Every business is required to maintain ample cash reserve to run the day-to-day business activities. That is why efficient cash flow management is so essential for the well-being of the company. For most companies, a common source of cash flow issues is poorly managed accounts receivable. The more cash you have in receivables owing to delayed payments and fraudulent accounts, the fewer funds you have for carrying out business operations.

Furthermore, mismanaged revenue cycle accounting will lead to cash flow disruption. This issue is typically compounded by incurring external vendor fees or internal labor costs for rendering products or services to clients without having cash inflow to offset such costs. In this write-up, we will unfold some best accounts receivable practices to improve cash inflow.

Measures You Can Take To Improve Cash Inflows and Revenue Cycle

What measures can you take to ensure seamless management of your revenue cycle and cash inflows? For startups, go through the following accounts receivable practices for effective management of revenue cycle.

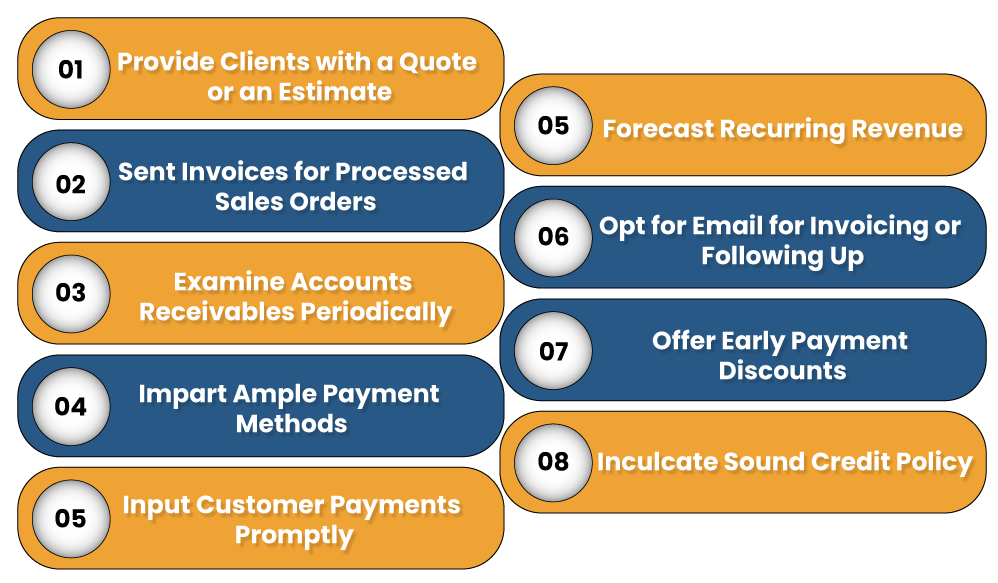

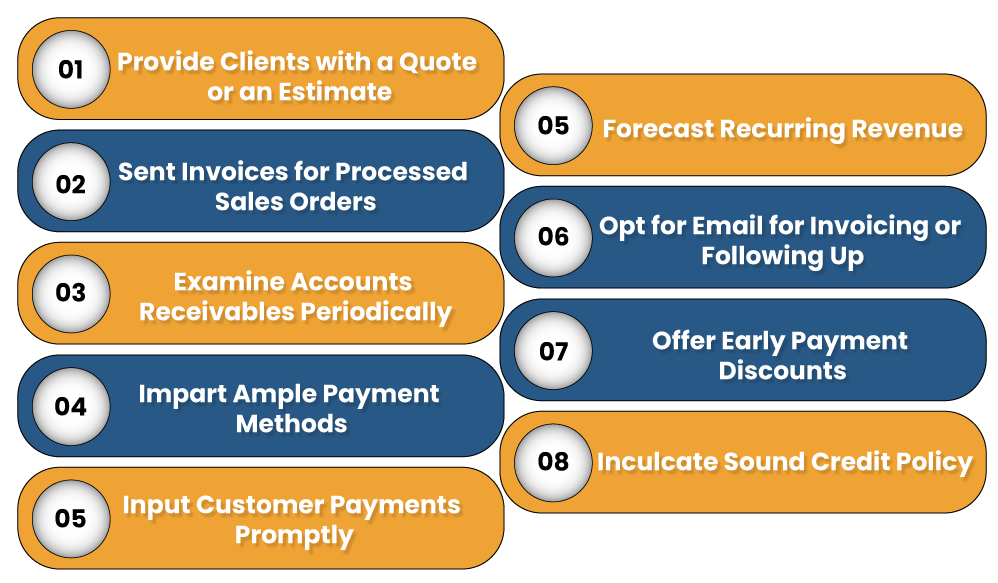

Provide Clients with a Quote or an Estimate

Prepare an estimate that encloses the specific services or products being sold, credit terms, sales prices, etc. This will enable your clients to better understand required costs in advance, averting surprises once the invoice arrives & resulting in speedy approval.

Make sure Invoices are sent for Processed Sales Orders

Prepare a sales order from the client’s purchase order or the approved estimate. Management should examine the open sales report to impart transparency to services that have been provided or products that have already been dispatched for which no invoice has been created.

Examine Accounts Receivables Periodically

Actively supervise the receivable collections process promptly upon invoicing. Management should examine the Receivable Aging report per week to create individual accountability responsible for managing collections. It is also imperative to set up a strategy for following up with all the fraudulent invoices. Periodic inspection of the firm’s collections still remains one of best accounts receivable practices.

Impart Ample Payment Methods

Providing clients with viable payment alternatives such as ACH (automated clearing house) and credit cards can minimize the delay from invoicing to client payment compared to signing & mailing a physical check. In the current scenario, digital payments can be made from smart devices, making it convenient to approve payments.

Read our article:What are the Best Practices for Working Capital Optimization of Accounts Receivable?

Input Customer Payments Promptly

Payments from clients should be posted in accounting records as soon as possible. This process makes sure that management has an updated and legitimate Receivable Aging report to review.

Forecast Recurring Revenue

This is one of the effective accounts receivable practices that have proven impact on the firm’s revenue cycle. Businesses[1] that reap recurring income from their clients on either or monthly or yearly basis for services must set up supplementary accounting procedures in order to forecast & schedule future invoicing.

Forecasting enables the company to compare invoicing for these charges against expectations to check if there was an error in issuing invoices to any clients.

If charges seem similar each month, consider incorporating automation into the process to ensure on-time delivery of invoices to avert any unexpected delays.

Opt for Email for Sending Invoicing or Following Up

Are you still relying on mail for sending bills to your clients? Billing your client via mail will delay the payment at least a few days. The first step to speed up the collection process is the utilization of email. By doing so, you can ensure that invoice is sent to the prospects on time as soon as the products or services are delivered to them. This can reduce the payment delay to a significant level.

Consider incorporating automation within the accounting department that will sync all these tasks for you for better outcomes. The right solution will notify the clients regarding the payment and follow up with them in case of payment delay-all without human intervention.

Offer Early Payment Discounts

No businesses are willing to pay higher than they need to for services or products. Incentivize your clients to make an early payment by offering payment discounts. For instance, you may enclose the terms “3/10 net 30*” to your invoice to allow clients to make early payment.

3/10 net 30*: It is a commonly used term in invoicing, which means that the discount @ 3% will be given to the clients if they make full payment within ten days. Here, the term “net 30” denotes a 30 days’ timeline within which clients should pay the total amount.

You might not be able to take all your clients into the confidence for making an early payment, but few of them will be lured towards these offers. Your business can minimize the cash flow disruption by optimizing the accounts receivable collections process and incorporating an automated AR system to aid your staff manages it better.

Be precise with follow-up reminders

Following up clients for payment is one of the common account receivable practices. On the most occasions, it fails to give favorable outcomes because most firms lack an efficient system to execute such activities.

Send your clients follow-up reminders when payments are coming due- Perhaps a week before the due date. If they fail to make a timely payment, send an email as a reminder in 3 to 5 business days after the due date has passed. If you don’t bother to respond to your mail, give them a call.

From time to time, even your legitimate clients will make the late payment. To avert that, you must have a protocol in place for how your firm will follow up on delayed payments.

Inculcate Sound Credit Policy

Surely you won’t like to end up extending credit to innumerable clients only to track down the money you’re owed. Most companies were inclining towards detailed credit policies that enclosed clear-cut guidelines for payment terms. If you cannot depict who is eligible for an extended payment term and who has to pay in full upfront, this complicates the situation even further.

Once you outlined a detailed credit policy, make sure to share the same with your employees and customers. This is important for reducing the chances of non-payment. As long as your policy stays transparent, staff won’t feel awkward having to deny credit to certain customers- and clients who get unapproved can’t feel as though they are being mistreated.

Conclusion

By leveraging the above-mentioned accounts receivable practices, you can impart transparency in the Account receivable process. Once your AR process gets simplified, it becomes easier for you to deal with these anomalies. However, if you still think that incorporating the said strategies is beyond your managerial ability, then you can outsource the process to a legit third-party firm for effective outcomes.

Read our article:Accounts Receivable: Definition and Tips to Manage