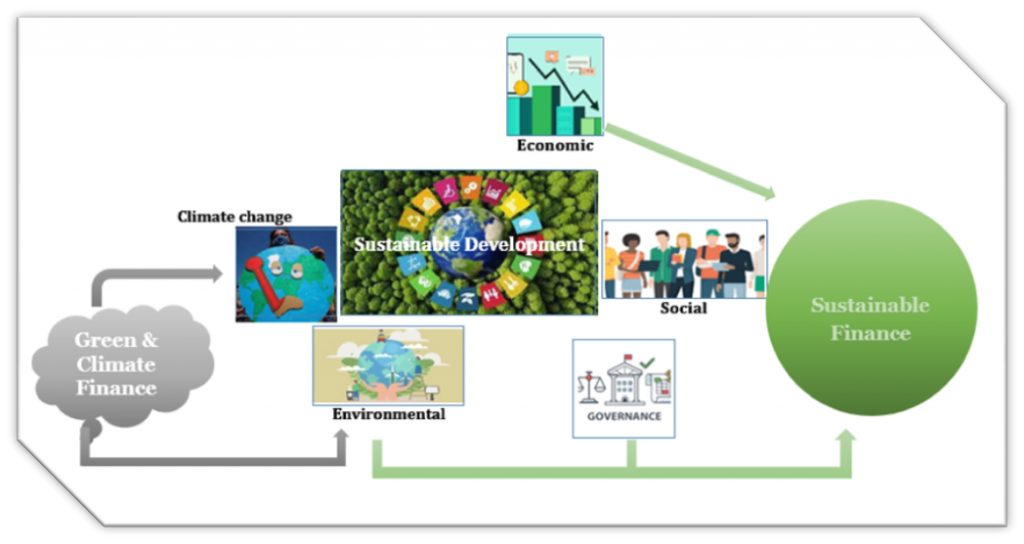

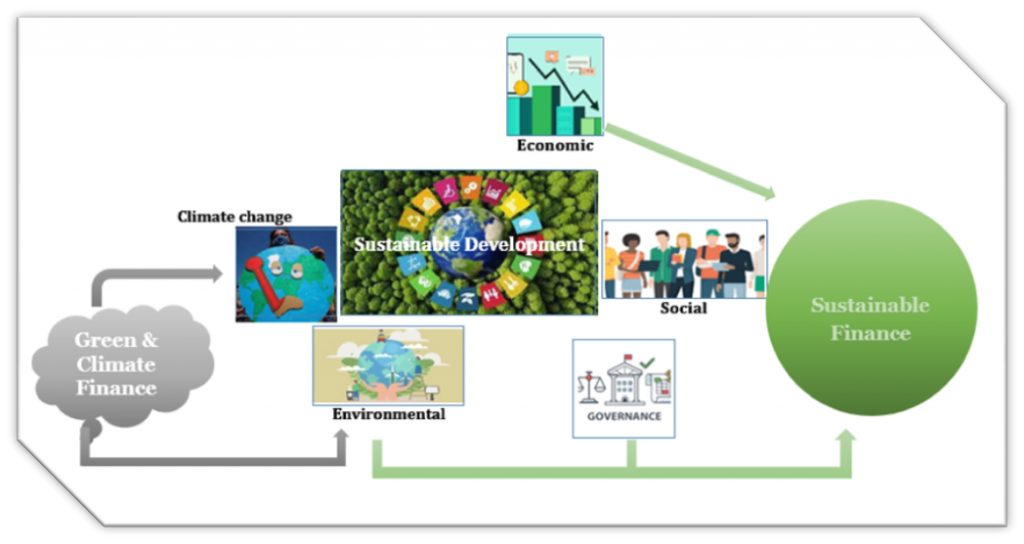

As governments and industries accelerate the shift toward a net-zero economy, it has become more critical than ever for businesses to embrace innovation and sustainability, open up new growth opportunities and stay relevant in the new low-carbon economy. Investment is essential for the development and increasing demand of a growing market. United Nations devised the term “Sustainability” in 1987 as the development method that meets the demand and needs of people at present without compromising the future need. The United Nations Environmental Programme (UNEP), in their approach to promote Sustainable Finance Scheme, has described the finance which includes:

- Sustainable Finance: Environmental, Social, Governance and Economic aspects.

- Green Finance: Climate finance but excludes Social and Economic aspects.

- Climate finance: It is a subset of environmental (green) finance.

Figure 1: Linkages between climate,green and sustainable finance

Because of the challenges, SIDBI has introduced a scheme called Sustainable Finance Scheme (SFS) an initiative towards the Green India mission. Sustainable finance, such as green bonds, holds stocks in companies with good environmental, social and governance (ESG) records with a goal of protecting the environment.

Origin of Sustainable Finance scheme (SFS)

The scheme was launched by the Small Industries Development Bank (SIDBI). It develops the entire value chain of energy efficiency or cleaner production and sustainable development projects that lead to necessary improvements in sustainable development in the MSMEs that are presently not covered under viable financing lines of credit.

Objectives & Eligibility Criteria of SFS

The main objectives of the scheme are as follows:

- New or existing Micro, Small, and Medium Enterprises (MSMEs) that come under the MSMED Act, 2006 will be eligible for funding under the scheme.

- To provide funds to projects not covered under international lines of credit to develop projects that help in energy efficiency and cleaner production.

- Provides funding for eco-friendly labelling, green buildings, green microfinance, Bureau of Energy Efficiency (BEE)[1] star rating, and renewable energy projects.

- Provide funding for biomass gasifier power plants, mini hydel power projects, wind energy generators, solar power plants, etc., for non-captive or captive use.

- Funding is provided for MSMEs that invest in waste management and sustainable development projects.

- Provides funding to Original Equipment Manufacturers (OEMs) that manufacture energy-efficient or cleaner production or green equipment etc. (OEMs have to be an MSME, or it has to supply their products to a substantial number of MSMEs)

|

S.No. |

Type of Enterprises |

Investment |

Turnover |

|

1 |

Micro enterprises |

Less than Rs.1 Crore |

Less than Rs.5 Crore |

|

2 |

Small enterprises |

Less than Rs.10 Crore |

Less than Rs.50 Crore |

|

3 |

Medium enterprises |

Less than Rs.20 Crore |

Less than Rs.100 Crore |

Interest Rate for Sustainable Finance Scheme

The interest rate is the same as offered by the credit ratings of MSMEs.

G20 Sustainable Finance Scheme

The Indian government is aiming toward the G20 Slogan of “One Earth, One Family, One Future” to connect with the country’s strategic aim of attracting huge investment into India’s technological and human development. This investment will ensure clean water, air and energy, building natural resilience to mounting climate shocks and accelerating the delivery of net zero objectives, i.e. SDG 13 and other classic green priorities. Sustainable finance in India is shaping up to be an imperative profoundly focused on people.

India’s Vision Towards Sustainable Finance

Hon’ble Finance Minister Mrs Nirmala Sitaraman, in Union Budget 2023, identified the market growth towards sustainable development, which includes as:

- Green Growth as the seven priority or Saptrishi

- Reducing carbon intensity by 2070

- Green job opportunities

- Lifestyle for Environment “LiFE”

- Green Credit Programme:

- Encourage behavioural change

- Mitigate climate change and ensure ecosystem sustainability

- Increasing energy and resource use efficiency

Conclusion

The market for sustainable finance is growing globally. In Asia, the sustainable finance market is accelerating, too, largely driven by green bonds. The market includes a range of types of capital under the broad ESG heading. Sustainable finance can be deployed as negative or exclusionary investments that aim to “do no harm” or positive/integrated investments that can be deployed to create additional social or environmental impact typically aligned with the SDGs. Consultation is needed by technical experts when making investment decisions in the financial sectors, which leads to increased longer-term investments into sustainable economic activities and projects through sustainable finance scheme that helps in energy efficiency and cleaner production.