In order to tackle the pandemic, most nations are undertaking prompt measures to avert economic recession. There have been integral measures such as prompt credit, export schemes, concessional reforms. Additionally, there are external measures such as bilateral investment that can improve trade & help firms prosper.

Currently, India & the European Union are collectively working on concluding new bilateral investment treaties. Bilateral Investment Treaty agreements are often envisaged as historical or academic interests. But, for most nations, these agreements help investors in understanding legal mechanisms & dispute resolution.

In this write-up, we analyze the impact of bilateral investment treaties on cross-border trading such as import and export.

Overview of Bilateral Investment Treaties in India

Bilateral investment treaties refer to treaties between nations intended to protect the investment made by both nations’ investors. These treaties encompass various conditions such as:-

- Giving fair treatment to overseas investors and investment

- Permitting repatriation of profits – this implies sending off money to the investor’s country.

- Giving legal measures such as dispute resolution, regulatory measures, and compensation.

Note:- The distinctive feature of most BITs is they permit for an optional dispute resolution mechanism, whereby an investor whose right has been contravened could have recourse to international arbitration, often under the backing of ICSID (International Centre for Settlement of Investment Disputes), instead of suing the host State in its courts. This process is known as investor-state dispute settlement (ISDS).

The first BIT was signed between Pakistan and Germany[1] on November 25, 1959. At present, there are more than 2500+ BITs is in action, involving most nations in the world. In the past few years, the no. of BITs and preferential trade agreements, in particular, has been raised at a rapid pace; practically every nation is a member of at least one. Influential capital-exporting states generally negotiate such treaties based on “model” texts (such as the Indian or U.S. model BIT). Environmental norms have also become an imperative of these types of agreements.

Read our article:Take – Off Your Business to International Market with Import and Export Code (IEC); Know IEC Code’s Benefits

India-EU BIT: Creating Growth Opportunities for Importers & Exporters

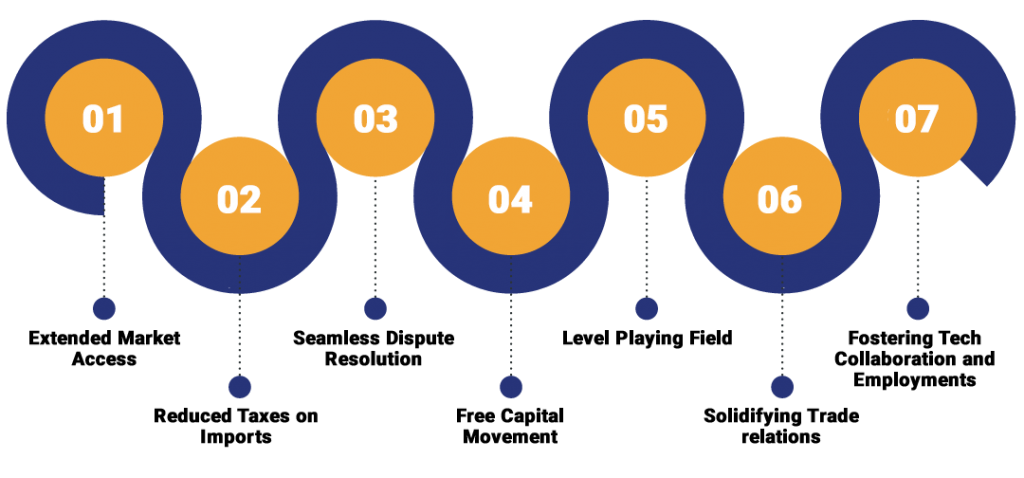

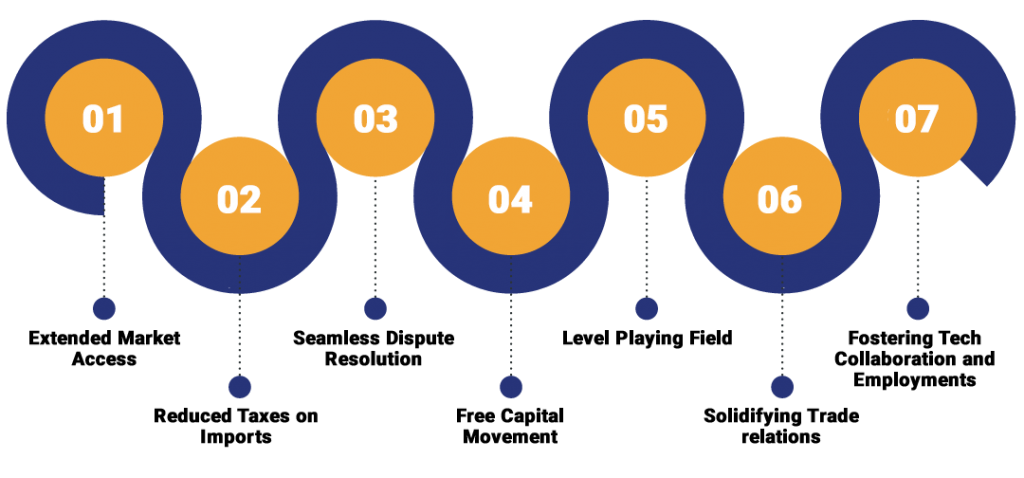

If concluded correctly, a bilateral investment treaty between India and the EU can allow Indian exporters and the importer to access string of benefits that ensures growth. The following are the potential benefits of the treaty:-

Extended Market Access

The bilateral investment treaties ensure improved market access to European nations with significantly reduced tariffs and customs duty.

Reduced Taxes on Imports

Taxation, by far, is still conceived as the controversial aspect of the BITs. Since every nation has its own taxation regime and policies, it harder for investors to draw out any conclusion in this regard. Also, the threats of double taxation often discourage investors from pouring in more capital. Fortunately, the inclusion of the “fair and equitable treatment” standard in BITs can protect the investors from stringent tax deductions.

Seamless Dispute Resolution

Most BITs are underpinned by international arbitration as the long-stop of dispute resolution. International Centre for Settlement of Investment Disputes (ICSID), International Chamber of Commerce (ICC), and the United Nations Commission on International Trade Law (UNCITRAL) are the common routes for investment treaty arbitration.

Free Capital Movement

Less stringent investment norms and free capital movement will allow the Indian investors to make larger investment.

Level Playing Field

In commerce, a Level Playing field denotes a fair practice of trade. A level Playing field will ensure that no investors will be treated prejudicially, and trade will be executed by the rules mentioned under the agreement.

Solidifying Trade relations

Since the European Union is a 28-country bloc, a BIT with the entire EU region could improve trading relations.

Fostering Tech Collaboration and Employments

European investment in Indian firm can garner growth opportunities, improve employment, and create space for technological collaboration,

Intellectual Property Rights Protection under Bilateral Investment Treaties

The term ‘investment’ in bilateral investment treaties includes IPRs such as (copyrights, trademarks, industrial designs, and patents), technical processes, know-how, and goodwill. This grants equivalent Intellectual Property Rights in an overseas nation. But, the exact nature of exclusions and protection are determined in the actual treaty agreed between the countries.

How Does Bilateral Investment Treaties Impact Businesses in India?

- Minimized shipping time, expenses, and process involved. It had been witnessed that multiple logistic requirements at shipping yards, airports, etc that involve duty payment & other procedures resulted in unnecessary delay. The bilateral investment treaty can help Indian exporters and importers to avert such lags.

- Gems, apparel, jewelry, & textiles from India are already enjoying a wider marketplace abroad. Though a BIT, there could be an improvement in global demand for Indian goods and handicrafts.

- The export level of a nation is proportional to its growth rate, and it is true in India’s case. Improved exports often translate into massive growth owing to profit, technology, and foreign exchange

Does BIT Encompass Services & Professionals?

Seamless work and study visa norms enclosed in a treaty make the exchange of professionals easier. But, in most BITs involving India, services professionals have yet to gain any relaxation in this context. Several service sectors in India, such as legal, accounting, and banking services, are heavily regulated. However, the pandemic has increased cross-border transactions in services, which might be included in future, BITs.

Ease of Doing Business in India – Cross Border Trading

In an astonishing progress’s journey, amidst an economic downturn in past years, India has witnessed a considerable leap of 14th places to finish 62 as far as ease of doing business ranking is concerned. A positive record registered in several regions of core evaluation, such as cross-border trading.

Conclusion

A BIT is an imperative tool for fostering the nation’s growth, making India more competitive globally, and creating a more robust economy. Bilateral investment treaties in maturing sectors like artificial intelligence, food processing, big data, renewable energy, aeronautics, and tourism can play a crucial role in encouraging import & export businesses in India.

For most nations, the BIT agreement acts as the only legal framework for conducting a bilateral investment. Besides, bilateral investment treaties provide better protection to the under-developed countries which have no other means to safeguards the investments against possible mistreatments.

Read our article:How to obtain IEC Code in India