PAN card is a unique system of identification, a computer-based system that gives an identification number to every Indian citizen for the tax-paying entity. Using this identity, a person’s whole tax record is kept on file against a single PAN number, the primary key for data storage. No two tax-paying entities may have the same PAN because this is shared across the country. In this writeup, we will discuss about the PAN card, how to apply or check the PAN Card online status, its benefits, and its importance.

What is a PAN Card?

Permanent Account Number or PAN card is a 10-digit unique identification alphanumeric number (containing alphabets and numbers) issued by the Income tax department to India to every Indian citizen. It identifies various taxpayers in the country.

Pan Card consists of details of a person are given below:

- Unique PAN number

- Full name of the PAN cardholder

- Full name of the PAN cardholder’s father

- Date of birth of the PAN cardholder

- Digital signature of the PAN cardholder

- Photograph of the PAN cardholder

- QR code

Let’s examine an example to understand better the meaning of each character on your PAN card: ABCDE1234F.

- The first three characters of PAN represent the alphabetic series that presently runs from AAA to ZZZ.

- The fourth character of the PAN indicates the cardholder’s status; for instance, the letters “P,” “C,” “F,” and “H” stand for “individual,” “firm/limited liability partnership,” and “HUF,” respectively.

- The fifth character represents the initial letter of the name in the case of a non-person and the first letter of the last name of the individual.

- The consecutive numbers in the following four characters range from 0001 to 9999.

- There is an alphabetic check digit as the tenth character in the PAN.

How to Apply for a PAN Card Online?

You can apply for a new PAN card online and request that certain information on your PAN card be updated or corrected.

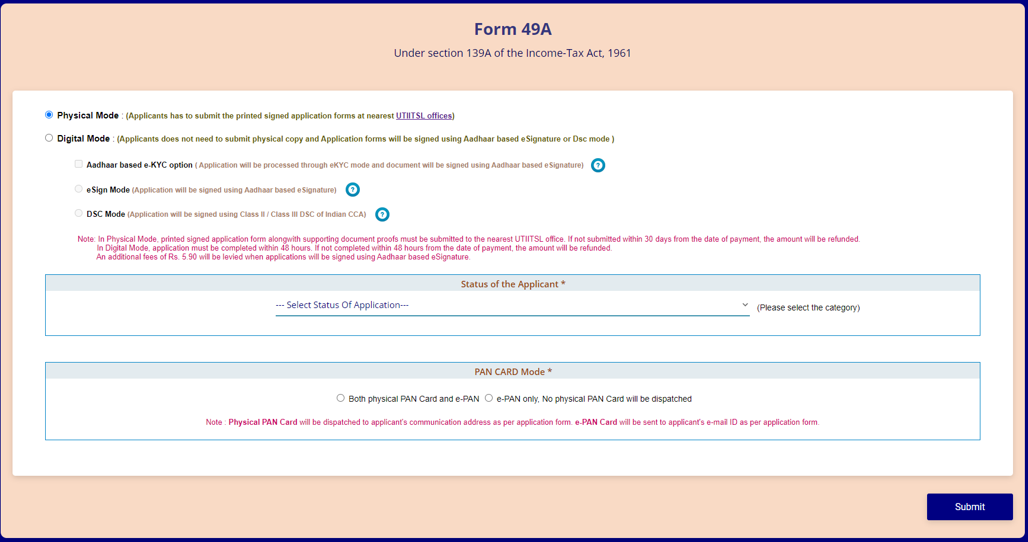

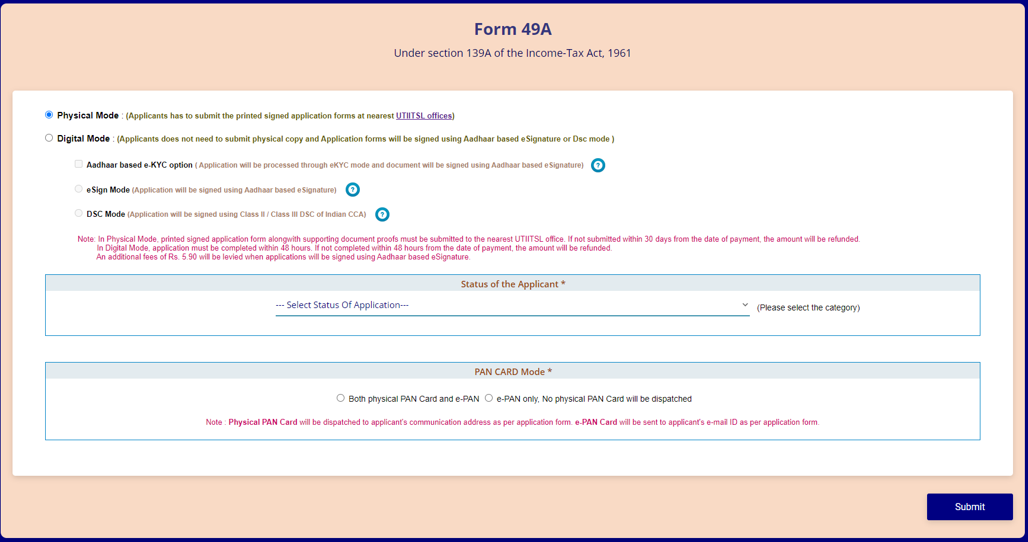

1. You can apply online through the Protean or UTITSL (UTI Infrastructure Technology and Services Limited) portals by paying the application price of ₹93 for an Indian communication address and ₹864 for a foreign communication address; this is the general procedure to apply for a PAN card are as follows:

- Go to the “New PAN” or a comparable option by visiting the Protean or UTITSL portal.

- Submit form 49A by entering the data as directed.

- Pay the costs with a debit or credit card, Net Banking, demand draft, etc.

- After successful payment, you will get an acknowledgment receipt.

- Within fifteen days, a physical copy of your PAN will be mailed to your address.

- Keep in mind that you are limited to one PAN card. If you fail to comply, you must pay ₹10,000 as a penalty under section 272B of the Income Tax Act, 1961.

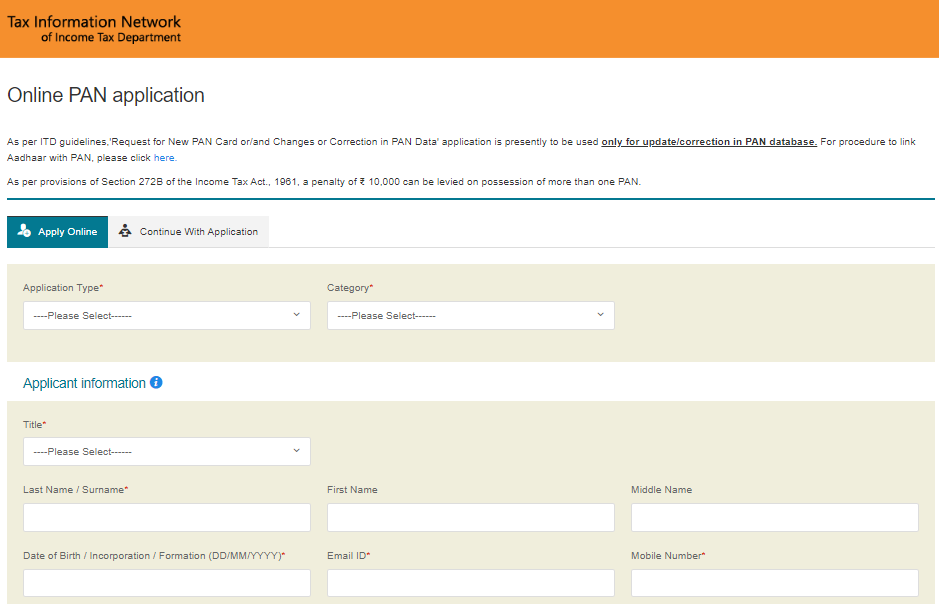

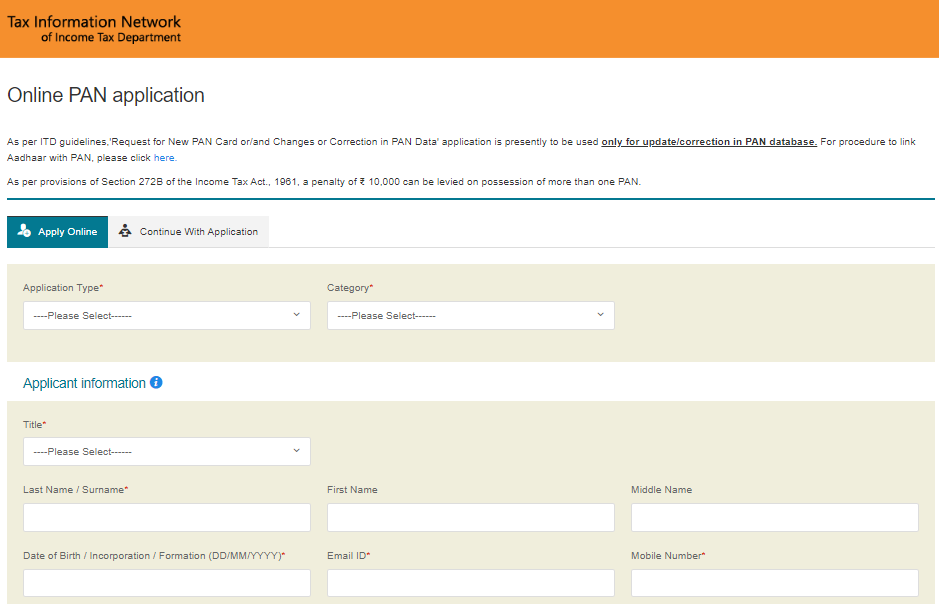

2 To Apply for a PAN card through NSDL (National Securities Depository Limited) follow the given below process:

- Visit NSDL

- Select the application type.

- Choose your category.

- Fill in all the needed information like your name, date of birth, email ID, and mobile number.

- Agree on all the terms and conditions.

- Enter the Captcha Code as shown. Then, click on ‘Submit’.

- You will receive an acknowledgment number After being taken to a new page.

- Enter the pertinent information from the next page.

- To apply for a PAN, you must pay and attach the necessary papers.

How to Check the Status of PAN Card Online?

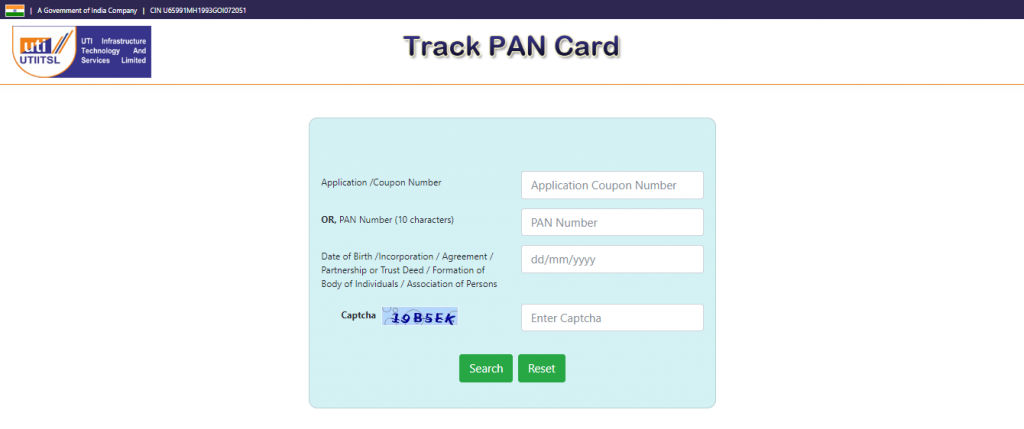

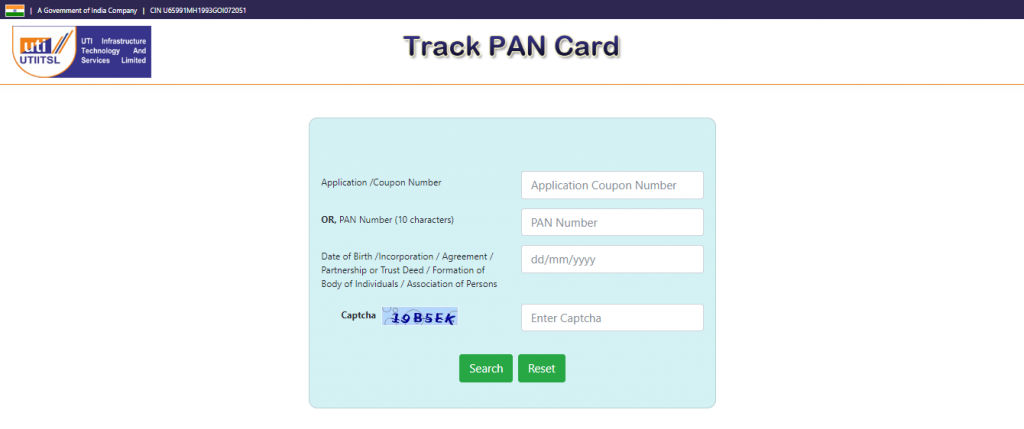

1: To check status of UTI PAN card online, follow the mentioned steps below:

- Enter your PAN or application coupon number.

- Enter your Date of Birth/Agreement/Incorporation, etc., and the captcha code.

- Click on the “Submit” button, and your PAN card status will show on the screen.

Note: After your application has been submitted, it may take up to 15 working days to receive the PAN Card.

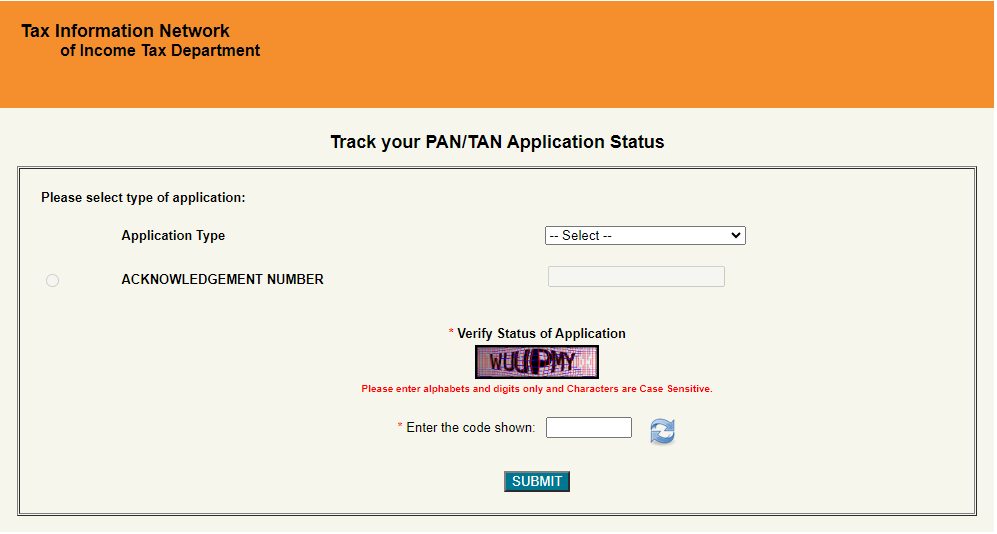

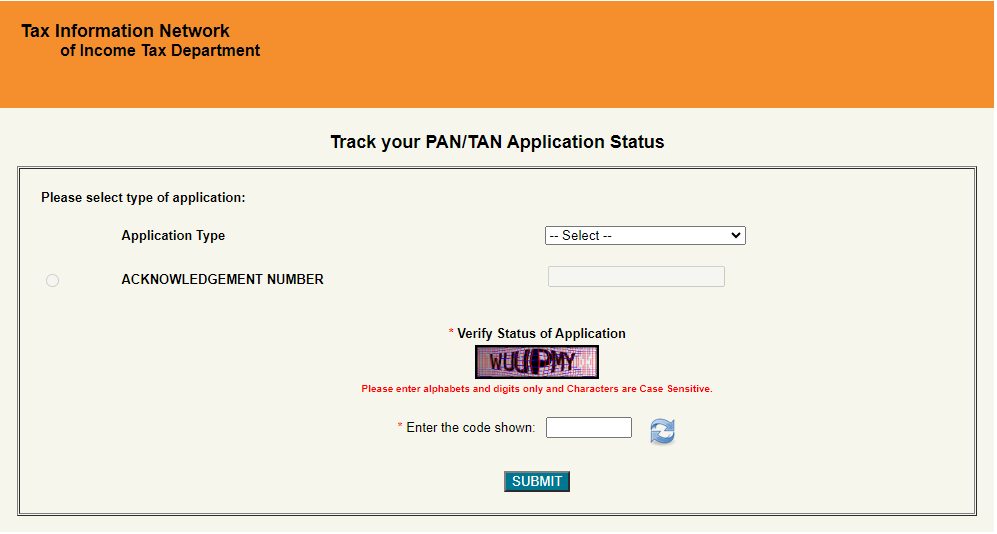

2: To know the PAN Card transaction status through the NSDL (Protean) website, follow the steps that are mentioned below:

- Click on https://tin.tin.nsdl.com/pantan/StatusTrack.html to visit the “Track your PAN/TAN Application Status” page instantly.

- Choose “PAN-New/Change Request” under “Application Type” now.

- Fill in the provided field with your 15-digit acknowledgment number.

- Enter the captcha code in the provided box to confirm the status of your PAN card application.

- To view the status of your NSDL PAN Card on your screen, click the “Submit” button.

Documents Required to Apply for a PAN Card Online

Form 49A or 49AA is one of the several forms you must submit to apply for a PAN Card online. Three primary categories exist for PAN Card applications: Proof of Address, Proof of Identity, and Proof of Date of Birth (or Age). The list of documents you must provide with your PAN Card application is shown below:

If you are an Individual Applicant

Proof of identity like Voter ID, Aadhaar, Driving License, etc.

Proof of address, like a utility or water bill, bank account statement, credit card statement, passport, driver’s license, government-issued domicile certificate, marriage certificate, matriculation certificate, etc.

If you are a member of a HUF (Hindu Undivided Family)

An affidavit issued by the HUF Karta must be submitted. Every coparcener’s name, address, and father’s name must be stated in the affidavit.

If you are a member of HUF and are applying for a PAN Card online on your own, you will need to provide proof of your identification, proof of address, and proof of date of birth.

For Companies Registered in India

It is necessary to show a copy of the Registration Certificate that the Registrar of Companies issued.

LLPs and Businesses Chartered or Founded in India

It is necessary to produce a copy of the Registration Certificate that the Registrar of Companies issued.

The Partnership Deed must be supplied in copy.

For Trusts Formed or Registered in India

A copy of the Registration Certificate Number a Charity Commissioner granted must be submitted.

For Association of Persons

A copy of the agreement, the registration number certificate from the Charity Commissioner or Co-operative Society Registrar, or any document from the Federal or State Government containing your name and address.

Applicants who are not Citizens of India

Evidence of identification includes:

- A copy of your passport.

- A copy of your PIO from the Indian government.

- An official copy of your OCI.

A copy of a VISA given by an Indian company, an FRO registration certificate, an NRE bank statement, a bank statement from the country of residence, etc., can all serve as proof of address.

How To Download E-Pan Online?

If you want to download the pdf of your PAN card online, follow the below-mentioned steps:

- Visit the official website of NSDL or UTIITSL, go to the homepage’s PAN Download Section by clicking on https://www.onlineservices.nsdl.com/paam/requestAndDownloadEPAN.html Or https://www.pan.utiitsl.com/PAN_ONLINE/ePANCard.

- If you have basic personal information, visiting NSDL (National Securities Depository Limited) is a good idea.

- There is a Get e-Pan card form available on the internet.

- To download the PAN card, select the PAN option.

- Now enter your date of birth, Aadhar number, PAN card, and, if applicable, GSTN.

- Carefully check the digits.

- After reading the terms and conditions, click the box.

- If you would like, you can switch the language from English to Hindi.

- Verify the recaptcha choice now.

- Press the “Submit” button to complete the process.

- After submitting the information, you will receive an OTP (One-Time Password) on the email address or mobile number linked to your PAN card application.

- Enter the acquired OTP in the field and verify it.

- After the OTP has been successfully validated, you can download the PDF version of your PAN card.

- Your E-Pan is now available to you in PDF format.

- You can print the PDF file you got if you require a hard copy of your PAN card.

Importance of PAN Card

Here are some essential reasons why you should get a PAN card:

- PAN cards are used for various tasks, such as opening a bank account and getting a gas connection, as proof of legal identity and photo.

- A PAN card is needed to create a bank account and perform other financial transactions related to banking. These days, it is necessary to fight money laundering and fraud. Any daily cash deposits exceeding Rs. 50,000 require the submission of PAN card details. Information from your PAN card must also be submitted for fixed deposits over Rs. 50,000.

- Applications for debit and credit cards also need PAN information. Your credit score could be impacted by applications denied for lack of PAN card information or other reasons.

- Every kind of loan application requires PAN card information.

- For any property transaction, sale, or purchase, the buyer and seller’s PAN card data are mandated by law if the value of the immovable property exceeds Rs. 5 lakhs. The PAN card numbers of each owner are needed when there is joint ownership.

- PAN details must be provided When acquiring any jewellery or bullion valued at more than Rs. 5 lakhs.

- PAN information is also needed to open Post office deposits above Rs. 50,000.

- PAN card details are also needed for digital payment wallets if monthly transactions exceed Rs. 20,000.

- PAN card information is needed to buy or sell any vehicle, except two-wheelers.

- PAN card information must also be provided to the broker, Demat, and trading account provider when trading shares.

- Investing in bonds, debentures, or mutual funds requires PAN card information.

- You must also submit PAN card details if your insurance premiums exceed Rs. 50,000 throughout a fiscal year.

- PAN card details are also required when converting local to foreign currencies.

- Most employers need your PAN card details when you apply for a job to process payroll and handle taxes. It is also necessary to file an ITR.

Who Can Apply for a PAN Card Online?

The organizations listed below are those that must apply for a PAN Card online:

- People whose income exceeds the starting point of the income tax brackets.

- Those who receive taxable income for the benefit of third parties (e.g., wages of a minor).

- Those who work in a profession or run a business with more than Rs. 5 lakhs in sales or revenue annually.

- People registered under the Central Sales Tax Act or the general sales tax laws of a union territory or state.

- Everyone who conducts financial activities that require sharing PAN card details.

- Charitable trusts are required to file returns under Section 139 (4A).

- An import/export code is required for importers and exporters.

- Those who are liable for excise taxes.

- Those who get paid after TDS are subtracted.

- Both individuals and their representatives must pay service tax.

- Those who send out bills in compliance with Rule 57AE.

Uses of PAN Card

- The PAN has to be quoted when you are paying direct taxes.

- Taxpayers are required to include PANs when submitting income taxes.

- PAN details are required to register a business.

- Numerous financial procedures require PAN information. Here are a few financial services that require the submission of PAN card information:

- Acquisition or disposal of real estate valued at least Rs. 5 lakh.

- Sales or purchases of non-two-wheeler vehicles.

- Payments over Rs. 25,000 were paid to lodging establishments and eateries.

- Payments made in connection with a necessity for foreign travel. In this case, if the amount exceeds Rs. 25,000, you must present your PAN.

- Payments for bank deposits above Rs. 50 thousand.

- Acquisition of bonds totaling at least Rs. 50,000.

- You are purchasing shares for a minimum of Rs. 50 lakhs.

- Acquiring insurance coverage for at least Rs. 50,000.

- Making mutual fund investments.

- More than Rs. 5 lakhs were paid to purchase bullion and jewellery.

- To transfer funds out of India.

- Money transfer from one NRE account to another NRO account

Types of PAN

PAN cards are known for different taxpayer categories, including:

- Individual

- HUF (Hindu Undivided Family)

- Company

- Firms/Partnerships

- Trusts

- Society

- Foreigners

Benefits of Having a PAN Card

There are lots of advantages to a PAN card. We have mentioned below the significant ones:

- Helps to Start a Business

Planning to launch a start-up?

PAN cards can be used for various purposes when launching a firm. Under government guidelines, the PAN is required for all businesses operating in India.

Additionally, businesses must have a Tax Registration Number (TRN) to transact and submit tax returns. The only way to get this TRN is to have a PAN. Furthermore, several e-commerce websites require businesses to have a TRN to sell goods on their platform.

- Deduction in Taxation

Tax purposes are one of the main justifications for owning a PAN card. If a person who receives interest on savings accounts over ₹10,000 annually does not have their PAN associated with the account, the relevant bank will withhold TDS at 30% rather than 10%.

- Opening a Demat Account or Bank Account

As per the prevailing guidelines, an individual lacking a PAN card cannot open a bank account.

However, this law does have one exemption if someone chooses to open an account with no balance under Prime Minister Jan Dhan Yojana. A voter ID card or ration card might be used as identification documentation in this situation. Similar to this, opening a Demat account requires a PAN card.

- Income Tax Returns Filing

All individuals who qualify for income taxation must file their income tax returns; a PAN card is required to achieve this.

Investing and Purchasing RBI Bonds or Insurance

Before investing, a person must fill out a form that may be found on the Association of Mutual Funds of India website (AMFI). A self-attested copy of the PAN card and an address proof must also be attached.

An investor’s KYC document is only allowed when they have a PAN card and are in compliance with KYC regulations. Similarly, investing in RBI bonds worth at least ₹50,000 requires a PAN card.

- Buying Foreign Currency

According to the Foreign Exchange Management Act, foreign currency purchases totaling ₹50,000 or more require a PAN card. This is because all foreign exchange transactions fall under the current or capital account categories.

- Transaction of Listed or Unlisted Securities

The Securities Contracts (Regulation) Act of 1956 requires a PAN card to purchase unlisted or listed securities, except for bonds, debentures, shares, and other marketable securities. This standard is relevant if each transaction exceeds ₹1 lakh in total. Buying or selling shares worth more than ₹1 lakh from an unlisted firm also requires a PAN card.

- Purchasing or Selling Immovable Property

A person must furnish their PAN details when buying or selling immovable property, like a house with a value greater than ₹10 lakhs.

- Purchasing or Selling a Four-wheeler Vehicle

A PAN card is also required if someone buys or sells a four-wheeled vehicle or wishes to obtain financing to purchase a car.

- Cash Deposits, Pay Orders, Banker’s Cheques, Bank Drafts

The PAN card must be presented if one wants to use pay orders, banker’s checks, bank drafts, or cash deposits above ₹50,000. This is also valid for situations in which a person is prepared to deposit more than ₹50,000 in cash into their bank account.

- While Applying for a Loan

When seeking loans, giving your lender your PAN card becomes necessary. This applies to all loan types, including secured and unsecured ones.

- To Buy Expensive Jewellery

A copy of your PAN card may be required when making an expensive jewellery purchase above ₹5,00,000.

- For Telephone Connections

Sometimes, you will need to provide the phone operator with a copy of your PAN card to obtain a new mobile connection.

What Happens if you don’t have a PAN Card?

Sometimes, you will need to provide the phone operator with a copy of your PAN card to obtain a new mobile connection.

According to the Income Tax Department of India, if your income is in the taxable range and you do not have a PAN card, you will pay a flat 30% tax on your income and wealth. Individuals, businesses, and other tax-eligible entities—including foreign nationals and businesses registered outside India—are subject to this regulation.

They are prohibited from opening a bank account, buying a car, or purchasing real estate for more than Rs. 10 lakh, among other things.

Companies cannot carry out a significant portion of their procurement and financial operations.

Wrapping up

For people living in India, the Pan Card is an essential document that is a distinct identifying number for various legal and financial operations. It guarantees income tax compliance, eases financial transactions, and stops tax avoidance. Getting a Pan Card online is an easy process. The procedures described in this tutorial will help you obtain your Pan Card quickly. Don’t forget to be precise with your information and monitor the progress of your application. Accept the advantages and ease of owning a Pan Card right now!

Frequently Asked Questions

Who requires a PAN card?

In India, each taxpayer is required to have a PAN Card. This covers people doing business or making money in India, companies, and international nationals.

Who can apply for PAN?

A PAN is essential for all current assesses, taxpayers, and anyone who must file an income return, even if they are doing so on behalf of others. Anyone planning to engage in business or financial transactions where providing a PAN is required must also have a PAN.

How do I apply for a PAN Card online?

The websites of UTIITSL (UTI Infrastructure Technology and Services Limited) and NSDL (National Securities Depository Limited) allow you to apply for a PAN Card online. Complete the online application, attach the necessary files, pay the application cost, and submit the form.

Which documentation is needed to apply for a PAN card online?

Documents proving identity (passport, Aadhaar card, etc.), evidence of address (utility bill, voter ID, etc.), and proof of date of birth (birth certificate, matriculation certificate, etc.) are frequently needed.

How can I find out how my PAN Card application is progressing?

On the NSDL or UTIITSL websites, you can check the application status of your PAN Card online. Enter your acknowledgment number and other necessary information to view the current status.

How long does it take to receive a PAN Card online?

After submitting a thorough application, you should obtain your PAN card online within 15 to 20 working days on average.

Can I edit or update the data on my PAN card?

You can use the NSDL or UTIITSL websites to file an online correction application to amend or modify the information on your PAN Card. You must submit accurate information along with supporting documentation.

Is it compulsory to quote PAN on 'return of income'?

Yes, it is compulsory to quote PAN on the return of income.

What is the Validity of a PAN Card?

Your PAN Card is unaffected by address changes, so it is valid for life.

What should I do if my PAN Card application is rejected?

You will be notified if your PAN Card application is denied and the reason for the denial. After making the necessary corrections and supplying the required paperwork, you can submit another application.

Is it mandatory to link my PAN Card with Aadhaar?

You must link your PAN card to your UID number for income tax purposes by a government obligation.

Can I apply for a PAN Card if I am a foreign national?

Yes, foreign nationals working or earning money in India can apply for a PAN Card. The necessary documentation may differ, but the application process is the same.

How do I surrender an additional or duplicate PAN Card?

By sending a formal request to the Income Tax Department together with the duplicate PAN Card(s), you can turn in an extra or duplicate PAN card.

What should I do if I have more than one PAN?

You can fill out and submit the PAN Change Request application by adding your existing PAN to the top of the form. The form's item number 11 should list any additional PANs that you were unintentionally assigned. The relevant PAN card copy or copies should be sent in with the form to be cancelled.

Is e-PAN a valid proof of allotment of PAN?

An e-PAN is an electronically issued, digitally signed PAN card that is a legitimate record of PAN allocation.

Is email ID mandatory for receiving e-PAN?

Yes. To obtain an e-PAN, a valid email address must be mentioned on the PAN application form.

Is it compulsory to link Aadhaar with PAN?

According to Section 139AA of the Income Tax Act, each individual with a PAN as of July 1, 2017, must link their PAN to their Aadhaar number. Aadhaar must also be quoted in full while filing a return or seeking a new PAN, according to Section 139AA.

Can I track my PAN Card delivery?

Yes, you can use the courier service provided by the issuing body (NSDL or UTIITSL) to track the delivery status of your PAN Card once it has been shipped.

Read our article: Pay Zero Tax For 12 Lakhs Income Tax Slab In FY 2024-25