For any business, the management of documents is essential. Similarly, for all the importers and exporters, managing all the paperwork related to their imports and exports is equally important. The whole process of import and export consists of many stages, and all require different documents. The documents and bills related to shipping, landing, and entry all hold significant importance in the import-export process. The Indian government, taking this into consideration, introduced an online portal known as ICEGATE Portal to handle all these records. The ICEGATE Portal is beneficial for all exporters, importers, cargo service providers, and others involved in this business. The ICEGATE Portal acts as an online portal where all the e-filling can take place.

A Brief Take on the ICEGATE Portal

The ICEGATE Portal, also known as the Indian Customs Electronic Data Interchange Gateway, was launched on a national level. The Indian Customs of the Central Board of Indirect Taxes and Customs (CBIC) is the regulatory authority overseeing the ICEGATE Portal. The ICEGATE Portal acts as a user interface between the Department of Customs and trade users. All vital information is exchanged on the ICEGATE portal.

Commerce users and the customs agency are included. According to ICEGATE statistics, lakhs of exporters and importers are currently being served by registered users. The ICEGATE Portal fulfills the department’s needs for electronic interaction and electronic information interchange. ICEGATE used the Customs Electronic Data Interchange capability to link fifteen broad-type partners with message-exchanging services, enabling EXIM commerce to happen significantly faster. In EXIM commerce, it facilitates quicker customs clearance.

Services Offered by ICEGATE Portal

Some of the main services that are provided by the Indian Customs Electronic Data Interchange Gateway are:

1. E-filling Facilities

The portal’s main service is the electronic filing of custom declarations. The prior method of manual submission of the customs declaration has now been changed to full e-filing. This change has made it very easy to handle customs-related documents. Electronic filing reduces time and increases accuracy. With the existence of an e-filing system, human errors are also greatly minimized.

2. Payment of Customs Duties through Electronic Means

ICEGATE introduces a synchronized method for enterprises to pay customs taxes electronically. By eliminating the need for actual bank or customs office visits, this type of service makes it possible for enterprises to fulfill their fiscal duties online effortlessly. When payments are processed quickly, customs clearance happens more quickly, facilitating the easy delivery of the items to their designated locations.

3. Real-time Tracking

The concept of transparency and accurate data in real-time is more advantageous in commerce across borders. ICEGATE acknowledges this need by offering a service that lets users follow the custom declaration’s trajectory in actual time. Businesses are empowered with real-time details on the progress of declarations, allowing companies to improve the way they plan and handle their transportation needs.

4. Exchange of Custom-related Documents

ICEGATE serves as an effective platform for electronically transmitting papers pertaining to customs. Dealing with the difficulties involved in managing tangible documents improves document security by lowering the possibility of damaging or losing them. Companies can electronically submit, acquire, and keep records, providing a smooth and well-organized means of customs clearance.

5. Easy and Direct Communication with Authorities of Customs

Effective trading strategies are largely dependent on effective interaction. This ICEGATE can simplify direct and coordinated communication between companies and customs officials. By eliminating the requirement for hardcopy communication, users can send and receive messages via the Internet, ask questions, look for answers, and get vital information using this online system. This involves taking responsibility and being transparent, along with speeding up the decision-making process.

6. Promotion of Digitization

In relation to the customs portal of ICEGATE, one of the initial operations promoted digitization. This forum demonstrates the Indian Customs Department’s dedication to streamlining trade procedures, removing administrative roadblocks, and fostering an atmosphere that is far more conducive to business.

7. Trade Facilitation

The overall objective of improving international trade facilitation is furthered by the whole range of services offered by ICEGATE. The method of automation offers instantaneous monitoring and connectivity while cutting down on documentation. The trade environment is changed by the ICEGATE to one that is marked by precision, quickness, and transparency.

8. Incorporating Efficiency

The services provided by ICEGATE represent a perfect change in how companies conduct business internationally. Businesses are empowered to handle unique operations with accuracy and ease by utilizing electronic documentation and monitoring in real time. Even though technology is constantly changing the face of international commerce, India’s dedication to development and connection for the benefit of the global economic community is demonstrated via ICEGATE.

9. Helpdesk Services

If anyone has any problems that can be technical in nature or any general inquiries, they can visit the helpdesk on the portal. The helpdesk is also very useful for answering any registration-related questions. Through the use of helpdesk services, the overall customer can be enhanced, and the users will be satisfied with the services. The response and the services of the helpdesk are also swift in nature.

The other services that are provided by this portal are:

- The refund of IGST

- Online license verification – EPCG/DES/DEPB

- 24/7 services

- Searching for the information using the PAN card

- Online IPR registration

- Import-export code status verification

Benefits of the ICEGATE Portal

The benefits of the ICEGATE Portal are mentioned below:

- The main advantage of this portal is that it facilitates the online filing of export and import declarations.

- The next benefit of the portal is that it enables the tracking of the documents on the sites. The documents can also be monitored on the portal.

- The portal is also beneficial for solving the queries of the users.

- The portal makes it very easy to establish transparency in import and export.

- The ICEGATE site is also very advantageous when it comes to managing all sorts of documents and paperwork for registered users.

- The bills of entry and lading can also be scrutinized after they are uploaded on the portal.

- The portal is most valuable for the exchange of data and for transferring data as well.

- With the assistance of this portal, the customs clearance procedure can also be expedited.

- All the documents are uploaded with digital signatures, which act as liable proof for the other parties.

Guidelines of DGFT for ICEGATE Registration

Some guidelines regarding registration under the ICEGATE have been laid down by DGFT. The guidelines are as follows:

- If the documents are going to be filed with ICEGATE using the RES, then holders of IEC have been urged to register under the new registration module.

- When an entity registers under the portal, there will be a single parent user, and others will be considered child users.

- The IEC bearer has the right to deactivate the IEC-authorized individual if they are not anymore working with the IEC bearer. As a result, IEC owners are advised to deactivate the IEC-approved individual in the ICEGATE Registration module.

- All are required to utilize their digital signatures for the registration along with the individual type class III digital signature certificate tokens.

- The details of the PAN used for the registration will be verified with the Department of Income Tax.

- Information from ICES directories is retrieved using the ICES number of registration provided during registration, which is also shown for validation. Only when the applicant confirms their information does the data-gathering procedure begin.

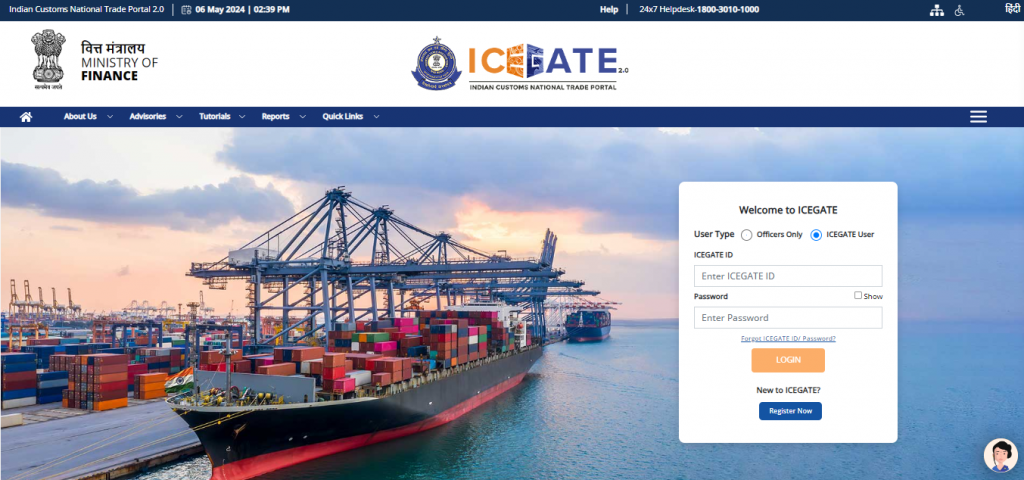

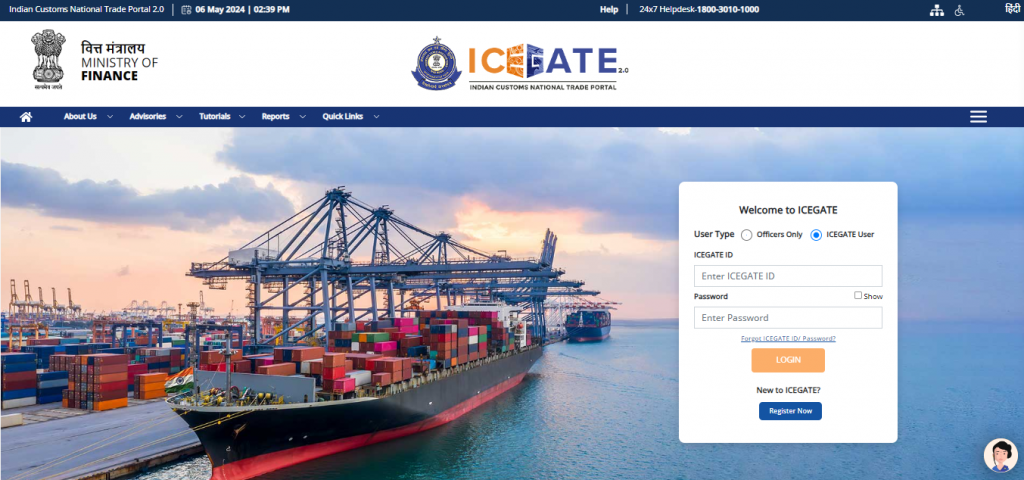

How to Register on the ICEGATE Portal?

There are some steps that need to be followed to register on the ICEGATE Portal. The steps for registering on the ICEGATE Portal are:

- The first step is to visit the portal website.

- Select the option to ‘sign up’ from the homepage.

- In order to register click on the ‘simplified registration’ option.

- The next stage is to enter the import and export code, GSTIN, and password into the portal.

- The page for entering the details is on the screen. Enter all the required details in the registration form.

- Now, you have to enter the ICEGATE ID and password.

- The applicant will now receive two different one-time passwords on both the phone and the email ID.

- Registration will be completed when both one-time passwords are entered.

- The applicant can check all the entered details once for the final time and click on the finish button.

By following the steps in the correct order, the applicant can successfully register on the portal. It is advised to seek professional advice to ensure a fast and seamless registration process.

ICEGATE Simplified Registration

ICEGATE’s auto registration is a registration process used to attract exporters and importers to register under the portal. The portal permits the registration of the import-export code along with approval and digital signature. Documents can be submitted through the ICEGATE portal.

For auto registration, an OTP is required on both the mobile and email ID in order to verify. The simplified auto registration is based on the goods and services tax network and IEC. The portal’s streamlined registration module allows registration without uploading the digital signature.

Documents Required to Register on the ICEGATE Portal

There are numerous documents required when registering on the ICEGATE Portal. It is vital to upload all the documents that are required by the portal in order to have a successful registration on the ICEGATE Portal. The list of documents is:

- The Aadhar card of the applicant

- Driving License

- Voter’s ID

- License or Permits

- Letter of Authorization

- F card/ G card authorization

- Import Export Certificate

- Digital signature

- Other additional documents

ICEGATE Portal E-Payment: Authorized Banks

The ICEGATE Portal offers services of e-payments as well for all the registered users. The ICEGATE Portal has authorized some of the banks in order to make easy e-payments. The list of banks authorized is as follows:

- State Bank of India

- Corporation Bank

- Bank of India

- Indian Bank

- UCO Bank

- Punjab National Bank

- Vijaya Bank

- IDBI Bank

- Bank of Maharashtra

- Union Bank of India

- Central Bank of India

- Indian Overseas Bank

- Bank of Baroda

- Canara Bank

New Initiatives under the ICEGATE Portal

Many initiatives have been taken under the ICEGATE portal. The initiatives of the ICEGATE Portal which are beneficial to the registered users are:

1- Custodian Registration Change

Custodian users can now provide a 10-character custodian code as well as GSTIN during the initial registration process when registering through ICEGATE. This will assist the custodian in keeping every single port mapping distinctive. We’ve made the ‘Custodian Reconciliation’ feature available to parent custodians when they sign in, enabling them to combine the GSTIN along with a 10-character custodian code for both themselves and their child custodian members who are registered on ICEGATE.

2- Registration Enquiry

This initiative helps the users check whether their PAN card is already registered under the ICEGATE Portal.

3- GSTN Integration

The integration of the GSTN can now also be done as a part of the new initiatives of the portal. Where a GSTIN is not automatically integrated, the user can request for the same. The GSTN will then be integrated from the Goods and Services Tax Network details.

4- CSN Enquiry

The CSN is Cargo Summary Notification. This initiative helps in checking the details related to the bills of cargo, lading bills, container details, etc. This initiative is useful for authorized notified carriers, consolidators, and freight forwarders.

5- RBI-SB-EDPMS Enquiry

The SB EDPMS Enquiry for ICEGATE users has been updated by ICEGATE. Both the public and the user can access this inquiry after logging in. Users of ICEGATE are able to see the total amount collected by the RBI EDPMS system and submit queries regarding the correction of SB EDPMS Status on the ICEGATE site. While the SB EDPMS status can be seen by the general public, ICEGATE authentication is required to access the specifics of the FE Realization and the SB EDPMS status correction.

6- CTO ICEGATE Registration

- All the CTOs can register to exchange the required data with ICEGATE.

- These are some of the initiatives under the ICEGATE Portal that are very useful and have various benefits.

ICEGATE Portal: Bill of Entry and Shipping Bill

The shipping bill and the bill of entry, along with the bill of lading, are some of the basic documents used by the importers and exporters, and they are to be uploaded to the portal. The bill of entry is a legal document that is filled when the goods arrive. The bill of entry is filed by either the customer agent or the importer. The shipping bill is the document that contains the details of the shipping clearance. All the details related to the goods are included in this bill. The shipping agencies issue the shipping bills. There are different types of shipping bills in the portal. They are:

- Free ICEGATE shipping bill

- ICEGATE shipping bill for Shipment Ex-Bond

- Drawback ICEGATE shipping bill

- Dutiable ICEGATE shipping bill

- Coastal ICEGATE shipping bill

To Wrap Up

In India, ICEGATE Registration is mandatory for companies and people involved in export and import operations. It provides the ability to utilize a wide range of electronic services, streamlining the process of clearing customs and increasing the effectiveness of commercial transactions internationally.

Businesses are able to guarantee smooth customs clearance processes and enhanced conformity with Indian customs legislation by following the registration process, fulfilling criteria, and making optimal use of the services available on the ICEGATE portal.

Frequently Asked Questions

Can I pay the customs duty online?

Yes, the custom duty can be paid online through the e-payment services provided by authorized banks.

What are the key services that ICEGATE provides?

The key services that are provided by the portal are electronic filing, tracking and the online payment of the customs duties, easy and direct communication with the regulatory authorities in case of inquiry, seamless exchange of custom duty-related documents, enhancing the facilitation in trades, promoting the digitization, helpdesk services, etc.

Is ICEGATE registration mandatory?

Yes, an ICEGATE registration is mandatory in nature.

What is custom duty?

Custom duty is a type of tax that is levied on the goods that are transported on an international level.

Is a digital signature required at the time of uploading the documents?

Yes, a person's digital signature is required when all the documents are uploaded online on the portal to ensure their authenticity.

Does the ICEGATE portal provide the facility for making electronic payments?

Yes, the portal provides the facility of making e-payments from within the portal itself. Various banks have been authorized to provide this exclusive e-payment facility.

How will the framework of IGST work on the portal?

To ensure that the benefits of the IGST are availed the Department of Customs will be in touch with GSTN electronically.

Is ICEGATE compulsory for export?

Yes, registration on the single window portal is mandatory for export and import.

What is the purpose of the ICEGATE Portal?

The main purpose of the ICEGATE portal is to furnish the facilities of electronic filing to the cargo partners, trade, and other partners in the trading.

Read also about Benefits of Obtaining an AD Code Certificate in India