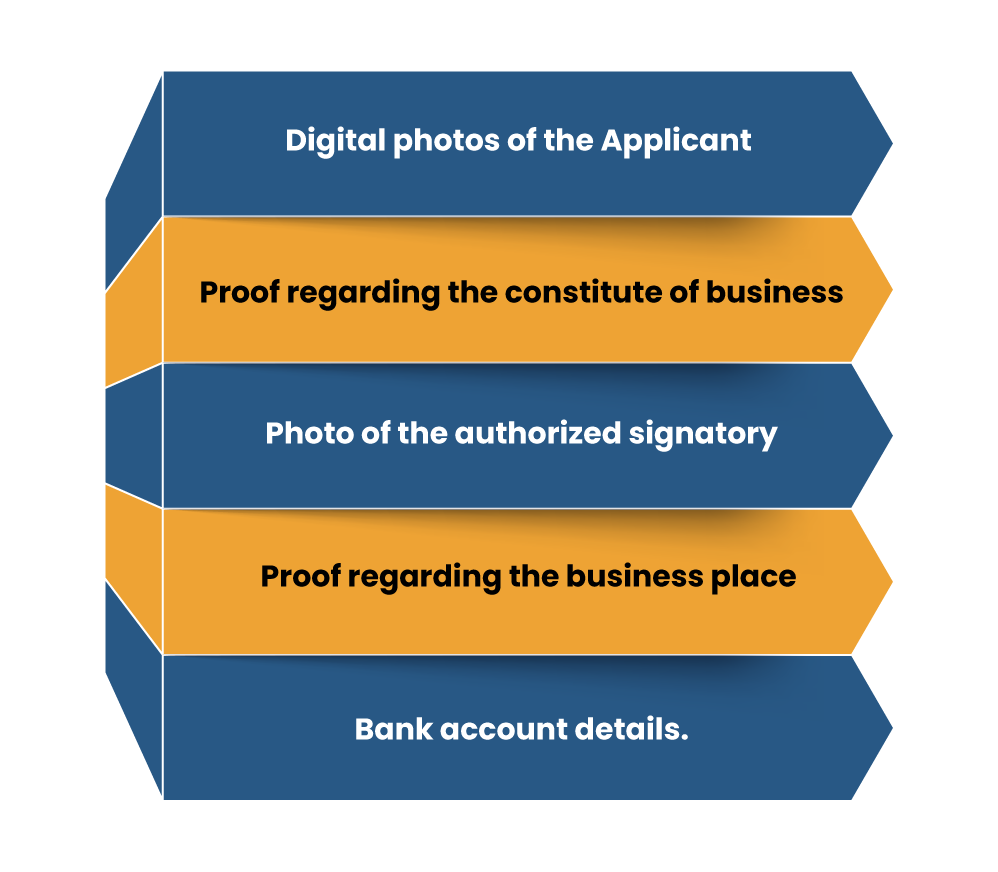

Applicant willing to register under GST needs to drop an application of the GST portal. While attempting such an undertaking, the portal will prompt the applicant to provide the following details.

Legal Prerequisites for establishing Footwear Business (Retail Unit)

If your budget doesn’t allow you to set up a costly production unit, you can jump into a retail domain. Here is the list of licenses one need to procure for setting a footwear retail unit in India.

Shop Act-License

Retail businesses in India cannot run without this license. The shop and establishment license is granted by the municipal corporation of the respective state. To avail of this license, the applicant needs to submit a duly filed applicant, viz Shop-Act form before the municipal corporation along with the following documents

- PAN, Aadhar, etc. for the identification proof

- proof of the property

- Retail outlet pictures

- Authority letter for business.

- Form – A.

Current Bank Account

The current Bank Account broadly deals with business-related transactions, and it is mandatory for every business owner. To open such an account, the applicant needs to submit a prescribed form and submit the same along with the requested documents such as PAN, shop act license, and electricity bill (for address proof).

GST Registration

Just like production units in India, every registered entity (except NGOs with 12AA registration) is mandated to register under GST. The applicant can hop onto the GST official site to drop an application for the GST registration. The common documents required to be submitted on the GST portal includes PAN card, identity proof, business registration proof, photos of the business owner, bank details and

Conclusion

Setting up the footwear business in India attracts moderate compliances and registration. If you got stuck with some legal implications at any stage, feel free to prompt the CorpBiz’s expert to avail professional guidance for the same.

Read our article:Tyre Retreading Business: A Perfect Ventures for Startups