The issue that remains in question during divorce proceedings includes the division of assets and liabilities. The assets include the marital property, which the couple acquired before and after the marriage. However, the question arises of whether the couple is open to negotiating and agreeing on their own on how they will be dividing the assets and liabilities, or whether, in the case of disagreements, they want the court to decide for them. Settling debts and liabilities is as important as settling assets. The liability that is incurred individually and separately will be paid by the spouse who incurred it.

Not keeping much focus on the principle of equality, i.e., to divide assets and liabilities equally, but on fairness and ability to pay. The spouse who is awarded more property or has more income as compared to the other spouse could be assigned to pay the larger share of the debt. As the procedure of dividing the debt between the spouses begins, it is important for both spouses to be open and transparent about their financial information. During the marriage, most of the financial decisions between the couple are made jointly; hence, the decisions to resolve the debts during and after the divorce must be taken jointly to avoid any further disparities between the spouses.

When The Debt Is Incurred After The Couple Is Separated But The Divorce Is Yet To Finalize?

In cases where the spouses are living separately but the divorce is not finalised, they are treated differently. In some states, even after the separation of the couple, the debt will continue to be dealt with in the same way as it was in the case of non-separation unless and until the divorce decree is passed. However, some other states deal with debt after the separation as the individual’s liability unless and until they are commuting in a community property state (the state that states all the debt incurred to acquire the property will be divided in equal shares). If the couples continue to stay in a community property state, then they are not recognised as a separated couple. The creditors, in the cases of joint accounts, want to be paid by the debtors whose names are on the joint account. Irrespective of whether the couple is separated or divorced, both spouses will be considered liable to pay the debt.

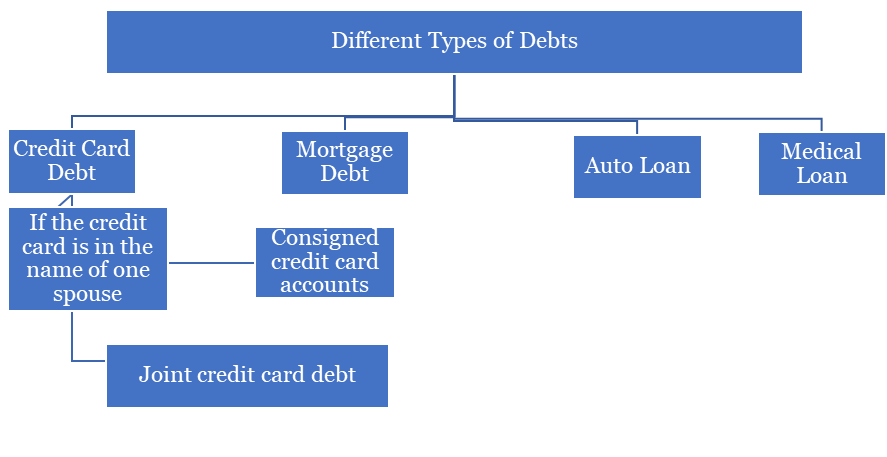

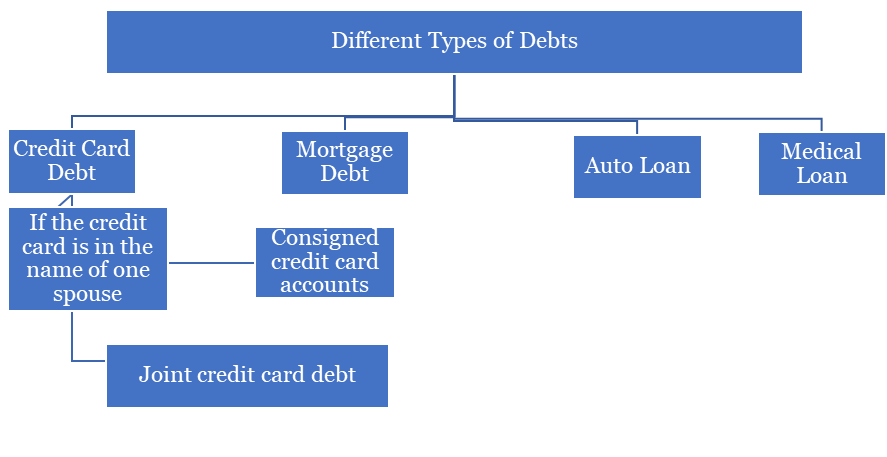

The Different Types Of Debts Are Dealt Differently At The Time Of Divorce Proceedings:

Credit Card Debt

Credit card in the name of one spouse

The spouse who holds the credit card will be held liable for the payment of the debt incurred. The other spouse will not be held liable, and no accountability will arise against him.

Joint Credit Card Debt

In this case, both spouses are liable to pay the debt; mostly, the debt is divided into equal shares; however, the court, at its discretion, could alter the ratio of the shares. Depending upon the earning capacity of each spouse or depending upon the fact that one of the spouses is awarded more assets,

Co-Signed Credit Card Accounts

In the case of co-signed credit cards, the co-signer has the responsibility to pay if the primary user can’t pay the debt. The primary user, at the request of the other spouse, could remove him or her as the co-signer.

Mortgage Debt

Generally, in the case of a joint mortgage, the income and assets of both spouses are taken into consideration; hence, the terms and consideration are set accordingly, so any of the spouses cannot be removed as per convenience. If the mortgage is in the names of both parties, then it is advised to sell the property and divide whatever amount is left after paying the extra arrears, if any. If the couple or any one of the spouses is not in favour of selling the property, then an agreement between the spouses has to be drawn. That agreement shall contain the terms and conditions very clearly, such as who will be paying the mortgage money at what interest rate and what will be the ratio of shares between the spouses.

Auto Loan Debt

In general practise, the spouse who has received the car as an asset in the division of assets will be responsible for the payment of the debt. Although, in the case of a joint loan, the credit could get really confusing. If one spouse fails to pay the debt or delays in doing so, the other one will also be, by default, responsible for that delay; hence, both are accountable to the creditor. To solve this confusion between the spouses, the best possible solutions are as follows:

- The spouses could refinance the loan with the agreement of the lender, who would refrain from causing any ambiguity.

- They could simply pay off the balance of the loan.

- They could give the bank the standing instructions to automatically debit the amount of the loan in instalments for the decided period of time.

- The final solution is to simply sell off the car; whatever amount is left to pay could be decided on agreement by the spouses themselves as to who will be paying and in what ratio.

The point to understand here is that a car loan or auto loan and the title of the car are two completely different things. It becomes crucial to ensure that ownership has been transferred to the spouse who is keeping the car. The name of the other spouse has to be removed from the title of the car. Hence, the onus is on the spouse who is not keeping the car to ensure that his or her name has been removed; otherwise, he or she will also be held liable along with the spouse (who is keeping the car).

Medical Debt

When the medical debt was incurred, it was important to specify whether the couple was living together or was in legal separation[1]. The court will decide at its discretion in the case of separation. The debt against emergencies will be handled differently than the debt against elective surgery or some other unnecessary procedure.

When One Of The Spouse Files For His/ Her Bankruptcy?

If there is a joint credit and one of the spouses has filed for bankruptcy, it is not going to eliminate the existence of that credit; rather, the creditor will pursue the other spouse who has not filed for any such declaration. The other spouse will be responsible for repaying the entire debt of the creditor.

Although the child support and the spouse support/alimony money will not be altered in the event of a bankruptcy filing, those payments are required to be made as they are part of the divorce decree.

Conclusion

During the divorce of the couple, it becomes essential to divide the debt and loan between them in a just and fair manner. This can be possible if any agreement regarding the same exists prior to the divorce proceedings, or the court will have to decide. The methods through which the court will decide are mentioned in the above article.

Read Our Article: The Importance Of A Divorce Settlement Agreement In A Divorce Case