Under Companies Act, 2013, the concept of Non-Profit Companies is prescribed under Section 8 of the Act. The idea of Non-Profit Companies in our country, India is not quite new. The profits earned from Non-Profit Companies are invested for the betterment and development of society. Furthermore, Section 8(4)(ii) of the Companies Act, 2013, the Section 8 Company can go for Conversion into any other form of Company under the Act.

The Companies (Incorporation) Rules, 2014 also provides for the procedure for the Conversion of Section 8 Company into any other form of Company. In this article, we will discuss the procedure for Conversion of Section 8 Company into Private Company.

What is a Section 8 Company and a Private Company?

Section 8 Company is formed to encourage and nourish certain acts of art, education, science, sports, religion, charity, social welfare, research, protection of environment or any other related objective. The members of Section 8 Company are paid no bonus and dividend. The profits of the Section 8 Company are used towards achieving and promoting the objective of the Company.

A Private Limited Company is a Company whose shares cannot be offered to the public at large for sale and has less legal requirements than the Public Company. The restriction on Private Company for offering shares to the public at large does not mean that the Private Company is a small Company. The Companies Act, 2013[1] , defines Private Company under Section 2(68) of the Act. Section 2(68) of the Companies Act, 2013, puts a restriction on the transferability of shares through the Articles of Association (AoA) of the Company. The maximum number of members a Private Company can hold is 200.

What legal provisions are associated with the Conversion of Section 8 Company into Private Company?

The legal provisions which are associated with the Conversion of Section 8 Company into Private Company are as follows:

- Section 8 of the Companies Act, 2013.

- Rule 21 of the Companies Incorporation Rules, 2014.

- Rule 22 of the Companies Incorporation Rules, 2014.

- Rule 23 of the Companies Incorporation Rules, 2014.

What are the Conditions for Conversion of Section 8 Company into Private Company?

The conditions required for the Conversion of Section 8 Company into Private Company are as follows:

As per Rule 21 of the Companies (Incorporation) Rules, 2014

The conditions prescribed for the Conversion as per Rule 21 of the Companies (Incorporation) Rules, 2014, are as follows:

- The Company should pass a Special Resolution in its General Meeting for the Conversion of Section 8 Company into Private Company.

- The Notice of the General Meeting should be attached to the Explanatory Statement. The Explanatory Statement should include:

- The Incorporation date of the Company.

- The main objects in the Memorandum of Article (MoA) of the Company.

- The reason due to which the current structure of the Company is not able to achieve the main object.

- If the main objects of the Company are proposed to be altered then what would be the altered objects and the reason for alteration of such objects.

- The details of the impact of Conversion on the members of the Company

- The details of the benefits that may accrue to the members of the Company after the Conversion of Section 8 Company into Private Company.

- List of privileges and concessions which are currently enjoyed by Section 8 Company. The privileges and concessions include the tax exemptions, receiving donations, foreign contributions, land or any other immovable properties.

- The details of the market price of the property acquired by the Company and the concessional rate given by the Company of such property.

- The Details of donations and bequests received by the Company.

- The certified true copy of the Special Resolution passed by the Company in its General Meeting should be filed with the Registrar of Companies (RoC).

- The certified true copy of Notice for the convening of General Meeting of Company should be filed with the Registrar of Companies (RoC).

- The application filed to the Regional Director should include the following Attachments:

- A true certifies copy of the Special Resolution passed by the Company in the General Meeting.

- The true certified copy of the Notice for the convening of General Meeting of the Company.

- The proof of serving Notice should be sent to the following authorities:

- To the Charity Commissioner,

To the Income Tax Commissioner who has jurisdiction over the Company, To the Chief Commissioner of Income Tax who has jurisdiction over the Company,

To any central department or state department or any organization or any authority in whose jurisdiction the Company was operating.

- The copy of the application filed to the Regional Director should be submitted to the Registrar of Companies (RoC) also.

As per Rule 22 of the Companies Incorporation Rules, 2014

The conditions prescribed for the Conversion as per Rule 22 of the Companies (Incorporation) Rules, 2014, are as follows:

- The Company should publish a notice for the Conversion of Section 8 Company. The Notice should be published in at least one vernacular newspaper in which the registered office of the Company is situated, and at least in one English newspaper having wide circulation in the district where the Companies registered office is located.

- All the annual returns and financial statements of the Company should be filed before making an application of Conversion to the Regional Director (RD).

- The Directors of the Company should submit a declaration before the Conversion, stating that no profit of the Section 8 Company is used and distributed among the members of the Company or any other person claiming through them.

- The Company should attach a certificate from a practising Chartered Accountant (CA), Company Secretary (CS), Certified Management Accountant (CMA) certifying that the conditions relating to the Conversion of Section 8 Company into Private Company as laid down in the Companies Act, 2013 has been duly complied with.

- The representations if any by the authorities should be made to the Regional Director within 60 days of receipt of the Notice. The representations should be made within 60 days of receipt of the Notice.

- The copy of proof of serving of Notice should be attached to the application made to the Regional Director (RD).

- The Regional Director can ask the applicant to get approval from any particular authority for the Conversion and can also obtain the report from the Registrar of Companies (RoC).

- After the approval from the Regional Director, the Company should hold a General Meeting for the alteration of Memorandum of Association (MoA) and the Articles of Association (AoA) for the Conversion. The Company after the General Meeting shall file with the Registrar of Companies:

- The true certified copy of the approval of the Regional Director within 30 days of receipt of approval in Form INC-20 with the prescribed fees.

- The altered Memorandum of Association (MoA) and Articles of Association (AoA) of the Company.

- The declaration by the Directors that the conditions if any imposed by the Regional Directors are duly complied with.

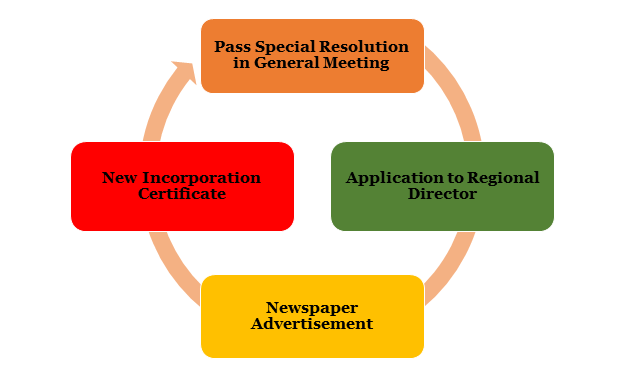

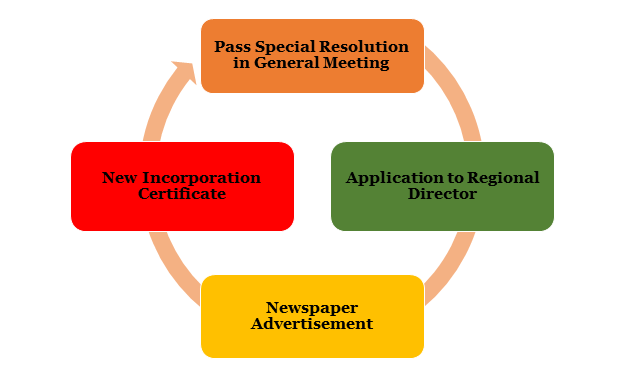

What is the procedure for Conversion of Section 8 Company into Private Company?

The procedure for the Conversion of Section 8 Company into Private Company is as follows:

Pass Special Resolution in General Meeting

As per Rule 21 of Companies (Incorporation) Rules, 2014, the Company should pass a special resolution in the General Meeting of its members for the approval of Conversion. The true certified copy of the Special Resolution along with the Explanatory Statement should be filed to the Registrar of Companies (RoC). The copy of the Special Resolution along with the Notice to convene General Meeting should be filed in Form MGT-14within 30 days of passing of the Special Resolution.

Application to Regional Director

As per Rule 21 of the Companies (Incorporation) Rules, 2014, the Company should file an application with the Regional Director. The application should be filed in Form INC-18 with the prescribed fee.

Newspaper Advertisement

After submitting an application to the Regional Director, the Company should publish a notice in the newspaper for the Conversion of Section 8 Company into Private Company. The publication in the newspaper should be done within a week from the date of submitting an application to the Regional Director.

The Copy of the Notice published should be sent to the Regional Director in Form INC-19.

New Incorporation Certificate

On receipt of the required documents, the Registrar of Companies will Issue Incorporation Certificate to the applicant. When the license of Company as Section 8 Company is revoked, the Company can apply for the Conversion of its status and name with the Registrar of Companies in Form INC-20.

Read our article:Conversion of Private Company into Section 8 Company: Complete Procedure

What are the After Effects of Conversion of Section 8 Company into Private Company?

As per the Rule 22 of the Companies (Incorporation) Rules, 2014, certain conditions can be imposed by the Regional Director (RD) after being satisfied and issuing an order for approval of the application for the Conversion of Section 8 Company into Private Company. The conditions imposed by the Regional Director are as follows:

- The Company, after Conversion, cannot claim the privileges and exemptions, as when the Company was registered under Section 8 of the Companies Act, 2013.

- If before the Conversion the Company has bought any immovable property from the Government at lower rates than the market price, then the newly established Private Company has to pay the difference at that time from the market price.

- The Company is left with some unutilized income and accumulated profits which are brought forward from the previous year should be utilized for the settlement of outstanding dues or any amount due to suppliers or creditors.

- After settling all the dues, if any amount is left, it will be transferred to the Investor Education & Protection Fund. The amount should be transferred within 30 days of the Conversion of Section 8 Company into Private Company.

Conclusion

The Companies Act, 2013, provides for Conversion of Section 8 Company into any other kind of Company. Companies go for Conversion when there is no way to achieve the desired object within the current structure of the Company. The Conversion process of Section 8 Company into Private Company is time-taking and long-lasting. We at Corpbiz have experienced and skilful professionals. Our professional will help and assist you with the process of Conversion and will assure the flawless completion of your work.

Read our article:Conversion of Private Company into OPC: Step by Step Procedure