In recent years, there is an emerging trend for conversion of partnership firm to Limited Liability Partnership (LLP). The conversion of partnership firm into a Limited Liability Partnership is done in accordance with the provisions of Section 55 of the LLP Act, 2008 which is read with 2nd Schedule.

The LLP’s was introduced through the Limited Liability Partnership Act, 2008 and the LLPs were made the foremost choice for medium and small sized businesses. One of the major reasons behind the conversion of Partnership firm into Limited Liability Partnership is because the LLPs are more flexible, separate legal entity, provides limited liability protection to partners, can have unlimited partners and provides ease in ownership transfer.

Eligibility Criteria for Conversion of Partnership Firm

The pressure on the personal assets of the partner is less as in comparison with the partnership firm. As the LLPs are the hybrid of both a partnership and a private limited company it offers many such advantages. But the real objective behind the conversion of partnership firm into LLP is due to the fact that LLPs offer a major advantage to the small and medium-sized businesses and suits their organisation requirements very well.

The main eligibility requirement for conversion of partnership firm into LLP is that:

- Every partner of the partnership firm will shift to be the partner of LLP and

- No other person except these partners of firm will be the partner of LLP.

- It is compulsory for all the partners to have a valid Digital Signature Certificate (DSC) and at least two partners must have a DPIN before making such an application.

- The registration of all the partners must be under Indian Partnership Act, 1932[1].

- For conversion of the partnership firm into LLP the consent of all the partners should be obtained.

- Any partner who wishes to be added or removed from the LLP can be so allowed only after the conversion of partnership firm in to LLP.

- Director Identification Number (DIN) or the Designated Partner Identification Number (DPIN) should be there for all Designated Partners.

Basic Requirement for Conversion of Partnership Firm into LLP

The basic requirement which shall be mandated by the partners before conversion of partnership firm into LLP is given below:-

- Upto date filing of Income tax returns

- Consent of unsecured creditors for conversion

- Minimum 2 Designated Partners

- Atleast 1 designated partners shall be an Indian Resident

- The Partners and Designated Partners can be same person

- Contribution of share capital from partner

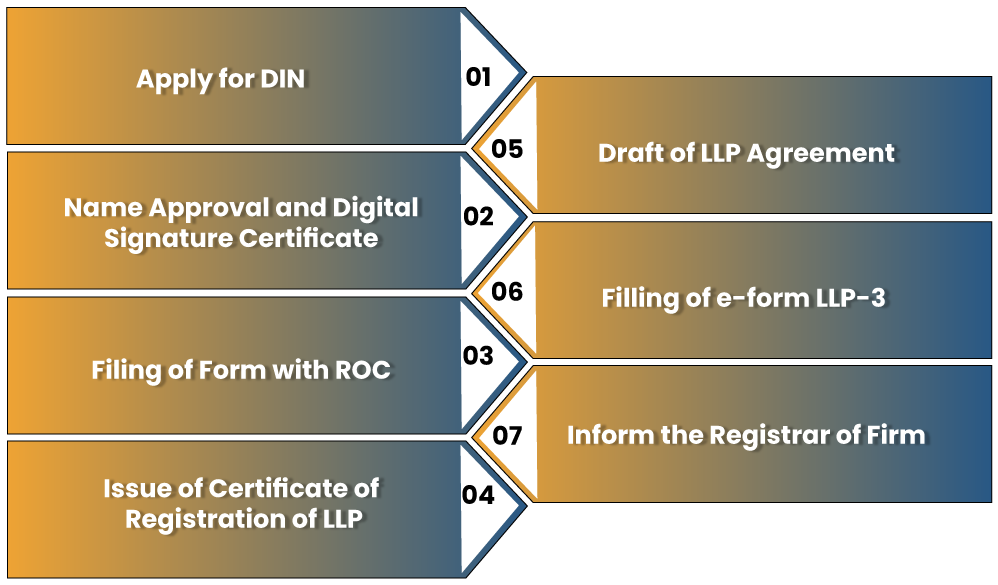

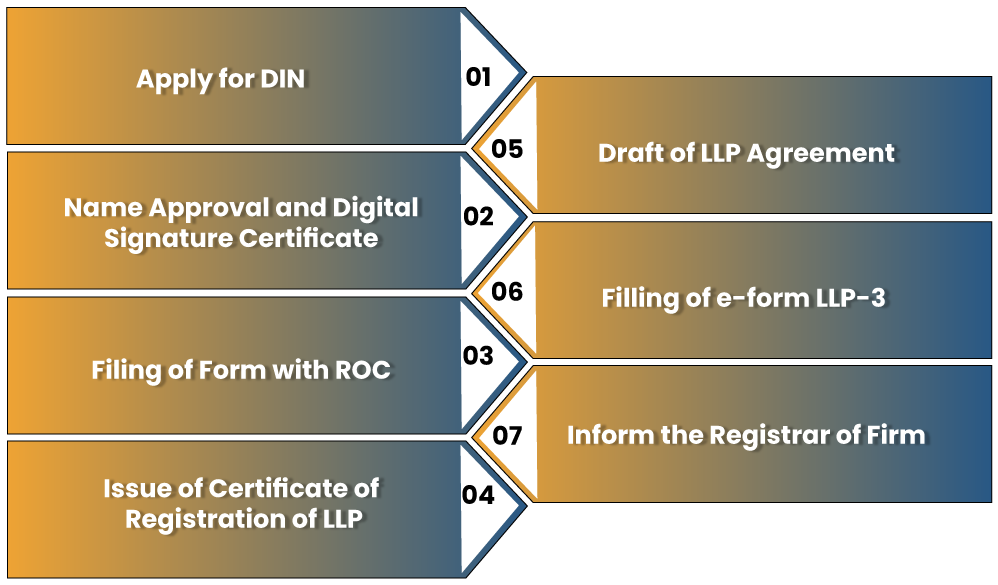

Procedure of Conversion of Partnership Firm to LLP

Apply for DIN

- In case of two designated partners – DIN can be obtained together with the Incorporation form (FiLLip)

- In case where there are more than two designated partners – DIN should be obtained for all other designated partners.

Name Approval and Digital Signature Certificate

The partners will have to register on the “RUN-LLP” option on the MCA portal wherein the partners shall register and reserve their unique name. They shall apply for “Conversion of partnership firm to LLP” and shall submit the required documents by giving the fee amount.

It is mandatory for all the partners of the LLP to possess their own digital signature certificates which shall be affixed in the relevant forms.

Filing of Form with ROC

The given below are few of the forms which are required to be filed with ROC along with the attachments for conversion of partnership firm into LLP.

- Form -17:-The conversion application is required to be file by the partners under Form-17 with the few attachments like statement of consent of all the partners, consent of all the unsecured creditors, statement of all the assets and liabilities of Company, Designated Partners declaration of Part B of Form 17 and acknowledgement copy of the latest filing of Income Tax Return.

- Form- FiLLiP : This form shall be accompanied by attaching documents like proof of office address (rent agreement), NOC from property owner, Copy of the utility bills, full contact details of all the partners with DSC & DIN and Form -9 that is a consent to act as designated partners.

Issue of Certificate of Registration of LLP

The Registrar under Section 58(1) of the LLP Act on getting satisfied that a firm has obliged with the provision of the Second Schedule shall in accordance with the provisions of the LLP Act and the rules, register the submitted documents and issue a certificate of registration.

Rule 32 (1) of the LLP Rules deals with the issuance of registration certificate by the Registrar on conversion of partnership firm into a LLP under his seal in Form- 19.

Draft of LLP Agreement

The contents of LLP shall contain:-

- Name of the LLP

- Name of the Partners & Designated Partners

- Rights & Duties of all the Partners

- Form of contribution

- Proposed Business description

- Governing Rules for the LLP

- Profit Sharing ratio

Filling of e-form LLP-3

This form contains all the information with respect to the LLP Agreement as has been entered into between all the partners.

Inform the Registrar of Firm

Within 15 days of the date of LLP registration under the provisions of the Indian Partnership Act, 1932 shall inform the respective Registrar of Firms with which it the LLP was registered regarding the conversion of the partnership firm into LLP and the particulars of the LLP as given in Form – 14 together with the following attachments:

- Copy of Incorporation Certificate of LLP.

- Copy of Incorporation documents submitted in FiLLiP.

Conclusion

The basic purpose behind introducing the LLP was to provide a simple form of business and at the same time provide limited liability to the partners. Taking into consideration the various benefits it is definitely worth that partners can decide the converting their existing partnership into a Limited liability partnership.

Thus, in today’s market competition LLPs are continually growing and sharing synergies by mergers and amalgamations with other businesses. It enjoys higher creditworthiness in comparison with the partnership firm. The flexibility in managing the business is something which has attracted many partnership firms to convert their existing firm into LLP.

Read our article:Difference between Winding up & Striking off a Company in India