According to rules as given by the Ministry of Corporate Affairs any Foreign Company can get themselves registered in India and the statutes under the Companies Act, 2013. If you are planning to set up any business in the India as a foreign company, then you have the option to either open a subsidiary of the parent company or to incorporate a registered Indian company in India. This article shall tell you everything that you need to know and will serve as the complete guide for registering a foreign company in India.

What do you mean by foreign company in India?

According to the Companies Act 2013, a Foreign Company in India is defined as any corporate body or any company that is incorporated outside India but has a business place in India whether through itself or by an agent, by electronic medium or physically and it conducts its activities of business in India in any different manner.

However, for the purpose of merger, there is a minor change in the meaning of a foreign company, i.e. Foreign Company in India means any corporate body or company which is incorporated outside India irrespective of having a business place in India or not.

Read our article:FEMA Compliance Checklist for Startups from FDI standpoint

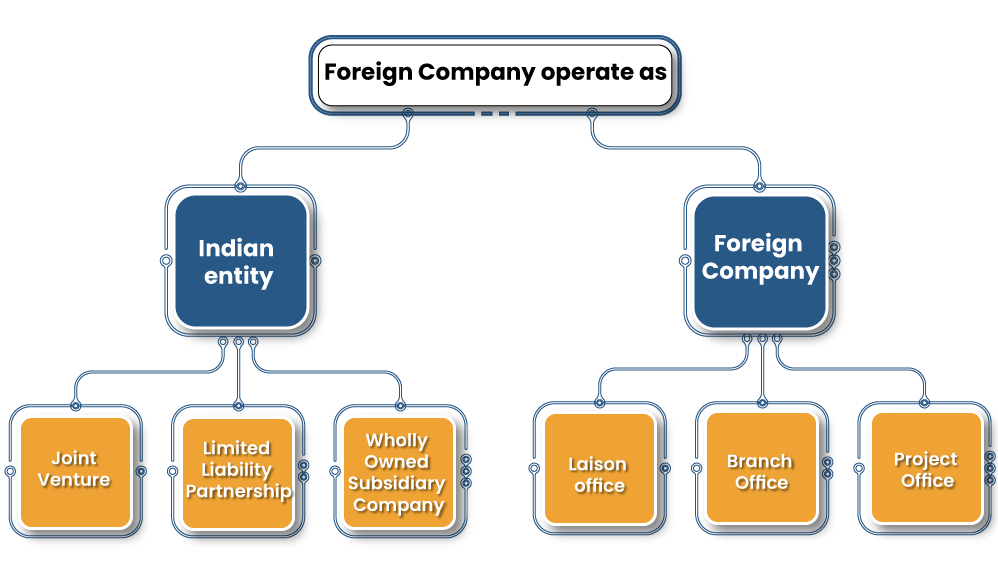

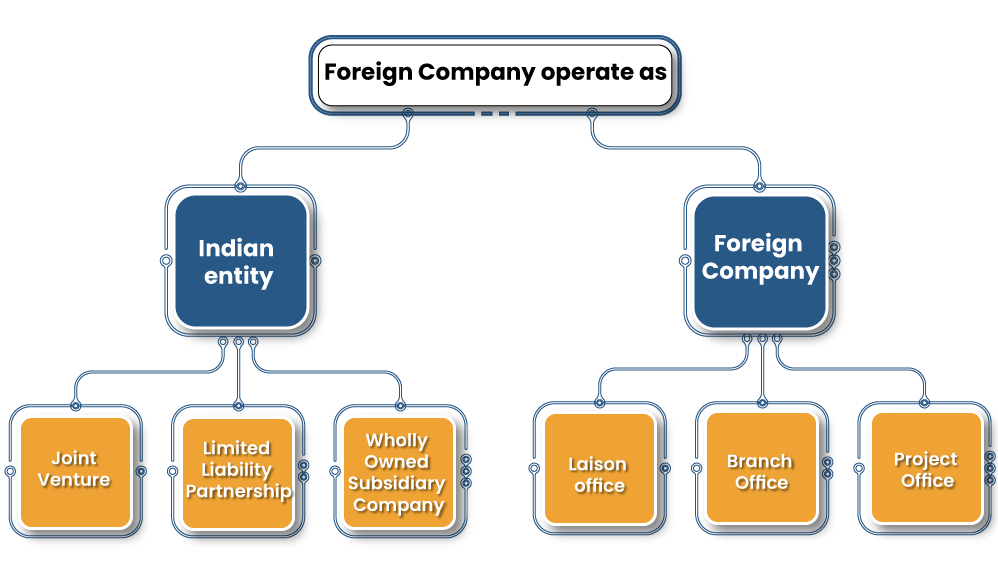

What are the ways for registering a foreign company in India?

India is the fastest budding economy in the world which offers many windows of opportunity to the foreign company in India to develop and grow their business. In India, the foreign investments are regulated by the policies and rules of RBI, FDI, FEMA, and the Companies Act 2013. For the purpose of establishing its business a foreign company in India has the following options:

Joint Venture:

The most preferred form of the practice for the corporate foreign company to undertake any business in India is Joint venture. A joint venture is done with any of the available business units in India. An enterprise which is newly made after two or more than two units join together with the purpose to achieve a commercial gain is joint venture. A foreign company can do the investment of equity in any Indian company through entering into a joint venture agreement and it can be done for a particular business purpose and for a fixed period of time. Some of the renowned joint ventures that happened were between Honda & Hero and TVS & Suzuki.

Wholly Owned Subsidiary Company:

A wholly owned subsidiary company is a company in which any foreign enterprise makes 100% Foreign Direct Investment in India through an automatic route. This is preferred as the easiest route by the foreign companies to establish business in India. A wholly owned subsidiary company is flexible to conduct business in India and can be created both as a public limited company or a private limited company. They are regulated by the Companies act, 2013.

Limited Liability Partnerships (LLPs): Limited Liability Partnerships has made it easier for the foreign companies to establish their business in India as LLP is allowed a 100 percent Foreign Direct Investment through an automatic route.

Liaison Office: A Liaison office can be defined as a business office which works as a linkage of communication that exists between the head office situated outside India and the parties living in India. A liaison office is not eligible to earn income in India or undertake any activity commercially. The major role of liaison office is to collect information regarding the possible opportunities in the market and to provide information concerning the company and the company’s products to the Indian consumers and to promote import and export to/from India. The jurisdiction of the liaison offices is set under RBI. The authorization for establishing a liaison office is initially given for three years time period and can be renewed further.

Project Office: Project office is a kind of temporary project which the foreign companies setup in India to execute particular project. The foreign companies setup these Project offices when they are offered for any contract by Indian Company. They are established with the permission of RBI on certain specific conditions.

Branch Office: Branch office is a kind of extension of any foreign company that is occupied in the business of manufacturing or trading. On the basis of approval from the RBI[1], any company that is incorporated outside India but engaged in the business of manufacturing or trading is allowed to open a branch office in India. The purpose of branch office is much more than as compared to a liaison office. It is involved in Importing and exporting of goods, in giving consultancy and professional services and keep a good research in the sector in which its parent company is engaged.

What is the process of registration of Foreign Company in India?

Registration procedures are different for different type of company. Therefore, it depends on which kind of company incorporation one is planning for and registration with the Registrar of Companies in India is mandatory. The basic essential for registration process is as given below:

- Obtain the Digital Signature Certificate (DSC)

DSC is necessary for digitally signing an electronic document and forms as it serves to report the MCA of the subsistence of the business association. The Foreign companies are required to have the passports of owners, bank proofs, photo IDs issued by government, etc. as essential documents to obtain a DSC.

- Obtain the Director Identification Number (DIN)

- Registration on the MCA Portal as a New User.

- Obtain the Certificate of Incorporation

A certificate of incorporation after fulfilling all the procedures required to comply for registration.

A foreign company in India is required to submit eform FC-1 to establish its place of business in India and the information has to filled by the foreign company itself. The foreign company need not obtain DIN but it is mandatory for them to register DSC through the associate DSC service available on the official MCA site.

Conclusion

Thus, the current automatic route has saved the energy and time of the investors as it has surely given a boost for the development of Indian economy and has lured more foreign entities to incorporate their business in India. Therefore, the incorporation of foreign company in India has resulted into creation of more employments and enhancement of incomes in our nation.

Read our article:A Complete Briefing on Compounding of Offenses under FEMA