When a company receives foreign direct investment (FDI) through capital Investment, the Company allots shares to the foreign investor for this, and there is a mandatory requirement for the reporting with RBI (Reserve Bank of India), which is to be done in form FC-GPR. It is a type of form which is issued by RBI under the Foreign Exchange Management Act, 1999[1], and can be availed only after getting approval of Company Registration with due process.

On 7th June 2018, RBI, by its notification, introduced a new reporting framework, an online reporting platform, FIRMS (Foreign Investment Reporting and Management System), for reporting of foreign investment by Indian entities (including companies, LLP and startups) in SMF (Single Master Form).

The new e-filing portal FIRMS at the moment facilitates filing of following transactions:

- Reporting of FDI into companies

- Reporting of FDI into LLP

- Transfer of share/capital in companies / LLP between resident and non-resident

- Issue/transfer of convertible notes.

“Foreign Direct Investment” (FDI) means investment through capital instruments by a person resident outside India in an unlisted Indian company, or in 10 percent or more of the post issue of paid-up equity capital on a fully diluted basis of a listed Indian company;

FDI Reporting to RBI with Form FC-GPR

Foreign currency Gross provisional Return (FC-GPR) is a form in which a company requires to submit with RBI for reporting of the issue of eligible instruments to the overseas investor against any FDI inflow with an e-Biz portal (https://www.ebiz.gov.in/) of Government of India.

FDI under various sectors is permitted under 2 Routes:

- AUTOMATIC ROUTE

- GOVERNMENT ROUT

- Automatic Route: Under this route, no prior approval is required by non-resident or Indian companies from RBI or Government of India before investing in the Company.

- Government Route: Under this route, prior approval is required either by the Government of India before investing in the Company.

When FC-GPR Form is required to be filed?

Below mentioned are the cases when FC-GPR form is required to be filed;

- In the case of incorporation if Shareholder is non-resident:

After incorporation, the Company needs to open a Bank Account. After subscription money received in the Bank Account, there is a need for reporting with RBI in FC-GPR form.

Under FEMA, in case of newly incorporated companies, there is no timeline for bringing in the Subscription money whereas,

Under the Companies Act 2013, there is a mandatory requirement for the subscribers to bring in subscription amount in 180 days from the date of incorporation.

Further issue of Shares:

Only the following Securities considered under FDI (Foreign Direct Investment):

In case Share Application money is received, shares required to be allotted in 60 days from the date of receipt of application money. As soon as shares are allotted, there is a need for reporting with RBI in FC-GPR form within 30 days of allotment.

- Equity Shares

- Convertible Preference Shares

- Convertible Debentures

Investment in any other instrument shall be treated as borrowings and need to fulfill ECB requirements.

Conditions Required:

Below mentioned are some conditions which should meet for FDI:

- Foreign Direct Investment must be compliant with the FDI policy.

- Securities issued must be under the Foreign Exchange Management.

Documents Required:

Below mentioned are the documents required for filing FC-GPR form;

- Copy of FIRC (Foreign Inward Remittance Certificate)

- Copy of KYC (Know your customer) report for the beneficiary if the beneficiary and remitter are different entities.

- CS Certificate: Certificate from Company Secretary that all the requirements have been complied with as per Companies Act, 2013.

- Valuation Report by Chartered Accountant / Merchant Banker- Certificate from Chartered Accountant or Merchant Banker, shall Indicate the manner of arriving at a price of the shares issued to the person resident outside India:

- Copy of FIPB approval (if required);

- Board resolution for the Allotment of Securities;

- Appointment of Authorised Representative;

- Letter of Debit Authorization;

- Reason for any delay in submission, if required;

The RBI (Reserve Bank of India) or AD Bank may ask any other documents if required.

Once all the above documents received, form FC-GPR to be filed.

What are the Steps for filing form FC-GPR with RBI?

Below are the Steps for filing form FC-GPR with RBI:

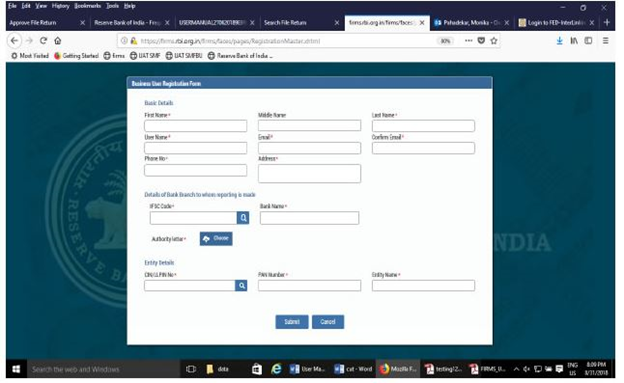

- Registration for Business User:

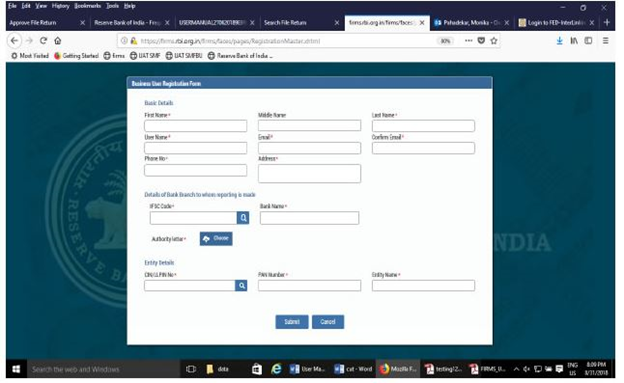

Step 1: For registering as a business user, go to the FIRMS website.

Step 2: At the Login box, you need to click on the Registration form with New Business User.

Step 3: Fill up the details under New Business user :

- Name

- User name (which should be unique)

- Email address

- Phone no.

- Address

- IFSC Code of the Bank branch with whom the reporting would be made.

- Bank name

- Authority letter as an attachment

- Company CIN/LLPIN

- PAN Number

- Entity name

Step 4: Click the Submit button, if any error is displayed then rectify the same and Submit the same.

Step 5: A Message “Record Saved Successfully” is displayed on top of the Login box.

AD Bank Branch will verify the same. Approval communicated with the Email notification with the Business user.

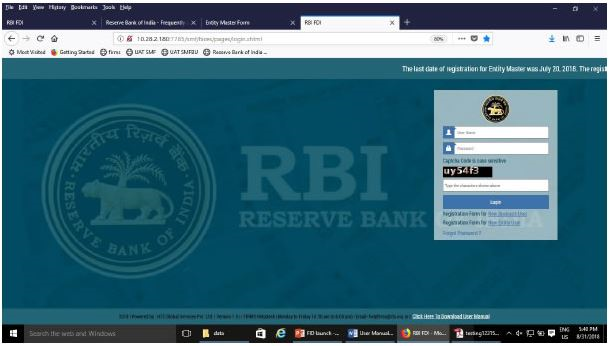

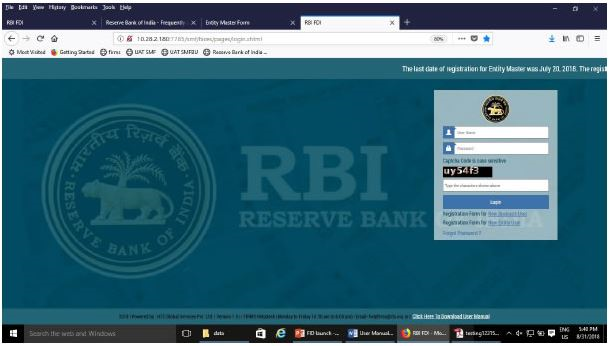

- Logging into Firms:

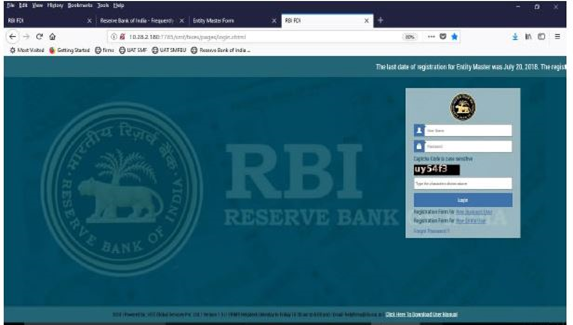

Step 1: Go to the FIRMS website.

Step 2: User Name and the Default password is received via Email,

Step 3: Business users can set a new password.

Step 4: After Logging in to FIRMS, it will create a workplace

- Form Filling and submission

Step 1: After completing the submission process for the form of registration of the new business user, you need to login to the firms into SMF and reach your workspace.

Step 2: Select the Return type- Select FC-GPR, the user will be taken to the form FC-GPR.

Step 3: Fill the Common Investment details.

- These details are common with all the returns that can be reported in SMF in FC-GPR form fill up the standard investment details such as shareholding pattern, date of issue of shares, etc.

Step 4: Issue Details

- Issue details likewise Date of Issue, Nature, and Initial FC-GPR Reference No. in case of subsequent filing.

Foreign Investment Details

- Foreign investor’s details such as Number of investors General details like Name Address Country of residence, Constitution/nature of the investing entity, etc. are required to be filled.

Amount of Issue

- Fill the total amount of inflow and the total amount for which the capital instruments have been issued.

Particulars of Issue

Shareholding Pattern

- Business users should ensure that details are correctly filled.

Submitting the Form

- After filling all the details, save and submit the form.

Penalty for Non-filing of Form FC-GPR with RBI:

Any delay in reporting beyond the prescribed period shall attract a penalty :

- percent of the total amount of investment subject to a minimum of Rupees Five Thousand and maximum of Rupees Five Lakhs per month or part thereof for the first six months of delay and twice that rate thereafter,

It is to be paid online into a designated account in RBI.

Read our article:Growth and Quality of FDI: Are all FDI Equal?