Madhya Pradesh has notified the Real Estate (Regulation and Development) Act Rules on October 22, 2016. The state has also launched the official RERA MP portal (rera.mp.gov.in[1]) to address grievances of home buyers against errant developers for their houses. Since the legislation came into force on May 1, almost 2,400 complaints have been registered, of which nearly 1,180 complaints have been resolved.

The Real Estate Regulation & Development Act, 2016, is an Act passed by the Parliament that seeks to protect homebuyers and also help boost investments in the real estate industry. The Act came into existence on May 1, 2017, with 69 of 92 sections as notified. The Act mandates registration of every project having a size of above 500 square meters or more than 8 apartments.

How to register with RERA MP?

The RERA MP mandates all real estate developers and projects in the state are required to enroll on the official RERA site. The mode of online registration has been provided to expedite a registration process. Every eligible project of the real estate remaining incomplete by April 30, 2017, or that whose completion certificate was not issued will be included in the ambit of RERA.

Real estate agents will receive a certificate number, which will be valid for 5 years. Registration fees in the case of individuals are Rs 10,000 and Rs 50,000 in the case of other than an individual.

Real estate agents facilitating sales must also require to register in RERA. Section 9 of the Act specifies that real estate agents that engaged in selling projects registered under the Act can do so only after registering themselves with authority. Section 10 of the Act gives the detailed functions and duties of real estate agents. RERA in Madhya Pradesh has started its operation from day first, i.e., May 1, 017. After a long time of almost 2.5 months, only four agents are registered in Madhya Pradesh.

Documents Required to Register for RERA MP

Madhya Pradesh today, is one of the first states in the country to build an authority in the Real Estate Regulation & Development Act. Under RERA MP rules, all real estate developers, agents, and promoters are required to furnish the relevant documents regarding registration of their projects with the state regulatory authority. The documents required are:

- Passport size photograph of agents/ promoters

- Copy of Aadhar card of agents/ promoters

- PAN card of MP real estate agent in case of an individual or PAN card of Firm/ Company

- Audited profit and loss statement along with the Income Tax Returns (ITRs) for the last three financial years

- Income Tax Return of the last three financial years or in case an applicant was exempted from filing returns under provisions of the Income Tax Act, 1961 of the 3-year preceding the application, a declaration to such effect.

- Authenticated copy of address proof of a place of business

- Registration proof (either Partnership Deed or COI in case of Company)

- Particulars of the Registration including the bye-laws, articles of association, memorandum of association, etc

- Details of open and covered parking spaces as proposed in the project

- Details of any type of dispute/litigation on a land title

- In case the developer is not the owner of the land, he needs to furnish a copy of the land agreement.

RERA impact on Real Estate Agent

Under the RERA Act 2016, all Real Estate Agents must have to register with the RERA before facilitating any transaction. Every Agent has to be listed by the Promoter during the Project Registration/Status Updates without which Agent cannot market the project

If any of the real estate agents fail to register, he must be liable to a penalty of Rs 10,000 for every day during which such default continues. It can be cumulatively extended up to 5% of the cost of the apartment, plot, or buildings of a real estate project, for which a sale or purchase has been facilitated.

Read our article:APRERA Notification on Late Quarterly Compliance Filing

Government Fees and Charges on RERA MP

The real estate agents require to pay government registration fees at the time of an application made to the Authority through NEFT or RTGS or any other type of digital transaction mode. The Registration Fees is as follows:

- In case of an Individual: Rs 10,000

- In case of other than an individual: Rs 50,000

RERA Act 2016 is a step towards reforming the real estate sector in India, encouraging more transparency, accountability, and professionalism.

Benefits of MP RERA implementation

- Timely delivery: Any contract which is signed between Madhya Pradesh Housing Board/developers and allottees must be completed in time. Under the RERA regime, properties must be constructed within the stipulated time, avoiding unnecessary delays and cost escalations.

- Guarantee: All properties that are registered under RERA have a five-year guarantee promising sound construction quality.

- No misleading advertisements: Marketing and advertising of real estate projects have to be done only after the successful completion of registration with a regulator.

Key obligations for Builders, Developers, and Promoters

Madhya Pradesh government has been adopted the RERA rules drafted by a central government. It requires that any project with 8 units or plot size more than 500 sq m has to be registered with the regulatory authority. According to RERA MP norms, a Promoter must disclose the following for eligible project:

- Original approved the layout plan along with specifications promised to an allottees

- The total amount of money collected from an allottee and utilized for activities involved in project completion

- Status of a project with photographic evidence, if the project is delayed, a revised time schedule with the reasons for the delay must be issued.

- Size of an apartment based on carpet area

- Bank details of an escrow account having 70 % of the total amount collected from the buyers

RERA MP Rules and regulations

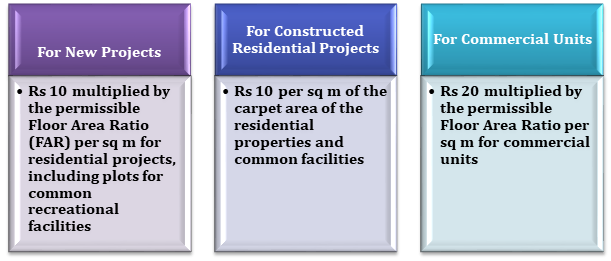

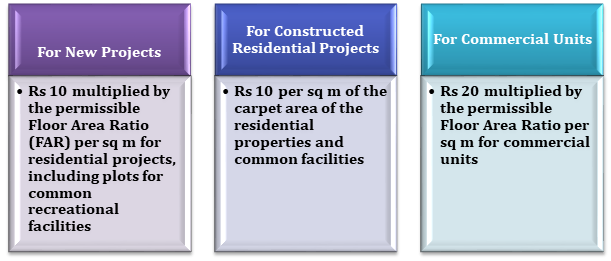

Apart from these documents, a certain amount must be charged while registering real estate projects under RERA. The registration amount would be calculated on the basis of following:

Rejection of RERA Application

In case a developer applies for withdrawal of registration of the project or in case the application is rejected, the RERA registration fee must be refunded within 30 days, after deducting 10% from the amount.

Registration validity of RERA MP

If all details were furnished correctly as per the directed guidelines, a registration certificate should be issued to the developer, which must be valid for five years.

Conclusion

The authority has designed for keeping the above factors in mind that reflects the values of a basic Authority’s functioning of RERA MP. It portrays the authority’s commitment to creating a caring, nurturing environment for the promotion of the real estate sector. The design of the emblem embodies a spirit that underpins the authority’s work – representing tranquillity, and transparency.

Read our article:Comprehensive Guide on RERA Registration for Promoters