An NGO (Non-Governmental Organization) or NPO (Non-Profit Organization) is a pool of enthusiastic individuals whose sole intention is to work to better society. NGOs are a privately-held establishment that works with a common goal to support local or global development by raising awareness on social issues. If any individual wants to contribute toward society’s welfare, they can work under NGO without entertaining any formalities. An NGO can be acknowledged in its own registered form & once it avails of the necessary work permits, it becomes eligible to access government based scheme and fiscal benefits to fund its campaign. The profit is not something that these institutions are up against. Unlike other firms, they focus on improving human life or society by addressing one or more issue. In this write-up, we will concentrate on the potential advantages of running an NGO in India.

Several Acts for NGO Registration in India

Firstly, you would have to choose the type of Act under which you wish to run your organization. These include as follow

- Trusts Act, 1882

- Society Registration Act, 1860

- Company Act, 2013

NGO registration under the Trusts Act, 1882

As per this Act, NGOs must be registered for charitable purposes like the relief of poverty, providing educational services, Medical relief etc.

Read our article:Important Sources and Government Funding For NGOs: A Complete Outlook

NGO registration u/s Society Registration act, 1860

Organizations who wish to register under this Act may work for a scientific or charitable purpose or any other purpose cited in Section 20 of the Society Registration Act, 1860. A minimum no. of seven-member can register under this Act.

NGO registration u/s Companies Act, 2013

Firms who wish to run under this Act must promote science, art, charity, culture, & other beneficial things for society. It is incorporative with an objective for the betterment of society in the field.

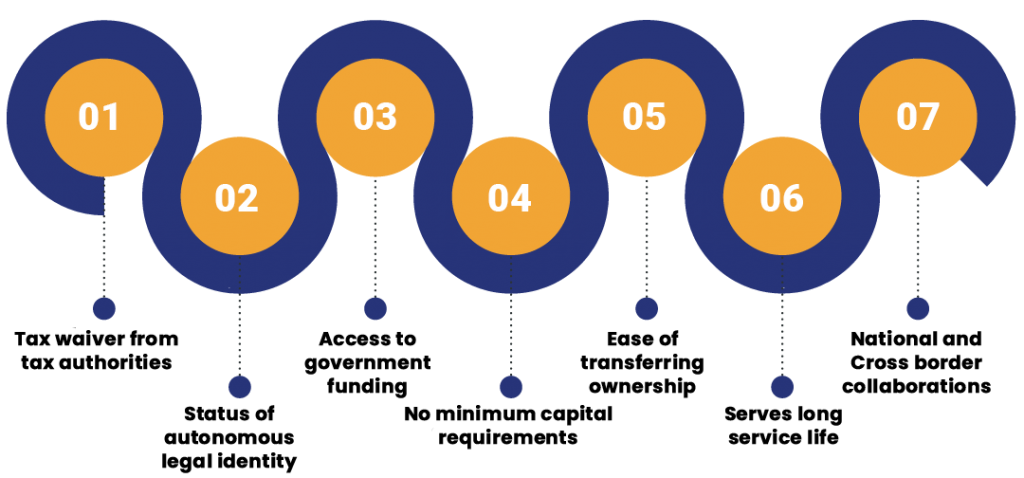

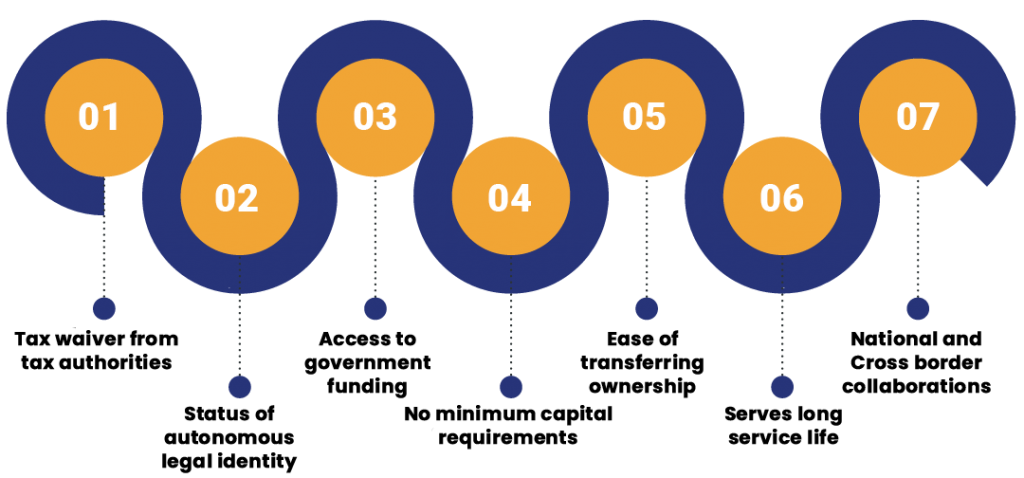

Potential advantages of running an NGO in India

The list below reflects the possible advantages of running an NGO in India.

Tax waiver from tax authorities

If you opt to run your organization under the Societies Act, 1860, you do not need to address tax liabilities as you are exempted from such requirement. The government has also provided waivers on the Entertainment and Service tax for institutions running under Trust Act,

Status of autonomous legal identity

Most NGOs in India rejoice status of separate legal entity in the eyes of the government.

Access to government funding as well as funds of private avenues

Once your firm becomes a registered NGO, you can have access to government funding. Also, such institution can visit private avenues that are keen to make a difference by funding a particular cause. NGOs under the Trust act, 1882[1], are eligible to get land from the government to carry out their operations.

No minimum capital requirements

At present, our law framework doesn’t impose any requirement of procuring any sort of capital for setting up an NGO in India. This is one of the crucial advantages of running an NGO in India, considering the fact that most start-ups lack fiscal support.

Ease of transferring ownership or title

The members running NGOs under Section8 of the Companies Act, 2013 can easily transfer their ownership without any legal obstacles.

Serves long service life

This is one of the vital advantages of running an NGO in our country. NGOs with better and clear goals are more likely to sustain longer than those who lack clarity or don’t possess long-term goals. These institutions usually receive consistent support from the government as well as the society which they are serving.

National and Cross border collaborations

Persistent NGOs with an urge to work protectively in a certain field would sooner or later get exposure to National and International NGOs, which help them increase their footprint. In some scenarios, global firms also invest in NGOs that speed up their operation, thereby ensuring a better outcome.

Freedom to discharge

NGOs are more beneficial than government-based programmes because they are part of the local community. They can cater to multiple projects at once that is designed to support society or human life in a positive sense. NGO’s ability to coordinate within local regime enables them to pinpoint reasons for the facilitation of positive change.

You protect your responsibility

An NGO can help you make acquisitions relating to financial matters and assets. This way, you can prevent yourself from addressing liabilities regarding the situation, such as judgements, divorce, seizures, & bankruptcies. NGOs’ property or assets remain protected against possible legal claim or disputes when comes to a debt reconciliation. This is a practical way to enable you to undertake NGO activities without wondering about the financial attack from outside.

As it is evident from above that establishing an NGO can render your firm endless benefits. It will speed up the operation of your campaign and help you achieve your goal, and built credibility over time.

Conclusion

In conclusion, it is safer to claim that setting up an NGO doesn’t have any potential downsides provided core objectives remains uncompromised on which it is built. NGOs built with a rightful intention are more likely to sustain longer than those with harmful deeds. A successful NGOs always have access to benefits like tax exemption, funding, land etc.

However, NGOs that negate the organization’s core value may sooner or later confront complicacies in terms of legality. So it is important to work within the purview of objectives on which the foundation of an NGO is based.

Do not forget to register your firm aforesaid Acts to reap more benefits and operate as an independent legal entity. You must make sure that your objective should stay within the regime of social welfare.

Read our article:Whether NGO Registration will make it Eligible for Government Funding?