Indian Handmade Carpet Industry is labour intensive & facilitates employment to over 20 lacs artisian/workers particularly women in the rural regions. Most of the weavers/artisans employed are from the underprivileged strata of the society & this trade facilitates stable occupation to them, including farmers and others at their homes. Exports increased from INR 4.4 crores in 1961 to INR 13810 crore in 2021. Ranked no.1 as a manufacturer & exporter of handmade carpets both in terms of volume & value, Artisans can produce handmade carpets in any colour, design, & quality as per the demand of international consumers & also caters to the demand of every segment of the society.

Manufacturers a diverse range of handmade carpets in low, medium, and supreme qualities to cater to a wide range of customers, raw material utilization are diverse & blending of different types of yarns is its forte. At present, India rejoices the first position in the global handmade carpet market. India has a long history of producing and shipping exquisite quality handmade carpets across the globe. The carpet export business can serve as a perfect venture for startups aiming to underpin a reliable income source with minimal investment. This write-up takes a brief glance at the different aspects of the carpet export business.

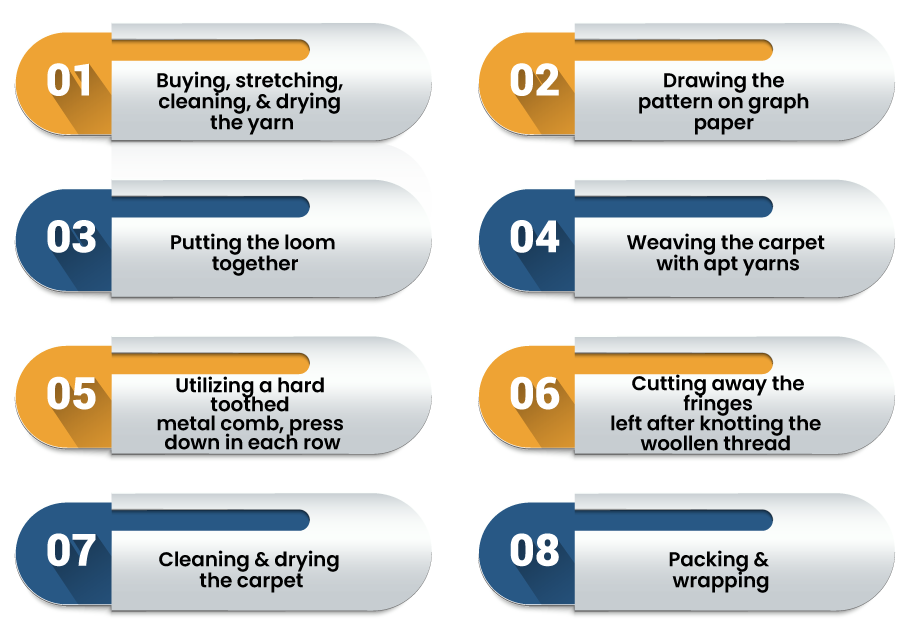

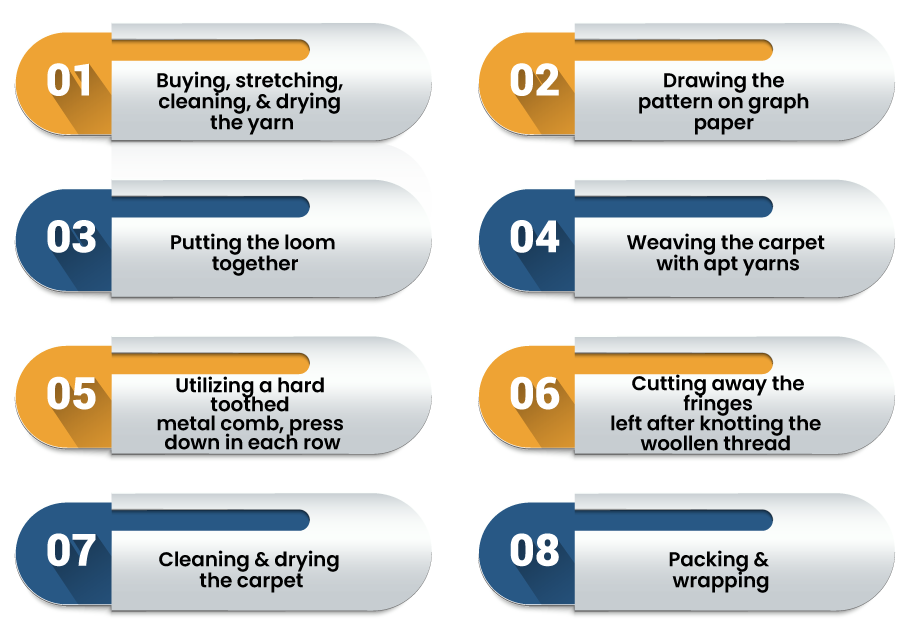

The typical process of manufacturing Carpet in India

Carpet manufacture consists primarily of the following activities:

Checklist for commencing Carpet Export Business

Here is the typical checklist for setting-up a carpet export business in India

Procure Machinery

Presently, plenty of OEMs offer a wide array of software-controlled carpet making equipment to the manufacturers. These equipment are capable of producing quality carpets with countless design options.

The machine is a circular digital jacquard carpet machine having 8 tone lines. These computerized machines are capable of producing absolute terry, whole secants, high low loop pile, and circle cutting styles.

Raw materials

The key appeal of a carpet is the ability to render a cushiony, warm surface underfoot. Customers usually take two characteristics into account while choosing a carpet: the type of synthetic and natural fibre used in the construction & the pile- how the loops of the fibre are weaved to the backing of the carpet. These characteristics determine the carpet’s comfort as well as its wear characteristics.

There are various ranges of fibre used in carpet, but the most popular are polyester, nylon, acrylic, polypropylene, and wool. Carpets are manufactured by looping the fibre yarns through the backing material. These loops can then be left either intact or cut at many lengths & angles. The procurement of these raw materials can be done from the various sources available online and offline.

Pinpoint Apt Location

The area required to set up a carpet-making unit is approximately 500 ft2. If possible, Identify the location with ample road connectivity and somewhere near the vicinity of shipping docks. This will help you minimize the overall transportation cost.

Opt for Business Incorporation

Business Incorporation serves as a fundamental license for establishments aiming to operate in a legal framework. To avail company incorporation, the startups need to choose a specific business structure from the following that come under different Acts.

- Partnership Firm (comes under Partnership Act, 1932)

- LLP (LLP Act, 2008)

- Private Limited company (Company Act, 2013)

- Public Limited Company (Company Act, 2013)

- One Person Company (Company Act, 2013)

Avail Business PAN Card

Once you incorporate your establishment successfully, the next step is to avail the Permanent Account Numbers from the Income Tax Department.

Open the Current Account

After obtaining a Permanent Account Number, you must open a current Bank account in a designated bank to cater to business-related transactions.

Secure the Import-Export code from DGFT

Import-export code is a mandatory certification for conducting EXIM-related undertakings in India. Directorate General of Foreign Trade is an apex government institution that grants the Import Export Code in India. To avail of such a certification, the applicant needs to fill an e-form on the DGFT’s portal[1], upload the requested documents, make an online payment, and submit the form via DSC or EVC mode.

Get the Udyog Aadhar Registration

Udyog Aadhar Registration, broadly known as MSME registration is a voluntary certification that aims to benefit small businesses by facilitating much-needed fiscal aid & exposure to different markets. Thus, Udyog Aadhar Registration is a boon for a carpet export business. Udyam Aadhaar Registration is granted after filing the prescribed e-form available on the Udyam Aadhaar portal.

Composite criteria for MSME

|

Composite Criteria: Investment in Plant & equipment & Annual Turnover |

|||

|

Classification |

Micro |

Small |

Medium |

|

Manufacturing Enterprises and Enterprises rendering Services |

Investment in Plant & Equipment: |

Investment in Plant & Equipment: |

Investment in Plant & Equipment: |

Avail of the GST Registration

GST registration enables your business to operate legitimately and makes your brand authentic and trustworthy. With the GST web portal simplifies various processes, starting from e-form to filing returns, GST registration is the initial step to efficiently managing your firm taxes.

Who seeks GST registration?

To avail GST registration, your annual turnover must meet one of the given thresholds:

- For the manufacturing sector, the threshold limit is INR 40 lacs or more

- For the service sector, the threshold limit is INR 20 lacs or more.

- For businesses belong to North-eastern & hill states, the threshold is INR 10 lacs or more

Further, if you fulfil any of the given criteria, you must avail GST registration:

- You sell goods or services via inter-state business

- You leverage e-commerce avenues to sell your products

- You are in the EXIM business

- You are intending to generate tax invoices for your end-users

- You are an entity participating as casual taxable individual in an event outside your state

- You are exposed to taxes under RCM i.e. reverse charge mechanism

- You are serving as a representative of a registered taxpayer

- You are an ISD i.e. Input Service Distributor

- You have a web-based store or an aggregator business

- You are functioning as an Online Information Database Access and Retrieval (aka OIDAR)

Opting out GST registration despite meeting the above requisite would attracts hefty penalties for the business owners.

Obtain the RCMC from Carpet Export Promotion Council

The Carpet Export Promotion Council (CEPC) serves as an apex government institution of exporters of handmade carpets & other floor coverings in India. The council renders support to exporters by pinpointing potential markets, facilitating fiscal aid, sponsoring participation in global events, conducting trade meets and reconciling trade disputes. Exporters registered with Carpet Export Promotion Council are bound to follow underlying norms for maintaining the quality of the products for the global market.

Conclusion

A carpet export business is thriving even under these times where business fraternity is still coping with the repercussion of the Covid-19 pandemic. And since India rejoices the prominent position in the global export of carpet, it does make sense for any aspiring entrepreneurs to jump into this venture.

Read our article:The procedure of Starting a Plastic Export Business in India