In this Startups Landscape, breakthrough business ideas improve value addition to the society. But transforming a bright business idea into a money munching machine seeks immense hardship, professionalism, and funding. Unfortunately, not all bright ideas have the backup of required financial cushion. This is where fundraising for startups come into play. This write-up aims to flash some light on technicality of the fundraising process, mainly the documentation part that will ease out your fundraising journey. The article enlists fundamental documentation related to the fundraising for startups in India.

Prominence of Documentation in Fundraising for Startups

In general, Institutions like Venture Capital[1], Private Equity, Angel Investors, & Investment bankers predominately favour those ideas that have potency to garner great ROI in future. So it would take more than a casual effort for the start-ups to convince these investors and crack the deal.

So does that mean the chances of getting an idea approved is remarkably difficult?

Well, the answer is No; provided you have a right blueprint to follow that entail on-par documentation and other tangible details that we have discussed in following section.

Read our article:Process of Startup India Registration: A Step by Step Guide

Documents regarding fundraising for startups in India

We have divided the documents relating to fundraising for startups into pre-funding & post-funding. It is vital to undertake this activity cautiously for the steady growth of the startups, with the norms adhered to at regular intervals.

Pitch deck

A Pitch deck refers to an official presentation which the startups mainly use to convince prospective investors during the fundraising process. It can be a simple power point presentation that manifests the following attributes of the business. In laymen terms, a pitch deck is a way to project your idea to any no. of the audience, mainly investors. One of the most critical facets of an effective pitch deck is to sync it based on the audience & forum to which it is supposed to be presented. Several prime components to a pitch deck include elaborative summary slides, the issue you are encountering, the product, the strategy/market, the employees, financials/projections & the tone you wish to convey.

Here’s what the Pitch deck ideally comprises in general

- Nature of product and services

- Survey on supply chain (demand and supply)

- Revenue generation model

- Project costing report

- Cashflow projections

- Unique Selling Proposition

- Industry-related data

Non-disclosure agreement (NDA)

NDA acts as a protective measure for start-ups in the fundraising campaign as it is only thing that keeps their trade secret, aspiring idea, IPs alive and safe. Hence, it plays pivotal roles in the process of fundraising for startups.

Startups in India often presume that consumer data, formulas, processes, & techniques are not imperative for making or breaking the venture. But, most successful businesses have a different thought on that as they strongly believed these factors are critical for startups growth.

Thus, it is imperative that employees, investors and consultants with whom valuable data would be shared have to be covered by a précised Non-Disclosure Agreement.

Do not forget to enclose your signature in NDA before sharing details with investors.

Due-Diligence report

Due diligence refers to the process of research and analysis that take place before the initiation of any venture, investment, acquisition, so on and so forth. The company usually leverages due diligence to identify to pain points & value of the subject of the due diligence. These findings are then aptly summarized in a report, commonly known as a due diligence report.

The process of due diligence take place in order to;

- Analyze multifarious aspects to avail better clarity on entities’ commercial potential

- Determine the financial viability of the proposed venture at a comprehensive level

- Examine the prevalent legal norms and regulatory framework linked with the proposed ventures or business dealing.

Areas of Focus in a Due Diligence Report

Viability: Accessing the feasibility of the target entity can be done via an extensive study of the business & financial plan.

Monetary facet: Critical fiscal data & a ratio analysis would be imperative to comprehend the complete picture.

Personnel: A critical parameter to consider is the potential & credibility of the individual working in the company.

Environment: No business functions in isolation. Therefore, it is imperative to dig down into the macro-environment & its overall impact on the target entity.

Technology: A very significant factor to consider is technology’s assessment available with the entity. Such an assessment is imperative as it aids pinpoint future actions.

Prevailing & Key Liabilities: Any type of pending litigations & regulatory problems ought to be taken into account.

Effect of synergy: The establishment of coordination between the target entity and the prevailing company serves as a medium for decision making.

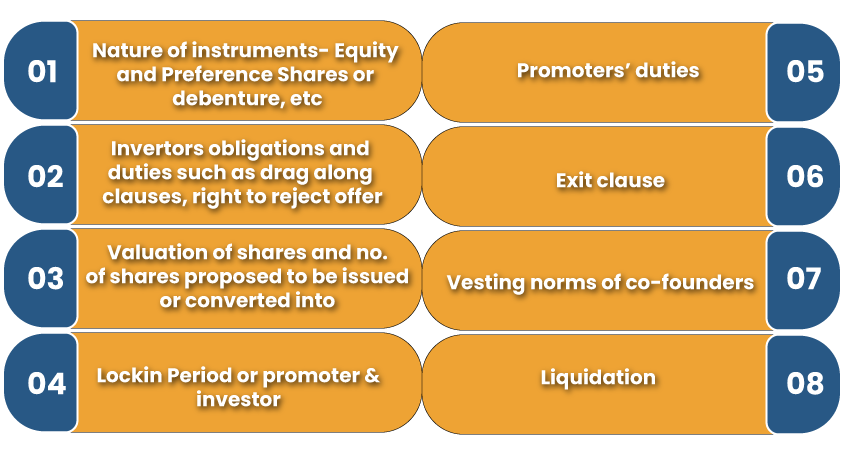

Term sheet

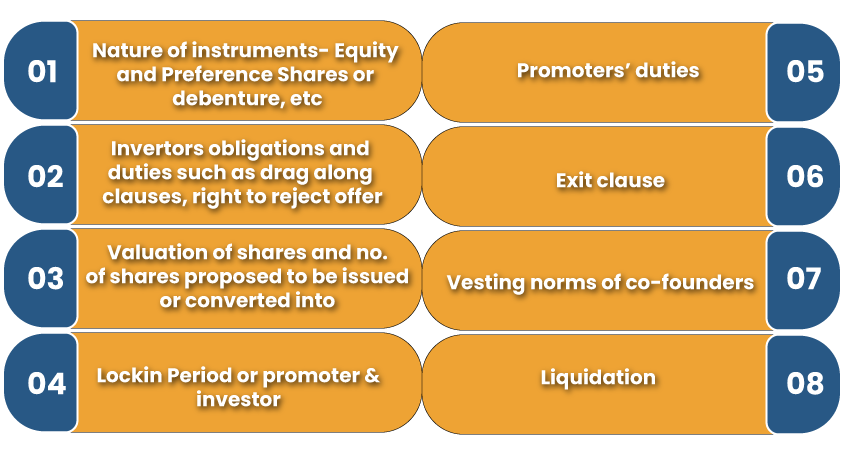

A term sheet refers to a non-binding agreement that manifests the fundamental terms and norms of an investment. The term sheet acts as an intuitive template & basis for more information, legally binding documents. Once the parties are engaged, reach an agreement on the information cited in the term sheet, a binding agreement that conforms to the sheet detail drawn up. Ideally, a term sheet encompasses the given aspects

Shareholder agreement

A shareholders’ agreement, broadly known as a stockholders’ agreement, refers to a legal contract that briefs out how an entity ought to perform its functions and drafts shareholders’ duties & rights. The agreement also entails detail pertaining to the company & the protection of shareholders. Such agreements aim to ensure that shareholders are treated impartially & their rights are respected. Further, it also enables shareholders to make decisions regarding the selection of future shareholders and facilitates protections for minority positions.

Point to be noted: Make sure the documentations mentioned should revolve around the following traits:

- Coherent

- Compelling

- Clarity

- Conciseness

Conclusion

Positioning yourself as a genuine contender for funding requires a tremendous amount of professionalism and a pre-planned approach. The documents mentioned above are nothing but essential prerequisites to kick start your funding journey. It is needless to mention that these documents should be created with due consideration, preferable under the guidance of field experts. Keep in the subtle preparation of document is the key to the success in the journey of Fundraising for Startups.

Read our article:Benefits of Startup India Registration in India