A Private Limited company by definition itself means a privately managed corporation owned by the associated individuals. The share of the company’s members is the movable property and it can be transferred in a way enlisted in the Articles of Association of the company. In this article, we would take a detailed look at the concept of Transferability of Shares.

What is Pre-Emption Clause or Right of First Refusal in Context of Transferability of Shares?

Pre-emptive rights refer to a contractual clause that allows shareholder to buy the company’s share before disclosing to general public. Under this, the preference to buy the shares is initially given to the shareholder rather than the outsiders.

According to the Pre-emption provision, if a member intends to sell shares, then such shares shall first be presented to the active company’s member. The member who intends to sell his/her share must approach the active members of the company in the first place. The keen member may buy out the share at the price determined by the auditor or the director of the company. Besides, the pricing of shares can be determined by the norms enlisted in the AOA. If the active members refuse to leverage the pre-emptive right, the shares can be sold to an interested individual or third party.

The pre-emption provision aims to restrict the transferability of shares between the member and the non-member and does not apply to inter-organizational transfer. This gives the implication that a member is not liable to sell his/her shares to other members under the said provision unless member(s) agree to buy out all the shares intended to be sold.

Read our article:Steps for Private Limited Company Incorporation In India

Example – Reflecting Concept of Pre-emptive Provision

Let’s say, Ramesh and Pankaj are a shareholder in a privately held organization and Pankaj proposes to sell out these shares to a third-party. Ramesh can leverage the pre-emptive right to buy out the shares intended to be sold. However, if Ramesh refuses to accept the price determined by the auditors, the share would be sold out to the third-party since no member shows interest to buys the shares. Henceforth, the sale of a share in this event cannot be deemed as an infringement of pre-emptive rights mentioned under the AoA of the company.

Preliminary Actions for Laying the Ground for Transferability of Shares

The following grounds ought to be followed by a privately held organization to render effect to the transfer of shares, which are as follows:-

- Transferor has to intimate the Director of the company about his/her intention to transfer his share.

- Upon receiving such a notice, the company has to communicate with other members regarding the said matter and the price set out by the auditor and the directors of the company.

- The company has to provide its member the period within which they should share their options to buy out such shares.

- If all the members refuse to buy out the shares, such shares can be transferred to the third-party, and such transfer will be deemed as valid from the company’s viewpoint.

The Procedure to be Followed for Transferability of Shares in a Private Limited Company

Step 1: Prepare the deed regarding the Transferability of shares as required.

Step 2: Execute the transfer duly approved by the Transferor and Transferee via signature.

Step 3: Stamp the deed regarding the Transferability of shares in compliance with the Indian Stamp Act.

Step 4: Get the witness’s signature, name, and address on the deed.

Step 5: Attach the document of transfer to the share allocation letter and forward it to the company.

Step 6: The Company shall examine the document and thereafter grant a new share certificate to the transferor upon successful validation of the documents.

Transfer of Shares under Section 2(68) the Companies Act, 2013

A term “Private Company” consolidates following characteristics as per the Section 2(68) the Companies Act, 2013[1].

- Private company is liable to maintain a minimum paid capital of Rs 1 Lakhs rupees.

- A Private company abides by the rules mentioned in the Article of Association regarding the transferability of shares.

- A Private Company cannot have more than 200 members

- A Private company cannot approach to public for subscribing the securities

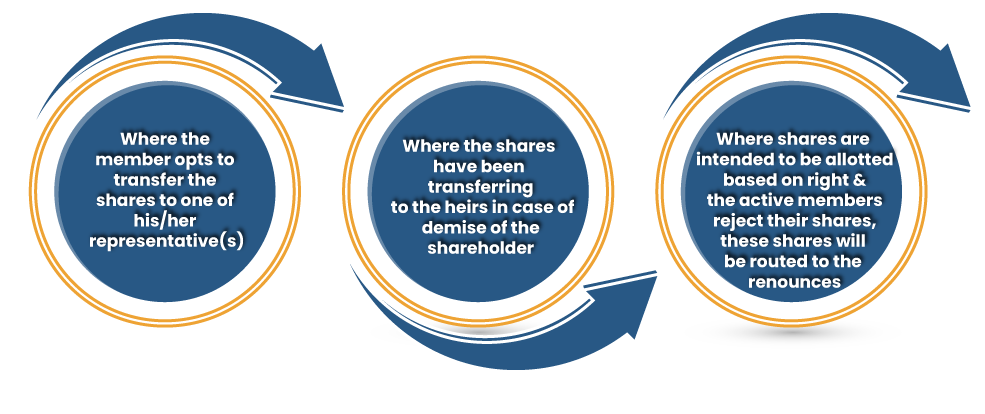

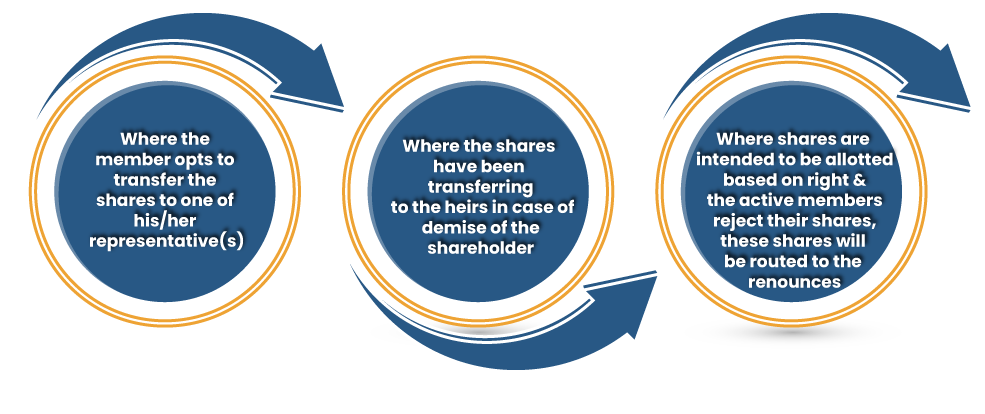

If the limitation is enlisted in the AOA of the company is enforced via private contract between shareholders, which is not binding either on the shareholders or on the company. It’s worth noting that the restriction on the transferability of shares is not applicable in the given cases, which are as follows:-

Time limits Subjected to the Transferability of Shares

The section below encloses information regarding time limits imposed on transferability of shares as per the existing law for the private limited company.

Businesses that Possess the Share Capital

The company shall, within sixty days of its commencement of activities, shall not perform any transferability of shares or any ownership interest on the inter-organizational basis other than the beneficial owners in the absence of a proper transfer instrument.

Application by the Transferor

The transfer shall stand invalid until the company intimates the transferor and the transferor within 2 weeks of receipt of the notice.

No Opposition Certificate

In given scenarios and under the subsequent course of time, the company shall provide a certificate to all securities allocated:-

- For memorandum subscribers – within the period of 2 months of the corporation date.

- In the event of transferring entire shares within the time span of 2 months of the allocation date.

- Delivery of the transfer instrument by the client within the time span of 1 month from the date of delivery.

- Debenture’s allocation– Within the time span of 6 months from the date of allocation.

Conclusion

Transferability of shares in a private limited company is subjected to certain conditions mentioned above. It’s worth noting that a member who intends to sell his/her shares cannot negotiate its prices once it is set out by the director of the company. For more understanding, please feel free to connect with Corpbiz to get better assistance in the concerned topic.

Read our article:Private Limited Company Registration Procedure in India