Tour & Travel agencies, broadly known as Tour and Travel agencies, are among the prominent industries in India & serves as a prevalent employment generator. Goa and the North-Eastern region of the country generate their primary revenue for this sector. Tour and Travel Business is an evergreen venture for startups confronting budget constraints. Increased per capita income of individuals and the ever-changing lifestyle of people is helping this sector to grow rapidly. This write-up will drill down the legalities for starting a tour and travel business in India along with other aspects.

Why Tour and Travel Business is a boon for startups?

- In 2020, the travel & tourism sector’s contribution to the nation’s GDP[1] was US$ 121.9 billion; this is projected to reach US$ 512 billion by 2028. In India, the industry’s direct contribution toward GDP is projected to register an annual growth rate (AGR) of 10.35% between 2019 & 2028.

- In 2020, the tourism sector generated around 31.8 million jobs, which was 7.3% of the overall employment in the nation. By 2029, it is projected to create over 53 million jobs in the country. The international tourist’s arrival is projected to surpass the figure of 30.5 billion by 2028. E-visa facility was facilitated to 171 nations as of March 2021.

- During 2019, a foreign tourist arrival was accounted for 10.89 million, attaining a growth rate of 3.20 years of year. During 2019, FEEs from tourism attained the revenue of Rs. 1,94,881 crore with a growth of 4.8% y-o-y.

- In 2019, arrivals via e-tourist Visa augmented by 23.6% y-o-y to 2.9 million. In FY 2020,

- FTAs decreased, foreign tourist arrival decreased by 75.5% YoY to US$ 2.68 million & arrivals via e-tourist Visa (Jan-Nov) surged negatively by 67.2% YoY to 0.84 million.

- The travel and tourism industry is accountable for 6 % of the nation’s Gross Domestic Product, as of 2011. The tourism sector employs more than 26 million job seekers, which represent almost 6% of the nation’s overall employment, as per the report of the World Economic Forum. Additional employment related to the tourism sector accounted for 37 million. In FY 2010, the tourism sector registered more than $14 billion of revenue with an AGR of 24.6%. The hotel industry creates more than 1.5 lakhs jobs.

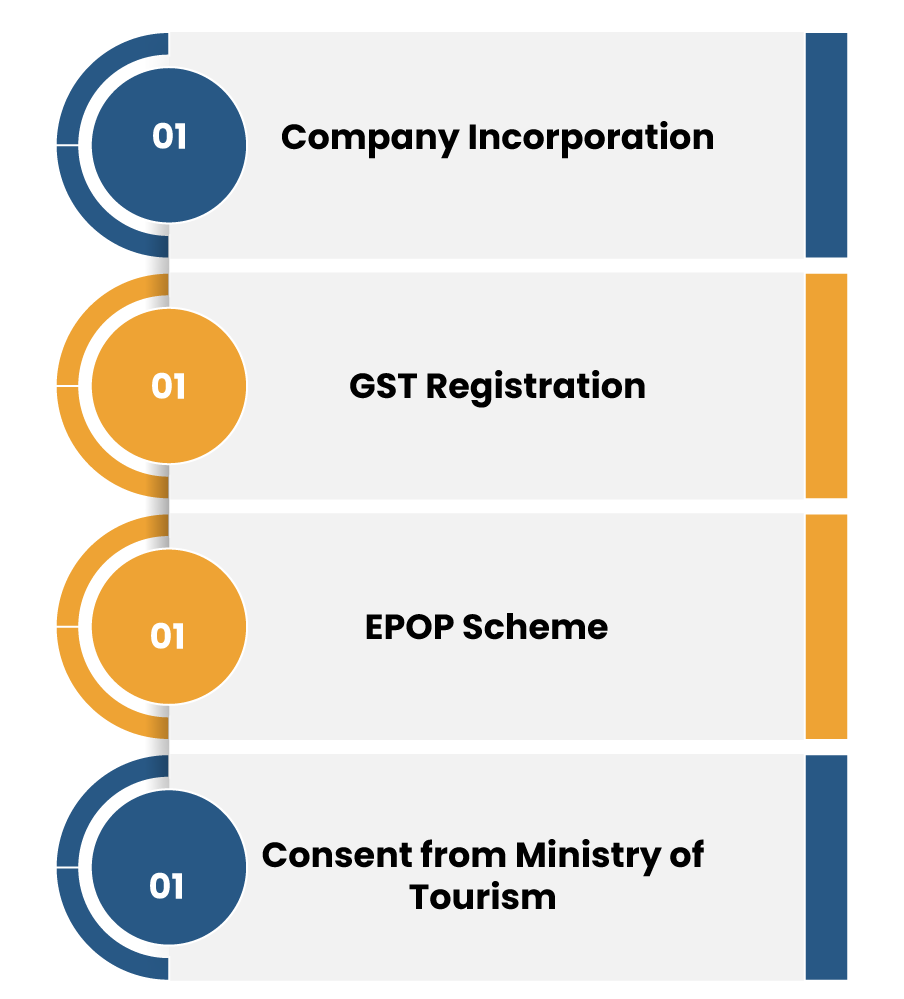

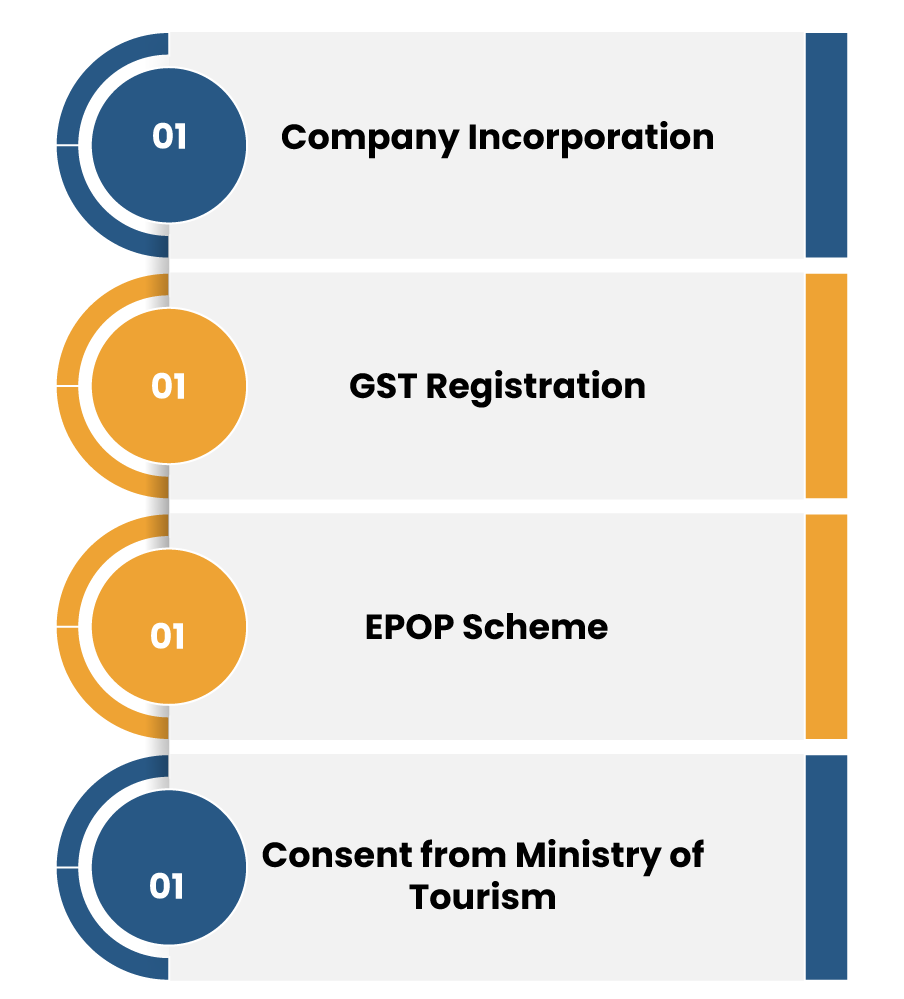

Licenses required to Setup Tour and Travel Business in India

Company Incorporation

Any person who intends to commence a Tour and Travel agency can make it functional under one of the following business structures:

- LLP

- Private limited company

- One Person Company

- Sole Proprietorship

- Partnership firm

- One person company comes under the ambit of the Company Act, 2013. An OPC is a hybrid business structure, wherein it combines most of the pros of a sole proprietorship & a company form of business.

- Sticking with the Sole Proprietorship business form will give you complete authority over the business as a sole owner, but it is not a profitable liability point of view. Functioning as a Sole Proprietorship can endanger your personal asset in case of a financial crisis. Therefore, fencing of liability isn’t possible under this business structure.

- A partnership firm is the best option for those teaming up with additional partners to start their business journey. Partnership Act, 1932 governs the partnership firms in India. Liability fencing in such firms is based on the terms mutually agreed by the partners in the partnership deed.

- The private limited is generally preferred by startups concerned about liability fencing and procurement of funds from other sources.

GST Registration for the Tour and Travel Business

The business owner needs to register under GST to collect GST from the consumers on the service incurred via the business.

The GST has subsumed various indirect taxes and thus; makes the overall tax structure more transparent and less stringent for the taxpayers. The GST imposition is basically applied on the two essential parameters:

- Inter-state supply of goods and services

- Annual turnover threshold

GST Rate payable by Air Travel agent in India

| Income Description | Amount of which travel agent has to pay the GST | GST Rate |

| Processing/service fee for booking customers’ tickets | Invoice value | 18% |

| Commission income from the airline for booking air ticket (domestic) | 5% of basic fare | 18% |

| Commission income earned form airlines on booking international air tickets Commission income from the airlines for booking international air tickets | 10% of basic fare | 18% |

EPOP Scheme

EPF is the employee welfare scheme that comes under the ambit of the Employees’ Provident Funds and Miscellaneous Act, 1952. The employee & employer under this scheme is liable to make an individual contribution of 12% of the employee’s basic salary & dearness allowance towards the Employee provident fund. Presently, the interest rate on EPF deposits has been capped at 8.50% p.a.

An overview on Government-certified Travel Agent

- The Ministry of tourism in India has started an initiative to promote the tourism sector in India. The scheme allows the travel agents and agencies to function as a government-approved entity. This way, they can foster better recognition for themselves to compete in the highly saturated market. Now to work as a registered agent, the individual needs to file an application on the Ministry’s official portal after meeting the following conditions:

- Travel Agent must possess a minimum paid-up capital of Rs 3 lacs. The applicants belong to the North–Eastern region, remote and rural areas have to maintain a minimum paid-up capital of Rs 50000 duly supported by the audited balance sheet.

- Travel Agent must have the approval of International Air Transport Association (IATA) or must have a professional background of functioning as a General Sales Agent / Passenger Sales Agent (PSA) of an IATA member Airlines.

- Travel Agents should have one year of professional experience in the tourism sector.

- The minimum office space to function as a travel agency should be at least 150 sq. Ft and 100 sq. ft for hilly areas situated 1000 meters above sea level. Also, the office must be equipped with proper infrastructure and resources.

Benefits of becoming an IATA Agent

Any entity seeking to function as a travel firm needs to get approval from the International Air Transport Association (IATA). This travel association facilitates various training methods as well as professional development services towards the travel firms. IATA accreditation has global recognition and acts as a growth catalyst for the tourism sector.

It is vital for a travel firm availing of international travel packages to function as an IATA approved entity as it helps travel firms compete in a hassle-free manner.

Conclusion

Functioning as a travel agency in India can be a profitable venture for those aiming to underpin a stable revenue source for themselves. A sharp spike has been witnessed in the growth of the tourism sector in the recent past. Thus, it is the right opportunity to set up a tour and travel business in India.

Read our article:The procedure of Starting a Plastic Export Business in India