Among all the types of registration, LLP Registration is the preferable kind of organization as it amalgamates the advantages of both the company and partnership firm into a single form of organization. LLP is done under the Limited Liability Partnership Act, 2008 and the Limited Liability Partnership (LLP) Rules, 2009[1]. Here in this article, we will see in detail the procedure of the LLP Registration.

What does LLP Mean?

LLP means Limited Liability where the liability of each partner is limited to the contribution made by the partner. Also, there is less compliance and regulations, and the cost of forming an LLP is low. The minimum number of partners required to incorporate an LLP is 2. Among all these partners, a minimum of two partners should be designated. Also, one partner should be a resident of India. There is an agreement called LLP Agreement which governs the rights and duties of these designated partners.

Concept of LLP under Limited Liability Partnership Act, 2008

LLP stands for a Limited Liability Partnership and is a form of corporate business that provides the benefits of limited liability of any company and the flexibility of the Partnership. Therefore, it indicates the elements of partnerships and corporations. In an LLP (Limited Liability Partnership), one partner is not liable for another partner’s misconduct or negligence. The legal compliances are less in LLPs as compared to company form of business and a minimum of two people can form an LLP. There is no maximum limit on the number of its partners in LLPs. Now, LLP is a preferred choice for small businesses instead of a general partnership.

It has a Separate Legal Identity from its partner. Limited Liability Partnership (LLP) is formed under the Limited Liability Partnership Act, 2008. The partners in an LLP are not liable for the unauthorized actions of the other partner and the liability of the individual partner is restricted to his stake in the Capital. It is a body corporate with a distinct legal entity and perpetual succession and applies to any trade or business.

Documents Required For the Incorporation of an LLP

I. Documents required for DSC-

For LLP registration, you must apply for the DSC of the designated partners of the proposed LLP. It is one of the initial steps to apply for DSC before the LLP Registration process. The entire process is done online and requires to be digitally signed. The designated partners must get the DSC. The documents required for DSC are-

- Passport size photo of the partner.

- Copy of Id and Address Proof.

- Email Id and Phone number

- Specimen Signature.

II. For Id and address proof, the designated partner can opt for the following documents-

- Voter ID Card

- PAN Card

- Passport

- Aadhaar Card

- Passport

- Electricity Bill

- Ration Card

- Telephone Bill

- Driving License

III. For Residential proof, the designated partner can opt for the following documents-

- Copy of Current Bank Account Statement/Phone Bill/Gas or Electricity Bill)

- Copy of Rent agreement

- No-objection Certificate from the property landowner

- Copy of the property (if the property is owned)

VI. Subscriber’s Sheet including the consent of the Partners.

V. In principal approval of the Regulatory Authorities, if the proposed name includes the word that requires the approval of Regulated authorities

VI. Additional Documents in case the Designated Partner is also a director/partner in any other company or LLP.

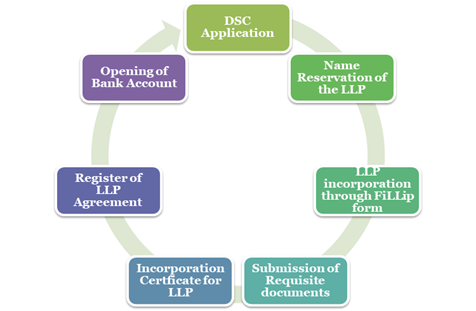

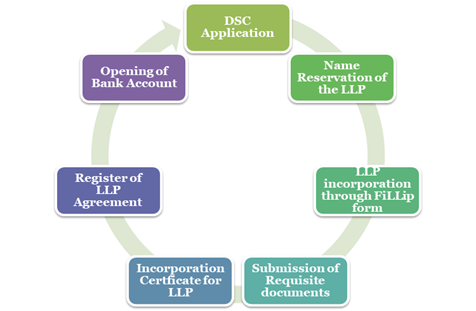

What is The Process of Registration of LLP?

The procedure for Limited Liability Partnership Registration is as follows:-

MCA (Ministry of Corporate Affairs) has reported an amendment to the LLP (Limited Liability Partnership) Rules, 2009 wherein LLPs name reservation and incorporation process has been amended to ease of doing business IN India. Moreover, the ‘RUN-LLP’ is a new web-based form commenced by the authorities through which the names of an LLP can be reserved without DPIN and DSC. Hereby, RUN-LLP Form is comparable and almost similar to the RUN web form in matter of companies.

To make the LLP incorporation process easier, a new form named FiLLiP) (Form for Incorporation of Limited Liability Partnership) has been introduced by which LLPs can be incorporated by 2 individuals as designated partners who do not carry DIN.

Obtain the DSC (Digital Signature Certificate)

To initiate the process of registration, you need to apply for the Digital Signature of the designated partners of the proposed LLP. The Designated partner has to obtain their digital signature certificates from the certified government agencies. The list of certified agencies is given as:

- National Informatics Center (NIC)

- IDRBT Certifying Authority

- SafeScrypt CA Services, Sify Communications Ltd.

- Code Solutions CA

- E-MUDHRA

- CDAC

- NSDL

- Capricorn

These different agencies charge different costs for obtaining the DSC.

Apply for DIN (Director Identification Number)

After obtaining the DSC, you need to apply for the DIN of all the designated partners and for those who intend to be the designated partner of the proposed LLP. There is a FORM named DIR-3 for through which the application for the allotment of DIN is made. When you apply for the DIN, you need to attach the scanned copy of documents such as your Aadhar Card or PAN card. The form has to be signed by a CS (Company Secretary) who is a full-time employee of the company or any of the Managing Director, CEO/CFO of the existing company.

Name Reservation

For reserving the name of the LLP Company, LLP-RUN is filed the Central Registration shall process which under the NON-STP. There is a provision to apply for two proposed name of the LLP. You need to check the availability of the name of your LLP on the MCA Website. The name must be different from any of the existing company names; then only the Registrar will approve the name. In case, the name is approved, the form RUN-LLP is accompanied with fee as per the Annexure “A”. In case, the name is rejected, the re-submission of the new name must be done within 15 days.

Incorporation of the LLP

- After the successful approval of the name of your LLP, a Form called FiLLiP (Form foe Incorporation of limited liability partnership) is filed. This form is filed with the Registrar of the state in which the registered office of the LLP is registered.

- The fee is paid in accordance with the provisions mentioned in the Annexure “A”.

- If an individual who is to be appointed as a designated partner does not have a DPIN or DIN, the Form FiLLiP provides the allotment of DPIN.

- Two individuals are allowed to apply for the allotment of DPIN.

- For reserving the name, the application must be made through FiLLiP.

- If the name that you have applied for has been approved, then the approved and reserved name must be filed as the final proposed name of the LLP.

File Limited Liability Partnership Agreement

These steps are the after company incorporation steps. The applicant needs to submit the partnership agreement in FORM-3 on the MCA portal within 30 days of the Incorporation of the LLP.

File PAN Application

After the LLP registration is completed, the applicants have to fill the PAN application for the LLP by providing all the details and relevant documents.

Submission of Requisite Documents

In the case of LLP Registration, an applicant is obligatory to attach the essential documents for LLP registration. You have to present the document with the LLP incorporation form. The below-mentioned documents are necessary for LLP registration-

- Residential proof and Id of the designated partners.

- Passport size photograph

- Specimen & signatures of the designated partners

- Proof of address of office- the place of business.

- Subscriber sheet together with the consent of the designated partners.

- Main disclosure of LLP(s) and/ or company(s) in which designated partner is already in a position of a director or partner.

- In case the proposed name holds any expression(s) or word(s) which needs approval from the central government, the associated documents are to be submitted as an attachment with the same.

Note-All the attachments must be scanned in pdf format.

- Incorporation Certificate– MCA will grant the application within 5 to 7 working/business days, once the form is presented to the MCA along with the essential attachment for LLP incorporation. After that if everything goes well, Incorporation certification will get issued by the authority.

- LLP agreement- The applicant has to submit the LLP agreement after incorporation of your LLP. The agreement identifies the mutual rights and duties amongst the partners.

- LLP agreement should be filed online in FORM-3 from the date of incorporation – within 30 days.

- The LLP Agreement should be printed on Stamp Paper and the value of Stamp Paper is different for every state.

Factors to consider while selecting name for LLP

The Registrar of Companies (RoC) has notified the guidelines for names for LLPs. It is necessary that the rules are closely followed or the application might be rejected which can lead to a much longer process.

Unique Component-

The name once already taken shall not be given to any other business. Hence, the applicant must ensure that the name he is applying for is a unique one.

Blacklist-

Adjectives, generic words and abbreviations are strictly not allowed. So names like ABC and good quality cookies would be rejected. The words like bank, stock exchange and exchange have to be first approved by RBI or SEBI or else would be rejected.

No Common Trademark-

There should not be a registered trademark by the same name on the IP India website. If there is one, the name can only be approved if you are able to get a No-Objection Certificate from its owner authorising you to use it.

Descriptive Component-

The word describing exactly what the business company is into is not allowed.

Check LLP Name Availability-

It is a time-consuming process to name an LLP as the government has brought together a difficult procedure with various rules. Moreover, there are many adequate names for an India LLP according to the Companies Act, 2013 and LLP Act, 2008.

Conclusion

LLP Company Registration in India is a simple and easy process and usually takes 10-15 days to complete. It totally depends upon how fast you provide the relevant documents and how smoothly the government is working for the procedure. A Limited Liability firm is the most common vehicle to carry the business and one of the ways to enjoy the benefit of a corporate entity in a limited partnership manner.

We at corpbiz will provide you a hassle-free LLP Registration for your business which would be dealt with by our professionals within a specified time frame, subject to governmental processing time. Our team takes care of the documents obligatory for LLP registration and assists in providing you the realistic opinion of LLP registration cost. Our clients can also maintain a check on the progress the LLP incorporation. Our experienced representatives are just a phone call away, if you have any questions about the LLP Registration process for your business. Corpbiz will make sure that your communication with professionals is charming and seamless.

Read our article:Do you want to Choose an LLP? Know more about this!