On an essential note of taxation, any person earning income must pay taxes, which is generally known as Income Tax. Nevertheless, the Income Tax Act has provided incomes to be exempt from. Income of charitable trusts/NGO gets exempt, for which the reasoning behind has already deliberated in the previous Blogs.

What are the classifications of exemptions allowable to charitable trusts and other similar institutions, under the Income Tax Act?

They can be categorized into three categories. The categories are:-

Classification 1 – Blanket Exemptions: – The un-monitored and primary blanket tax exemptions are as follows:-

- The Educational institutions/hospitals entirely or substantially financed by central/state Government [10(23C)(iiiab),(iiiac)]

- The Educational institutions/hospitals with aggregate annual income receipts below Rs. l crore. [10(23C)(iiiad) and (iiiae)]

Classification 2 – Exemptions with some restrictions

- The Charitable Funds or institution withstanding throughout India/States [10(23C)(iv)] 80

- Public religious and charitable trust or institution under section [10(23C)(v)]

Classification 3- Exemptions with full restrictions

- Public religious, charitable trusts including any legal obligations [under Sections 11 to 13]

What are the main sections that grant an exemption to the Income of trusts/NGO?

- The two main sections that grant an exemption to the income of trusts are ‘Section 11’ and ‘Section 12’ of the IT Act, 1961[1]. Furthermore, apart from these two sections, Section 10(23C) also exempts the income of establishments operating in the field of ‘education or medical relief.’ They should exist solely for ‘charitable purposes’ and not for profit and even income of institutions like universities, colleges, etc.

- As the majority of the charitable trusts run ‘educational institutes and/or hospitals,’ this is a relevant section from their overview. In addition to these two sections, there is a significant section, Section 80G of the Act, which grants’ tax exemption to the donor’ in respect of the donation/gifts given by him to a trust ‘recognized’ under this particular section. It gets more comfortable for a Trust to get donations when it gets recognized under Section 80G of the Act.

- In furtherance to these sections, Section 35(1) (ii) allows the deduction of ‘expenditure on scientific research,’ while section 35AC allows ‘expenditure on eligible projects’ or policies/schemes. More or less, the charitable trusts or institutions use these two sections. Nevertheless, the system of these two sections is not similar to the exemptions for the charitable trust, as these two sections haven’t considered in this treatise yet.

What is Section 11 of the Income Tax Act, 1961, all about?

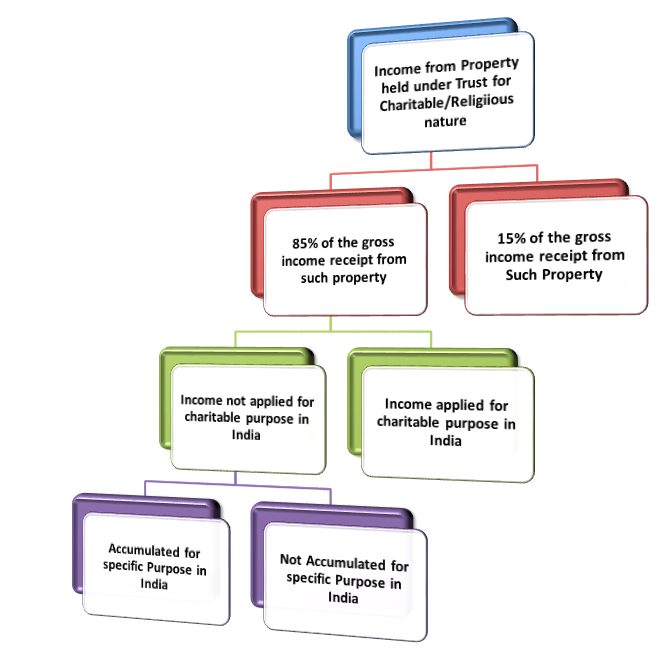

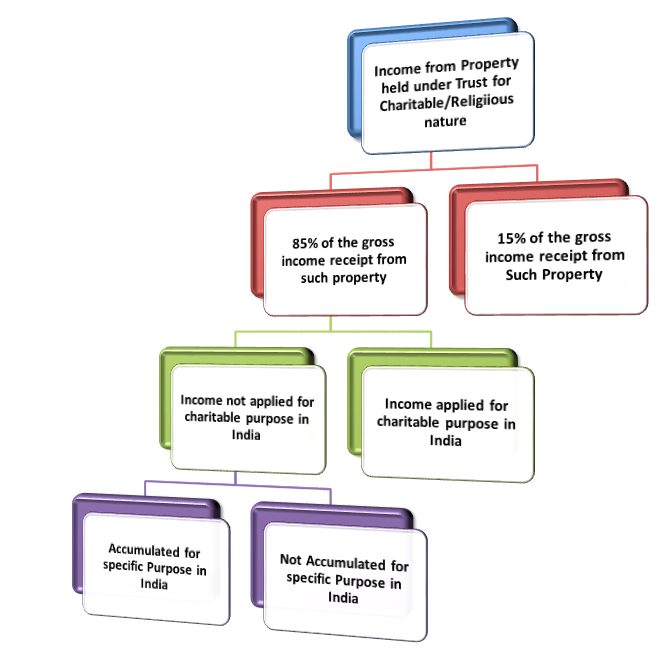

Section 11 lays down all the specifications of statutory provisions for exempting ‘Income from property’ held for charitable/religious purposes. Moreover, the schemes of this section are as follows:-

- Section 11(1) defines the types of income that shall not get excluded in the Total Income of the person for the preceding year. This income comprises income resultant from property held under trust entirely for charitable or religious purposes to the extent such income gets applied for these purposes in India.

- In cases where income is not involved but stored or set apart for application, the extent to which such Income not more than 15% of the revenue from such property, is also held as exempt. This section also contains income in the form of voluntary contributions forming ‘a corpus of the trust’ or institution to be exempt.

- Section 11(1 A) describes the treatment given to the capital receipts arising out of the ‘transfer of capital assets.’ The Transfer should be for the being property held under trust entirely for religious/charitable purposes as per the Act.

- Section 11(1B) is a mandatory provision in terms of the income covered under clause 2 of subsection 1.

- Section 11(2) describes the mode of accumulation or setting apart of income in case 85% of the income is not used for charitable purposes.

- Section 11(3) is determined to be another deeming provision. It specifies that:-

- Income referred to in subsection (2) ‘applied for another’ than charitable purposes,

- The income that ceases to be collected/accumulated or ‘set apart’ for the application;

- The income which ceases to persist as ‘invested or deposited’ in the forms or modes specified in section 11(5),

- Income that is paid or attributed to any other trust or institution shall believe to be the income of the person for the previous year.

- Section 11 (3A) authorizes the assessing officer to overlook the default of the assessee as mentioned above in receipt of Interest/Income.

- Section 11(4) clarifies that property held under trust includes a ‘business undertaking’ so held by the institutions. It also empowers assessing officer to regulate and determine the income of such ‘business undertaking’ as per the IT Act. In cases where the income determined by the AO is ‘more than the Income’ as shown by the trust, then the excess shall get considered to get applied to purposes other than charitable or religious purposes.

- Section 11(5) lays down the forms and methods in detail for investing or depositing the accumulated income. Section 11(5) (xii) refers to any ‘other type’ or mode of investment or deposit as may get approved. Therefore, leaving a route open for the Government to comprise any further ways of investment as deemed fit.

What happens to the Voluntary Contributors when those aren’t believed to be “Income” under section 11?

- According to the case “ManasSewaSamiti v. Additional Commissioner of Income-tax,” it deliberates that section 11(1) discusses the exemptions accessible to charitable organizations. Therefore, when we ponder upon income under section 11(1), we consider the ‘incomes which are eligible for exemptions’ subject to the provisions of sections 11, 12 & 13 of the Act.

- Section 11(1)(d) debars voluntary contributions received towards the corpus from the scope of income under section 11(1) of the Act. The marginalization of voluntary donations to the corpus creates an implied openness towards other voluntary contributions. Though section 11 does not speak of ‘voluntary contribution’ other than towards corpus.

- It is section 12(1), which delivers that ‘voluntary contributions’ would be believed to be income derived from property for section 11. By the name speaks clearly, ‘Voluntary contributions’ do not fall in the group of ‘income,’ like other incomes. Consequently, those incomes have been believed as income by section 12(1) of the Act.

- However, for section 11(1), income means the ‘real income,’ which has been established by the assessee. It shall be calculated not in agreement with the provision of the Act but unity with the standard rule of accountancy. It should be in a commercial sense without mentioning to the head of the incomes stated under section 14.

- Further, it got clarified that where the trust establishes income from ‘house property,’ ‘interest from securities,’ ‘capital gains,’ and other sources, the word income should get understood in its commercial sense, which is known as ‘book of income.’ Nevertheless, the principles of ‘commercially determining income‘ are not relevant as the voluntary contributions are apprehensive since they get deemed incomes. Therefore, voluntary contributions have to get understood in the head of section 12(1), alongside case laws which are accessible for our reference.

What are the viewpoints saying- voluntary contributions can get treated as income?

- Following the section 12(1), any voluntary contributions (for section 11) gained by a trust created solely for charitable or religious purposes are believed to be income introducing from property held under trust wholly for charitable or religious purposes.

- On the other hand, ‘voluntary contribution’ received with a detailed direction, intending to form part of the ‘corpus‘ of the trust/NGO or institution, shall not be incorporated in income for section 11. In short and crisp, voluntary contributions other than those headed for ‘corpus specific direction’ gets considered as income.

- According to the case “Padmaraje R. Kadambande v. C.I.T. [1992] 195 ITR 877,” it says that the addition of section 2(24)(iia) along with section 12(1) has shaped a ‘statutory assumption’ which considers voluntary contribution as an income. Therefore, it can say that the donations established from several donors, deprived of carrying any specific direction, i.e., ‘not being corpus donations,’ would fall under ‘Voluntary Contributions’ and believed to be income.

- According to the case “The Madras High Court in C.I.T. v. A.M.M. Arunachalam Educational Society 243 ITR 229” it says that the assessee, which had the object of running in the succession of an educational institution and a School, was qualified for exemption under section 10(22) (now Section 10(23C). It got deliberated on the ground that a society that runs a school could be preserved as an ‘educational institution’ by itself, ensuing the verdict in “Aditanar Educational Institution vs. Addl.CIT 224 ITR 310 (S.C.)”.

Read our article:Medical Relief under Income Tax: An Updated Overview

Does Section 11(4A) need to be fulfilled to avail Section 11 exemption?

Yes, Section 11(4A) needs to get fulfilled to avail sections 11 exemption as per the Income Tax Act. The reasoning could get made by exhibiting few case laws chronologically; depicting the whole picture of surfacing Section 11(4A) took place along with different court trials. The cases are as follows:-

- According to the case “C.I.T. Vs. St. Thomas Cathedral Church (Kerala High Court)”, it raises the relevant issues addressing whether the income derived out of ‘Kuri business (Chit Funds)‘ directed by the Charitable Trust is qualified for an exemption or not. Therefore, due to the application of sub-section (4A), it announces Section 11 of the Income Tax Act to be with effect from 01-04-1984.

- In the second phase of such deliberations, a trial bench court in “Commissioner of Income Tax Vs. Dharmodayam Co. (1997) 225 ITR 686″ believed a few specific measures on it. It says that if the “Kuri business (Chit Funds)’ is held in trust, and then the income from that place would not be administered by sub-section (4A). The Hon’ble Supreme Court pronounced it in “C.I.T. V. Dharmodayam Co. (1977) 109 ITR 527 (S.C.)”.

- The court has pointed out that the assessee is permitted to claim Exemption under Section 11(1) of the IT Act concerning its income from such ‘Kuri businesses.’ It gets quoted that decision of this very court in “(1997) 225 ITR 686″ was set notwithstanding by the hon’ble Supreme Court in the judgment in “Commissioner of Income Tax V. Dharmodayam Co. and another (2001) 248 ITR 816″. But then again, sub-section 11 (4A) has introduced certain circumstances in the matter of submission of sub-sections (1), (2) (3) & (3A) of Section 11 of the IT Act.

- Final Assumption: – The Supreme Court perceived that the Tribunal and High courts had not practically functioned to those conditions and not given due deliberations to those aspects. For that reason, it must decide if an assessee is permitted to get the benefit of the exemption under Section 11. The Tribunal needs to regulate if it satisfies the obligation of Section 11 (4A).

What does Budget 2020 proposes exemption under section 11 for Trusts or institutions?

- Any simultaneous registration for exemption under section 11, and requesting approval for Section 10(23C) exemption is now not permissible as per the Budget 2020. Trust/institution which are listed by section 12AA / 12AB and gets the approval under section 10(23C), or reported under section 10(46) after amendment, then the registration under section 12AA / 12AB shall become out of action from the date of such announcement.

- It gives a choice to the establishment to get its registration u/s. 12AA / 12AB functioning by making requests for that. Nevertheless, in such circumstances, he will not be permitted to get the benefit of section 10(23C) approval / 10(46) report.

- The process for making registration operative over again gets specified in the amended provisions. The nitty-gritty of the above amendment of section 11 has stated below. The section 11 of the Income Tax Act (in sub-section (7)) with effect from the 1st of June, 2020,–

- It has provided that “registration shall become not working from the date on which the trust/institution got approved under clause (23C) of section 10. It can inform or notify by clause (46) of the said section or the date on which this particular clause has come into force.

- It has provided that the trust or institution, whose registration has become out of action under the first provision, may apply to get its registration functioning under section 12AB. It should be subject to the condition that the approval under clause ‘(23C) of section 10’ or announcement under clause (46) of the said section to such trust or institution shall cease to have any effect since the date on which that registration becomes operative. From then on, it shall not be permitted to exemption under the respective relevant clauses.”

Conclusion

The learnings included in the above article are entirely for informational purposes after deliberating due care. Above and beyond, it does not convey any professional advice or formal preferences. With this, we at Corpbiz have legal consultants to help you with the process of registering to assure your income tax exemptions for your charitable deliberations, ensuring the successful and timely fulfillment of your work.

Read our article:Guide on Section 2(15) of the Income Tax Act and its Impact – Get the Complete Outlook!